Bankruptcy Help in California

U.S. Bankruptcy Help connects Californians with independent, pre-screened attorneys who focus on bankruptcy law and know federal rules, California-specific exemptions, as well as California bankruptcy court procedures.

What Is Bankruptcy in California?

When debt snowballs, bankruptcy can pause collections and create a path to relief. California is an "opt out" state. This means California has its own exemption systems. California also has its own wage rules, and four federal bankruptcy districts, so local guidance matters.

While bankruptcy is a federal court process, California law shapes what you can keep (your “exempt” property), including a powerful homestead exemption for your residence and other protections for vehicles, household goods, and wages. Collections on discharged debts must stop.

Types of Bankruptcy in California

Chapter 7 Bankruptcy

Chapter 7 allows individuals to discharge most of their unsecured debts. This means you can eliminate debts like credit card bills and medical expenses. However, not all debts can be discharged, such as student loans and tax debt not subject to discharge (although rare, student loans can be discharged if they meet certain circumstances).

Chapter 7 Eligibility:

The most common way to qualify for Chapter 7 in California, is to be under California's median income or pass the means test, which compares your income to the state median income for your household size. Check out some of our other resources on Chapter 7 here.

Chapter 13 Bankruptcy

Chapter 13 allows individuals with a regular income to develop a plan to repay all or part of their debts over three to five years. This type of bankruptcy is often used to catch up on missed mortgage payments or to protect assets from foreclosure or repossession. If you want to learn more about Chapter 13 or the differences between Chapter 13 and Chapter 7 have a look at our other resources.

Chapter 11 Bankruptcy

Chapter 11 is generally used by California businesses to restructure obligations while operations continue. Individuals can file chapter 11, but this is rare. California routinely sees the nation’s highest overall chapter 11 filing count.

California Bankruptcy Essentials

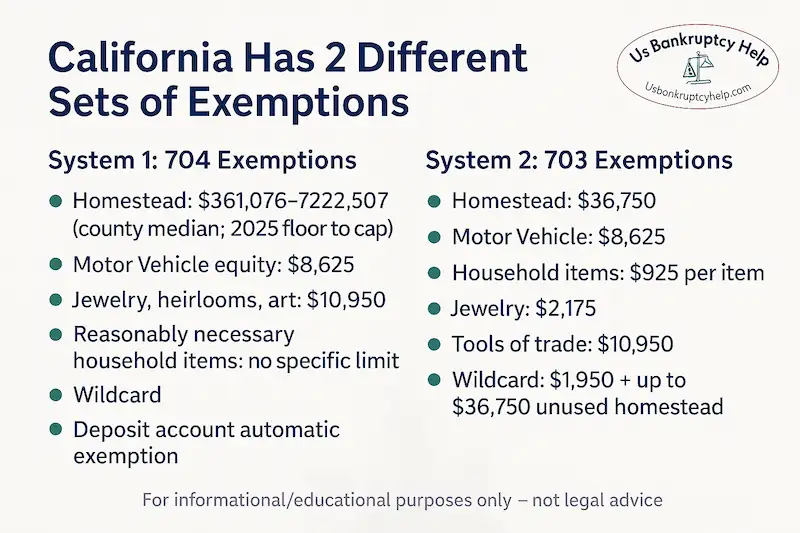

Our attorney-reviewed content blends federal rules with California specifics: the dual exemption systems (703 vs. 704), the annually adjusted homestead, wage-garnishment limits tied to state or local minimum wage, and procedures in the Northern, Eastern, Central, and Southern Districts of California.

California Bankruptcy Exemptions

California has specific bankruptcy exemptions that allow you to protect certain types of property when you file for bankruptcy. To claim California exemptions, you must have lived in the state for at least 730 days (2 years) before filing.

California Homestead Exemption (Primary Residence)

California’s 704 homestead exemption shields the greater of $300,000 or your county’s prior-year median home price, adjusted for inflation. For 2025, published analyses place the floor/cap at about $361,076 to $722,507 (your exact number depends on county data at filing). It is highly recommended to consult with a bankruptcy attorney to determine the precise homestead exemption applicable to your specific county.

Personal Property Exemptions

You can protect personal property such as clothing, appliances, and vehicles up to a certain value. California offers two different sets of exemptions, and you must choose one to apply to your case. The choice between the two sets of exemptions can be strategic, depending on the nature and value of your assets. Consulting with a knowledgeable attorney can help you maximize the protection of your personal property.

Personal Property Exemption Highlights

- Motor vehicle: up to $8,625 equity (System 703; similar protection under 704).

- Household goods and furnishings: typical caps apply; amounts adjusted periodically.

- Retirement accounts: most tax-qualified plans are protected.

Wildcard Exemption (system 703)

If you use System 703, you get a wildcard that can be applied to anything: $1,950 plus any unused 703 homestead amount—up to $38,700 if you don’t take the 703 homestead (figures effective April 1, 2025). Choosing between 703 and 704 is strategic—703 favors those without large home equity; 704 favors homeowners with equity. Get legal advice before selecting.

Who Qualifies for Bankruptcy in California?

Chapter 7 Bankruptcy

You qualify if your household income is at or below the California median for your family size or, if above, you still pass the means test after allowable expenses. Special rules may exempt certain military members from the means test.

Chapter 13 Bankruptcy

You need a regular income and must be under the April 1, 2025 debt caps ($1,580,125). Repeat-filing rules and prior dismissals can affect timing.

The Bankruptcy Filing Process in California

Filing bankruptcy in California involves several steps. It's important to understand these steps to ensure a smooth process. Having a clear understanding of the process can reduce stress and help you prepare for each stage, ensuring that you meet all necessary requirements and deadlines.

Step 1: Credit Counseling

Before you can file for bankruptcy, you must attend a credit counseling session from an approved provider. This session is designed to explore your financial situation and see if there's an alternative to bankruptcy. The counseling typically lasts about 60 to 90 minutes and provides an opportunity to discuss budgeting and financial management strategies.

Step 2: File the Petition

Filing for bankruptcy begins with submitting a petition to the bankruptcy court. This petition includes detailed information about your finances, including your assets, debts, income, and expenses. It's crucial to be thorough and accurate, as any discrepancies can delay the process or even result in the dismissal of your case. Professional assistance from an attorney can help ensure that all paperwork is correctly completed and submitted.

Step 3: Automatic Stay

Once you file your petition, an automatic stay is granted, which temporarily stops creditors from collecting debts from you. This can provide immediate relief from harassment by creditors. The automatic stay can halt foreclosure proceedings, repossessions, and wage garnishments, allowing you to focus on your bankruptcy process without creditor interference.

Step 4: 341 Meeting of Creditors

Approximately 20 to 40 days after filing, you must attend a meeting of creditors, also known as a 341 meeting. Here, the trustee and your creditors can ask questions about your financial situation and the bankruptcy forms you submitted. This meeting is typically straightforward, but being prepared to answer questions truthfully and accurately is important. Your attorney will usually accompany you to provide support and ensure the meeting proceeds smoothly.

Step 5: Debtor Education

After filing, you must complete a debtor education course. This course is different from the initial credit counseling session and must be completed to receive a discharge of debts. The course aims to provide you with the skills and knowledge to manage your finances responsibly in the future, ensuring you avoid financial pitfalls post-bankruptcy.

Step 6: Discharge / Plan Confirmation

If all steps are followed correctly, you will receive a discharge of your debts. This means you are no longer legally required to pay the debts covered by the bankruptcy. A discharge marks the end of the bankruptcy process for chapter 7.

In chapter 13, the court confirms your plan after about 6 to 9 weeks, and you will make payments according to the plan for 3 to 5 years. After completing all payments, you will receive a discharge of any remaining eligible debts.

Urgent Financial Issues in California

Foreclosure

California uses mostly nonjudicial foreclosure. After a Notice of Default, there’s generally a 90-day period before a Notice of Sale, then at least 21 days before auction. Filing for bankruptcy before the sale stops the process via the automatic stay.

Wage Garnishment

State law caps garnishment at the lesser of 20% of disposable earnings or 40% of the amount over 48× the applicable (state or local) minimum wage. Bankruptcy can immediately stop ongoing garnishments.

Vehicle Repossession

Filing triggers the stay, halting repossession and most civil actions immediately while your case proceeds.

Immediate Solutions for Bankruptcy Issues in California

Discover effective and immediate solutions for your financial struggles. Whether you're facing foreclosure, wage garnishment, or vehicle repossession, our comprehensive resources can guide you to protect your assets and regain financial stability.

Pros and Cons of Filing for Bankruptcy

Filing for bankruptcy has both advantages and disadvantages. Understanding these can help you decide if it's the right path for you. Analyzing the pros and cons in the context of your personal financial situation is essential for making an informed decision.

Pros

- Debt Relief: Bankruptcy can discharge many types of debt, providing relief from financial burdens.

- Automatic Stay: This stops most collection actions against you, giving you breathing room.

- Fresh Start: Bankruptcy offers a chance to rebuild your financial life without overwhelming debt.

Cons

- Credit Impact: Bankruptcy can negatively affect your credit score, making it harder to get loans or credit in the future.

- Public Record: Bankruptcy filings are public, which means they can be viewed by others.

- Loss of Property: Depending on the type of bankruptcy, you may lose non-exempt assets.

Understand Your California Bankruptcy Options

Understanding your bankruptcy options in California is essential for navigating financial distress. Whether considering Chapter 7 or Chapter 13, each option has specific requirements and benefits that can help you regain control over your financial life. Consulting with a qualified bankruptcy attorney can provide personalized guidance tailored to your situation, ensuring you make the best decision for your future. By taking an informed and strategic approach to bankruptcy, you can successfully navigate the process and emerge with a stronger financial foundation.

Bankruptcy in California FAQs

Which California bankruptcy court will I use?

California is split into four federal bankruptcy districts. You file in the district that covers your county. A local attorney can tell you exactly which courthouse handles your case.

How much are the filing fees in California, and can I pay over time?

There are standard court filing fees to start a case. Many courts let you pay in installments, and some people with very low incomes may qualify for a fee waiver. Ask your attorney or the clerk’s office about your options.

What does the Chapter 7 “means test” mean in simple terms?

It’s a screen that compares your household income and allowed expenses to California guidelines. If you’re under the guideline, you usually qualify. If you’re over, you might still qualify after certain expenses are counted. An attorney can run the numbers for you.

How does the California homestead exemption work?

It protects a portion of the equity in your primary home so you can keep your residence up to a certain amount. The exact protection depends on your county and changes over time. A lawyer can check the current figure for your area.

What’s the difference between California’s “703” and “704” exemption systems?

California gives you two sets of protections, and you must choose one:

- 704 is often better for homeowners with significant equity.

- 703 includes a flexible “wildcard” you can use to protect things like cash or a tax refund.

- Picking the right one is strategic and depends on what you own.

How do wage-garnishment limits work in California?

Only part of your paycheck can be taken, and the limit is tied to minimum-wage rules. Filing for bankruptcy usually stops a garnishment right away.

Can bankruptcy stop a foreclosure sale in California?

Yes—if you file before the sale, the automatic stay generally pauses the process. California foreclosures move on a set timeline, so acting quickly is important.

Are there debt limits for Chapter 13 in California?

Yes. Chapter 13 has caps on how much secured and unsecured debt you can have. These limits are set by federal law and are updated from time to time. Your attorney can confirm if you’re within them.

Can I keep my car if I file for bankruptcy in California?

Yes. You may keep your car when you file for bankruptcy in California, but this depends on the chapter you file, how much equity you have in your car, and what CA exemption you are using.

Latest Articles on California Bankruptcy

Expert insights and guidance from California bankruptcy attorneys.

Cost of Living Insights

Understanding the High Cost of Living in Los Angeles

Learn about managing high living costs in Los Angeles and explore financial strategies to stay affordable. Read the full article: Understanding the High Cost of Living in Los Angeles

Managing Expenses in California

Strategies to Cope with California’s High Cost of Living

Discover how exemptions and careful financial planning help Californians manage high living expenses effectively. Read the full article: Strategies to Cope with California’s High Cost of Living

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin