Understanding California Bankruptcy Exemptions

California bankruptcy exemptions are laws that protect certain assets from exposure to creditors during bankruptcy proceedings. These exemptions allow you to keep specific property, ensuring that you have the necessary resources to start over after your bankruptcy case is resolved.

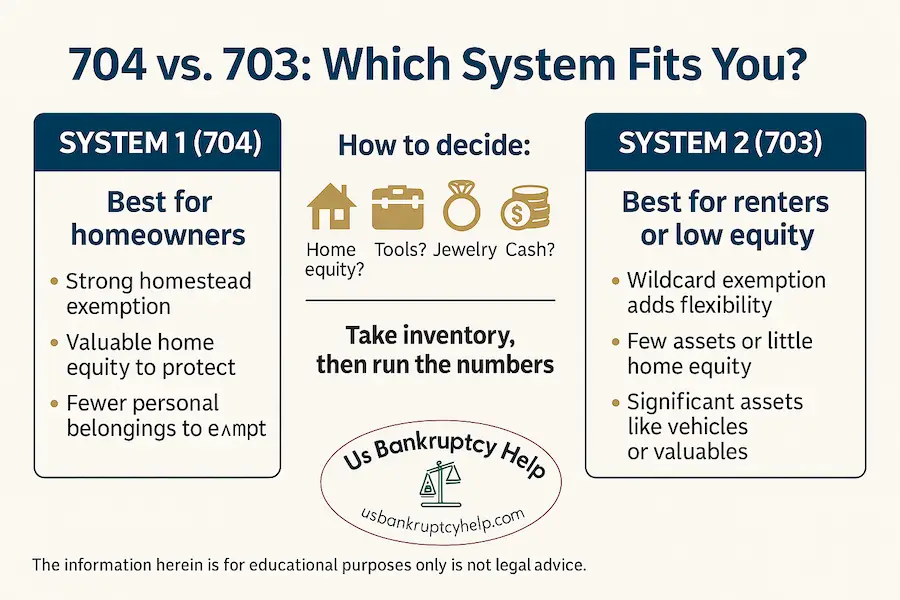

California is an "opt-out" state. This means that California does not offer federal bankruptcy exemptions to those who qualify for California exemptions. Instead California offers two different sets of California bankruptcy exemptions provided in CCP § 704 and CCP § 703. These exemptions are broken down into two systems: System 1 (704 Exemptions) and System 2 (703 Exemptions). Some would say that that number scheme seems backwards, and I would agree. But just to give you a quick sanity check, yes you are reading that correctly- system 1 is 704 and system 2 is 703. When you file a bankruptcy case, you may only choose one set of exemptions. You may not choose both or pick some from one and some from the other. As you will see, each set has its unique benefits.

Understanding the Purpose of Bankruptcy Exemptions

Bankruptcy exemptions serve a critical purpose in the bankruptcy process. They ensure that you can retain the essential assets you may need for a fresh start. By protecting certain properties, exemptions prevent the complete depletion of your resources, allowing you to maintain a basic standard of living post-bankruptcy. This balance between creditor repayment and debtor protection is vital for a fair financial reset.

The Two Systems: A Comparative Overview

California’s two systems of exemptions, System 1 and System 2, cater to different financial situations and priorities. System 1, also known as the 704 Exemptions, is typically more beneficial for homeowners due to its generous homestead exemption.

On the other hand, System 2, the 703 Exemptions, offer greater flexibility with a larger wildcard exemption, which can be advantageous for those without significant home equity. Understanding the distinctions between these systems is crucial when selecting the one that aligns best with your financial profile. It is highly recommended that you consult with a California bankruptcy attorney to help you make this important decision.

Why Choosing the Right California Exemption System Matters

Choosing the correct exemption system is one of the most strategic decisions in the bankruptcy process. The right choice can maximize asset protection, minimize debt repayment, and enhance your financial recovery. Factors such as home equity, the value of personal property, and professional needs should guide this decision. While these exemptions may seem pretty straight forward, they can be affected by case law, and change often. Consulting with a California bankruptcy attorney can provide valuable insights, ensuring that your choice aligns with your long-term financial goals and legal requirements.

Chapter 7 Bankruptcy and California Bankruptcy Exemptions

The major benefit of chapter 7 is the ability to discharge unsecured debt quickly. The trade-off is that any property not fully covered by exemptions could be exposed to pay creditors. In practice, this means the chapter 7 trustee can require you to turn over, sell, or otherwise settle assets that aren’t protected. For this reason, understanding California exemptions is essential to determine what property you can retain. To learn more about chapter 7, read our detailed guide on Chapter 7 Bankruptcy in California.

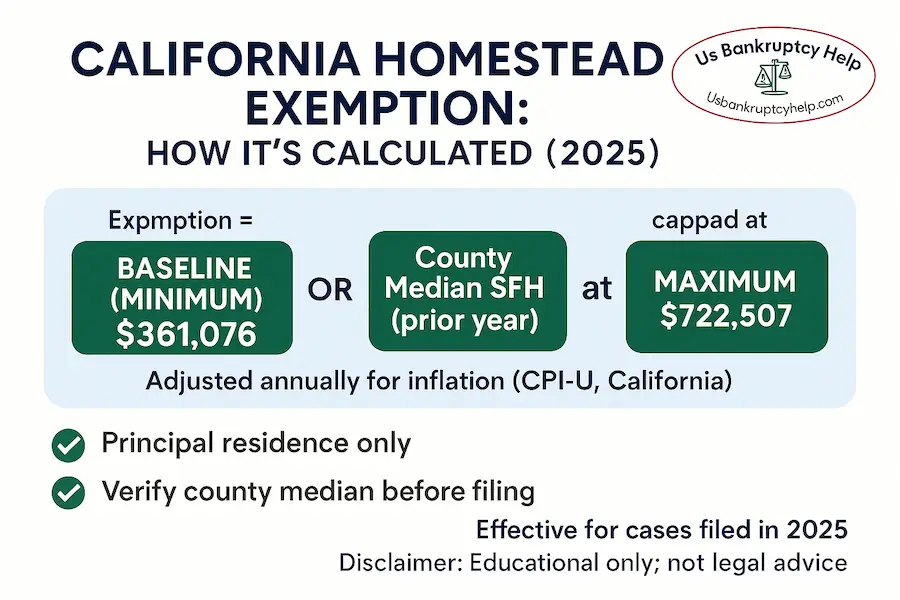

California Homestead Exemption

California’s 704 homestead protects the greater of $300,000 or your county’s prior-year median home price, adjusted for inflation; for 2025, published analyses place the floor/cap at about $361,076 to $722,507 (your exact number depends on county data at filing). These amounts adjust annually for inflation. Always verify your current county figure before filing.

Protecting Your Home: The Significance of the Homestead Exemption

The homestead exemption is a cornerstone of financial stability for many Californians facing bankruptcy. By safeguarding a significant portion of home equity, it ensures that individuals and families can maintain their residence, which is often their most valuable asset. This protection is not just about preserving property but also about maintaining community ties and personal well-being during financially tumultuous times.

Regional Variations: How County Differences Affect Your Exemption

The homestead exemption amount varies significantly across California, reflecting the diverse real estate market within the state. In high-cost areas, such as Los Angeles or San Francisco, the upper limit of the exemption can provide critical protection against losing a home.

Understanding these regional variations is crucial for accurately assessing your potential financial outcome in a Chapter 7 filing.

Strategic Use of the Homestead Exemption

Maximizing the benefits of the homestead exemption requires strategic planning. Homeowners should evaluate their current equity and projected changes in property value. For those with substantial equity, leveraging this exemption can significantly influence the decision between Chapter 7 and Chapter 13 bankruptcies. It’s also essential to understand the legal nuances, such as residency requirements, to ensure eligibility for the full benefits of the exemption.

Other Key Exemptions Significant for Chapter 7

Aside from the homestead exemption, several other key exemptions can protect your assets in a Chapter 7 bankruptcy filing:

Personal Property

This includes household goods, appliances, clothing, and furnishings. Each system has different limits on the value of personal property you can exempt.

Exemption Limits: Navigating System Differences

The personal property exemption varies between System 1 and System 2, impacting what you can retain. System 1 typically provides broader protection for household items, which can be crucial for families. System 2, while offering lower limits on specific items, compensates with flexibility through its wildcard exemption. Evaluating your household assets against these limits is a critical step in the exemption selection process.

Motor Vehicle Exemption

Protects equity in one or more vehicles. System 1 allows an exemption of up to $8,625, while System 2 offers up to $8,625.

The Role of Vehicle Exemptions in Financial Recovery

A reliable vehicle is often essential for employment and daily life. The motor vehicle exemption recognizes this necessity, allowing debtors to retain transportation critical for economic recovery. Understanding the equity in your vehicle and how it fits within exemption limits can guide decisions on keeping or replacing it during bankruptcy.

Jewelry Exemption

You can exempt up to $10,950 worth of jewelry under System 1, while System 2 allows up to $2,175.

Assessing Jewelry Value: Protecting Sentimental and Financial Assets

Jewelry often holds both financial and sentimental value. The exemption limits necessitate a careful appraisal of your jewelry’s worth. Prioritizing pieces with higher monetary or emotional significance can ensure that important personal items are retained through the bankruptcy process.

Tools of the Trade

Essential for those who require specific tools for their profession. System 1 permits up to $10,950, whereas System 2 allows up to $10,950 for professional tools and books.

Professional Tools: Securing Your Livelihood During Bankruptcy

For professionals reliant on specific tools, retaining them can be crucial for maintaining or re-establishing income post-bankruptcy. The tools of the trade exemption acknowledges this, providing protection for essential work equipment. Strategically applying this exemption can support a smoother transition back to financial stability.

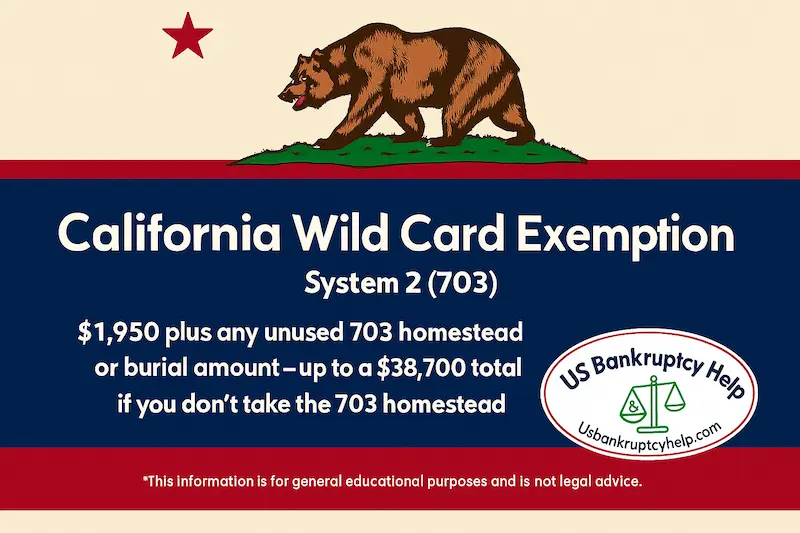

California Wildcard Exemption

Under System 2, the wildcard is $1,950 plus any unused 703 homestead or burial amount—up to a $38,700 total if you don’t take the 703 homestead (effective Apr 1, 2025–Mar 31, 2028).

Maximizing Flexibility with the Wildcard Exemption

The wildcard exemption offers unparalleled flexibility, particularly under System 2. It allows debtors to protect assets not covered by other specific exemptions. This can include a wide range of personal property, providing strategic advantage in safeguarding diverse assets. Understanding how to leverage the wildcard exemption can significantly affect the overall outcome of your bankruptcy case.

Chapter 13 and California Bankruptcy Exemptions

Chapter 13 bankruptcy, often referred to as a reorganization bankruptcy, enables you to repay debts over a three to five-year period. Unlike Chapter 7, Chapter 13 does not involve liquidating assets. However, the exemptions still play a vital role in determining your repayment plan.

Importance of Exemptions in Chapter 13

In Chapter 13 bankruptcy, exemptions help determine how much you must pay to unsecured creditors. The more exemptions you can claim, the less you'll need to pay in your repayment plan. This makes understanding California Chapter 13 bankruptcy exemptions essential for crafting an affordable plan. For more details on how California’s bankruptcy exemptions work specifically in chapter 13 cases, see our comprehensive guide on Chapter 13 Bankruptcy in California.

Calculating Payments: The Impact of Exemptions

Exemptions in Chapter 13 directly influence the calculation of your repayment plan. By reducing the amount available to creditors, exemptions can lower monthly payments, making the plan more manageable. This can be crucial for maintaining financial stability throughout the repayment period, allowing for a more sustainable path to debt relief.

The Strategic Role of Exemptions in Debt Management

Exemptions serve as a strategic tool in managing debt within Chapter 13 bankruptcy. They enable debtors to protect essential assets while negotiating favorable terms with creditors. Understanding how exemptions affect the repayment plan can empower debtors to craft strategies that minimize financial strain and maximize asset retention.

Long-term Financial Planning with Exemptions

Beyond immediate relief, Chapter 13 exemptions can contribute to long-term financial planning. By preserving critical assets and reducing debt obligations, exemptions help create a foundation for future financial health. This forward-thinking approach is essential for individuals aiming to rebuild credit and secure economic stability post-bankruptcy.

Differences in Exemptions Between Chapter 7 and Chapter 13

While the exemptions themselves remain the same between Chapter 7 and Chapter 13, their application differs. In Chapter 7, exemptions determine which assets are protected from liquidation, whereas in Chapter 13, exemptions affect the amount you pay to creditors.

If you're deciding between chapter 7 and chapter 13 bankruptcy, our in-depth comparison of Chapter 7 vs. Chapter 13 Bankruptcy can help you determine which option better fits your financial situation.

Application Differences: Protecting Assets vs. Managing Debt

The application of exemptions varies significantly between the two bankruptcy types. In Chapter 7, they shield assets from liquidation, directly influencing what you retain. In Chapter 13, they impact debt repayment calculations, indirectly affecting your financial recovery. Understanding these distinctions is key to leveraging exemptions effectively in either context.

Choosing the Right Bankruptcy Type: The Role of Exemptions

Exemptions play a pivotal role in deciding between Chapter 7 and Chapter 13 bankruptcies. They influence asset retention in Chapter 7 and repayment obligations in Chapter 13. Assessing your financial situation, including asset value and debt level, against exemption benefits can guide this critical choice, ensuring alignment with your financial objectives.

Exemptions and Financial Outcomes: A Comparative Analysis

The outcome of bankruptcy proceedings can vary based on how exemptions are applied. In Chapter 7, effective use of exemptions can lead to significant asset retention. In Chapter 13, they can facilitate a feasible repayment plan. Comparing these potential outcomes helps in making informed decisions, aligning bankruptcy strategies with long-term financial goals.

Choosing the Right Exemption System

Deciding between System 1 and System 2 exemptions is crucial. Here are a few considerations to help you choose the right system for your situation:

- Home Equity: If you have significant equity in your home, System 1’s higher homestead exemption might be more beneficial.

- Personal Property: Consider the value of your personal belongings, as System 2 offers a more substantial wildcard exemption.

- Professional Tools: If you rely on tools for your trade, assess which system offers better protection for these essential items.

Consulting a Bankruptcy Attorney: Making Informed Choices

Consulting with a bankruptcy attorney is often the best way to ensure you’re making the right choice for your circumstances. A legal expert can provide personalized guidance, considering your unique financial situation, asset portfolio, and long-term goals. This professional advice is invaluable in navigating the complexities of bankruptcy exemptions and achieving optimal outcomes.

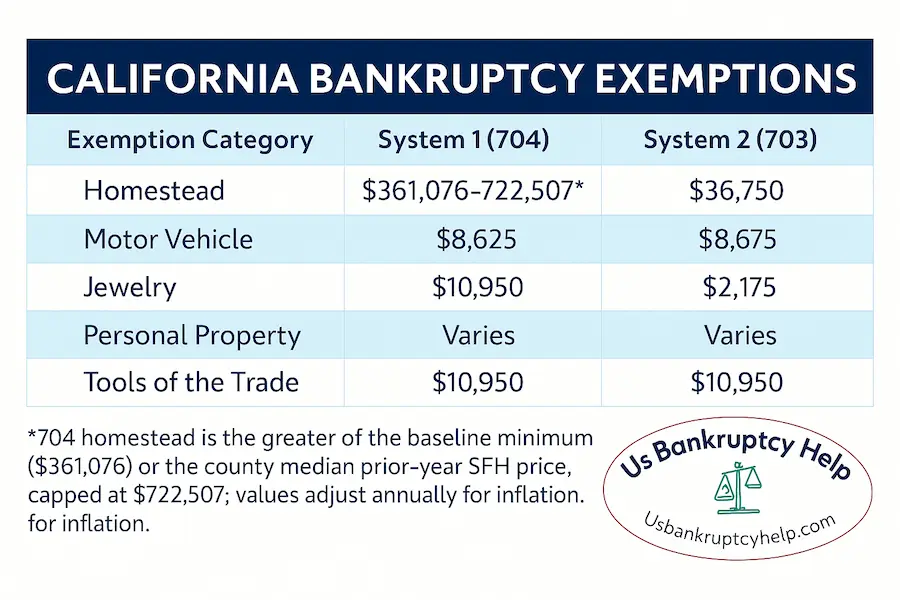

California Bankruptcy Exemptions Chart

To simplify the selection process, here's a quick reference chart for California's bankruptcy exemptions under both systems:

| Exemption Category | System 1 (704) | System 2 (703) |

|---|---|---|

| Homestead | $361,076–$722,507* | $36,750 |

| Motor Vehicle | $8,625 | $8,625 |

| Jewelry | $10,950 | $2,175 |

| Personal Property | Varies | Varies |

| Tools of the Trade | $10,950 | $10,950 |

| Wildcard | $0 | $1,950 + unused 703 homestead/burial |

*704 homestead is the greater of the baseline minimum ($361,076) or the county median prior-year SFH price, capped at $722,507; values adjust annually for inflation. † Under 704.060, only up to $4,850 of the tools-of-trade exemption may be applied to a commercial vehicle ($9,700 if spouses are in the same trade and claim the combined exemption).

For more detailed exemption specifics, see our California Bankruptcy Exemptions List page, which offers additional guidance on amounts, updates, and real-world examples.

Frequently Asked Questions

What is the 2025 California homestead exemption amount?

It’s county-specific. For 2025 filings, the computed statewide range is roughly $361,076 to $722,507, with many high-cost counties at or near the cap (e.g., Los Angeles/Orange: $722,151). Always verify your county’s current number before filing.

Can I mix and match System 1 and System 2 exemptions?

No. California law requires you to choose either System 1 (704) or System 2 (703) in its entirety. Careful comparison—or advice from a bankruptcy attorney—will ensure you select the system that shields the most value for your situation.

How do I decide which exemption system is better for me?

In general, System 1 favors homeowners with substantial equity thanks to its high homestead allowance, while System 2 benefits renters or low‑equity homeowners because of its generous wildcard exemption. Tally your equity and personal‑property values, then run the numbers under both systems to see which protects more.

Do California exemptions apply in Chapter 13 bankruptcy?

Yes. The same exemption amounts determine how much equity you must pay into a Chapter 13 plan. Higher exemptions lower your required plan payments to unsecured creditors, making the monthly amount more affordable.

Can California bankruptcy exemptions erase all of my debt?

Exemptions protect assets, not debts. They stop certain property from being sold in Chapter 7 or from inflating Chapter 13 payments, but they do not determine which obligations are dischargeable. Eligibility for debt discharge follows federal rules.

How often can I claim the California homestead exemption?

You can claim a homestead each time you file, but if you acquired your residence within 1,215 days before filing, a federal cap can limit the homestead you can claim (with some rollover exceptions). For cases filed April 1, 2025–March 31, 2028, that federal cap is $214,000.

Are retirement accounts protected under California exemptions?

Yes. Most tax-qualified retirement plans are protected. In bankruptcy, ERISA-qualified plans (e.g., 401(k), 403(b)) are fully exempt under federal law, and California law (704.110, 704.115) also protects public and private retirement benefits. Traditional and Roth IRAs are exempt up to $1,711,975 per person in cases filed April 1, 2025–March 31, 2028.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin