Understanding Maryland Bankruptcy Laws: A Guide

Navigating Maryland bankruptcy laws and the state of Maryland bankruptcy system can feel overwhelming. If you’re thinking about bankruptcy in Maryland, understanding the rules up front can make the process clearer and less stressful.

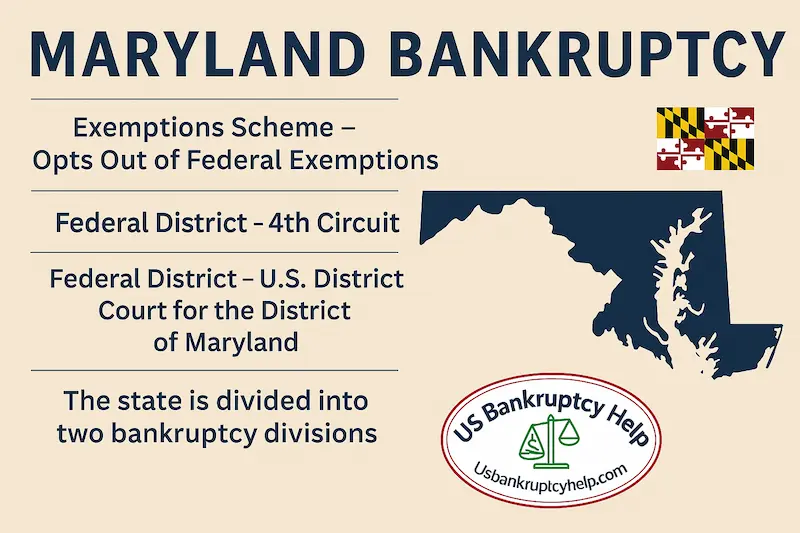

Maryland Bankruptcy Laws — At a Glance

- What Maryland Bankruptcy Does: A legal process under federal Title 11 of the U.S. Code that can stop most collection activity (calls, garnishments, lawsuits) and, if you qualify, wipe out or restructure many debts for Maryland residents and small businesses.

- Main Chapters for Individuals: Most consumers in Maryland file under chapter 7 or chapter 13, with chapter 11 sometimes used for higher-debt individuals or businesses that need to reorganize while continuing to operate.

- Maryland Uses Its Own Exemptions: Maryland has opted out of the federal exemption scheme, so most filers must use Maryland’s state exemption laws rather than federal exemptions. These rules influence what happens to your home equity, vehicle, household goods, and other property in a case.

- Where You File: Personal and business cases are filed in the US Bankruptcy Court for the District of Maryland, which covers the entire state and applies both the federal Bankruptcy Code and Maryland-specific rules and exemptions.

- Basic Process Snapshot: Most Maryland cases involve required credit counseling, preparing and filing a bankruptcy petition and schedules, an automatic stay stopping most collections, a 341 meeting of creditors, debtor education, and then, if all requirements are met, a discharge of qualifying debts.

- Bankruptcy Cost in Maryland: Total cost typically includes a federal court filing fee (which varies by chapter), required counseling and education courses, and attorney fees that change based on chapter and case complexity. Chapter 13 and chapter 11 usually involve higher overall attorney fees than simpler chapter 7 cases.

- Impact on Credit and Future Borrowing: A filing appears on your credit report for several years, but many people begin rebuilding credit with on-time payments, careful use of new credit, and budget discipline—often finding that life is more manageable than before the case was filed.

- Why Local Guidance Matters: Because Maryland bankruptcy laws sit at the intersection of federal statutes, Fourth Circuit precedent, and Maryland exemption rules, working with an experienced Maryland bankruptcy attorney can help you choose the right chapter, protect key assets where possible, and move smoothly from filing to discharge.

- Where to Learn More: For deeper Maryland-specific detail, see Bankruptcy in Maryland: State Overview plus our dedicated guides to chapter 7, chapter 13, and Maryland exemption rules.

Bankruptcy is a legal tool designed to help individuals and small businesses manage overwhelming debt. Used correctly, it can stop collection calls, lawsuits, and garnishments, and give you a structured path toward a financial reset.

