Understanding Wisconsin Bankruptcy Laws and Procedures

When money is tight and bills keep piling up, trying to make sense of Wisconsin bankruptcy laws can feel overwhelming. Yet understanding how bankruptcy works in Wisconsin is one of the most important steps you can take if you’re seriously considering a fresh financial start.

Bankruptcy is a legal tool, not a moral judgment. It exists to give honest people in difficult situations a way to manage or eliminate debts they can no longer afford. Used correctly, it can stop lawsuit threats, collection calls, wage garnishments, and give you breathing room to rebuild.

Because bankruptcy is based on federal law but applied through Wisconsin-specific procedures, the process has layers. These rules are designed to balance the rights of people who need relief (debtors) with the rights of those who are owed money (creditors), so everyone is treated fairly under the law.

Two courts handle almost all bankruptcy Wisconsin cases: the US Bankruptcy Court Western District of Wisconsin and the Wisconsin Eastern Bankruptcy Court. Which court you file in depends on where you live, and each court follows detailed local rules and procedures that affect how your case moves forward.

Before you ever file, it’s critical to understand whether you qualify, which chapter makes sense for your situation, and what the “means test” is looking at. Eligibility, income, household size, and your mix of debts all matter when you’re deciding if, and how, to move ahead.

This guide walks through the major types of bankruptcy available to Wisconsin residents, explains how the courts and trustees fit into the process, and highlights key decisions you’ll face along the way.

By the end, you’ll have a clearer, step-by-step picture of how to file bankruptcy in Wisconsin and what to expect at each stage of the process.

Wisconsin Bankruptcy Laws at a Glance

- Wisconsin bankruptcy laws combine federal rules with Wisconsin-specific procedures that affect exemptions, court locations, and how cases are handled.

- Most bankruptcy Wisconsin cases are handled by either the US Bankruptcy Court Western District of Wisconsin or the Wisconsin Eastern Bankruptcy Court, depending on where you live.

- Before filing, it’s essential to understand your options under chapter 7 and chapter 13, how the means test works, and whether you meet eligibility requirements.

- This guide is designed to give you a step-by-step overview of how to file bankruptcy in Wisconsin, from choosing a chapter to understanding the roles of the court and trustee.

Overview of Wisconsin Bankruptcy Laws

Wisconsin bankruptcy laws create the basic framework for debt relief in the state. They outline how individuals and small businesses can use bankruptcy to manage overwhelming debt, protect essential property, and work toward a financial reset.

Most of the rules come from federal law—Title 11 of the United States Code (the “Bankruptcy Code”)—but every bankruptcy Wisconsin case is also shaped by Wisconsin-specific procedures and exemptions. Many of the state exemption rules are collected in Chapter 815 of the Wisconsin Statutes, including the general personal property exemption statute (Wis. Stat. § 815.18) and the homestead exemption statute (Wis. Stat. § 815.20), which help determine what property you can keep and how certain debts are treated.

Wisconsin has not opted out of the federal bankruptcy exemptions, so qualifying filers can often choose between the Wisconsin exemption set in Chapter 815 and the federal exemption set under 11 U.S.C. § 522(d). Which exemption system you choose can make a major difference in how much property you are able to protect.

Main Bankruptcy Options in Wisconsin

For most people, the core choices under Wisconsin bankruptcy laws are between chapter 7 and chapter 13. Each chapter follows a different process, has different eligibility rules, and leads to different outcomes for your debts and assets. There is also chapter 11, which is used primarily by business entities but is sometimes filed by individuals whose debts or assets are too large for chapter 13 limits.

Here’s a quick overview of the main options for individuals (all found within Title 11 of the United States Code). This page gives you the big picture, while our dedicated chapter 7 and chapter 13 pages go much deeper into each path:

- Chapter 7: A faster process that uses non-exempt property, if any, to pay creditors and then wipes out many unsecured debts under the chapter 7 provisions of the Bankruptcy Code. For a detailed, step-by-step explanation of how this works in real cases, read our dedicated chapter 7 guide for Wisconsin.

- Chapter 13: A court-approved repayment plan, usually over three to five years, that lets you catch up on key debts while keeping property, using the chapter 13 framework for individuals with regular income. For a deeper dive into how plans are structured, how payments are calculated, and what to expect in Wisconsin chapter 13 cases, see our dedicated chapter 13 bankruptcy in Wisconsin guide.

- Chapter 11 (less common for individuals): A reorganization chapter under the Bankruptcy Code most often used by businesses, and occasionally by higher-debt individuals who exceed chapter 13 limits.

Understanding how these options work under Wisconsin bankruptcy laws, the federal Bankruptcy Code, and the Wisconsin exemption statutes is the first step toward choosing a realistic path to financial recovery. This page is designed to give you the overall roadmap. If you want a deeper dive into a specific path, our Wisconsin chapter 7 guide and Wisconsin chapter 13 guide each walk through that chapter in much more detail.

Key Takeaways: Overview of Wisconsin Bankruptcy Laws

- Wisconsin bankruptcy laws work together with federal law— Title 11 of the United States Code (the Bankruptcy Code)—and Wisconsin exemption statutes such as Wis. Stat. § 815.18 and Wis. Stat. § 815.20 to control how debts are managed, what property you can keep, and which court hears your case.

- Most individuals choose between chapter 7 and chapter 13 under the Bankruptcy Code, but chapter 11 can be an option in higher-debt situations, especially for businesses and some individuals who exceed chapter 13 limits.

- Small differences in exemptions (state or federal), income, and the type of debt you have can strongly influence which option makes sense in a bankruptcy Wisconsin case.

- This guide will build on this overview to show you how to file bankruptcy in Wisconsin step by step, from understanding the courts to working with a trustee under Title 11.

The Role of Bankruptcy Courts in Wisconsin

When you file bankruptcy in Wisconsin, your case is handled in federal court, not state court. Every bankruptcy Wisconsin case is assigned to a U.S. Bankruptcy Court judge whose job is to apply federal law fairly to both debtors and creditors.

Two primary bankruptcy courts serve the state: the U.S. Bankruptcy Court for the Western District of Wisconsin and the U.S. Bankruptcy Court for the Eastern District of Wisconsin. Each court covers a specific group of counties and follows its own set of local rules and procedures, but both apply the same federal Bankruptcy Code.

Bankruptcy judges in these courts do much more than simply “approve” or “deny” a case. They review petitions, rule on motions, decide disputes, and make sure everyone follows the law—from debtors and creditors to attorneys and trustees.

Here is a brief breakdown of what the bankruptcy courts in Wisconsin typically do:

- Adjudicating bankruptcy petitions: Reviewing your filing, making sure it meets legal requirements, and entering key orders like the discharge or confirmation of a chapter 13 plan.

- Overseeing the bankruptcy estate: Working with the trustee on how assets are handled, how claims are treated, and whether proposed repayment plans comply with the law.

- Resolving disputes: Deciding disagreements between debtors and creditors, including objections to exemptions, plan terms, or the treatment of particular debts.

Understanding which Wisconsin bankruptcy court will handle your case—and what that court actually does—makes it easier to follow the process and communicate with your attorney. In the next sections, we’ll look more closely at the Western District and the Eastern District so you can see how each one is organized and where your case is likely to be filed.

Key Takeaways: Bankruptcy Courts in Wisconsin

- All bankruptcy Wisconsin cases are handled in federal court, by specialized U.S. Bankruptcy Courts rather than state courts.

- Wisconsin has two bankruptcy courts—the Western District and the Eastern District—and which one you use depends on where you live.

- Bankruptcy judges apply the federal Bankruptcy Code and related jurisdiction statutes, such as 28 U.S.C. § 1334 and 28 U.S.C. § 157, to hear and decide bankruptcy cases and related disputes.

- Knowing which court will oversee your case, and what that court does, is a key part of understanding how to file bankruptcy in Wisconsin and what to expect after your case is filed.

US Bankruptcy Court Western District of Wisconsin

The U.S. Bankruptcy Court for the Western District of Wisconsin handles bankruptcy Wisconsin cases for residents in the western half of the state, including areas around Madison, Eau Claire, La Crosse, and Wausau. Both individuals and businesses file here under chapters 7, 11, 12, and 13 of the Bankruptcy Code.

The court maintains staffed clerk’s offices in Madison and Eau Claire. Each location follows federal law as well as local rules and procedures published on the court’s official website: U.S. Bankruptcy Court — Western District of Wisconsin. Understanding where to file, how to contact the clerk’s office, and how to access hearing information is an important part of preparing to file bankruptcy in Wisconsin.

| Office | Address & Phone | Website |

|---|---|---|

| Madison (Main Office) | U.S. Bankruptcy Court Western District of Wisconsin 120 North Henry Street, Room 340 Madison, WI 53703-2559 Main Phone: (833) 758-0380 Case Information (VCIS): (866) 222-8029 | Court Locations — Western District |

| Eau Claire | U.S. Bankruptcy Court Western District of Wisconsin 500 South Barstow Street, Room 223 Eau Claire, WI 54701-3608 Main Phone: (833) 758-0380 In-person filing only — no mail accepted at this location. | Eau Claire Location — Official Site |

Filing in the Western District means following the court’s local rules, forms, and filing procedures, which are all available on the official website. Working with an experienced Wisconsin bankruptcy attorney can help you avoid common filing mistakes and make sure your case is filed in the correct division with the right supporting documents.

Wisconsin Eastern Bankruptcy Court

The U.S. Bankruptcy Court for the Eastern District of Wisconsin manages bankruptcy Wisconsin cases for residents in the eastern part of the state, including the Milwaukee metro area, Green Bay, the Fox Valley, and surrounding counties. Like the Western District, it handles cases under chapters 7, 11, 12, and 13 of the Bankruptcy Code.

The court’s main bankruptcy clerk’s office is in downtown Milwaukee, with additional hearing locations in Green Bay (and, in some instances, Oshkosh). County-by-county coverage is shown on the court’s jurisdiction map, which is a helpful tool for figuring out whether your case belongs in the Eastern District or the Western District.

The Eastern District follows the federal Bankruptcy Code and its own local rules and procedures, all available on the official website: U.S. Bankruptcy Court — Eastern District of Wisconsin. Before you file, it’s important to understand where to send documents, how to contact the clerk’s office, and which locations accept filings.

| Office | Address & Phone | Website |

|---|---|---|

| Milwaukee (Main Office) | U.S. Bankruptcy Court Eastern District of Wisconsin U.S. Federal Courthouse – Milwaukee 517 East Wisconsin Avenue, Room 126 Milwaukee, WI 53202 Main Phone: (414) 297-3291 Toll-Free: (866) 582-3156 Case Information (VCIS): (866) 222-8029 | Court Locations — Eastern District |

| Green Bay (Hearings Only) | U.S. Bankruptcy Court Eastern District of Wisconsin U.S. Federal Courthouse – Green Bay 125 S Jefferson Street Green Bay, WI 54301 Hearings only — no filings accepted at this location. Use the Milwaukee address for mail and in-person filings unless your attorney instructs otherwise. | Court Locations — Eastern District |

Filing in the Eastern District means following both national and local bankruptcy rules, using the correct forms, and paying close attention to filing instructions from the clerk’s office. An experienced Wisconsin bankruptcy attorney can help you determine whether the Eastern District is the right venue for your case and guide you through the specific procedures this court requires.

Key Takeaways: Wisconsin Eastern Bankruptcy Court

- The Eastern District of Wisconsin Bankruptcy Court handles cases from Milwaukee, Green Bay, and many surrounding counties, as shown on the court’s jurisdiction map.

- The main bankruptcy clerk’s office—and the place to file documents—is located in Milwaukee at 517 East Wisconsin Avenue, Room 126, with hearings also held at the Green Bay federal courthouse.

- Office hours, phone numbers, and filing instructions are kept current on the court’s official site at wieb.uscourts.gov, which should be your primary source for procedural updates.

Eligibility and the Means Test in Wisconsin

Not everyone who wants to file bankruptcy in Wisconsin can simply choose chapter 7. Congress built a screening tool, known as the “means test,” into the Bankruptcy Code to separate truly distressed households from those who may be able to repay some debt over time.

The means test comes from 11 U.S.C. § 707(b) and related provisions. It compares your household’s income to Wisconsin median income figures published for bankruptcy purposes, and then allows certain standardized deductions and actual expenses. The income data used in these calculations is drawn from official Census and IRS sources and updated regularly by the U.S. Trustee Program.

At a high level, eligibility works like this:

- Current monthly income: The means test looks back over the six full calendar months before you file and averages most forms of income received by your household during that period.

- Comparison to Wisconsin median income: Your averaged income is compared to the median for a household of your size in Wisconsin, using the official tables posted by the U.S. Trustee Program and based on Census Bureau data.

- Allowed deductions and expenses: Even if your income is above the median, you may still pass the means test after applying allowed deductions such as housing, transportation, taxes, and certain secured and priority debt payments.

If you “pass” the means test, you may be eligible to proceed under chapter 7, subject to other requirements. If you do not pass, chapter 13 may still be an option, using a three- to five-year repayment plan based on your disposable income and the rules in the Bankruptcy Code.

Because the means test forms, median income numbers, and deduction standards change over time, it is important to rely on current official tables and, ideally, have an experienced Wisconsin bankruptcy attorney review your situation before deciding how to file bankruptcy in Wisconsin.

How to File Bankruptcy in Wisconsin

The steps to file bankruptcy in Wisconsin follow a general pattern, but the exact details depend on which chapter you use (for example, chapter 7 versus chapter 13) and on local rules in the Western or Eastern District. Think of this as a broad roadmap of how to file bankruptcy in Wisconsin—not a substitute for personalized legal advice or the chapter-specific guidance you’ll get from a Wisconsin bankruptcy attorney.

In most cases, once you hire an experienced Wisconsin bankruptcy lawyer, they and their staff will handle nearly all of the technical work: gathering information, preparing forms, filing your case electronically, and guiding you through each requirement. Your main role is to be honest, thorough, and responsive with documents and questions so your attorney can present your situation accurately.

At a high level, a typical bankruptcy Wisconsin case involves these basic steps:

- Initial consultation and strategy: You meet with a Wisconsin bankruptcy attorney, review your income, debts, and assets, and decide whether chapter 7, chapter 13, or another chapter makes sense under Wisconsin bankruptcy laws.

- Gathering financial documents: You collect pay stubs, tax returns, bank statements, bills, collection letters, and information about property, loans, and lawsuits. Your attorney uses this to complete the required forms and means test analysis.

- Credit counseling course: Before filing, you must complete an approved pre-filing credit counseling course within 180 days of your case. Your attorney will usually recommend a provider and help you file the completion certificate with the court.

- Preparing and reviewing the petition and schedules: Your lawyer drafts the bankruptcy petition, schedules, and related forms using your financial information. You review them carefully for accuracy and sign under penalty of perjury that everything is complete and truthful.

- Filing with the correct Wisconsin bankruptcy court: Your attorney files the case electronically in either the Western District or the Eastern District of Wisconsin, depending on your home address, and pays the filing fee or submits an application for installments or a fee waiver if appropriate.

As soon as your case is filed, the automatic stay under 11 U.S.C. § 362 usually goes into effect. This powerful court order pauses most collection activities, including many lawsuits, garnishments, and phone calls, while the court and a bankruptcy trustee review your case.

After filing, you’ll attend a short “meeting of creditors” (also called a 341 meeting) where the trustee asks you questions under oath about your finances. In a chapter 13 case, there are additional steps to confirm your repayment plan; in a chapter 7 case, the focus is on exemptions and whether there are any non-exempt assets. Your attorney prepares you for this meeting, attends with you, and handles follow-up issues that may arise.

Because the specific steps after filing depend heavily on the chapter you choose, your income, your assets, and the local practices of the Wisconsin bankruptcy court handling your case, working with a knowledgeable Wisconsin bankruptcy attorney is one of the most important parts of successfully navigating how to file bankruptcy in Wisconsin from start to finish.

Key Takeaways: How to File Bankruptcy in Wisconsin

- This section gives a broad overview of how to file bankruptcy in Wisconsin; the exact steps and forms will vary depending on whether you file under chapter 7, chapter 13, or another chapter.

- A Wisconsin bankruptcy attorney typically handles the detailed work—drafting the petition, filing with the correct court, tracking deadlines, and guiding you through the meeting of creditors—while you focus on providing accurate information and documents.

- Completing required credit counseling, filing in the correct Wisconsin bankruptcy court, and triggering the automatic stay under 11 U.S.C. § 362 are core parts of almost every case, regardless of chapter.

Exemptions Under Wisconsin Bankruptcy Laws

One of the most important parts of any bankruptcy Wisconsin case is understanding which property you can protect. Wisconsin bankruptcy exemption laws are the rules that say what you are allowed to keep when you file, so you can maintain a basic standard of living and have a realistic chance at a fresh start. This page gives you the big-picture overview, but our dedicated Wisconsin exemptions guide is the place to go for the specific categories, amounts, and planning strategies.

In Wisconsin, individuals generally have a choice between using the state exemption system found in Chapter 815 of the Wisconsin Statutes or the federal exemption system in 11 U.S.C. § 522(d). You cannot mix and match between the two lists; you and your attorney must choose one exemption scheme and apply it consistently to all of your property.

The Wisconsin state exemptions are primarily collected in Wis. Stat. § 815.18 (personal property and other items) and the homestead provision in Wis. Stat. § 815.20. The federal exemptions are listed in the Bankruptcy Code itself at 11 U.S.C. § 522 and are adjusted periodically for inflation.

Very broadly, the kinds of property that exemptions are designed to protect include:

- Equity in your home: A homestead exemption that can protect a portion of the equity in your primary residence under either Wisconsin or federal law.

- Everyday personal property: Household goods, clothing, basic furnishings, and similar items needed for daily life.

- Tools of the trade: Certain equipment, tools, or business property that you need to keep working and earning income.

- Retirement and protected accounts: Many tax-qualified retirement accounts and certain pensions, which are often shielded under both state and federal law.

Choosing between Wisconsin’s exemptions and the federal exemptions is a strategic decision that can dramatically affect what you keep in a chapter 7 case and how your plan is calculated in a chapter 13 case. The dollar limits and specific categories change over time, so it is critical to work with a Wisconsin bankruptcy attorney who is familiar with both systems and can match your property to the exemption set that best protects your assets.

This page provides only a high-level overview of exemptions under Wisconsin bankruptcy laws. For the detailed charts, updated dollar amounts, and practical examples of how specific assets are treated, use our Wisconsin bankruptcy exemptions guide as your primary reference on Wisconsin exemption planning.

Key Takeaways: Exemptions Under Wisconsin Bankruptcy Laws

- Exemptions are the rules that decide what property you can keep when you file bankruptcy in Wisconsin, and they are essential to protecting your home, basic belongings, and income-producing tools.

- Wisconsin is a “choice” state: most filers can elect either the Wisconsin exemption system in Chapter 815 of the Wisconsin Statutes or the federal exemption system in 11 U.S.C. § 522(d), but not a mix of both.

- The best exemption choice depends on your specific mix of assets—especially home equity, vehicles, and savings—so it should be made with careful analysis by a knowledgeable Wisconsin bankruptcy attorney. For a deeper, asset-by-asset breakdown of what is protected, our Wisconsin bankruptcy exemptions guide is the go-to resource.

The Role of the Bankruptcy Trustee and Other Key Players

Once you file a bankruptcy Wisconsin case, you are no longer dealing only with the court and your creditors. A court-appointed bankruptcy trustee steps in and plays a central role in reviewing your case, asking follow-up questions, and applying the rules of the Bankruptcy Code and Wisconsin exemption law to your specific situation.

In a chapter 7 case, the trustee’s duties are outlined in provisions such as 11 U.S.C. § 704. In a chapter 13 case, the standing chapter 13 trustee’s responsibilities are set out in 11 U.S.C. § 1302 and related sections. Trustees in Wisconsin are supervised by the U.S. Trustee Program within the U.S. Department of Justice, which oversees the administration of bankruptcy cases nationwide.

Very broadly, a trustee in a Wisconsin bankruptcy case will:

- Review your paperwork: Examine your petition, schedules, and supporting documents to confirm that your income, expenses, assets, and debts are accurately disclosed.

- Conduct the 341 meeting: Lead the “meeting of creditors,” ask you questions under oath about your finances, and give creditors a chance to raise issues if they appear.

- Administer the bankruptcy estate: In chapter 7, determine whether there are any non-exempt assets to sell for the benefit of creditors; in chapter 13, review and administer your repayment plan and payments made through the plan.

- Enforce compliance: Make recommendations to the court, object if your plan or exemptions do not comply with the law, and ensure that both you and your creditors follow the rules.

In addition to the trustee, several other key players appear in almost every bankruptcy Wisconsin case:

- Debtor: The person or business filing for bankruptcy protection. As the debtor, you have duties to disclose all assets, debts, income, and transfers honestly and completely.

- Debtor’s attorney: The lawyer who advises you, prepares your case, files it with the correct Wisconsin bankruptcy court, and represents you at the 341 meeting and in any hearings or negotiations that follow.

- Creditors: The individuals, companies, or agencies you owe money to. They may file claims, object to certain aspects of your case, or, in many consumer cases, choose not to participate actively at all.

- Bankruptcy Court and Judge: The U.S. Bankruptcy Court for the Western or Eastern District of Wisconsin, and the judge assigned to your case, who apply the Bankruptcy Code and enter orders resolving disputes, confirming plans, and granting discharges.

- U.S. Trustee Program: The component of the U.S. Department of Justice that appoints and supervises trustees, monitors the integrity of the system, and enforces certain provisions of the Bankruptcy Code.

All of these players interact to move your case from filing to discharge or plan completion. Understanding the trustee’s role and how your attorney, the court, and your creditors fit into the picture can make the Wisconsin bankruptcy process feel more predictable and less intimidating.

Key Takeaways: Trustees and Other Players in Wisconsin Bankruptcy Cases

- The bankruptcy trustee is not your judge, and not exactly your lawyer or your creditor; the trustee is a neutral fiduciary who reviews your case, runs the 341 meeting, and administers the bankruptcy estate under the Bankruptcy Code.

- Your Wisconsin bankruptcy attorney is your advocate and guide, helping you understand what the trustee, judge, and creditors are looking for and making sure your case stays on track.

- Knowing who the key players are—and what they are responsible for—can make it much easier to understand what is happening at each stage of your Wisconsin bankruptcy case.

Common Mistakes and How to Avoid Them

Bankruptcy is a powerful tool, but small mistakes can cause big problems in a Wisconsin bankruptcy case—delays, extra hearings, or even dismissal. The good news is that most issues are preventable if you know what to watch out for and work closely with an experienced Wisconsin bankruptcy attorney.

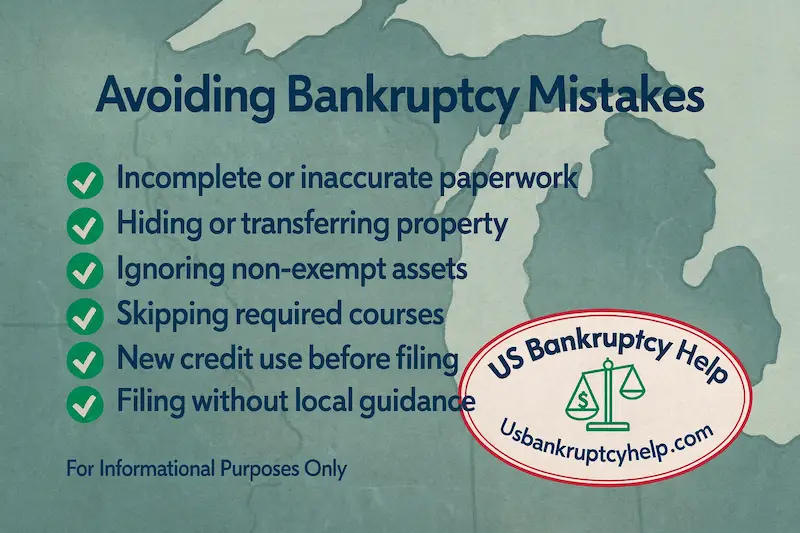

Some of the most common mistakes include:

- Incomplete or inaccurate paperwork: Forgetting a creditor, leaving out an asset, or guessing at income and expenses can cause serious trouble. Everything in your petition and schedules is signed under penalty of perjury, so accuracy matters.

- Hiding or transferring property: Giving away assets, putting them in someone else’s name, or “selling” property for far less than it’s worth right before filing can be viewed as a fraudulent transfer. That can lead to objections, loss of exemptions, or even denial of discharge.

- Ignoring non-exempt assets: Assuming “no one will notice” something you own is risky. Your attorney needs a complete list of everything you own to correctly apply either Wisconsin or federal exemptions and to anticipate any issues with the trustee.

- Skipping required courses: The pre-filing credit counseling course and post-filing debtor education course are mandatory. If you miss them or fail to file the certificates, your case can be dismissed or you may not receive a discharge.

- Using credit or taking loans right before filing: Running up cards, taking cash advances, or financing big purchases immediately before a Wisconsin bankruptcy can lead to creditor challenges and claims of fraud, especially on luxury items or recent cash advances.

- Filing without local guidance: Trying to file pro se (without an attorney) in the Western or Eastern District of Wisconsin, while possible, can be overwhelming. Local rules, forms, and trustee expectations are detailed, and missing something simple can derail an otherwise good case.

Careful preparation, complete honesty with your attorney, and following the instructions from the Wisconsin bankruptcy court and trustee will prevent most of these problems. Before you file, talk openly with a Wisconsin bankruptcy lawyer about your assets, debts, and recent financial moves so they can help you avoid costly mistakes and keep your case on track.

Costs, Legal Help, and Resources for Bankruptcy in Wisconsin

Filing bankruptcy in Wisconsin involves both court costs and professional fees, but those costs are usually small compared to the debt relief and protection you receive. Understanding the basic categories of expense and the types of help available can make it easier to plan how to file bankruptcy in Wisconsin without surprises.

The federal courts set filing fees for bankruptcy cases, and those fees are the same in the Western and Eastern Districts of Wisconsin. In addition, most people pay for required credit counseling and debtor education courses, plus attorney’s fees if they choose to work with a Wisconsin bankruptcy lawyer (which is strongly recommended in anything more than the simplest case).

Legal help can dramatically reduce stress and mistakes. A knowledgeable Wisconsin bankruptcy attorney will analyze your income and assets, help you choose the right chapter and exemption system, prepare and file your petition with the correct court, and guide you through trustee questions and hearings. In many chapter 13 cases, attorney fees are paid partly through your repayment plan rather than all up front.

Depending on your situation, you may also qualify for low-cost or free assistance. Common resources include:

- Local legal aid organizations: Nonprofit programs in Wisconsin that may provide free or reduced-fee representation or advice for qualifying low-income individuals facing debt and collection problems.

- Wisconsin lawyer referral and limited-scope services: Many private bankruptcy attorneys offer low-cost consultations, payment plans, or limited-scope services to help you file correctly even if you cannot afford a full representation package all at once.

- Approved credit counseling and education providers: Before and after filing, you must complete courses from agencies approved for the district where you file; your attorney can recommend reputable options and make sure certificates are filed on time.

- Official court and federal websites: The Western and Eastern District bankruptcy courts and the federal judiciary’s main site publish fee schedules, local rules, and basic guides to bankruptcy procedures, which are useful background information even when you are working with an attorney.

If paying the full filing fee up front is difficult, your Wisconsin bankruptcy attorney can discuss options such as fee installments or, in limited circumstances, requesting that the court waive the filing fee based on your income. The key is to be honest about your budget so your lawyer can propose a realistic fee arrangement that still gets your case filed correctly and on time.

Using trusted Wisconsin bankruptcy attorneys, legal aid programs, and official court resources—not random internet advice—will give you the most accurate picture of costs and help you move through the bankruptcy Wisconsin process with confidence.

Key Takeaways: Legal Help and Resources in Wisconsin Bankruptcy Cases

- Bankruptcy in Wisconsin involves court filing fees, counseling course costs, and usually attorney’s fees, but those expenses are often small compared to the debt relief and protection you receive.

- Working with an experienced Wisconsin bankruptcy attorney is one of the best ways to avoid costly mistakes, choose the right chapter, and make sure your case is filed correctly in the Western or Eastern District.

- Legal aid programs, lawyer referral services, and approved counseling providers can make the bankruptcy Wisconsin process more affordable and easier to navigate, especially for people on a tight budget.

Life After Bankruptcy: Rebuilding and Moving Forward

Life after bankruptcy in Wisconsin is not about starting from zero—it’s about starting from a cleaner slate. The calls slow down, the pressure eases, and you finally have room to rebuild. The key is to be intentional about what you do with that fresh start so you don’t slip back into the same stress that led you to consider bankruptcy in the first place.

Your credit report will still show your bankruptcy for a number of years, but that doesn’t mean you are “locked out” of financial opportunities. Many people begin seeing offers for credit, car loans, and even mortgages sooner than they expect—what matters is how you handle new credit and your day-to-day money decisions after your case is over.

Some practical steps to rebuild after a Wisconsin bankruptcy include:

- Create a realistic, written budget: Track your income and essential expenses first (housing, utilities, food, transportation), then plan carefully for discretionary spending so you don’t drift back into using credit to fill gaps.

- Build a small emergency fund: Even a modest savings cushion in a separate account can help you handle surprise car repairs, medical bills, or seasonal expenses without reaching for a credit card.

- Monitor your credit reports: Check your reports regularly to confirm that discharged debts are reported correctly and to watch your progress as your score slowly improves over time.

- Rebuild credit slowly and intentionally: Many people start with a secured credit card or small credit-builder loan, use it for limited purchases, and pay the balance in full each month to show responsible use of new credit.

- Keep good records going forward: Saving pay stubs, tax returns, and key financial documents makes it easier to apply for housing, financing, or even future legal advice if you ever need it again.

A Wisconsin bankruptcy filing is not the end of your financial story; it is a turning point. With a clear budget, a focus on savings, cautious use of new credit, and guidance from professionals when you need it, it is possible to move from constant crisis back to stability and eventually to long-term financial goals like homeownership, retirement savings, and greater peace of mind.

Key Takeaways: Life After Bankruptcy in Wisconsin

- Bankruptcy gives you breathing room, but rebuilding requires new habits—especially around budgeting, saving, and using credit carefully.

- Monitoring your credit reports and starting small with secured credit or credit-builder tools can help you steadily improve your credit profile after a Wisconsin bankruptcy case.

- With time, patience, and consistent good decisions, many people are able to move from the stress that led them to bankruptcy toward a far more stable—and hopeful—financial future.

Frequently Asked Questions About Wisconsin Bankruptcy Laws

Bankruptcy in Wisconsin raises a lot of practical questions: Which court do I file in? Can I keep my house or car? How long will this stay on my credit? The answers depend on your specific situation, but these common questions can help you understand the basics before you talk with a Wisconsin bankruptcy attorney.

Do I file in the Western District or the Eastern District of Wisconsin?

Which Wisconsin bankruptcy court you use depends on where you live. The Western District of Wisconsin and the Eastern District of Wisconsin each have their own jurisdiction maps showing which counties they cover. Your attorney will confirm the correct court and file your case electronically in that district.

Can I keep my home or car if I file bankruptcy in Wisconsin?

Many people do keep their home and vehicle in a Wisconsin bankruptcy case, especially if they stay current on payments and use exemptions correctly. Whether you can protect these assets depends on:

- The amount of equity you have in the property.

- Whether you use Wisconsin exemptions under Chapter 815 of the Wisconsin Statutes or the federal exemptions under 11 U.S.C. § 522(d).

- Which chapter you file under (chapter 7 versus chapter 13) and whether you are curing arrears through a repayment plan.

A Wisconsin bankruptcy attorney will walk through your equity, loan balances, and exemption options before you file so you understand what is likely to happen with your home and vehicles.

How long will a Wisconsin bankruptcy stay on my credit report?

In general, a chapter 7 bankruptcy can appear on your credit report for up to 10 years, and a chapter 13 for up to 7 years, under national credit reporting standards. That does not mean your score is “frozen” the whole time—responsible use of new credit, on-time payments, and steady income can help your score improve well before those time periods expire.

Do both spouses have to file bankruptcy together in Wisconsin?

No. In Wisconsin, you can file individually or as a married couple, but because Wisconsin is a marital property state, the decision is more complex than simply “one or both.” How your assets and debts are titled, when they were incurred, and how Wisconsin marital property rules apply can all affect whether a joint or individual filing makes more sense. This is a key issue to discuss with a Wisconsin bankruptcy lawyer before you file.

Will I have to go to court in person?

Most people never appear in front of a bankruptcy judge. In a typical Wisconsin consumer case, your only required appearance is the “meeting of creditors” (also called a 341 meeting), which is conducted by the trustee, not the judge. Depending on current procedures in the Western or Eastern District, that meeting may be held by phone, video, or in person. Your attorney will tell you when and how to appear and what to expect.

Do I really need a Wisconsin bankruptcy attorney?

The law does not require you to hire an attorney, but the Bankruptcy Code, Wisconsin exemption choices, and local court rules are complex. An experienced Wisconsin bankruptcy lawyer can:

- Help you decide whether chapter 7, chapter 13, or another option is appropriate under Wisconsin bankruptcy laws.

- Make sure your case is filed in the correct Wisconsin bankruptcy court with complete and accurate schedules.

- Protect as much property as possible using the exemption system that best fits your assets.

A short consultation with a Wisconsin bankruptcy attorney can often save you from costly mistakes and give you a much clearer picture of what bankruptcy would look like in your specific situation.

Navigating Bankruptcy in Wisconsin

Understanding Wisconsin bankruptcy laws is an important step toward taking control of your situation instead of simply reacting to collection calls and mounting bills. From choosing the right chapter to knowing which Wisconsin bankruptcy court will handle your case, the process touches federal law, state exemptions, and detailed local procedures in the Western or Eastern District.

Because these rules intersect in complex ways, especially when you are weighing chapter 7 versus chapter 13 and deciding between Wisconsin and federal exemptions, working with an experienced Wisconsin bankruptcy attorney is one of the most valuable decisions you can make. A knowledgeable lawyer can explain your options in plain language, prepare and file your case correctly, and help you avoid mistakes that could cost you money or put your fresh start at risk.

Bankruptcy is not about giving up; it is about drawing a line under past financial problems and building a more stable future. With accurate information, careful planning, and the right professional guidance, each step you take in the Wisconsin bankruptcy process can move you closer to lasting financial stability and genuine peace of mind.

Explore Some of Our National Bankruptcy Guides

- Chapter 7 Bankruptcy: National Guide

- Chapter 13 Bankruptcy: National Guide

- Chapter 7 vs Chapter 13 Bankruptcy: National Guide

- Can Just One Spouse File Bankruptcy?

- Can You File Bankruptcy and Keep Your House?

- Can You File Bankruptcy and Keep Your Car?

- How Often Can You File Bankruptcy?

- Chapter 13 Vehicle Cramdown

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin