Understanding Oregon Bankruptcy Laws: A Guide

If you’re overwhelmed by debt and trying to make sense of Oregon bankruptcy laws, you’re not alone. The rules that govern bankruptcy in Oregon blend federal law with state-specific protections, and understanding them is crucial for anyone seriously considering filing bankruptcy in Oregon.

Oregon Bankruptcy Laws at a Glance

Jurisdiction: Oregon (U.S. Bankruptcy Court for the District of Oregon) • Audience: Consumer debtors, small business owners & advisors • Chapters Covered: 7, 13 & 11 (select cases) • Exemption Systems: Oregon state vs. federal (11 U.S.C. § 522)

This guide provides a high-level overview of Oregon bankruptcy laws and procedures for individuals and small businesses. It explains how Oregon bankruptcy filings work in practice, how federal law interacts with Oregon exemption rules, how the United States Bankruptcy Court Oregon handles cases, and what to expect before, during, and after filing.

- Author & Experience: Written by Casey Yontz, Oregon bankruptcy attorney with 18+ years of consumer bankruptcy practice.

- Primary Oregon Statutes: ORS 18.345 (exempt personal property), ORS 18.395 (homestead exemption), and related provisions in ORS chapter 18 governing judgment enforcement and exemptions.

- Key Federal Statutes: Title 11, U.S. Bankruptcy Code (chapters 7, 11 & 13), including 11 U.S.C. § 707(b) (means test), § 109(h) (credit counseling), and §§ 523, 727, 1328 (discharge & exceptions).

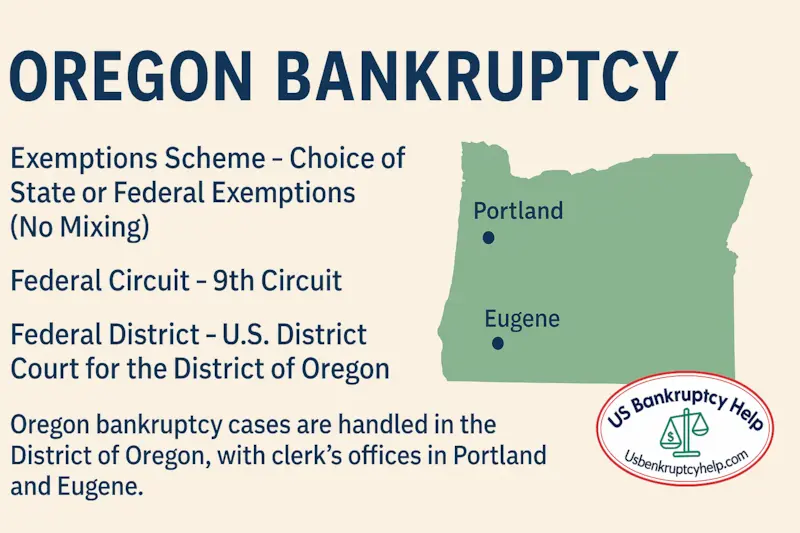

- System Highlights: Single federal district (District of Oregon) with clerk’s offices in Portland & Eugene; most consumer cases filed under chapter 7 or 13; choice between Oregon and federal exemptions for many filers; means test using Oregon median income figures; credit counseling & financial management courses required in most cases.

- Costs & Process: Court filing fees are set at the federal level for all Oregon bankruptcy filings, while attorney’s fees vary by chapter and case complexity. This guide explains the high-level process, but how much it costs to file bankruptcy in Oregon and the exact steps will always depend on your facts and your chapter.

- Scope & Limitations: This page offers a broad overview of Oregon bankruptcy laws, exemptions, means testing, court locations, and life-after-bankruptcy issues. It does not cover every edge case, business scenario, or advanced strategy and should be read together with more detailed state-specific and chapter-specific guides.

- Not Legal Advice: This information is for general educational purposes only, is not legal advice, and does not create an attorney–client relationship. Always consult an Oregon bankruptcy attorney before relying on any rule or exemption in a real case.

This guide is designed to make the state of Oregon bankruptcy system easier to understand. We’ll break down the main options for individuals, explain how Oregon bankruptcy filings work in real life, and outline the basic eligibility rules so you can see where you might fit.

You’ll also learn about key exemptions that can protect your home, car, and other essential assets under Oregon law. Along the way, we’ll talk about how the United States Bankruptcy Court Oregon fits into the process and what that means for your case.

Whether you’ve just started searching online for “bankruptcy Oregon” or you’re already close to a decision, this overview is meant to give you a clear, practical foundation. By the end, you should feel more confident about how Oregon bankruptcy laws work and better prepared to have informed conversations with a qualified attorney or financial professional.

Overview of Oregon Bankruptcy Laws

Bankruptcy is a legal process that gives people in serious debt a structured way to reset their finances. In Oregon, the core rules come from federal law, but the way your property is protected and how your case plays out is also shaped by state of Oregon bankruptcy exemptions and local court procedures.

To be able to file bankruptcy in Oregon, you must have been a resident of Oregon for a minimum of 91 days. Most individual Oregon bankruptcy filings fall under two chapters of the Bankruptcy Code: chapter 7 and chapter 13. There is also chapter 11, which is used primarily by business entities but is sometimes used by individuals who are over the debt limits for chapter 13. Each chapter offers a different path to debt relief depending on your income, assets, and long-term goals, so understanding how they work in bankruptcy Oregon is important before you choose a direction.

Oregon bankruptcy laws are designed to balance two things: giving honest debtors a fresh start and making sure creditors are treated fairly. When used correctly, the process can stop collection calls, pause garnishments, and create breathing room to rebuild—but it also requires careful planning and full disclosure.

Key aspects of Oregon bankruptcy laws include:

- Federal Bankruptcy Framework: Federal law in Title 11 of the United States Code (the Bankruptcy Code) governs the process, but Oregon-specific exemptions and procedures determine what property you can keep. The federal exemption framework is set out in 11 U.S.C. § 522.

- Main Chapters For Individuals: Most individual Oregon bankruptcy filings are under chapter 7 or chapter 13, with chapter 11 available in some higher-debt or more complex situations.

- Chapter 7 Basics: Chapter 7 cases follow the rules in 11 U.S.C. chapter 7, and may involve selling non-exempt property, if any, so the trustee can make distributions to unsecured creditors.

- Chapter 13 Repayment Plans: Chapter 13 repayment plans are governed by 11 U.S.C. chapter 13, including plan requirements and confirmation standards in §§ 1321–1325, and typically run three to five years while you keep your property.

- Chapter 11 For Complex Cases: Chapter 11 reorganization, found in 11 U.S.C. chapter 11, is commonly used by businesses, but individuals who exceed the chapter 13 debt limits in 11 U.S.C. § 109(e) sometimes use it as well.

- Counseling & Education Requirements: Filing bankruptcy in Oregon requires approved pre-filing credit counseling and a post-filing financial management course, as outlined in 11 U.S.C. § 109(h) and 11 U.S.C. § 111.

- Oregon Bankruptcy Court: The United States Bankruptcy Court for the District of Oregon oversees Oregon bankruptcy filings, appoints trustees, and applies both federal law and state-specific rules in consumer and business cases.

Understanding these core elements of the Oregon bankruptcy system makes it easier to see whether chapter 7, chapter 13, or in some cases chapter 11 might fit your situation—and whether moving forward with a bankruptcy filing is the right tool for your financial recovery.

Types of Bankruptcy in Oregon: Chapter 7 vs. Chapter 13

When you look at Oregon bankruptcy laws in practice, most individuals end up in one of two main chapters of the Bankruptcy Code: chapter 7 or chapter 13. Each option is built for a different financial situation and a different kind of “fresh start.”

Chapter 7 is generally the faster, more straightforward path. In many cases, it allows qualifying filers to discharge unsecured debts like credit cards, medical bills, and certain personal loans after a relatively short process. It can be a good fit for people with limited income and little or no non-exempt property. If you think chapter 7 might be right for you, take a closer look at our detailed guide to bankruptcy chapter 7 in Oregon.

Chapter 13, by contrast, is built around a court-approved repayment plan. Over three to five years, you make structured payments based on your budget and use that plan to catch up on debts such as mortgage arrears, car payments, or taxes while keeping your property.

On this site, our preferred in-depth resource for understanding how chapter 13 works in real Oregon cases is our Oregon Chapter 13 bankruptcy guide. That page walks through eligibility, plan structure, common Oregon filing scenarios, and practical planning tips in far more detail than this overview.

There is also chapter 11, which you’ll usually see associated with businesses and complex reorganizations. Some individuals with higher debt levels or more complicated financial situations use chapter 11 when they are not eligible for chapter 13 or when the flexibility of chapter 11 is strategically useful.

Each chapter has its own advantages, tradeoffs, and long-term consequences. Choosing the right path under bankruptcy Oregon law depends on your income, assets, types of debt, and long-term goals.

Key differences between these chapters include:

- Chapter 7: A relatively quick process that uses non-exempt property, if any, to pay unsecured creditors and then wipes out many remaining unsecured debts if you qualify.

- Chapter 13: A 3–5 year repayment plan that restructures debts and allows you to cure arrears over time while keeping your home, car, and other important assets if you stay current on the plan.

- Chapter 11 (honorable mention): A reorganization chapter most often used by businesses, but sometimes by individuals with higher or more complex debts who do not qualify for chapter 13 and need a more flexible structure.

If you want a deeper, big-picture explanation before drilling into Oregon-specific rules, you can also review our national guides on chapter 7 bankruptcy, chapter 13 bankruptcy, and comparing chapter 7 vs. chapter 13. Your Oregon chapter 7 and chapter 13 state pages—including our Oregon Chapter 13 bankruptcy guide —then build on this foundation with local means test numbers, exemptions, and trustee details.

Understanding these differences at a high level is critical. They shape how a bankruptcy filing will affect your Oregon property, monthly budget, and long-term financial recovery.

Eligibility and the Means Test in Oregon

Not everyone who considers bankruptcy Oregon-wide will qualify for the same chapter. Under Oregon bankruptcy laws and federal law, eligibility for chapter 7 or chapter 13 is tied closely to your household income, expenses, and debt load. One of the key gatekeepers for many Oregon bankruptcy filings is the “means test.”

When you are filing bankruptcy in Oregon, the means test helps determine whether you can proceed under chapter 7 or whether you may need to look at a repayment plan under chapter 13 instead. The rules come from 11 U.S.C. § 707(b) and the definition of “current monthly income” in 11 U.S.C. § 101(10A).

Practically speaking, most people experience the means test through the official forms often still referred to as “Form 22.” For chapter 7 cases, this is Official Form 122A (Means Test for Chapter 7). For chapter 13, similar calculations on Official Form 122C help determine how much disposable income must be committed to your repayment plan.

In practical terms, the means test compares your household income to the Oregon median income figures published by the U.S. Trustee Program. If your income is below the applicable state median for your household size, you usually pass the first part of the test and may qualify for chapter 7, subject to other requirements. If your income is above the median, further calculations of allowed expenses and deductions may still allow a chapter 7 filing, but many people in this situation end up in chapter 13—and in chapter 13, the same means-test-style calculations influence how much you must pay unsecured creditors over the life of the plan.

Because the means test is math-heavy and data-driven, accuracy really matters. Every Oregon bankruptcy filing requires honest reporting of income, necessary living expenses, secured debt payments, and priority debts. Small mistakes can affect whether your case remains in chapter 7, shifts to chapter 13, or results in a higher required plan payment than necessary.

Means test key components under state of Oregon bankruptcy practice include:

- Income Assessment: Comparing your current monthly income to the Oregon median income tables used in bankruptcy Oregon cases, adjusted for household size.

- Expense Analysis: Applying allowed living expenses, secured debt payments, and priority debts under the Bankruptcy Code to see how much, if any, disposable income remains.

- Chapter Placement & Plan Impact: Determining whether your financial profile fits chapter 7 or points toward a repayment plan under chapter 13—and, in chapter 13, helping to set the minimum amount that must be paid to unsecured creditors during your Oregon bankruptcy filing.

How Oregon Exemptions Work In Bankruptcy

When you file bankruptcy in Oregon, exemptions are the rules that explain what property you’re allowed to keep. Bankruptcy itself is a federal process, but the state's exemption system has a big impact on how a real case feels for an Oregon family or small business owner. One important rule is that you generally must be a resident of Oregon for at least 730 days (2 years) before you can use Oregon's state exemption system.

On this site, our detailed and most up-to-date discussion of Oregon exemption amounts and categories lives on a dedicated Oregon bankruptcy exemptions guide. That page is where we track changes to the dollar limits, categories, and planning details, and it should be your primary reference for current Oregon exemption information.

At a high level, exemptions exist to help protect the basic building blocks of everyday life so that a bankruptcy filing can actually give you a fresh start. In many Oregon cases, that means some protection for equity in a home, a vehicle you rely on, essential household goods, and qualified retirement savings. Oregon residents may also have a choice between using state exemptions or the federal exemption system, but you generally have to pick one approach or the other for your case.

The underlying Oregon exemption rules used in bankruptcy filings are found in state law, including ORS 18.345 (exempt personal property) and ORS 18.395 (homestead exemption), along with related provisions in chapter 18 of the Oregon Revised Statutes. Because the exact dollar amounts and categories can change over time, it's important to rely on current information when planning a bankruptcy filing in Oregon.

The specific exemption amounts, categories, and planning strategies are too detailed to cover on this general Oregon overview page. This section is meant to show where exemptions fit into the process. For a line-by-line breakdown, examples, and strategy tips, start with our Oregon exemptions guide and then talk with a knowledgeable attorney about how those rules apply in your situation.

Broadly speaking, when you review that guide you'll see exemptions grouped into categories such as:

- Your home: Protections that may shield a portion of equity in your primary residence, subject to Oregon's homestead limits and conditions.

- Transportation and everyday essentials: Rules that can protect a modest vehicle, furniture, clothing, and other basic household items used for daily life.

- Retirement and income protections: Safeguards for many tax-qualified retirement accounts and certain types of income, helping you preserve long-term financial stability even after a bankruptcy filing.

How these protections apply in your case—and how they interact with chapter 7, chapter 13, or even chapter 11—depends on your asset mix, debt load, and filing strategy. That's why most people considering bankruptcy in Oregon benefit from reviewing a detailed exemptions chart and then getting individualized legal advice before they file.

The Bankruptcy Filing Process in Oregon

High-Level Overview of Oregon Bankruptcy Filings

For most individuals and small businesses, oregon bankruptcy filings follow a general sequence under federal law and Oregon-specific procedures. At the same time, the exact steps, deadlines, and strategy can vary a lot depending on the chapter you file (chapter 7, chapter 13, or chapter 11), your assets and income, the county you live in, and how the trustee and United States Bankruptcy Court Oregon handle your case.

Why This Is Not a DIY Process

The overview below is not a do-it-yourself guide or a substitute for legal advice. Filing bankruptcy in Oregon is a technical process that involves strict paperwork requirements, local rules, and long-term consequences for your finances. Because of this complexity, it is usually highly recommended to consult with an experienced Oregon bankruptcy attorney before you file, so you can choose the right chapter and avoid costly mistakes.

Key Pre-Filing Steps in Oregon

In a typical bankruptcy Oregon case, you’ll first need to gather detailed financial records. This includes information on income, debts, assets, tax returns, and recent bank statements. Comprehensive documentation is crucial for a successful filing and for preparing the official forms used in Oregon bankruptcy filings.

Next, you must complete pre-bankruptcy credit counseling from an approved agency. This step is required by federal law before most cases can be filed and is designed to help you evaluate your financial situation and explore alternatives to bankruptcy, even if you ultimately decide that a bankruptcy Oregon filing is the best path.

Then, your attorney (or you, if filing on your own) will prepare and submit the bankruptcy petition and accompanying schedules to the United States Bankruptcy Court Oregon. The United States Bankruptcy Court for the District of Oregon reviews your paperwork, opens the case, assigns a trustee, and issues the automatic stay that stops most collection activity. Additional steps can include responding to trustee requests, handling reaffirmation agreements, dealing with motions, or addressing plan confirmation issues in chapter 13 or chapter 11 cases.

Throughout the process, you'll attend the meeting of creditors, also known as the “341 meeting.” This is a relatively brief but important hearing where the trustee asks questions about your finances and documents, and creditors have the opportunity to appear and ask limited questions as well. Your Oregon bankruptcy attorney will typically prepare you for what to expect at this meeting and guide you through the rest of the case.

With all of these moving parts, working with a knowledgeable attorney who regularly handles oregon bankruptcy filings can make the process smoother, reduce the risk of errors, and help you get the full benefit of the protections offered by Oregon bankruptcy laws.

Typical Steps in an Oregon Bankruptcy Filing

At a very general level, most Oregon bankruptcy filings will involve some version of the following steps:

- Collect financial records: Gather pay stubs, tax returns, bank statements, bills, and a complete list of assets and debts so your paperwork is accurate and complete.

- Complete credit counseling: Finish an approved pre-filing credit counseling course and obtain the required certificate for court.

- File the petition and schedules: Submit your bankruptcy petition, schedules, and related forms with the United States Bankruptcy Court Oregon to formally start the case, usually with the help of an Oregon bankruptcy attorney.

- Attend the 341 meeting: Appear at the meeting of creditors, answer the trustee’s questions truthfully, and provide any follow-up documents requested.

Required Documentation and Credit Counseling

Key Documents in Oregon Bankruptcy Filings

Accurate paperwork is one of the most important parts of Oregon bankruptcy filings, and it is also one of the easiest places to make mistakes if you try to do everything on your own. Whether you are filing bankruptcy in Oregon under chapter 7, chapter 13, or chapter 11, the court and trustee will rely heavily on the forms and documents you submit to understand your income, expenses, assets, and debts.

In a typical bankruptcy Oregon case, this means completing the official bankruptcy petition, schedules, and statements, along with signing them under penalty of perjury. You will usually need to provide recent pay stubs or other proof of income, tax returns, bank statements, and information about any real estate, vehicles, business interests, or other property you own. These documents help the United States Bankruptcy Court Oregon and the trustee determine how the state of Oregon bankruptcy laws and exemption rules apply to your situation. Even small omissions or errors can create problems, which is one reason many people choose to work with an experienced Oregon bankruptcy attorney rather than treating these forms as a DIY project.

Federal law also requires most people to complete a pre-filing credit counseling session with an approved agency before their case can be filed. This requirement appears in 11 U.S.C. § 109(h) and the standards for approved providers are set out in 11 U.S.C. § 111. During this session, a counselor reviews your income, expenses, and debts with you and explains alternatives to bankruptcy, even if you ultimately decide that proceeding with an Oregon bankruptcy filing is the best option. Your attorney can help you choose an approved provider and make sure the timing and documentation for this requirement are handled correctly.

The summary below is only a high-level overview of the documentation and counseling requirements. The exact list of documents, forms, and deadlines in a real case will depend on your chapter, your assets and debts, and how the trustee and court handle your file—which is why individualized advice from an Oregon bankruptcy attorney is so valuable.

Necessary elements for most Oregon bankruptcy filings include:

- Complete and accurate forms: Bankruptcy petitions, schedules, and statements that fully disclose your income, assets, debts, and recent financial activity, supported by pay stubs, tax returns, bank records, and other documents your attorney or the trustee may request.

- Credit counseling certificate: Proof that you completed an approved pre-filing credit counseling session within the required time frame before your case was filed with the United States Bankruptcy Court Oregon, usually coordinated with the help of your Oregon bankruptcy attorney.

United States Bankruptcy Court Oregon Locations

All Oregon bankruptcy filings are handled by the United States Bankruptcy Court for the District of Oregon. Although cases are filed electronically in most situations, the court maintains staffed offices in Portland and Eugene where filings are administered, hearings are held, and clerk’s office staff are available to assist with procedural questions.

Knowing which courthouse serves your area can help you understand where hearings may take place and which contact information applies to your case. Below are the primary locations for the United States Bankruptcy Court Oregon:

| Office | Address | Website |

|---|---|---|

| Portland | 1050 SW 6th Ave, Suite 700 Portland, OR 97204 (503) 326-1500 (800) 726-2227 | U.S. Bankruptcy Court — District of Oregon |

| Eugene | 405 E 8th Ave, Suite 2600 Eugene, OR 97401 (541) 431-4000 (866) 777-0442 | U.S. Bankruptcy Court — District of Oregon |

While most Oregon bankruptcy filings are initiated online through the court’s electronic filing system, these locations are the physical hubs for hearings, in-person filings by self-represented debtors, and other official court business.

Dischargeable vs. Non-Dischargeable Debts

One of the most important goals in many Oregon bankruptcy filings is the discharge—the court order that wipes out certain debts at the end of the case. Under Oregon bankruptcy laws and federal law, not every debt is treated the same way. Some obligations can be discharged, while others survive the bankruptcy and must still be paid.

The core rules on what is and is not dischargeable come from the Bankruptcy Code, including 11 U.S.C. § 523 (exceptions to discharge), 11 U.S.C. § 727 (chapter 7 discharges), and 11 U.S.C. § 1328 (chapter 13 discharges). How those rules apply in a real bankruptcy Oregon case can depend on the chapter you file, the type of debt, and your specific facts.

At a very general level, many everyday unsecured debts can be discharged if you complete your case, while certain high-priority obligations and misconduct-related debts are much harder (or impossible) to discharge. The brief examples below are for orientation only—your dedicated chapter 7 and chapter 13 guides will go into much more detail.

Examples of Debts That May Be Dischargeable

- Credit card balances: Regular consumer credit card debt and personal lines of credit, unless tied to fraud or recent abusive use.

- Medical bills: Unpaid hospital, doctor, and other medical or dental bills in most cases.

- Personal loans: Many unsecured personal loans, payday loans, and old utility or deficiency balances.

Examples of Debts That Are Often Non-Dischargeable

- Support obligations: Most child support and spousal support (alimony) obligations remain fully enforceable after bankruptcy.

- Many student loans: Educational loans are generally not discharged unless you meet a demanding “undue hardship” standard in a separate proceeding.

- Certain taxes and misconduct-related debts: Some tax debts, fraud-based obligations, and willful injury claims may survive the bankruptcy, depending on the facts.

This overview is not a complete list of dischargeable and non-dischargeable debts, and it is not a substitute for legal advice. The discharge you receive in a chapter 7, chapter 13, or chapter 11 case—and how it interacts with Oregon bankruptcy laws—depends heavily on your specific situation. For a deeper dive, be sure to review the dedicated guides on chapter 7, chapter 13, and chapter 7 vs. chapter 13, and consider speaking directly with an experienced Oregon bankruptcy attorney about how the discharge rules apply to your debts.

Life After Bankruptcy: Impacts and Recovery

Credit, Opportunities, and a Fresh Start

Filing for bankruptcy in Oregon can feel like a major step, and it is. An Oregon bankruptcy filing will typically stay on your credit report for years—up to about ten years for many chapter 7 cases and often around seven years for many chapter 13 cases. During that time, you may face higher interest rates and extra scrutiny when you apply for new credit, housing, or some types of employment.

At the same time, for many people under significant financial stress, bankruptcy Oregon relief is the first real opportunity to breathe again. Once the constant collection calls, garnishments, and lawsuits are addressed through the bankruptcy process, you can begin focusing on rebuilding instead of just trying to stay afloat. With careful planning, many filers start seeing improved credit profiles much sooner than the full reporting period.

The period after a discharge under Oregon bankruptcy laws is a natural time to reset your budget, build an emergency fund, and establish healthier financial habits. Some people choose to work with financial planners, credit counselors, or their Oregon bankruptcy attorney to create a step-by-step recovery plan that matches their income, goals, and family situation.

Practical steps for rebuilding your financial life after bankruptcy include:

- Monitor your credit reports: Review your reports regularly from all three major bureaus to confirm discharged debts are showing correctly and to track gradual improvement over time.

- Build a realistic budget: Create a written budget that prioritizes housing, transportation, and essentials, while leaving room for savings so you are less likely to rely on high-interest credit again.

- Pay every bill on time: On-time payments going forward are one of the strongest signals you can send to future lenders that you are managing your post-bankruptcy finances responsibly.

- Consider secured credit options: Carefully using a secured credit card or small credit-builder loan and paying it in full each month can help re-establish positive payment history after your Oregon bankruptcy filing.

While the road after bankruptcy is not instant or effortless, many Oregonians find that, with discipline and a clear plan, they are in a stronger and more stable position a few years after discharge than they were in the years leading up to their case.

Frequently Asked Questions About Bankruptcy Oregon

Many people considering bankruptcy in Oregon have similar questions about cost, process, location, and how specific debts (like student loans) are treated. The answers below are general and educational only—your situation may be very different, so it’s always smart to speak with an experienced Oregon bankruptcy attorney about your specific facts.

How Much Does It Cost to File Bankruptcy in Oregon?

When people ask how much does it cost to file bankruptcy in Oregon, there are usually two main components: the court filing fee and any attorney’s fees. The filing fee is set at the federal level and is the same for all cases filed in the United States Bankruptcy Court for the District of Oregon (though it can change over time). Attorney’s fees vary depending on the chapter you file, the complexity of your case, and the experience of your lawyer.

In some situations, the court may allow the filing fee to be paid in installments, and in limited chapter 7 cases, a fee waiver may be available if your income is very low and you meet specific criteria. Your Oregon bankruptcy attorney can explain the current filing fee, typical attorney fee ranges in your area, and whether installment payments or a waiver request might make sense in your situation.

Can You File Bankruptcy on Student Loans in Oregon?

Many people wonder whether you can file bankruptcy on student loans in Oregon. The short answer is that you can file bankruptcy even if you have student loans, but most student loans are not automatically discharged like credit cards or medical bills. Under federal law, you generally have to prove “undue hardship” in a separate lawsuit within your bankruptcy case to seek a discharge of student loan debt.

That process usually involves a detailed review of your income, expenses, and prospects going forward, and the standards can be demanding. There have been recent policy discussions and guidance that may affect how some courts and agencies evaluate student loan discharge requests, but this area is complex and very fact-specific. An Oregon bankruptcy attorney who is familiar with current law and local practice can help you evaluate whether an undue hardship case is realistic for you.

How Do You File Bankruptcy in Oregon?

If you are asking how do you file bankruptcy in Oregon, you are really asking about a series of steps rather than a single form. At a high level, the process usually includes gathering your financial records, completing required credit counseling, preparing the bankruptcy petition and schedules, filing your case with the United States Bankruptcy Court Oregon, and attending the 341 meeting of creditors.

In practice, each of these steps includes many detailed sub-steps, deadlines, and strategic decisions, such as when to file, which chapter to use, how to time certain transactions, and how to apply Oregon exemptions. Because of these complexities—and the risk of losing property or having your case dismissed—most people are better served by working with an experienced Oregon bankruptcy attorney rather than trying to file on their own.

Where do I File Bankruptcy in Oregon?

Another common question is where to file bankruptcy in Oregon. All Oregon bankruptcy filings go through the United States Bankruptcy Court for the District of Oregon. The court has primary clerk’s offices in Portland and Eugene, and most cases today are filed electronically, especially when you are represented by counsel.

Your county of residence—and sometimes where your business operates or where most of your assets are located—generally determines the proper venue within the District of Oregon. Your Oregon bankruptcy attorney will handle the electronic filing and make sure your case is opened in the correct division, using the correct forms, with the correct filing fee and supporting documents.

How Do Exemptions Protect My Assets?

Exemptions under Oregon bankruptcy laws and federal law can protect some of the equity in your home, vehicle, household goods, and retirement accounts, even after you file. The idea is to give you a realistic chance at a fresh start rather than leaving you with nothing. In an Oregon bankruptcy filing, the specific exemptions available and the dollar limits that apply will depend on whether you use the Oregon exemption system or the federal exemptions, as well as your mix of assets.

Choosing and applying exemptions correctly is one of the most technical parts of a case and can dramatically affect whether you keep or lose certain property. Because of that, it is especially important to review your asset picture with a knowledgeable Oregon bankruptcy attorney before you file.

What Types of Debts Can Be Discharged?

Many unsecured debts can be discharged if your Oregon bankruptcy case is successfully completed, including most credit card balances, medical bills, and many personal loans. The exact scope of your discharge depends on the chapter you file, your prior bankruptcy history, and whether any creditor or trustee challenges the discharge of a particular debt.

Some debts, however, are harder or impossible to discharge, such as most support obligations, many tax debts, and most student loans unless you meet the undue hardship standard. Your chapter 7 or chapter 13 guide—and a conversation with an Oregon bankruptcy attorney—can help you understand how the discharge rules apply to your particular mix of debts.

Will I Lose My Home or Car in Bankruptcy?

Whether you will lose your home or car in bankruptcy depends on several factors, including the chapter you file, the amount of equity you have, the exemptions available, and whether you stay current on any mortgages or car loans. In some Oregon bankruptcy filings, people are able to keep both their home and vehicle by using exemptions and staying current on secured payments, especially in chapter 13 cases that are designed to help you catch up over time.

In other situations—particularly where there is significant non-exempt equity or the payments are unaffordable—it may not be realistic to keep certain property. Because these decisions are so fact-specific and life-changing, it is critical to review your housing and transportation goals with an experienced Oregon bankruptcy attorney before you file, so you understand your options and likely outcomes.

These FAQs are only a starting point. Because every Oregon bankruptcy filing is shaped by unique facts and goals, speaking directly with a knowledgeable local attorney is the best way to get clear, actionable answers for your situation.

Navigating Oregon Bankruptcy Laws

Understanding Oregon bankruptcy laws is an important first step toward deciding whether bankruptcy Oregon relief is right for you. This guide has given you a high-level overview of how oregon bankruptcy filings work, how federal law and the state of Oregon bankruptcy exemption system interact, and the role the United States Bankruptcy Court Oregon plays in overseeing cases.

At the same time, this is only an introduction. The chapter you file, the assets you own, the types of debts you have, and your long-term goals all shape how the law will apply in your specific situation. Because the process of filing bankruptcy in Oregon is technical and fact-sensitive, it is usually wise to talk directly with an experienced Oregon bankruptcy attorney rather than treating this guide—or any online resource—as a do-it-yourself roadmap.

If you are feeling overwhelmed by debt, know that many people in Oregon have used bankruptcy to create a more stable financial future. With the right information, thoughtful planning, and qualified legal advice, you can evaluate your options under Oregon bankruptcy laws and choose a path that gives you the best chance at a genuine fresh start.

Explore Our Oregon Bankruptcy Guides

Explore Some of Our National Bankruptcy Guides

- Chapter 7 Bankruptcy: National Guide

- Chapter 13 Bankruptcy: National Guide

- Chapter 7 vs Chapter 13 Bankruptcy: National Guide

- Can Just One Spouse File Bankruptcy?

- Can You File Bankruptcy and Keep Your House?

- Can You File Bankruptcy and Keep Your Car?

- How Often Can You File Bankruptcy?

- Chapter 13 Vehicle Cramdown

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin