Understanding Chapter 13 Bankruptcy: A Guide

In this article, we break down the key aspects of chapter 13 bankruptcy—how it works and who qualifies—so you can make informed decisions about your financial future.

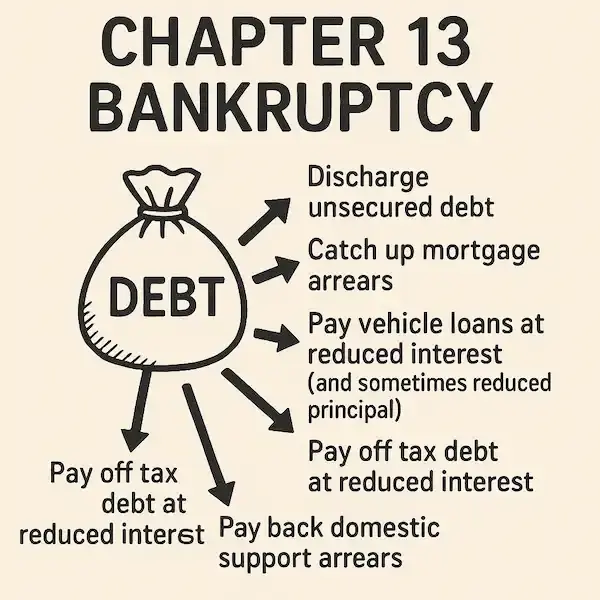

Chapter 13 Bankruptcy – Countless Options

Navigating financial challenges can be daunting. Chapter 13 Bankruptcy offers a structured path to manage overwhelming debt. It's a legal process designed for individuals with regular income. This option allows you to reorganize debts and create a manageable repayment plan. Unlike chapter 7, it doesn't offer a discharge right away. Instead, it provides a chance to catch up on missed payments, and offers a discharge after a 3 to 5 year payment plan. Understanding the nuances of Chapter 13 is crucial. This guide will explore its benefits, process, and implications. Whether you're considering bankruptcy or advising others, this comprehensive overview will help you make informed decisions. Let's delve into the details of Chapter 13 Bankruptcy and how it can offer a fresh financial start.

What Is Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy is often called the "wage earner's plan." This legal process allows individuals with a steady income to restructure their debts. Unlike other types of bankruptcy, it focuses on creating a feasible repayment plan. This plan typically lasts between three to five years.

In Chapter 13, debtors get to retain their assets. This feature makes it distinct from Chapter 7, where liquidating assets is common. Chapter 13 can halt foreclosure, allowing individuals to catch up on overdue mortgage payments.

Eligibility hinges on having a regular income. Additionally, there are debt limits for secured and unsecured debts. This ensures the process is suitable for those facing significant, but not overwhelming, debt.

Filing for Chapter 13 involves multiple steps. Initially, a petition is filed in bankruptcy court. Alongside this, a proposed repayment plan must be submitted. This plan outlines how debts will be managed and repaid over time.

A list of Chapter 13 Bankruptcy features:

- Allows debt reorganization

- Provides a structured repayment plan

- Does not require asset liquidation

- Stops foreclosure proceedings

- Protects co-signers

The court plays a pivotal role in the process. It approves the repayment plan after evaluating its feasibility. Creditors have the opportunity to object to the terms. Once approved, the debtor follows the plan, making regular payments to a trustee. This trustee then distributes the payments to creditors. Through this structured process, Chapter 13 offers a path to regain financial stability without losing valuable assets.

How Chapter 13 Bankruptcy Works

Chapter 13 Bankruptcy operates through structured debt reorganization. It allows debtors to design a repayment plan that fits their financial situation. The process begins when individuals file a petition in the bankruptcy court.

The key feature of Chapter 13 is the repayment plan. This plan outlines how the debtor will pay back creditors over a three to five-year period. This extended timeline makes payments more manageable for those with a steady income.

Once the plan is submitted, it must receive approval from the court. The court assesses its feasibility. Creditors may object, but if the plan demonstrates a reasonable approach to debt repayment, it is likely to proceed.

The role of the bankruptcy trustee is crucial. This person receives all payments from the debtor. The trustee then distributes these payments to the creditors as outlined in the plan. This ensures an orderly and fair process.

An essential component is the automatic stay. This legal mechanism halts most collection activities. Foreclosure processes and other collection efforts must cease, providing immediate relief to the debtor.

A breakdown of how it all works:

- File a petition and repayment plan in court

- Establish a three to five-year repayment period

- Receive approval from the bankruptcy court

- Make payments to the bankruptcy trustee

- Benefit from an automatic stay on debt collection

Through these coordinated steps, Chapter 13 offers a clear path to restructuring debts. Individuals can work towards financial recovery while keeping their homes and other assets intact. This system provides the debtor with both protection and a structured plan for financial rectification.

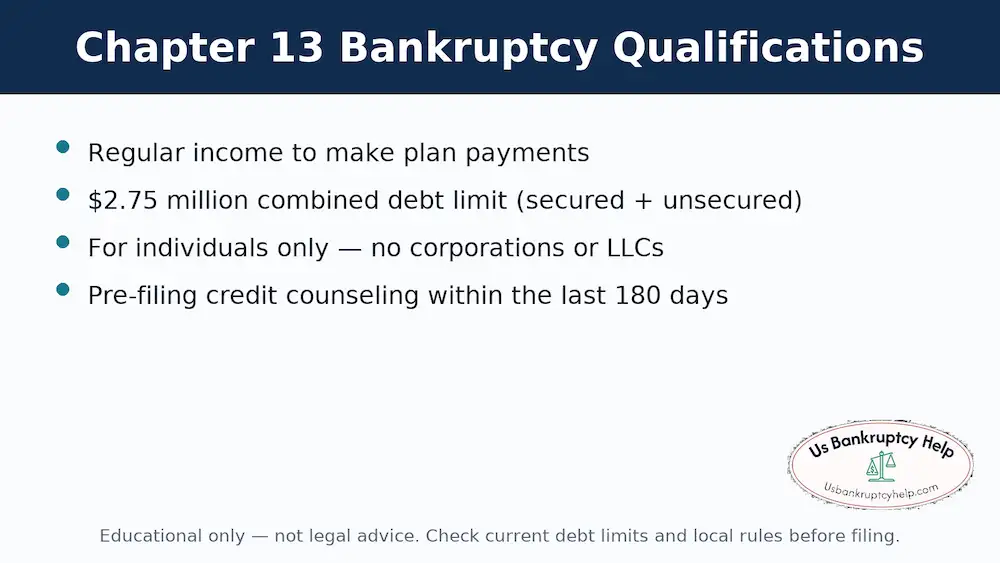

Eligibility Criteria for Chapter 13 Bankruptcy

To qualify for Chapter 13 Bankruptcy, individuals must meet certain criteria. These requirements ensure the process is accessible to those who can benefit most. Key among these is having a regular income source.

This income supports the feasibility of a repayment plan. Without it, maintaining scheduled payments becomes challenging, jeopardizing the bankruptcy arrangement. Therefore, demonstrating consistent income is pivotal.

Debt limits also apply to Chapter 13 eligibility. Individuals must not exceed specific unsecured and secured debt thresholds. These limits are reassessed periodically, affecting potential filers.

Debtors are also required to complete credit counseling before filing. This step ensures they understand alternatives and the implications of their decision. Participating in a counseling session from an approved agency is mandatory.

Here’s a quick checklist for eligibility:

- Regular and stable income

- Unsecured debt below the specified limit

- Secured debt below another specific limit

- Completion of a credit counseling course

- Ability to comply with repayment plan demands

These criteria help filter eligible applicants and set a foundation for a successful Chapter 13 case. Evaluating these factors is crucial before proceeding with a bankruptcy filing.

The Chapter 13 Bankruptcy Process: Step by Step

The Chapter 13 Bankruptcy process unfolds in several key steps. Each stage requires detailed attention and compliance with legal requirements. Understanding this progression helps debtors prepare effectively.

Initially, debtors must complete credit counseling. This step ensures informed decision-making. Counseling must be obtained from a federally approved agency.

Next, filing the petition is crucial. Alongside the petition, specific documents like income and debt details are submitted. This formal initiation begins the legal proceedings.

Upon filing, an automatic stay activates. This stay halts most debt collection actions. It provides debtors with a breathing space.

One of the most significant tasks is crafting a repayment plan. This plan outlines how debts will be settled over time. It must be reasonable and feasible.

Creditors and the trustee meet with the debtor. This 341 Meeting reviews the debtor's financial affairs. Full transparency is essential for a smooth meeting.

A confirmation hearing follows the meeting. Here, the court reviews the repayment plan for approval. Successful approval is vital for proceeding.

Debt payment as per the plan then begins. The trustee manages these payments, directing funds to creditors. This administration is monitored closely.

Finally, upon successful completion, debts are discharged. This discharge marks the end of the bankruptcy process. It relieves the debtor from remaining eligible debts.

Step 1: Credit Counseling Requirement

Before filing for Chapter 13, credit counseling is mandatory. This session provides insights into alternative resolutions. Counseling must be undertaken within 180 days before filing.

Participation from a recognized agency is required. This step ensures debtors understand all financial options. It's a cornerstone of the pre-filing phase, ensuring informed decisions.

Step 2: Filing the Petition and Required Documents

The filing stage is formal and structured. A petition, along with necessary documents, is submitted to the court. This includes income, expense, and debt details.

Here's what typically needs to be filed:

- The official Chapter 13 petition

- Income and expenditure statements

- List of debts and properties

- Completed credit counseling certificate

This documentation serves as a comprehensive financial overview. It sets the groundwork for the case. Accuracy and completeness are crucial throughout this phase.

Step 3: The Automatic Stay and What It Means

Once the petition is filed, an automatic stay takes effect. This legal provision pauses most creditor actions. It stops foreclosure and creditor harassment temporarily.

This stay is significant for a debtor's peace of mind. It allows time to restructure without immediate pressure. However, certain exceptions apply, like ongoing criminal cases.

Step 4: The Repayment Plan

Crafting the repayment plan is a core aspect of Chapter 13. This plan outlines how debts will be repaid over three to five years. It considers the debtor’s income and essential expenses.

Key elements of the repayment plan include:

- Prioritization of debt types

- Detailed repayment schedules

- Clear timelines for payments

The plan must reflect genuine repayment capabilities. It should also meet legal standards and creditor expectations. Approval of this plan is vital for the process to proceed.

Step 5: Meeting of Creditors (341 Meeting)

The 341 Meeting offers creditors a chance to question debtors. It focuses on verifying the debtor’s financial situation. Attendance is mandatory unless excused by the court.

This meeting is a transparent forum. Debtors must answer honestly and comprehensively. It’s generally straightforward but requires preparation.

Step 6: Confirmation Hearing

The confirmation hearing is a critical milestone. Here, the court evaluates and potentially approves the repayment plan. Approval means the plan is deemed fair and achievable.

If issues arise, modifications might be necessary. These adjustments can align the plan with legal standards. Successful confirmation propels the case forward.

Step 7: Making Payments and Plan Administration

Once confirmed, payments begin per the structured plan. The bankruptcy trustee oversees these disbursements. Regular payment adherence is crucial.

Key responsibilities during this phase include:

- Making timely payments

- Communicating with the trustee

- Adapting to any plan adjustments

Effective administration ensures smooth progress. Adherence to the schedule can lead to successful plan completion.

Step 8: Discharge of Debts

Completing the repayment plan leads to debt discharge. This release eliminates remaining qualifying debts. It signifies the end of the Chapter 13 process.

The discharge provides a clean financial slate. However, not all debts may be discharged. This closure is a significant relief and a fresh start opportunity.

Key Benefits of Chapter 13 Bankruptcy

Chapter 13 Bankruptcy offers several notable benefits. It is designed to assist individuals in reestablishing financial stability while retaining their assets. This aspect makes it appealing compared to other bankruptcy types.

Allowing Filers to Pay Back Arrears

An example of a primary benefit of chapter 13 is stopping foreclosure proceedings. This process allows debtors to save their homes by catching up on missed mortgage payments. It provides a structured framework to manage and overcome arrears

Chapter 13 debtors can also prevent vehicle repossession by filing and putting their vehicle arrearage into their chapter 13 plan. Often times filers are able to pay back their arrears and pay off their vehicle at lower interest rates and sometimes even at a lower principal balance through a chapter 13 vehicle cram down.

Additionally, Chapter 13 helps protect co-signers. By creating a repayment plan, co-signers are shielded from creditors pursuing them for debts. This protection can reduce familial and relational stress.

The repayment plan allows debts to be rescheduled. This enables the debtor to spread payments over a longer period. This flexibility can ease the monthly financial burden and aid in better budgeting.

Some specific advantages include:

- Protecting valuable assets from liquidation

- Allowing a longer timeframe to repay secured debts

- Halting collection efforts immediately after filing

- Facilitating a manageable, court-approved repayment plan

Drawbacks and Risks of Chapter 13 Bankruptcy

While Chapter 13 Bankruptcy has advantages, it is not without its drawbacks and risks. It's essential to understand these before proceeding.

One major risk is the commitment to a strict repayment schedule. Missing payments could result in case dismissal, causing added stress. Adhering to the plan requires financial discipline and foresight.

Another potential drawback is the effect on credit scores. Filing for Chapter 13 marks a public record on credit reports for up to seven years. This can impact future credit opportunities and financial endeavors.

Additionally, legal costs and associated fees can be substantial. These must be accounted for in the financial planning process.

Key risks include:

- Negative impact on credit score and report

- Requirement of long-term financial discipline

- Potential for case dismissal if obligations aren't met

Chapter 13 vs. Chapter 7 Bankruptcy: Key Differences

Understanding the differences between Chapter 13 and Chapter 7 Bankruptcy is crucial. Each serves different needs and circumstances.

Chapter 13 Bankruptcy is often called a "wage earner’s plan." It allows individuals to repay debts over time without liquidating assets. This process spans three to five years, offering a structured repayment plan.

In contrast, chapter 7 Bankruptcy involves asset liquidation, or settlement, if there are assets that are over-exempt to settle debts. It's typically quicker, often concluding within months. Chapter 7 is suitable for those without significant income or assets.

Eligibility for each type of bankruptcy varies. Chapter 13 requires regular income and adherence to certain debt limits. Chapter 7 primarily requires passing a means test, assessing financial capability.

Key differences include:

- Chapter 13: focuses on debt reorganization and payment plans.

- Chapter 7: involves liquidating assets to pay debts.

- Timeline: Chapter 13 spans years, while Chapter 7 is faster.

- Income requirement: Chapter 13 needs consistent earnings.

Before choosing, evaluate your financial situation. Consider long-term goals and consequences of each bankruptcy type. Learn more about the the differences between chapter 7 and chapter 13 here.

Impact of Chapter 13 Bankruptcy on Your Credit and Finances

Filing for Chapter 13 Bankruptcy significantly affects your credit score. The bankruptcy will appear on your credit report for up to seven years. This can temporarily lower your credit score, making future loans more difficult to secure.

While your credit score may drop initially, Chapter 13 offers a chance to rebuild. Regular, on-time payments towards your repayment plan can slowly improve your creditworthiness. It shows creditors your commitment to managing your debts responsibly.

The process can provide financial stability by organizing debt payments. This stabilization helps manage existing obligations effectively. Ensuring you avoid further financial pitfalls is crucial during and after the bankruptcy process.

Key financial impacts include:

- Negative impact on credit score initially

- A public record of bankruptcy for seven years

- Possible improvement over time with consistent payment

- Opportunity to prevent accumulation of additional debt

Considering these factors will help you weigh the financial implications of filing for Chapter 13 Bankruptcy.

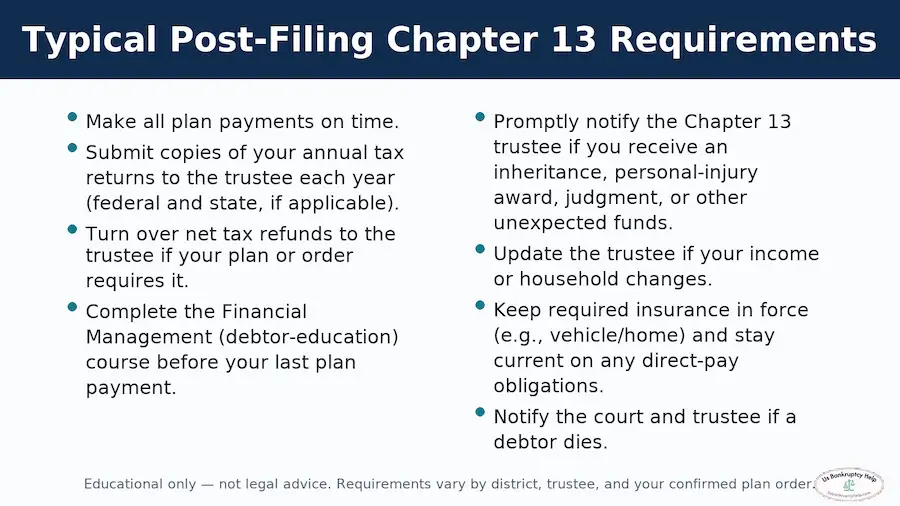

Life During and After Chapter 13 Bankruptcy

Life under Chapter 13 Bankruptcy requires strict financial discipline. You'll need to adhere to a detailed repayment plan. Consistent budgeting becomes essential to meet these obligations.

Every month, you must make payments to the bankruptcy trustee on time. This reinforces your financial stability and helps complete your bankruptcy plan. Skipping payments can jeopardize your progress.

During the bankruptcy period, making smarter financial choices is critical. This might mean scaling back on non-essential spending. Focusing on necessary expenses will keep your plan on track.

Life after completing Chapter 13 Bankruptcy can bring relief and a new financial beginning. Successfully finishing your plan discharges remaining eligible debts, leaving a clean slate. Staying financially disciplined after bankruptcy can help in building a more secure financial future.

Post-bankruptcy financial strategies include:

- Maintaining budgeting habits

- Continuing to prioritize debt payments

- Planning long-term financial goals

- Rebuilding credit responsibly through secure credit cards

This proactive approach allows you to regain control over your financial life.

Frequently Asked Questions About Chapter 13 Bankruptcy

People often have many questions about Chapter 13 Bankruptcy. Understanding the nuances can help ease concerns and clarify the process.

One common question is about the cost involved. Filing fees and attorney costs can vary. It's important to budget for these expenses.

Another frequent question revolves around the impact on credit. Chapter 13 remains on your credit report for seven years. However, it can also pave the way for a fresh start.

Debtors often wonder about eligibility criteria. Income stability and debt limits play a crucial role. Each case is unique, so consulting a professional is beneficial.

Questions also arise about the repayment plan's flexibility. Adjustments are possible with court approval. Open communication with trustees and creditors is vital.

People often ask if they can keep their property. Chapter 13 typically allows individuals to retain assets. This aspect makes it a preferable choice for many.

Here are some key FAQs:

- What costs are associated with filing?

- How does Chapter 13 affect credit?

- What eligibility criteria must be met?

- Can repayment plans be adjusted?

- Will I lose my property?

Tips for Navigating the Chapter 13 Bankruptcy Process

Success in Chapter 13 Bankruptcy hinges on diligent planning. Understanding the process is vital. Consistency in following the plan improves outcomes.

Maintain open communication with your attorney. They can help manage unexpected issues. Legal guidance ensures the plan stays viable and compliant.

Developing good financial habits is essential. Create a realistic budget and stick to it. This prevents future financial pitfalls and builds a stable foundation.

Key tips to remember:

- Stay in contact with your attorney.

- Build and follow a strict budget.

- Be prepared for financial discipline.

- Keep all required documentation organized.

- Monitor your plan's progress regularly.

Real-World Success Stories: Chapter 13 Bankruptcy and Great Outcomes

1) Foreclosure paused and mortgage arrears cured with a chapter 13 repayment plan

A family was five months behind on their mortgage after a medical setback. Filing chapter 13 triggered the automatic stay and stopped the scheduled foreclosure. Their confirmed plan spread roughly $17,500 in arrears over 60 months while they resumed regular payments to the servicer. Escrow shortages and HOA dues were folded into the plan, removing penalty pressure. Within a few months, the loan was back on track and the household had a predictable, single trustee payment each month.

- • Foreclosure halted immediately by the automatic stay

- • Arrears repaid inside the plan; regular mortgage paid outside

- • HOA and escrow issues resolved; budget stabilized

2) Older SUV kept with a vehicle cramdown that lowered the monthly payment

A commuter owed far more than her SUV was worth, but the loan was older than the 910-day rule. In chapter 13, her plan treated only the car’s fair-market value as the secured claim and paid it at a court-approved interest rate. The remaining balance was reclassified as unsecured and paid alongside credit cards. The reduced secured balance cut her monthly out-of-pocket, prevented repossession, and preserved reliable transportation for work.

- • Secured claim reduced to current market value (cramdown)

- • Lower interest and payment made the car affordable

- • Unsecured remainder paid pro-rata with other debts

3) Small business owner reorganizes priority taxes and protects cash flow

A self-employed contractor fell behind on federal and state income taxes during a slow season. Chapter 13 allowed him to pay priority tax debt in full over 60 months while spreading older penalties and credit cards across the unsecured pool. With a wage-deduction order sending one trustee payment each month, he avoided levies, kept tools and a work truck, and stayed current on quarterly estimates. The plan ended with penalties discharged and a clean slate with the taxing authorities.

- • Priority taxes amortized inside the plan—no new collection actions

- • Tools and vehicle retained; business operations continued

- • Predictable payment replaced irregular, high-stress bills

4) Wholly unsecured second mortgage stripped to unsecured and removed at discharge

A homeowner’s property value had dropped below the first-mortgage balance, leaving a junior lien completely “underwater.” In chapter 13, counsel filed a motion to value that second mortgage at $0 and treat it as unsecured. After the court approved the valuation and the debtor completed plan payments, the junior lien was stripped from the home. Monthly housing costs dropped to the first mortgage only, and every payment built equity again.

- • Junior lien treated as unsecured; no longer secured by the home

- • First-mortgage payment became the sole housing obligation

- • Path to equity recovery without a burdensome second loan

When to Seek Legal or Financial Advice

It's crucial to seek legal or financial advice before filing for Chapter 13 Bankruptcy. An experienced attorney can help assess your situation, explore options, and guide the process.

During the bankruptcy process, consult your attorney if uncertainties arise. Timely advice can help navigate legal complexities and mitigate potential issues. Professional guidance ensures sound decision-making throughout.

Conclusion: Is Chapter 13 Bankruptcy Right for You?

Determining if Chapter 13 Bankruptcy is right involves careful evaluation. Consider your financial goals and current obligations. This form of bankruptcy can offer a structured path to manage debts while keeping assets.

Weigh the pros and cons thoroughly. Ensure you understand the process and its impact on your future. A successful Chapter 13 filing can lead to debt discharge and financial stability.

Consult with a financial advisor or attorney to make a well-informed decision. Tailored advice can help you navigate toward your financial recovery path efficiently and effectively.