In the state of Maryland, bankruptcy is built on federal law, but Maryland adds its own state-specific rules and exemptions. Those Maryland exemptions can play a major role in what happens to your home equity, vehicle, and essential household property.

All cases are handled by the US Bankruptcy Court for the District of Maryland. This US bankruptcy court in Maryland reviews your paperwork, oversees your case, and ensures compliance with both federal rules and Maryland-specific requirements.

For most individuals, there are two main types of bankruptcies in Maryland: Chapter 7 and Chapter 13. Each option has different eligibility rules, timelines, and long-term consequences, so choosing between them is one of the most important decisions in any bankruptcy Maryland case.

The process of how to file for bankruptcy in Maryland typically includes credit counseling, the means test, detailed financial disclosures, and a court-supervised review of your situation. Because these rules are technical and the stakes are high, many people look for bankruptcy help in Maryland from an experienced attorney or law firm.

This guide will walk through the key pieces of Maryland bankruptcy laws so that when you search for terms like “state of Maryland bankruptcy” or “how to file for bankruptcy in Maryland,” you’ll find clear, practical information you can actually use to make informed financial decisions.

Maryland Bankruptcy Laws: Overview of the Process

How Federal Law Shapes Maryland Bankruptcy Cases

Maryland bankruptcy laws start with the federal Bankruptcy Code and then layer in Maryland-specific rules. For chapter 7 cases, the core framework comes from Title 11 of the United States Code, specifically Chapter 7 (sections 701–784), which governs how a trustee is appointed, how the bankruptcy estate is created, and how assets are collected and distributed to creditors.

How Maryland Exemptions Affect Case Administration

When that federal chapter 7 structure is applied in the state of Maryland bankruptcy system, Maryland’s own exemption statutes shape how a case is administered. Most exemptions are found in the Maryland Code, Courts and Judicial Proceedings § 11-504 and related provisions, and they influence what the chapter 7 trustee can sell, what you can keep, and how much equity you can protect in things like a home, vehicle, or household goods.

These Maryland bankruptcy exemptions work hand in hand with the federal Bankruptcy Code, and together they determine the real-world outcome of your case—whether you are filing under chapter 7 or chapter 13.

The Role of the US Bankruptcy Court for the District of Maryland

The process itself is overseen by the US Bankruptcy Court for the District of Maryland. This court handles all bankruptcy Maryland filings and proceedings, applies Title 11 of the U.S. Code, and enforces Maryland’s exemption rules and local procedures. Debtors receive the protection of federal law, but the outcome is heavily affected by how Maryland’s statutes interact with the federal system.

Key Steps Under Maryland Bankruptcy Laws

Before declaring bankruptcy in Maryland, individuals must complete credit counseling. This required step must be done through an approved agency and is intended to ensure that you understand your options, responsibilities, and whether bankruptcy is the right fit for your situation.

Here’s a quick high level overview of how the process typically works under Maryland bankruptcy laws:

- Complete credit counseling from an approved provider.

- File a bankruptcy petition under Title 11 with the US Bankruptcy Court for the District of Maryland, listing all assets, debts, income, and expenses.

- Attend a meeting of creditors (the “341 meeting”) where the chapter 7 or chapter 13 trustee reviews your case and may ask follow-up questions.

- Comply with any additional court and trustee requirements, including providing documents and, in chapter 13, making plan payments.

- Receive a discharge of qualifying debts if you meet all requirements under Maryland bankruptcy laws and the federal Bankruptcy Code.

Through these steps, the combination of federal law and Maryland-specific exemptions is designed to provide an orderly process and, for eligible filers, a fresh financial start. Because the rules are technical and fact-specific, it is usually wise to seek legal advice before moving forward.

Types of Bankruptcy in Maryland

For most individuals, the main types of bankruptcies in Maryland are chapter 7 and chapter 13. Each chapter handles debt in a different way, and which one makes sense for you depends on your income, assets, and long-term goals.

This page gives a high-level overview of how these options fit into Maryland bankruptcy laws. For a deeper dive into eligibility rules, timelines, and strategy, it’s best to review our dedicated Maryland chapter guides on chapter 7 and chapter 13. In some situations—especially where debts are above chapter 13 limits or a business needs to restructure—chapter 11 bankruptcy in Maryland may also be part of the conversation.

A Brief Look at Chapter 7

Chapter 7 is typically used when there isn’t enough income to support a long-term repayment plan. In a Maryland chapter 7 case, a trustee reviews your assets and applies Maryland bankruptcy exemptions to determine what property is protected. Unsecured debts like credit cards and medical bills may be wiped out if you qualify.

If you want a detailed walkthrough of eligibility, the means test, and what typically happens to homes, cars, and other assets in a chapter 7 case, you can continue reading in our Maryland chapter 7 guide.

A Brief Look at Chapter 13

Chapter 13 is designed for people who have steady income and want to keep important assets while catching up on past-due balances over time. In a Maryland chapter 13 case, you propose a court-approved repayment plan, usually lasting three to five years, and make regular payments through the trustee.

Homeowners often consider chapter 13 when they are behind on mortgage payments and need time to cure the arrears while protecting the property under Maryland bankruptcy laws. For more detail on how plans are structured, how payments are calculated, and how exemptions fit into the analysis, see our Maryland chapter 13 guide.

Chapter 11 Bankruptcy in Maryland

When Chapter 11 Bankruptcy in Maryland May Make Sense

Although most consumer cases involve chapter 7 or chapter 13, there are situations where chapter 11 bankruptcy in Maryland is a better fit. Chapter 11 is commonly used by businesses that need to reorganize while continuing to operate, but it can also be used by individuals who are over the chapter 13 debt limits or have more complex financial structures.

In practice, chapter 11 bankruptcy in Maryland may be considered by small business owners, professionals with significant secured and unsecured debt, or individuals with multiple properties or closely held business interests where a standard repayment plan is not flexible enough.

Key Features of Chapter 11 for Maryland Businesses and Individuals

Chapter 11 cases are typically more procedurally complex and expensive than chapter 7 or chapter 13, but they offer a high degree of flexibility in restructuring debts, leases, and business operations. The debtor usually remains in possession of assets and proposes a plan of reorganization that must be reviewed and approved through the federal courts serving Maryland.

If you are a business owner or an individual with substantial secured or unsecured debt, it may be worth understanding how chapter 11 works at a national level before deciding which chapter to pursue, especially if you are weighing chapter 11 bankruptcy in Maryland against other options.

For a broader overview of how chapter 11 compares to the other options, you can review our national guide to chapter 11 bankruptcy.

Choosing a Bankruptcy Direction in Maryland

All three of these chapters—7, 13, and 11—can offer meaningful relief, but the right choice depends on your full financial picture. This overview is a starting point; for strategy, timelines, and detailed examples within Maryland, the chapter-specific guides above are the best place to continue your research. If you’d like a big-picture comparison that applies nationwide, you can also review our national chapter 7 vs chapter 13 guide.

How Maryland Bankruptcy Laws Interact With Federal Law

The Federal Bankruptcy Code: Where Every Case Starts

Every bankruptcy case in the state of Maryland bankruptcy system starts with federal law. The U.S. Constitution gives Congress the power to create uniform bankruptcy laws, and Congress did that through Title 11 of the United States Code—often called the Bankruptcy Code. That federal code sets out the basic rules for chapter 7, chapter 13, and other chapters, including how cases are filed, how the bankruptcy estate is created, and how trustees administer assets.

Maryland’s Role: Exemptions And Local Rules

While the Bankruptcy Code provides the foundation, Maryland bankruptcy laws shape the outcome in important ways. Maryland has “opted out” of the federal exemption scheme, which means people filing here must use Maryland’s own exemption laws rather than the federal set.

Most of the key Maryland bankruptcy exemptions are found in the Maryland Code, Courts and Judicial Proceedings § 11-504 and related sections. These provisions govern how much equity you can protect in items like your home, vehicle, household goods, and certain personal property. How those exemptions apply in a chapter 7 or chapter 13 case can change what the trustee can reach and what you are able to keep.

For a deeper look at the specific protections available, you can review our dedicated guide to Maryland bankruptcy exemptions.

Courts, Circuits, And How Precedent Works In Maryland

Maryland is part of the United States Court of Appeals for the Fourth Circuit. That means decisions from the Fourth Circuit are binding authority on the federal courts in Maryland when they interpret the Bankruptcy Code and other federal questions in bankruptcy cases. Bankruptcy judges in Maryland are expected to follow Fourth Circuit precedent on federal law issues, even when different circuits might handle similar questions another way.

When it comes to exemptions, the question of how a particular Maryland exemption applies in a bankruptcy case is decided first by the bankruptcy court. The court is applying federal bankruptcy law, but it has to decide what the Maryland legislature and Maryland appellate courts meant when they drafted and interpreted the state exemption statute. In practice, the bankruptcy judge looks to the text of the Maryland Code and to Maryland appellate decisions, and then applies that state-law meaning within the federal bankruptcy framework.

Maryland Bankruptcy Framework At A Glance

The summary below shows where Maryland sits in the federal system and which code titles most directly affect bankruptcy administration in the state:

| Topic | MD Bankruptcy Framework |

|---|---|

| Federal Circuit | United States Court of Appeals for the Fourth Circuit |

| Federal District | United States District Court for the District of Maryland (D. Md.) |

| Federal Code Title For Bankruptcy | Title 11, United States Code (Bankruptcy Code) |

| Maryland State Code Title Affecting Bankruptcy Administration | Maryland Code, Courts and Judicial Proceedings, Title 11 – Judgments (including § 11-504 exemptions from execution) |

Navigating this mix of federal statutes, Fourth Circuit case law, and Maryland Code provisions is critical for a successful filing. The federal Bankruptcy Code decides the structure of your chapter and the discharge rules, while Maryland bankruptcy laws determine which assets are protected and how much value must be made available to creditors. Because of this interaction, working with someone who understands both the Fourth Circuit’s approach and Maryland’s exemption framework can help you maximize asset protection and avoid costly mistakes when declaring bankruptcy in Maryland.

The Bankruptcy Process: How to File Bankruptcy in Maryland

When people search for how to file bankruptcy in Maryland, they are usually looking for a roadmap. This section gives a high-level overview of what declaring bankruptcy in Maryland generally involves, but it is not a step-by-step instruction manual or legal advice. The exact process and paperwork will look different depending on whether you file under chapter 7 or chapter 13, your income, your assets, and your local court’s procedures.

A High-Level Overview of the Maryland Bankruptcy Process

Although every case is unique, most consumer bankruptcy matters in the state of Maryland follow a basic sequence under the federal Bankruptcy Code and local rules of the US Bankruptcy Court for the District of Maryland.

At a very general level, a typical case will include milestones like:

- Completing required credit counseling from an approved provider before filing.

- Working with your attorney to gather documents and prepare the bankruptcy petition and schedules.

- Filing your case with the US Bankruptcy Court for the District of Maryland, which triggers the automatic stay.

- Attending the meeting of creditors (the “341 meeting”) with the trustee.

- Completing a post-filing debtor education course and addressing any issues the trustee or court raises.

Credit Counseling, Means Testing, And Chapter Choice

Before you can file, you must complete a credit counseling session through an approved agency. This requirement applies to most individuals declaring bankruptcy in Maryland and is meant to ensure that you understand the alternatives and responsibilities involved.

For those considering chapter 7, a means test compares your income to Maryland’s median income levels and analyzes your allowed expenses. Depending on the outcome, you may qualify for chapter 7, or a chapter 13 repayment plan may be more appropriate. The details of how the means test and chapter choice work are covered more fully in our dedicated Maryland chapter guides.

Filing, The Automatic Stay, And The 341 Meeting

Once your petition and schedules are filed with the court, the automatic stay usually goes into effect immediately. This stay is a powerful protection that can stop most collection actions, including garnishments, lawsuits, and many foreclosure efforts, while your bankruptcy case is pending.

Shortly after filing, the court will schedule a meeting of creditors (also called the 341 meeting). At this brief hearing, you answer questions under oath about your finances and paperwork. A chapter 7 or chapter 13 trustee leads the meeting and may request additional documents or clarification based on your situation.

Completing Requirements And Receiving A Discharge

To finish the process, you must complete a post-filing debtor education course on financial management and comply with any additional requests from the trustee or court. In chapter 7, eligible debts may be discharged relatively quickly once these requirements are met. In chapter 13, you generally must complete your court-approved repayment plan before receiving a discharge.

Because the steps and timelines differ significantly between chapter 7 and chapter 13, and because Maryland bankruptcy laws and exemptions can affect nearly every decision along the way, it is risky to treat this overview as a “how-to” guide.

Most people seeking bankruptcy help in Maryland work closely with an experienced Maryland bankruptcy lawyer or law firm. A local attorney can walk you through which chapter makes the most sense, how the process will look in your specific circumstances, and what to expect at each stage so your case proceeds smoothly from filing to discharge.

Maryland Exemptions: Broad Overview

What Exemptions Do In A Maryland Bankruptcy Case

When people talk about using exemptions in bankruptcy cases, they are really talking about the set of laws that decide what property is protected if you file. Exemptions tell the trustee and your creditors which assets are generally off-limits, and which items may have to be turned over or factored into a repayment plan.

In the state of Maryland, you cannot simply choose the federal exemption scheme the way filers can in some other states. Instead, Maryland requires most individuals to use Maryland’s own exemption laws, which makes it especially important to understand how those state rules interact with the federal Bankruptcy Code.

A High-Level Look At Maryland Exemption Protection

At a very general level, Maryland exemption laws are designed to protect certain core categories of property so you are not left with nothing after a bankruptcy. Depending on your situation, these protections may apply to things like a portion of your home equity, a reasonable amount of personal property, some equity in a vehicle, and many tax-qualified retirement accounts.

The details matter, though: the exact categories, dollar limits, and eligibility rules can change over time and are applied differently depending on whether you are in chapter 7 or chapter 13. Rather than relying on a short summary, it is much safer to review a current, Maryland-specific exemption guide.

For a deeper breakdown of categories, amounts, and examples, you can visit our dedicated page on Maryland bankruptcy exemptions.

How Exemptions Fit Into Your Maryland Bankruptcy Strategy

Exemptions are not just an abstract legal concept—they drive strategy. In chapter 7, exemption planning affects what a trustee can reach and what you are likely to keep. In chapter 13, the value of non-exempt property can influence how much your plan must pay to unsecured creditors over time.

Because Maryland exemption rules are state-specific and fact-sensitive, it is risky to make assumptions about what is “safe” without getting advice. Most people considering bankruptcy help in Maryland will talk with an experienced Maryland bankruptcy attorney, who can walk through your asset list, apply the current exemption laws, and help you understand what filing would really look like in your case.

The Role of the US Bankruptcy Court for the District of Maryland

The US Bankruptcy Court for the District of Maryland is where every Maryland bankruptcy case officially lives. When you file under chapter 7, chapter 13, or chapter 11, your petition, schedules, and supporting documents are all filed with this federal court rather than a state court.

After filing, the US Bankruptcy Court for the District of Maryland issues the key orders and notices that shape your case: the automatic stay order, the notice of the meeting of creditors (the 341 meeting), and any scheduling or confirmation hearings that apply in your chapter. The court’s docket becomes the official record of what has been filed, what has been ruled on, and what still needs to be done.

The court’s jurisdiction covers the entire state, with proceedings held in multiple locations so Maryland residents and businesses can access the system without having to travel across the country. Judges of the US Bankruptcy Court for the District of Maryland apply the federal Bankruptcy Code, follow Fourth Circuit precedent on federal issues, and give effect to Maryland’s exemption laws and other state-specific rules.

For someone considering bankruptcy help in Maryland, it’s helpful to remember that this court is not just a distant institution—it is the place that processes your paperwork, enforces the automatic stay, confirms or denies your plan (in chapter 13 or chapter 11), and ultimately enters the discharge that wipes out qualifying debts if you complete the process successfully.

Bankruptcy Cost in Maryland: Court Fees and Attorney Fees

When people search for bankruptcy cost in Maryland, they are usually trying to understand what it will actually take to get a case filed and finished. The total cost includes court filing fees, attorney fees, required courses, and sometimes a few smaller out-of-pocket expenses, and it can look different depending on which chapter you file under and how complex your situation is.

Court Filing Fees in Maryland Bankruptcy Cases

The federal court sets the basic filing fees, which apply in the US Bankruptcy Court for the District of Maryland. For most individuals:

- Chapter 7 filing fees are typically a little over $330.

- Chapter 13 filing fees are usually just over $310.

These figures can change periodically when the federal fee schedule is updated, so it is always wise to confirm the current amounts with the court or your attorney before filing.

How Attorney Fees Vary by Chapter and Case Complexity

Attorney fees are the biggest variable in the bankruptcy cost in Maryland. There is no single “standard” fee that applies to every case. Instead, the fee depends on the chapter you file under and how complex your financial picture is.

- In many chapter 7 cases, Maryland bankruptcy attorneys charge a flat fee that covers counseling, document preparation, filing, and representation at the 341 meeting. Simpler cases with few assets and straightforward debts tend to be on the lower end of the range, while cases involving business interests, multiple properties, or contested issues are higher.

- In chapter 13, attorney fees are often higher overall because the lawyer is involved for several years while the repayment plan is proposed, confirmed, and monitored. A portion of the fee is frequently paid through the chapter 13 plan itself, subject to court approval.

- In chapter 11, fees can be significantly higher than in chapter 7 or chapter 13, reflecting the added complexity of business reorganizations or high-debt individual cases. Those fees are usually billed hourly and are closely reviewed by the court.

Many firms that offer bankruptcy help in Maryland will discuss fee options up front and may provide payment plans or structure fees differently depending on the chapter and your budget.

Other Costs to Keep in Mind

In addition to court and attorney fees, there are smaller costs that are part of the bankruptcy cost in Maryland:

- Required credit counseling and debtor education courses, which are usually modestly priced.

- Possible fees for things like appraisals, credit reports, or document retrieval in more complex cases.

For many people, the potential debt relief and protection offered by bankruptcy outweigh these upfront costs, but it is important to get a clear, written fee explanation from your Maryland bankruptcy attorney before you move forward so you know exactly how the numbers work in your specific chapter and case type.

Working with a Maryland Bankruptcy Attorney or Law Firm

Why Local Bankruptcy Help in Maryland Matters

Navigating bankruptcy can be complex, and the details of Maryland bankruptcy laws can have a big impact on your results. A Maryland bankruptcy attorney offers local, state-specific experience and can help you understand how federal rules, Maryland exemptions, and Fourth Circuit precedent all come together in your case.

Instead of trying to piece everything together from online articles, working with a lawyer gives you a single point of contact who can explain your options in plain language and help you avoid mistakes that could cost you money, time, or critical property.

How a Maryland Bankruptcy Attorney Can Help

One of the first things a Maryland bankruptcy attorney will do is review your full financial picture—income, expenses, assets, and debts—and help you decide whether bankruptcy is appropriate at all. If it is, they can help you choose between chapter 7, chapter 13, or, in some higher-debt or business situations, chapter 11.

Your attorney also prepares and files the petition, schedules, and supporting documents with the US Bankruptcy Court for the District of Maryland, makes sure deadlines are met, and represents you at the meeting of creditors and any necessary hearings. This kind of guidance can be especially important if your case involves non-exempt assets, business interests, or a complicated history with creditors.

Choosing a Maryland Bankruptcy Law Firm

Not every firm approaches bankruptcy the same way, so it pays to be thoughtful about who you hire for bankruptcy help in Maryland. When you are comparing attorneys or law firms, it can be useful to focus on a few key factors:

- Experience: Look for a firm with a strong track record handling chapter 7, chapter 13, and, where relevant, chapter 11 cases in Maryland.

- Reputation: Reviews, referrals, and client testimonials can give insight into how well the attorney communicates and follows through.

- Scope of services: Make sure they provide end-to-end support—from initial consultation through discharge or plan completion—and that you understand how fees work for the chapter you are likely to file.

Working with a qualified Maryland bankruptcy attorney or law firm can make the process smoother, less stressful, and more predictable, so you can focus on rebuilding your financial life instead of worrying about every procedural detail.

Life After Bankruptcy: What to Expect in Maryland

Life After Bankruptcy in Maryland: A Fresh Starting Point

Filing for bankruptcy can feel like a major low point, but legally it is meant to give you a fresh start. Once your case is complete, collection calls should stop on discharged debts, and you can shift your energy from crisis management to rebuilding. Life after bankruptcy in Maryland is not instant perfection, but it can be a lot more stable and manageable than what came before.

Adjusting Your Financial Habits Post-Discharge

After bankruptcy, your day-to-day financial habits matter more than ever. It’s essential to create a realistic budget that covers housing, transportation, food, insurance, and a small cushion for savings. Many people find it helpful to keep things simple for a while—using cash or debit for most purchases and being very deliberate about any new credit they take on.

Rebuilding Credit After Bankruptcy in Maryland

Your credit score will not bounce back overnight, but it can improve steadily with consistent, patient effort. The fact that you filed will remain on your credit report for a number of years, yet lenders also pay close attention to what you do after the filing date. Positive, recent history can gradually outweigh older negative marks.

Consider focusing on a few core steps:

- Credit monitoring: Regularly review your credit reports to confirm discharged debts are reported correctly and to catch errors early.

- Secured credit cards or small starter accounts: When you are ready, using a secured card or carefully chosen starter account and paying it on time every month can help rebuild your payment history.

- Financial planning and saving: Setting clear goals and building even a modest emergency fund can reduce the chances of needing high-interest credit when surprises happen.

Moving Toward Long-Term Stability

By staying committed to a budget, monitoring your credit, and being intentional about new debt, you can steadily move toward greater financial stability after bankruptcy in Maryland. The process takes time and discipline, but many people find that life a few years after discharge is quieter, more predictable, and much less stressful than the period that led up to filing.

Frequently Asked Questions About Bankruptcy in Maryland

These common questions offer a high-level overview of bankruptcy in Maryland. The answers are for general information only and are not a substitute for legal advice about your specific situation.

How do I file bankruptcy in Maryland?

To file bankruptcy in Maryland, you generally complete required credit counseling, gather financial documents, prepare your bankruptcy petition and schedules, and file them with the US Bankruptcy Court for the District of Maryland. After filing, the court will schedule a meeting of creditors (the 341 meeting), and you must complete a post-filing debtor education course before you can receive a discharge in most cases.

The exact process and paperwork will look different depending on whether you file under chapter 7, chapter 13, or chapter 11, and on the complexity of your income, assets, and debts. Because mistakes can be costly, most people work with an experienced Maryland bankruptcy attorney to make sure the filing is accurate and follows local rules and procedures.

How much does it cost to file bankruptcy in Maryland?

The bankruptcy cost in Maryland includes court filing fees, attorney fees, and required credit counseling and debtor education courses. Court filing fees are set at the federal level and are typically a little over $330 for a chapter 7 case and just over $310 for a chapter 13 case, though these amounts can change when the federal fee schedule is updated.

Attorney fees vary based on the chapter you file under and how complex your case is. Chapter 7 is often handled for a flat fee, while chapter 13 and chapter 11 usually involve higher overall fees because they require more ongoing work. Many firms offering bankruptcy help in Maryland will explain their fees up front and may structure payment options to fit your budget.

How many times can you file bankruptcy in Maryland?

There is no strict lifetime limit on how many times you can file bankruptcy in Maryland, but there are important timing rules that control how soon you can receive another discharge after a previous chapter 7, chapter 13, or chapter 11 case. These waiting periods are set by federal law and depend on which chapter you filed before and which chapter you are considering now.

For a more detailed breakdown of how often you can file and still get a discharge, including common timing combinations (such as chapter 7 after chapter 13, or chapter 13 after chapter 7), you can review our dedicated guide on how often you can file bankruptcy.

Where to file bankruptcy in Maryland?

If you live, work, or have most of your assets in Maryland, your case is typically filed with the US Bankruptcy Court for the District of Maryland, not a state court. The court has multiple locations within the state, and your filing location is usually determined by your county of residence or where your primary business is located.

Your attorney will prepare the petition and file it electronically with the court. If you are filing without an attorney, you will need to follow the court’s local rules and procedures for pro se filers, which can be found through the US Bankruptcy Court for the District of Maryland’s official resources.

Can I file bankruptcy without my spouse in Maryland?

Yes, it is possible to file bankruptcy without your spouse in Maryland. Federal bankruptcy law allows one spouse to file individually, even if you are married. However, whether that is a good idea depends on how your debts and assets are titled, whether you live in a community property or separate property state, and how Maryland law treats jointly held property and obligations.

Because this is a nuanced issue, it’s important to understand the pros and cons of an individual filing versus a joint filing. For a more in-depth discussion of this topic, you can read our guide on whether just one spouse can file bankruptcy, and discuss your specific situation with a Maryland bankruptcy attorney.

Can I get fired in Maryland for bankruptcy?

In most situations, employers are not allowed to fire you solely because you filed for bankruptcy. Federal law provides protections that make it illegal for a private employer or a government employer to terminate your employment, or take certain negative actions against you, just because you sought relief under the Bankruptcy Code.

That said, bankruptcy can still come up in background checks, licensing, security clearance reviews, and credit checks for certain positions, particularly in finance or positions of trust. If you are worried about how a bankruptcy filing might affect your job or professional license in Maryland, it is wise to speak with a knowledgeable attorney so you can understand both your legal protections and any potential practical considerations.

Maryland Bankruptcy Laws: Key Takeaways and Next Steps

Understanding Maryland bankruptcy laws is essential if you are seriously considering bankruptcy in Maryland. Filing can provide meaningful debt relief and stop aggressive collection activity, but it also carries long-term consequences for your credit, assets, and financial plans. It is important to look at your entire financial picture—not just one bill or one creditor—before you move forward.

Because state of Maryland bankruptcy cases sit at the intersection of federal law, Maryland exemptions, and local court practice, most people benefit from getting personalized bankruptcy help in Maryland rather than relying on generic information. A Maryland bankruptcy attorney can explain how the rules apply to you, help you choose between chapter 7, chapter 13, or in some situations chapter 11, and guide you through the filing process in the US Bankruptcy Court for the District of Maryland.

As you decide on next steps, it can be helpful to keep a few core considerations in mind:

- Evaluate how a bankruptcy Maryland filing would affect your credit, your budget, and your long-term financial goals.

- Identify which chapter best fits your situation—such as chapter 7, chapter 13, or, for some higher-debt or business cases, chapter 11—before you file.

- Gather and organize pay stubs, tax returns, bills, loan statements, and asset information so your attorney can quickly see your full financial picture.

With careful planning, accurate information, and experienced guidance, Maryland bankruptcy laws can be used as a tool—not a last resort—to help you move from constant financial stress toward a more stable and manageable future.

Explore Our Maryland Bankruptcy Guides

Explore Some of Our National Bankruptcy Guides

- Chapter 7 Bankruptcy: National Guide

- Chapter 13 Bankruptcy: National Guide

- Chapter 7 vs Chapter 13 Bankruptcy: National Guide

- Can Just One Spouse File Bankruptcy?

- Can You File Bankruptcy and Keep Your House?

- Can You File Bankruptcy and Keep Your Car?

- How Often Can You File Bankruptcy?

- Chapter 13 Vehicle Cramdown

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin