Understanding Bankruptcy in Indiana

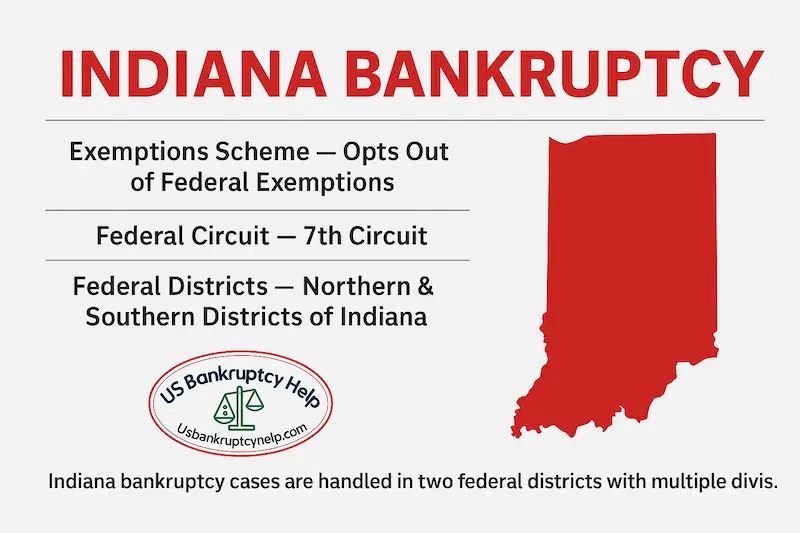

Bankruptcy in Indiana — At a Glance

A quick snapshot of how bankruptcy in Indiana works so you can decide what to read next.

- Two Courts: Northern or Southern District, based on where you live.

- Chapters: chapter 7 or chapter 13 (compare: 7 vs. 13).

- Automatic Stay: usually starts at filing; pauses most collections.

- Exemptions: Indiana is an opt-out state; state exemptions protect essentials.

- Courses: pre-filing credit counseling + post-filing debtor education.

- Attorney: local practice + exemptions can swing outcomes—work with an Indiana bankruptcy attorney.

Bankruptcy in Indiana: Why This Page Matters

If you’re considering bankruptcy in Indiana, you’re probably dealing with calls, deadlines, and tough choices. You’re not alone—and you’re not behind. Indiana offers a clear, court-supervised path to relief, and understanding how it works can immediately lower the stress.

Prefer real-world outcomes? Jump to Indiana success stories.

How Indiana Bankruptcy Laws Are Applied

Indiana bankruptcy laws operate alongside federal rules and are applied locally in two courts: the Northern District of Indiana Bankruptcy Court and the Southern District of Indiana Bankruptcy Court. Procedures can differ by district, but the mission is consistent—protect your rights and move your case forward in an orderly way.

Chapter 7 vs. Chapter 13 in Indiana (Quick Overview)

Most filers start by confirming eligibility through the means test and completing required credit counseling. Filing then triggers the automatic stay—typically pausing collections, garnishments, utility shut-offs, and most lawsuits while the case proceeds. Depending on your goals, chapter 7 can deliver a faster discharge of unsecured debts, while chapter 13 structures a manageable repayment plan to help you keep important property.

Looking for the in-depth guide? See our Indiana Chapter 7 Bankruptcy Guide.

Indiana Exemptions: Opt-Out State Note

A quick note on exemptions: exemptions are the laws that help you protect essential property (like some home equity, basic personal property, or certain benefits) during your case. Indiana is an opt-out state, which generally means long-time residents use Indiana’s exemption scheme rather than the federal set, with limited federal non-bankruptcy protections still available. We’ll cover the specifics later in this guide so you can see what may apply to you.

Overview of Bankruptcy in Indiana

Indiana’s Map Before The Directions

Think of this as the map before the directions. Federal law sets the rules, and Indiana applies them locally so your case moves through a predictable process. Where you live determines which court handles your file, but the core playbook is the same statewide.

Who Typically Files In Indiana

Who typically files in Indiana? People facing sustained collection pressure, wage garnishments, medical or credit-card debt they can’t realistically service, or a temporary income shock that made everything else slide. Bankruptcy isn’t a moral judgment—it’s a legal tool designed to stabilize a tough situation.

What Changes When You File

What actually changes when you file? The automatic stay usually takes effect, most collections pause, and a trustee is assigned to oversee your case. From there, your path depends on your goals and eligibility—some Hoosiers target a faster discharge of unsecured debts; others choose a structured plan to catch up and keep important property.

District Differences vs. Statewide Consistency

What varies by district vs. what stays the same:

- Varies: local procedures, forms, trustee assignments, hearing locations, and scheduling.

- Consistent: federal eligibility rules, required courses, trustee oversight, and the overall case stages from filing to discharge.

Exemptions Snapshot

A note on Indiana’s exemption framework: Indiana is an opt-out state, so long-time residents generally use Indiana’s exemptions rather than the federal set. Exemptions are the protections that help you keep essential property; we’ll break down the specifics in the dedicated exemptions section.

The Bottom Line

In summary: once you know which district you’re in and which chapter fits your goals, the process is structured and navigable. Many Hoosiers work with experienced counsel for strategy and execution, but the roadmap is clear either way.

Indiana Bankruptcy Laws and Exemptions

How Indiana Bankruptcy Laws Work With Federal Rules

Indiana bankruptcy laws work alongside the federal Bankruptcy Code to create a predictable, court-supervised path to relief. At a practical level, the “Indiana layer” matters most when it comes to what you can keep, which forms you’ll use, and how your case moves through your district.

What Exemptions Do (And Why They Matter)

Exemptions are the protective rules that help you keep essential property through the case. Instead of being a loophole, they’re the law’s way of making sure you can still maintain a household and a livelihood after discharge. Indiana is an opt-out state, which generally means long-time residents use Indiana’s exemption scheme rather than the federal set (with some limited federal non-bankruptcy protections potentially still in play).

Common Exemption Categories In Indiana

Broadly speaking, Indiana’s exemption framework covers categories like home equity, basic personal property, and certain benefits—often enough to protect everyday essentials while your case is pending. Exact amounts and eligibility details change from time to time, and how those protections apply can depend on your facts (timing, equity, liens, and the chapter you file).

Common exemption categories include:

- Homestead equity in a primary residence (subject to statutory caps).

- Personal property essentials (e.g., clothing, household goods, and similar basics).

- Wildcard-style coverage that can help protect value not covered elsewhere, within limits.

How Indiana Bankruptcy Laws Shape Strategy

Why this matters: exemptions influence strategy. In chapter 7, they help determine what is protected vs. what a trustee could administer; in chapter 13, they shape plan design and the minimum you must repay unsecured creditors. Because small details can swing outcomes, most Hoosiers benefit from tailored advice before filing.

Stay Current On Indiana Bankruptcy Law Changes

We’ll publish a separate Indiana exemptions guide with current figures, examples, and edge cases (so this page stays evergreen and avoids duplicate content). Until then, the safest approach is to confirm the latest statutory amounts and verify how they apply to your specific situation before you file.

Types of Bankruptcy: Chapter 7 vs. Chapter 13

Most Hoosiers considering bankruptcy in Indiana choose between chapter 7 and chapter 13. Both offer a lawful reset but serve different goals, timelines, and budgets.

In chapter 7, eligible filers can obtain a relatively quick discharge of qualifying unsecured debts. A trustee reviews the case, and while Indiana exemptions often protect essentials, non-exempt property can be administered under the Code.

In chapter 13, you propose a court-approved repayment plan (typically three to five years) that can help you catch up on arrears and keep important property while making affordable monthly payments.

Key differences at a glance:

- Asset treatment: chapter 7 relies on exemptions to protect property; chapter 13 structures payments to keep property while curing arrears.

- Payments: chapter 7 has no ongoing plan payments; chapter 13 requires a monthly plan payment.

- Eligibility: chapter 7 uses the means test; chapter 13 generally requires regular income to fund a feasible plan.

Want deeper details without leaving this page’s scope? See our national explainers: chapter 7 bankruptcy, chapter 13 bankruptcy, and chapter 7 vs. chapter 13.

Some Indiana filers—especially small business owners or individuals with higher debt levels—explore chapter 11 for custom restructuring. If that’s on your radar, start here: chapter 11 bankruptcy.

The right fit comes down to goals, eligibility, and budget. A short strategy session with an experienced bankruptcy attorney can clarify which chapter aligns with your timeline and what you need to protect.

The Bankruptcy Process in Indiana

How the Process Works

Filing for bankruptcy in Indiana is a structured, court-supervised sequence. Knowing the milestones ahead of time lowers stress and helps you make good decisions at the right moments—without getting lost in the weeds.

Most Hoosiers begin with a quick reality check: what debts are causing the pressure, what income is available, and which chapter aligns with the goal (a faster discharge vs. a structured catch-up plan). From there, the process follows a predictable flow.

Required Courses (Applies Statewide)

Before you file, you must complete a brief credit counseling course (within 180 days of filing). See the U.S. Trustee Program’s approved credit counseling providers. After you file, you’ll complete a short debtor education course before discharge—here’s the approved debtor education providers.

Where You File: Northern vs. Southern District

Your case is filed where you live—the Northern District or the Southern District of Indiana—and filing triggers the automatic stay. In most cases, the stay pauses collections, garnishments, utility shut-offs, and most lawsuits while your case moves forward.

- What differs by district: some local procedures, forms, trustee assignments, hearing locations, and scheduling.

- What’s consistent statewide: federal eligibility rules, required courses, trustee oversight, and the core path from filing to discharge.

What Changes by Chapter

- Chapter 7: generally a faster track to discharge for eligible filers; exemptions matter for what’s protected.

- Chapter 13: a 3–5 year, court-approved plan that can help you catch up on arrears and keep important property.

Milestones After You File

Every case includes a short, mandatory 341 meeting (meeting of creditors) where a trustee verifies your information and may ask a few straightforward questions. Many cases involve no creditor appearances, but the meeting must be held in every case.

Key Stages at a Glance

- Complete a pre-filing credit counseling course (required).

- File your petition in the correct Indiana district (Northern or Southern).

- Automatic stay takes effect in most cases (collections and most lawsuits pause).

- Attend the 341 meeting with the trustee.

- Complete the post-filing debtor education course before discharge.

Chapter-specific events—like plan confirmation hearings in chapter 13—depend on your chosen path. The big takeaway: Indiana follows a clear, repeatable playbook. With the right strategy and, ideally, guidance from an experienced bankruptcy attorney, most filers find the process more straightforward than they feared.

Because small details (exemptions, timing, chapter choice, district procedures) can swing outcomes, you should work with an experienced Indiana bankruptcy attorney rather than filing on your own. Counsel can spot issues early, keep your case compliant, and align the strategy with what you need to protect.

Northern District of Indiana Bankruptcy Court

The Northern District serves Indiana’s northern counties and maintains multiple offices for filings and public access. Local procedures can vary slightly by location, but all offices operate under the same district-wide rules and ECF system.

| Office | Address | Website |

|---|---|---|

| South Bend | 401 South Michigan Street South Bend, IN 46601 (574) 968-2265 | Northern District of Indiana — Official Site |

| Fort Wayne | E. Ross Adair Federal Building & U.S. Courthouse, Room 1188 1300 South Harrison Street Fort Wayne, IN 46802-3435 (574) 968-2265 | Northern District of Indiana — Official Site |

| Hammond | 5400 Federal Plaza, Room 2200 Hammond, IN 46320 (574) 968-2265 | Northern District of Indiana — Official Site |

| Lafayette | Not staffed. Do not mail or deliver documents to the Lafayette courthouse. Direct filings/mail to another Northern District office (e.g., Fort Wayne). | Court Locations — Northern District |

Sources: Northern District official site and court location pages.

Local practice matters. An experienced Indiana bankruptcy attorney who files regularly in the Northern District can navigate location-specific procedures, trustee expectations, and scheduling—reducing delays and risk.

Southern District of Indiana Bankruptcy Court

The Southern District of Indiana Bankruptcy Court serves the southern portion of the state. It handles a variety of bankruptcy cases, including Chapters 7 and 13.

This court is committed to a fair and expedient bankruptcy process. It offers helpful resources for filers to navigate their cases effectively. Understanding the specific procedures can be crucial for successful filings in this district.

| Office | Address | Website |

|---|---|---|

| Indianapolis | Birch Bayh Federal Building & U.S. Courthouse, Room 116 46 E Ohio St Indianapolis, IN 46204 (317) 229-3800 | Southern District of Indiana — Official Site |

| Evansville | 352 Federal Building 101 NW Martin Luther King Jr Blvd, Room 352 Evansville, IN 47708 (812) 434-6470 | Southern District of Indiana — Official Site |

| New Albany | 110 U.S. Courthouse 121 W Spring St, Room 110 New Albany, IN 47150 (812) 542-4540 | Southern District of Indiana — Official Site |

The Southern District Court has distinct guidelines that must be followed. Failing to adhere to these can result in setbacks or even case dismissal. Familiarity with the court's process allows for more efficient case management.

Key points to consider when dealing with the Southern District include:

- Adhering to district-specific filing requirements

- Preparing accurate and complete documentation

- Accessing the court’s resources for assistance

Filing here necessitates attention to detail. Ensuring proper compliance with local procedures is vital. Working with a legal professional can facilitate better understanding and outcomes.

Given the Southern District’s local procedures and calendars, it’s best to proceed with an experienced Indiana bankruptcy attorney who practices here routinely. Counsel helps ensure filings are complete, compliant, and set up for a smooth case.

Eligibility and Means Testing in Indiana

How Chapter 7 Eligibility Works (Means Test)

Eligibility in Indiana depends on your goals, your income, and the chapter you file. For chapter 7, the means test compares your recent income against Indiana’s median figures for your household size and then applies standardized deductions. Passing the test can position you for a faster discharge of eligible unsecured debts.

- At or below median: you may qualify for chapter 7.

- Above median: deductions and special circumstances can still matter—otherwise, chapter 13 may be the better fit.

What Chapter 13 Looks For

Chapter 13 focuses on steady income and a feasible plan. You propose payments over 3–5 years to address secured and unsecured debts under court supervision.

- Regular income is needed to fund the plan.

- Plan design must meet minimum requirements, which can be influenced by exemptions and the value of non-exempt property.

Official Figures & Where to Check

For up-to-date, official figures and forms, the U.S. Trustee Program maintains the means-testing pages: USTP means test resources and the state median income tables. Your attorney will confirm the correct table and effective date.

Need the Deep Dive?

For mechanics, examples, and tables, see our national explainers: chapter 7, chapter 13, and chapter 7 vs. chapter 13. We’ll also publish a dedicated Indiana chapter 7 guide with the current median-income table to keep this page evergreen and avoid duplicate content.

Because small facts (timing, household size, recent income changes) can sway outcomes, work with an experienced Indiana bankruptcy attorney rather than trying to file on your own.

Required Courses and Documentation

The Two Required Courses

Every Indiana case requires two short courses administered by U.S. Trustee–approved providers:

- Pre-filing credit counseling — must be completed within 180 days before filing. It reviews your debt picture and lawful alternatives.

- Post-filing debtor education — completed before discharge. It covers budgeting, money management, and credit use.

For official, up-to-date provider lists, see the U.S. Trustee Program: approved credit counseling providers and approved debtor education providers.

What to Have Ready

Your attorney will tailor a checklist for your district and chapter, but most Hoosiers gather a few core items so the case moves smoothly:

- Recent tax returns (typically last two years).

- Proof of income (pay stubs or other income records, usually 6 months).

- List of assets and liabilities (what you own and what you owe).

District Details & Attorney Guidance

Forms, formatting, and scheduling can differ slightly between the Northern and Southern Districts. An experienced Indiana bankruptcy attorney who practices in your district will make sure filings are complete, compliant, and timed correctly, reducing delays and risk.

The Role of the Bankruptcy Trustee and 341 Meeting

What a Trustee Does (Big Picture)

In every Indiana case, a court-appointed trustee oversees the file, verifies information, and applies the Bankruptcy Code and local rules. The trustee is not your lawyer and does not represent you or your creditors; their job is to administer the case fairly and efficiently.

Chapter 7 Trustee (Asset Review & Administration)

- Reviews your petition, schedules, and exemptions to confirm what is protected under Indiana law.

- Determines whether there are any non-exempt assets to administer for the benefit of unsecured creditors.

- May request documents (e.g., tax returns, pay stubs, bank statements) and, if applicable, collect and distribute any non-exempt value.

Chapter 13 Trustee (Plan Oversight & Payments)

- Evaluates your proposed repayment plan for feasibility and compliance (length, required payments, treatment of secured/unsecured claims).

- Receives your monthly plan payments and distributes funds to creditors according to the confirmed plan.

- Monitors ongoing requirements (tax returns, income changes) and may object if the plan or payments fall out of compliance.

The 341 Meeting (Meeting of Creditors)

Every case includes a brief, mandatory 341 meeting conducted by the trustee (not a judge). You’ll be placed under oath and asked straightforward questions about your petition, schedules, income, expenses, property, recent transfers, and intentions for secured debts. Creditors can attend and ask limited questions, though many cases see no creditor appearances.

What to Bring

- Government-issued photo ID

- Proof of Social Security number

- Any trustee-requested documents (e.g., recent pay stubs, bank statements, tax returns)

After the Meeting

In chapter 7, the trustee decides whether the case is “no-asset” or whether there is value to administer; in chapter 13, the focus shifts to plan confirmation and staying current on payments. Because small details can affect outcomes, work with an experienced Indiana bankruptcy attorney to prepare, respond to trustee requests, and keep your case on track.

Find Your Trustee (Official Lists)

Trustee assignments are by district/division and can change. Always verify the current listing on the U.S. Trustee Program’s official pages:

- USTP — Chapter 7 Panel Trustees (Indiana)

- USTP — Chapter 13 Standing Trustees (Indiana)

- USTP — Private Trustee Locator

An experienced Indiana bankruptcy attorney will confirm your assigned trustee and any local requirements in the Northern or Southern District.

Indiana Bankruptcy Success Stories

Saved The Home: Chapter 13 To Stop Foreclosure

A Marion County family fell three months behind after a medical leave. Their Indiana bankruptcy attorney filed chapter 13 before the sale date, triggering the automatic stay and proposing a 60-month plan to cure arrears while maintaining ongoing payments.

- Outcome: foreclosure paused; arrears spread out over the plan; family kept the home and finished on time.

Fresh Start From Garnishments: Chapter 7 Discharge

A South Bend single parent facing wage garnishments from credit cards and medical bills qualified for chapter 7 after the means test. Indiana exemptions protected basic household items and a modest vehicle.

- Outcome: garnishments stopped; eligible unsecured debts discharged within a few months; budget stabilized.

Kept The Car & Caught Up: Chapter 13 With Vehicle Strategy

A Fort Wayne commuter was behind on an auto loan and at risk of repossession. Their attorney used chapter 13 to catch up and, because the loan was older than 910 days, adjusted treatment on the balance consistent with the Code and local practice.

- Outcome: no repossession; affordable payment; car kept for work.

Personal Guarantees Resolved: Chapter 7 For a Closed Small Business

A Columbus entrepreneur closed a struggling LLC but was left with personal guarantees on vendor lines and a business credit card. After careful review for timing and documentation, chapter 7 addressed the qualifying personal liability.

- Outcome: eligible personal debts discharged; client transitioned to new employment without collection pressure.

Keep The Doors Open: Subchapter V Reorganization

A Bloomington trades company with seasonal cash flow used chapter 11 to restructure secured debt and negotiate payment terms with vendors, guided by an Indiana lawyer familiar with local trustee expectations.

- Outcome: leaner balance sheet, preserved jobs, and a court-approved plan the business could actually meet.

These are composite, illustrative scenarios based on common outcomes in Indiana courts. Results vary. Speak with an experienced Indiana bankruptcy attorney about your specific facts, district, and goals.

Frequently Asked Questions About Bankruptcy in Indiana

What Types Of Bankruptcy Do Individuals Usually File In Indiana?

Most Hoosiers file under chapter 7 or chapter 13. Chapter 7 targets a faster discharge of qualifying unsecured debts (if you qualify); chapter 13 uses a 3–5 year court-approved plan to catch up and keep important property. For deeper dives, see chapter 7, chapter 13, and chapter 7 vs. chapter 13.

Does Bankruptcy Erase All Debts?

No. Many unsecured debts (e.g., credit cards, certain medical bills) can be discharged, but some obligations typically survive (e.g., most student loans absent undue-hardship relief, recent taxes, domestic support). Your attorney will map which debts are dischargeable in your case.

How Will Bankruptcy Affect My Credit?

A filing is a public record and appears on credit reports. As a general guideline, a chapter 7 can report for up to 10 years; a chapter 13 up to 7 years. Many filers begin rebuilding sooner with on-time payments and responsible credit use after discharge.

Is It Safe To File Without An Attorney?

We don’t recommend it. Exemptions, timing, district procedures, and trustee expectations can change outcomes. An experienced Indiana bankruptcy attorney manages strategy and compliance so your case stays on track.

What Is The Automatic Stay And When Does It Start?

The automatic stay typically begins when your case is filed in the Northern or Southern District and pauses most collections, garnishments, utility shut-offs, and many lawsuits. There are exceptions and special rules for repeat filings—your attorney will confirm how the stay applies to you.

How Do Indiana Exemptions Work?

Exemptions are the rules that protect essential property. Indiana is an opt-out state, so long-time residents generally use Indiana’s exemption scheme rather than the federal set. Exact protections depend on category, amounts, and your facts. We’ll cover specifics in a dedicated Indiana exemptions guide.

Do I Have To Take Classes?

Yes—two short courses from U.S. Trustee-approved providers: pre-filing credit counseling and post-filing debtor education. (We link the official lists earlier on this page.) Keep your certificates; you’ll need them.

What’s The 341 Meeting Like?

It’s a brief, mandatory meeting with the trustee (not a judge). You’ll answer straightforward questions under oath about your petition, income, expenses, and property. Many cases see no creditor appearances.

How Long Does A Case Take?

- Chapter 7: often a few months from filing to discharge in a typical no-asset case.

- Chapter 13: usually 3–5 years, because you make monthly plan payments before discharge.

Will I Lose My Car Or Home?

It depends on equity, exemptions, and the chapter you file. Options for vehicles/homes can include keep-and-pay, catching up in chapter 13, reaffirmation (for some secured debts), redemption (in limited cases), or surrender. Your attorney will model the safest path.

What If My Income Is Above Indiana’s Median?

You may still pass the chapter 7 means test after deductions, or chapter 13 may fit better. Small facts—household size, timing, income changes—can shift results. See our explainers on chapter 7 and chapter 13.

Can I File Again If I Filed Before?

Yes, but waiting periods apply between discharges and depend on which chapter you filed then vs. now. Your attorney will calculate the applicable timeline and strategy.

Which Court Handles My Case?

Your residence determines whether you file in the Northern District of Indiana Bankruptcy Court or the Southern District of Indiana Bankruptcy Court. We list office locations and the official district websites in the sections above.

What Should I Do First?

- Talk with an experienced Indiana bankruptcy attorney about your goals and timeline.

- Confirm chapter fit (7 vs. 13) and how Indiana exemptions may protect essentials.

- Follow your district’s requirements to avoid delays.

Resources and Legal Help in Indiana

These official resources help you verify requirements and find district-specific info. Your attorney will point you to the right forms and procedures for your case.

- U.S. Trustee Program — Means Test Resources

- U.S. Trustee Program — Approved Credit Counseling Providers

- U.S. Trustee Program — Approved Debtor Education Providers

- Northern District of Indiana Bankruptcy Court — Official Site

- Southern District of Indiana Bankruptcy Court — Official Site

- Trustee Lists — Chapter 7 Panel Trustees | Chapter 13 Standing Trustees

For legal help, consult an experienced Indiana bankruptcy attorney who regularly files in your district. Legal aid may be available for qualifying residents.

Is Bankruptcy Right for You?

Bankruptcy is a legal tool—not a last resort—and used correctly it can stabilize a tough situation and set you up to rebuild. The key is matching the chapter to your goals, understanding how Indiana exemptions protect what matters, and filing in the right district with a clean, compliant case.

An experienced Indiana bankruptcy attorney can pressure-test your options, confirm eligibility, and align timing and paperwork with Northern or Southern District procedures. That guidance often means fewer surprises, a smoother process, and better long-term results.

Your Next Smart Moves

- Clarify your goals: fast discharge vs. structured catch-up and property retention.

- Confirm chapter fit (7 or 13) and how Indiana’s exemption rules may apply to you.

- Work with counsel who files regularly in your district to keep everything compliant and on schedule.

If you’re ready to explore relief, a short consultation can answer the big questions—chapter choice, timeline, and what you can protect—so you can move forward with confidence in Indiana.

Explore Our Indiana Bankruptcy Guides

Explore Some of Our National Bankruptcy Guides

- Chapter 7 Bankruptcy: National Guide

- Chapter 13 Bankruptcy: National Guide

- Chapter 7 vs Chapter 13 Bankruptcy: National Guide

- Can Just One Spouse File Bankruptcy?

- Can You File Bankruptcy and Keep Your House?

- Can You File Bankruptcy and Keep Your Car?

- How Often Can You File Bankruptcy?

- Chapter 13 Vehicle Cramdown

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin