Understanding Chapter 7 Bankruptcy: A Guide

Chapter 7 bankruptcy is the most common type of bankruptcy filed in the U.S.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is a legal process designed to help individuals discharge certain unsecured debts (like credit cards, medical bills and personal loans) offering a path to a fresh financial start. But how does this chapter work, and what does this really mean for you?

We want to demystify Chapter 7 bankruptcy. We'll delve into its definition, process, and qualifications. We'll also explore its benefits and drawbacks. Our goal is to provide a comprehensive understanding of Chapter 7 bankruptcy. This will help you make informed decisions about managing your debts. We'll also compare Chapter 7 with chapter 13 bankruptcy. These are two distinct paths, each with its own implications and advantages. Understanding the differences is crucial when considering bankruptcy.

Bankruptcy is a complex area of law. It's filled with jargon that can be confusing. We'll break down these terms and explain them in a way that's easy to understand. We'll also debunk common myths about bankruptcy. For instance, not all debts can be wiped out through Chapter 7.

Bankruptcy can have a significant impact on your life. It's not just about the financial implications. We'll also discuss the emotional and psychological effects of filing for bankruptcy. This guide is here to help you understand Chapter 7 bankruptcy. It's a tool to help you navigate your financial journey. Let's get started.

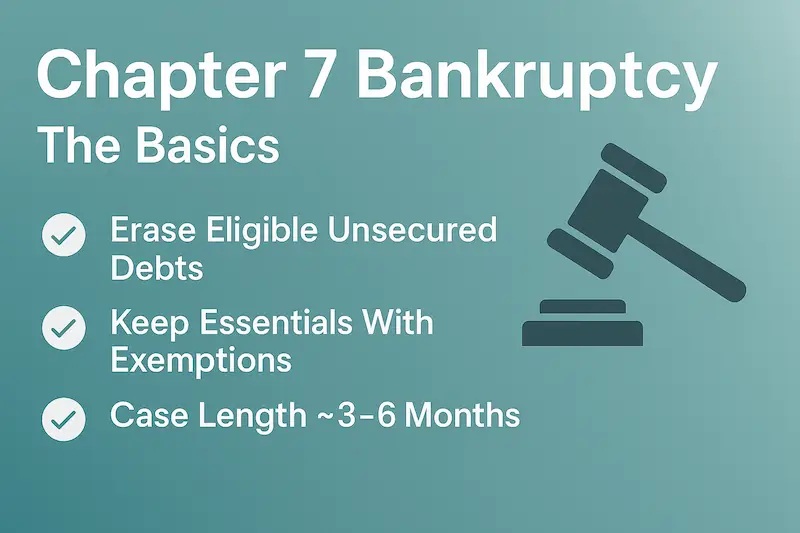

How Chapter 7 Bankruptcy Works

Chapter 7 bankruptcy is a legal mechanism that provides relief to individuals overwhelmed by debt. Chapter 7 wipes the slate clean of unsecured debts, allowing for a fresh financial start. This is accomplished by the court issuing a discharge. The discharge is an order to qualified unsecured creditors that they can no longer attempt to collect the discharged debts from the debtor.

To qualify for Chapter 7 bankruptcy, individuals need to pass a means test. This test compares one's income with the median income level in their state. Passing this test ensures that Chapter 7 is intended for those truly needing relief.

Once a person files for Chapter 7, an automatic stay is triggered. This legal provision temporarily halts most collection efforts, such as phone calls and lawsuits. It offers immediate, though temporary, relief from creditor actions.

An appointed bankruptcy trustee plays a central role in the Chapter 7 process. This official administers the liquidation of non-exempt assets and handles the distribution of proceeds to creditors. In most cases debtors protect their assets with exemptions, meaning they can keep essential property, and asset liquidation is not common in most cases.

The overarching aim of Chapter 7 is to discharge debts, but certain obligations cannot be discharged. Examples include alimony, child support, and most student loans. These must continue to be paid even after bankruptcy proceedings conclude.

The timeline for Chapter 7 bankruptcy typically spans four to six months. This relatively quick process can provide debtors with a rapid path to financial freedom.

However, the decision to file for Chapter 7 bankruptcy should not be made lightly. There are long-term effects on credit scores and potential impacts on future financial opportunities.

Despite its benefits, bankruptcy carries a stigma, and the process can be emotionally taxing. Individuals often face stress and uncertainty during and after the process.

In summary, Chapter 7 bankruptcy offers a structured way to address insurmountable debts through asset liquidation. Understanding the full scope, including legal rights and obligations, is essential for anyone considering this option.

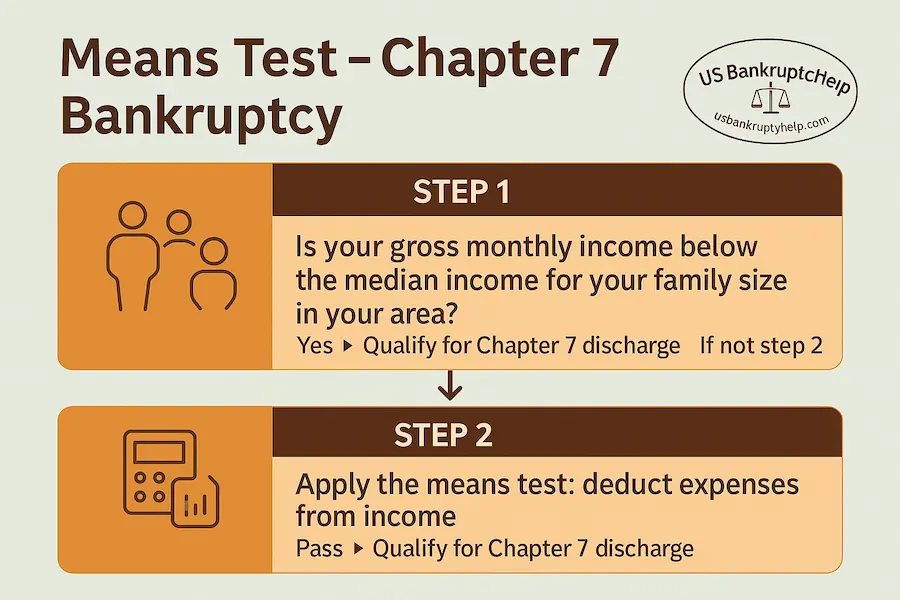

Qualifying for Chapter 7 Bankruptcy

To qualify for Chapter 7 bankruptcy, individuals must meet specific eligibility requirements. The primary criterion is the means test.

The means test evaluates your financial situation by comparing your income with your state's median income. If your income is below this median, you generally qualify for Chapter 7.

For those with income above the median, further calculations are necessary. Detailed expenses and debts are considered to determine eligibility.

Passing the means test ensures that Chapter 7 is reserved for those who genuinely need it. It's a safeguard against abuse of bankruptcy protection.

Besides the means test, you must also complete credit counseling. This is mandatory and must be done within 180 days before filing the bankruptcy petition.

Here’s a brief checklist for qualification:

- Income below or equal to the state's median

- Passing the means test

- Completion of credit counseling

- A financial management course required before discharge

Once qualified, you must compile and disclose all financial details accurately. This includes information about income, expenses, assets, and debts.

Honesty in reporting is essential. Incomplete or inaccurate information can result in denied discharge or even charges of bankruptcy fraud.

Understanding these qualifications is crucial before initiating the Chapter 7 process. The guidance of a competent bankruptcy attorney can help navigate these complex requirements.

The Chapter 7 Bankruptcy Process

Navigating Chapter 7 bankruptcy involves several critical steps. Each phase requires careful attention and compliance with legal procedures.

Pre-Filing Steps - Credit Counseling and Document Gathering

The journey begins before you even file your petition. Pre-filing steps are essential and cannot be skipped. Your first task is to complete a credit counseling session. This should be done within 180 days before filing for bankruptcy.

Credit Counseling

Credit counseling is not a scary as it sounds. It is a course that is taken online and the average time to complete the course is about 1 hour. Once you have this course completed it is valid for 180 days. The credit counseling course you take must be approved by the U.S. Trustee Program. This ensures the session meets legal standards. The US Trustee's office has a list of approved credit counseling agencies on their website.

Upon completion of your course, you'll receive a certificate of counseling. Make sure that you keep this certificate as it will need to be included with your filing.

Document Gathering

While you are preparing for filing or to meet with your bankruptcy attorney to begin the process, it is a good idea to begin gathering your documents. You will likely need at a minimum of around 6 months of pay stubs (or profit and loss if you are self-employed) and the previous 2 years of tax returns.

Filing the Petition

Filing the petition marks the official start of your bankruptcy case. It's a critical step involving detailed paperwork. Your petition includes a comprehensive list of your debts, assets, and income. Ensure accuracy to avoid complications later in the process.

Filing and the Automatic Stay

Your petition is filed in the bankruptcy court in your jurisdiction. This initiates the legal proceedings and activates the automatic stay. The automatic stay halts most collection efforts and legal actions against you. It's an immediate relief benefit of filing.

Court Fees and Case Number

Filing incurs a court fee, though fee waivers are available for eligible individuals. Your attorney can help with these applications. Once filed, the court assigns a case number, and proceedings formally begin. From here, you enter the next phase of the process.

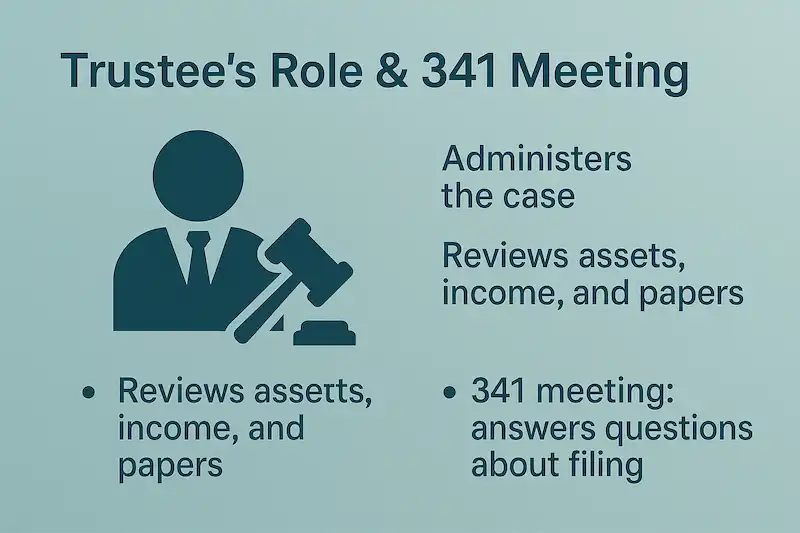

The Role of the Bankruptcy Trustee

After filing your petition, a bankruptcy trustee is assigned to your case. The trustee's role is pivotal in Chapter 7 proceedings. The trustee reviews your filing for accuracy and completeness. This involves verifying the information provided in your documents.

Nonexempt Assets Must be Reconciled by Liquidation or Settlement by the Chapter 7 Trustee

Chapter 7 filers use exemptions to protect their assets. The exemptions that are used are different in each state. If an asset of the debtor is not exempt, the debtor must either surrender the asset, or reach a settlement with the chapter 7 trustee to keep the asset. Funds received from the liquidation or settlement of nonexempt assets are used to pay creditors.

Trustees Conduct the 341 Meeting

They also conduct the meeting of creditors, where they ask questions about your finances. Your honesty and transparency here are critical.

Shortly after filing, you'll attend the meeting of creditors, also known as the 341 meeting. This is a mandatory step in bankruptcy proceedings. During this meeting, the bankruptcy trustee and any attending creditors can ask you questions under oath. Prepare to discuss your financial situation openly.

Creditors seldom attend, but the trustee always will. They will verify the accuracy of your petition details. Answer all questions truthfully to avoid any risk of perjury charges. This meeting usually lasts no more than 10 to 15 minutes. Its purpose is to confirm the information in your documents. It’s a straightforward process when you’re well-prepared and transparent.

Liquidation of Non-Exempt Assets

In Chapter 7, some of your assets may be liquidated. This process targets non-exempt assets to pay creditors. Exempt assets vary by state but often include essentials like your primary residence and basic household goods.

A list of non-exempt assets might include:

- Second homes

- Additional vehicles

- Luxury items

The trustee handles the sale of these non-exempt items. Proceeds from sales go toward paying down your debts. Liquidation may sound daunting, but protections exist to preserve essential items. Understanding exemptions helps ease concerns.

Discussing your assets with a bankruptcy attorney ensures you maximize exemptions. This keeps more valuable possessions out of the liquidation process.

The Financial Management Class

Before you can receive your discharge, you must take a second class. This class is known as the "Financial Management Class" and it must be completed within 60 days after the first date of the 341 meeting. Failing to complete this could result in your case being closed without a discharge. The US Trustee's office has a list of approved financial management courses on their website.

The Discharge of Debts

The primary benefit of Chapter 7 is the discharge of debts. This legal process releases you from certain financial obligations. Once debts are discharged, you’re no longer legally required to pay them. Chapter 7 wipes the slate clean of unsecured debts. Unsecured debts are debts that do not have security or collateral.

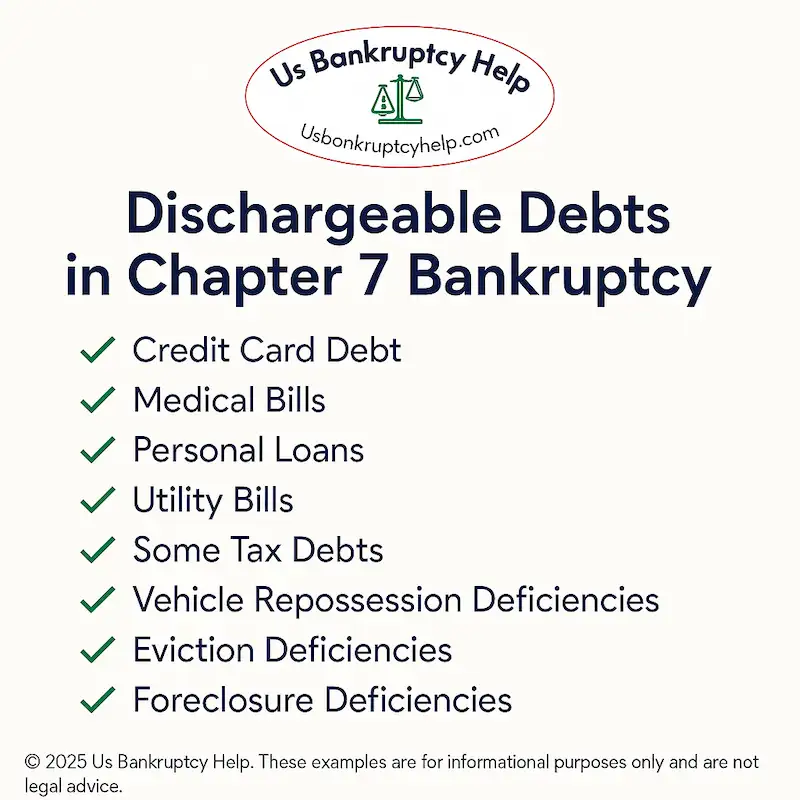

Examples of the types of unsecured debts chapter 7 discharges are:

- Credit Card Debt

- Medical Bills

- Personal Loans

- Utility Bills

- Some Older Tax Debts

- Vehicle repossession deficiencies

- Eviction deficiencies

- Foreclosure deficiencies

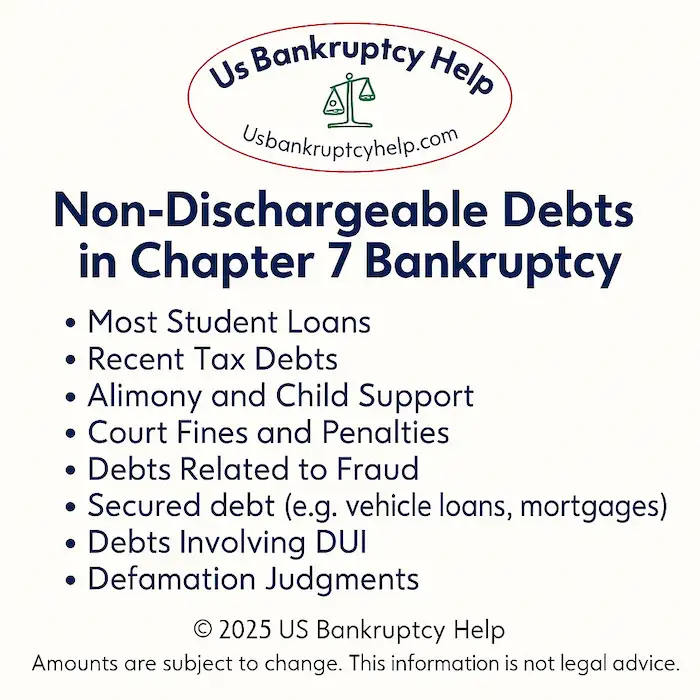

Examples of the types of debt that chapter 7 will not discharge are:

- Most Student Loans

- Recent Tax Debts

- Alimony and Child Support

- Court Fines and Penalties

- Debts From Fraud

- Secured debt (e.g. vehicle loans, mortgages)

- Debts Involving DUI

- Defamation Judgments

Legal advice can clarify any uncertainties about specific debts. Understanding which debts are and aren’t dischargeable is crucial.Consulting a professional ensures you're guided correctly and understanding debt discharge limitations can prevent surprises. It prepares you for which financial burdens remain post-bankruptcy.

Chapter 7 vs Chapter 13 Bankruptcy

Considering bankruptcy involves choosing the right chapter. Chapter 7 and Chapter 13 are the most common options.

Chapter 13 also offers a discharge of debts just like chapter, however this comes after a 3 to 5 year period in which the debtor pays their "disposable income" a chapter 13 trustee. Through this payment plan, the debtor has the ability to pause creditor action, and cure arrears, pay off certain secured debts like mortgages and vehicle loans), and priority debts (like taxes).

Both types aim to relieve financial distress. However, they differ significantly in processes and outcomes. Learn more about chapter 7 vs chapter 13 here..

Many factors determine which chapter suits you best. Income level, asset retention, and debt types are crucial considerations.

Chapter 7 provides a quicker resolution but can result in asset liquidation. It usually benefits those with limited income.

In contrast, Chapter 13's repayment plan extends over three to five years. It's more suited for individuals with regular income.

Choosing the Right Chapter for You

Selecting the appropriate bankruptcy chapter is personal. It hinges on your financial situation and future goals.

Chapter 7 may be ideal for those without significant assets. If immediate relief is your priority, consider this option.

If asset retention is critical, Chapter 13 might suit you better. The structured repayment allows for managing debts over time.

Consider your income stability. If you can comfortably make monthly payments, Chapter 13's plan could work.

List your priorities and constraints:

- Need for Quick Relief: Opt for Chapter 7.

- Asset Retention Importance: Choose Chapter 13.

- Income Stability: Chapter 13 fits if steady income exists.

- Legal Guidance Necessity: Consulting an attorney aids decision-making.

Consult a bankruptcy attorney to analyze your specific case. An expert ensures you make a well-informed decision.

Legal advice can clarify any uncertainties about specific debts. Consulting a professional ensures you're guided correctly.

Understanding debt discharge limitations can prevent surprises. It prepares you for which financial burdens remain post-bankruptcy.

The Impact of Chapter 7 Bankruptcy on Your Credit

Filing for Chapter 7 bankruptcy significantly affects your credit score at first. Initially filing can drop your credit score by several points. How much it will drop depends on your credit history and score before filing.

A Chapter 7 bankruptcy remains on your credit report for up to 10 years. Some creditors see a bankruptcy filing as a major negative event, which can lead to higher interest rates or credit denials. Other creditors disregard it after a few years.

While the impact may hurt at first, it is not insurmountable. Over time, as you manage finances responsibly, your credit can recover, but that is entirely up to you.

Here are common impacts of Chapter 7 bankruptcy on credit:

- Credit Score Drop: Immediate and significant decrease after filing.

- Credit Report Mark: Stays for a decade, affecting creditworthiness.

- Higher Loan Rates: Potential for increased interest on future credit.

- Reduced Credit Access: Difficulty obtaining new credit cards or loans.

Some lenders specialize in serving people with bankruptcy histories. Such opportunities can assist in rebuilding your credit post-bankruptcy.

It's essential to focus on responsible financial habits after discharge. Regular bill payments and maintaining low credit card balances aid recovery.

Monitoring your credit report for errors is equally critical. Challenge any inaccuracies to ensure your credit reflects your true financial health. Overall, Chapter 7 impacts credit profoundly at first, but this doesn't last forever. With strategic management, you can rebuild and restore your credit status over time.

Rebuilding Your Credit After Chapter 7 Bankruptcy

Rebuilding credit after Chapter 7 bankruptcy requires patience and strategic planning. While challenging, it is indeed achievable.

Start by creating a realistic budget. Track your income and expenses to avoid unnecessary debts.

Secured credit cards are helpful tools for credit rebuilding. They require a security deposit that becomes your credit limit.

Timely payments are crucial. Consistently paying your secured credit card bills on time reflects positively on your credit report.

Consider obtaining a co-signer for a loan or credit card. Ensure the co-signer understands the risks involved.

Diversifying your credit mix can also aid recovery. Mix credit types, such as a car loan alongside a credit card, to enhance your score.

It’s important to check your credit report regularly. Look for mistakes and dispute any errors that could harm your score.

Here are some steps to rebuild credit effectively:

- Create a Budget: Manage income and expenses to prevent new debts.

- Use Secured Cards: Build credit with a secured card by making timely payments.

- Diversify Credit Types: Combine different credit types, such as installment loans and revolving credit.

- Pay Bills Promptly: Consistent on-time payments improve your credit history.

- Check Credit Reports: Regularly review your credit reports for accuracy and dispute errors.

Remember to stay cautious with new credit offers. Avoid overspending or acquiring more credit than you can manage.

Building a solid financial foundation post-bankruptcy takes time, but it’s possible. With discipline and a strategic approach, you can restore your financial health and regain access to credit opportunities.

Common Myths and Misconceptions About Chapter 7 Bankruptcy

Bankruptcy often carries a heavy load of myths. These misconceptions can mislead individuals considering this financial step.

One common myth is that all debts are erased. In reality, certain debts remain, like alimony and student loans.

Another misconception is that filers lose everything. In fact, exemptions protect many assets from liquidation.

Some believe filing damages credit forever. While it impacts credit, many rebound by practicing good financial habits.

People often think only irresponsible spenders file. However, bankruptcy often results from medical expenses, job loss, or other unforeseen events.

Others assume it's a quick fix. Bankruptcy requires careful deliberation and a commitment to rebuilding financial health.

Here are some myths to consider:

- Myth 1: Bankruptcy is a personal failure.

- Myth 2: It permanently disqualifies you from borrowing.

- Myth 3: Only people with low incomes can file.

- Myth 4: Bankruptcy attorneys are unnecessary.

- Myth 5: All debts vanish without exceptions.

Finally, a persistent myth is that it’s hard to qualify. While the means test is required, many find they are eligible.

Understanding these myths is crucial. Dispelling these notions helps individuals make informed decisions about pursuing Chapter 7 bankruptcy.

Real-World Success Stories: Chapter 7 Bankruptcy and Great Outcomes

1) Paycheck protected: garnishment ended and cash flow restored

A warehouse supervisor was losing 25% of each paycheck to a credit-card judgment and juggling payday loans to cover rent. Filing chapter 7 immediately stopped the wage garnishment under the automatic stay. After the brief § 341 meeting and waiting period, the court entered a discharge wiping out the cards and payday balances. With take-home pay back to normal, the debtor set up automatic bill-pay and rebuilt a modest emergency fund within three months.

- • Garnishment halted the day the case was filed

- • High-interest unsecured debts discharged at the end of the case

- • Budget surplus redirected to savings and on-time utilities for credit rebuild

2) Home preserved by exemptions while unsecured debt disappeared

A single parent was current on the mortgage but drowning in medical bills and retail cards. By using the homestead and personal-property exemptions available in their state, the chapter 7 trustee had no non-exempt equity to administer. The debtor kept making the regular mortgage payment (“pay-and-stay”) while the unsecured balances were discharged. Without collection pressure, they refinanced the loan a year later at a lower rate and grew a small college fund for their child.

- • Homestead exemption protected equity in the primary residence

- • Credit cards and medical debts eliminated, freeing monthly cash

- • Mortgage stayed current; long-term housing stability maintained

3) Keeping the car with a smart § 722 redemption

A commuter owed $12,900 on a compact car worth only $6,900 and faced a payment that no longer fit the budget. In chapter 7, counsel arranged a § 722 redemption: the debtor paid the vehicle’s present fair-market value in a single new loan, and the remaining old balance was wiped out in the discharge. The net effect was a smaller, right-sized car payment and a reliable ride to work without risking repossession.

- • Old upside-down loan replaced with a payoff at the car’s current value

- • Excess balance eliminated in the chapter 7 discharge

- • Transportation preserved with a lower monthly obligation

4) Judgment lien removed to clear title and unlock a refinance

Years after a small-claims lawsuit, a judicial lien still clouded a homeowner’s title and blocked refinancing. During chapter 7, the debtor filed a motion to avoid the lien because it impaired their homestead exemption. The court granted the motion, the lien was removed from the record, and the debtor later refinanced, dropping the monthly payment and finishing needed roof repairs—without carrying the old judgment any longer.

- • Judicial lien avoided for impairing the homestead exemption

- • Clean title enabled a lower-rate refinance and home repairs

- • Fresh-start discharge ended lingering lawsuit debt

These illustrations are educational. Outcomes depend on exemptions, equity, timing, and local practices. Speak with a bankruptcy attorney about your specific facts.

Is Chapter 7 Bankruptcy Right for You?

Deciding on Chapter 7 bankruptcy is a personal journey. It requires weighing both the advantages and potential drawbacks.

A fresh start can be invaluable for those overwhelmed by debt. Discharging unsecured debts provides relief and a chance to rebuild.

However, it's vital to consider the long-lasting impact on credit. This process can affect financial opportunities for years.

Thoughtful consideration of your assets is needed. Exemption rules differ by state, influencing what property you can keep.

Exploring alternative debt solutions is wise before committing. Consult with a bankruptcy attorney to understand all your options.

In the end, bankruptcy should be a carefully considered decision. It can be the right choice for those needing a true financial reset.

State‑Specific Information on chapter 7 bankruptcy

Do you want to know more about how chapter 7 works in your state? Click below for tailored guidance:

View chapter 7 details for your state

Glossary of Bankruptcy Terms

Understanding bankruptcy language is crucial for navigating the process. Here is a handy list of essential terms:

- Automatic Stay: A court order that halts creditors from collecting debts once bankruptcy is filed.

- Bankruptcy Discharge: The release of a debtor from personal liability for certain debts.

- Bankruptcy Estate: All legal or equitable interests of the debtor at the time of bankruptcy filing.

- Chapter 7 Bankruptcy: Discharges qualified unsecured debts.

- Exempt Property: Assets that a debtor is allowed to keep during bankruptcy.

- Non-Exempt Property: Assets that can be sold by a bankruptcy trustee to pay creditors.

- Means Test: A calculation to determine eligibility for Chapter 7, comparing income to the median state income.

- Credit Counseling: Mandatory sessions to receive a certification before filing for bankruptcy.

- 341 Meeting: Also known as the meeting of creditors, where the debtor answers questions under oath.

- Trustee: A person appointed to manage the bankruptcy estate, oversee the process, and ensure fair treatment of creditors.

Frequently Asked Questions About Chapter 7 Bankruptcy

How does Chapter 7 affect my credit score?

Filing for Chapter 7 can significantly impact your credit score at first. It typically lowers the score temporarily due to the record of bankruptcy on your credit report. This entry remains visible for up to 10 years. However, responsible financial habits post-bankruptcy can help improve your score over time.

What debts can be discharged under Chapter 7?

Most unsecured debts can be discharged, including credit card balances and medical bills. However, certain obligations like alimony, child support, and most student loans are not dischargeable. It's crucial to understand which debts qualify for discharge when considering Chapter 7.

Do I need a lawyer to file for Chapter 7 bankruptcy?

While hiring a lawyer isn’t mandatory, it’s highly recommended. Bankruptcy laws are intricate; exemptions look straightforward but are nuanced. An attorney can guide you through eligibility, filing, and maximizing exemptions—often leading to a smoother process and better outcomes.

How do I know if I qualify for chapter 7 (the means test)?

Eligibility is based on a two-part means test. First, compare your household’s average gross income for the past six full months to your state’s median for your family size. If you’re under median, you generally qualify. If you’re over, the test allows specific deductions (housing, taxes, childcare, secured-debt payments, and more) to determine whether you still pass. Note: cases with primarily business debts are usually not subject to the means test.

How long does a chapter 7 case take, from filing to discharge?

Most straightforward cases finish in about three to six months. After you file, the automatic stay begins, you receive a case number, and your § 341 meeting is typically set 30–45 days later. If no one objects and you complete all requirements (including the debtor-education course), the court usually enters your discharge about 60–90 days after that meeting.

What happens at the § 341 “meeting of creditors”—do I see a judge?

The § 341 meeting is run by a trustee, not a judge, and usually lasts 5–10 minutes. You’ll present a government photo ID and proof of Social Security number, swear an oath, and answer questions about your petition, assets, income, and recent financial activity. Creditors may attend but rarely do. Many districts hold these meetings by phone or video; your notice will specify how to join.

Will chapter 7 stop creditors and halt wage garnishments, lawsuits, or collection calls?

In most cases, yes. Filing triggers the automatic stay, which immediately halts garnishments, collection lawsuits, bank levies, and creditor calls. Some obligations—like domestic support and certain recent tax actions—aren’t stopped, and a creditor can ask the court to lift the stay. Depending on timing and amount, part of the wages taken in the 90 days before filing may be recoverable.

If only one spouse files chapter 7, how does it affect the other spouse?

A single-spouse filing can discharge that filer’s personal liability on eligible debts, but it doesn’t erase a non-filing spouse’s liability on joint accounts or co-signed loans. In community-property states, community assets may receive added protection after discharge, while separate debts remain separate. Credit reports are individual: the non-filing spouse’s report won’t show the bankruptcy, though joint accounts may reflect changes. Ask counsel how local property and exemption rules apply to your household.