Understanding Chapter 13 Bankruptcy in California

Chapter 13 bankruptcy allows citizens of California with a regular income to develop a plan to repay all or part of their debts. This is different than chapter 7, which gives a quick discharge of unsecured debts while taking into consideration the debtor's non-exempt assets.

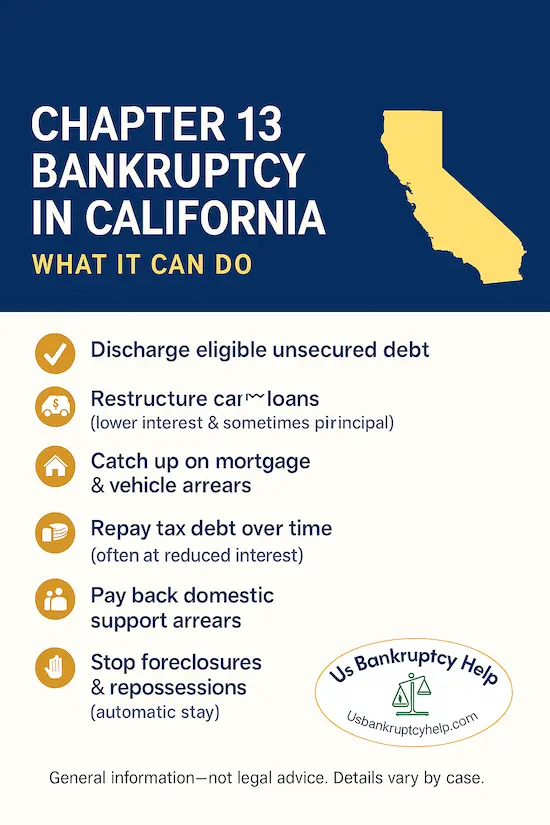

Chapter 13 is full of many options that are useful to Californians. Like chapter 7, chapter 13 offers a discharge of unsecured debt, but that comes after the 3 to 5 year payment period. In the meantime, while in the chapter 13 plan, debtors can use the plan to catch up secured debt, like mortgage arrears and vehicle arrears. They can pay off priority debt that is not dischargeable, like back taxes and domestic support obligations. Oftentimes, debtors can pay these items at reduced interest, and sometimes even reduce principal.

How Chapter 13 Works in California

Generally, chapter 13 can be summed up as this: You file a petition and list all of your assets and debts. With the petition you propose a plan of how much you are going to pay your creditors. Creditors may object to this plan. Once the court confirms your plan—after the trustee’s review and any creditor objections are resolved—you make monthly payments for 3–5 years. When you complete the plan and other required steps, the court discharges any remaining eligible general unsecured debts.”

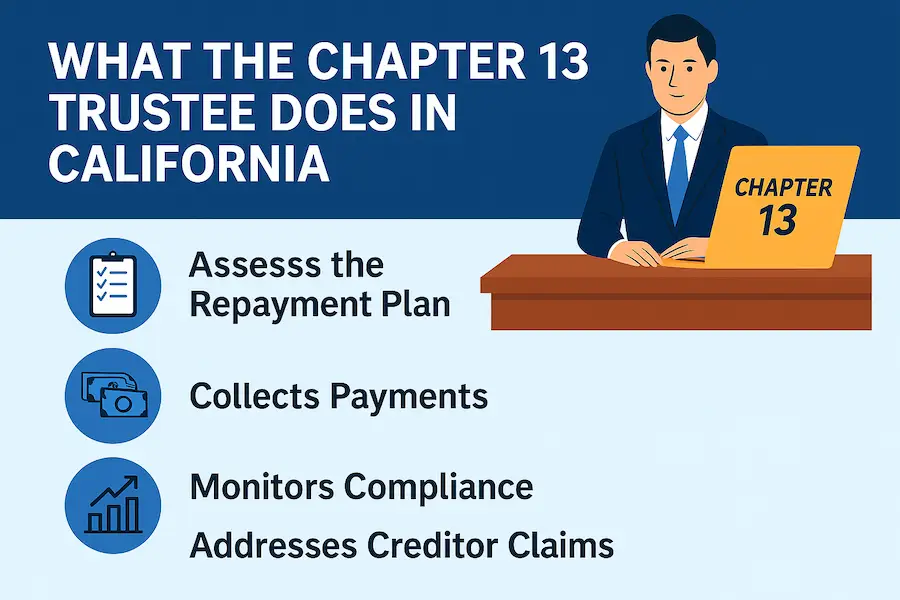

Who Is the Chapter 13 Trustee

The Chapter 13 trustee is a court-appointed administrator who oversees your repayment plan, reviews your documents, collects your monthly payments, and distributes the funds to creditors. In California, the specific trustee assigned to your case will depend on the federal district and division where you file. Each division has its own standing Chapter 13 trustee.

Below is a list of the current Chapter 13 trustees in California, along with their contact information. You can also find out more about the California chapter 13 trustees here.

| Trustee | District / Jurisdiction | Address | Phone | Email / Website |

|---|---|---|---|---|

| Amrane Cohen | Central District of California — Santa Ana Division | 770 The City Drive South, Suite 8500, Orange, CA 92868 | (714) 621-0200 | amrane@ch13ac.com |

| Nancy K. Curry | Central District of California — Los Angeles | 1000 Wilshire Blvd., Suite 870, Los Angeles, CA 90017 | (213) 689-3014 | ncurry@trusteecurry.com |

| Kathy Anderson Dockery | Central District of California — Los Angeles | 801 Figueroa Street, Suite 1850, Los Angeles, CA 90017 | (213) 996-4400 | TRUSTEE@LATRUSTEE.COM |

| Elizabeth F. Rojas | Central District of California — San Fernando Valley & Northern Divisions | 15260 Ventura Blvd., Suite 830, Sherman Oaks, CA 91403 | (818) 933-5700 | lrojas@ch13wla.com |

| Rodney A. Danielson | Central District of California — Riverside | 3787 University Avenue, Riverside, CA 92501 | (951) 826-8000 | rodd@rodan13.com |

| David P. Cusick | Eastern District of California — Sacramento Division | P.O. Box 1858, Sacramento, CA 95812 | (916) 856-8000 | cusick13.com |

| Lilian G. Tsang | Eastern District of California — Fresno & Modesto Divisions | P.O. Box 3051, Modesto, CA 95353-3051 | (209) 576-1954 | info@mod13.com |

| Martha G. Bronitsky | Northern District of California — Oakland | P.O. Box 5004, Hayward, CA 94540 | (510) 266-5580 | 13trustee@oak13.com |

| David E. Burchard | Northern District of California — San Francisco & Santa Rosa | P.O. Box 8059, Foster City, CA 94404 | (650) 345-7801 | administrator@burchardtrustee.com |

| Devin Derham-Burk | Northern District of California — San Jose | P.O. Box 50013, San Jose, CA 95150-0013 | (408) 354-4413 | faxlt@ch13sj.com |

| Michael Koch | Southern District of California — San Diego & Imperial Counties | 402 West Broadway, Suite 1450, San Diego, CA 92101 | (619) 338-4006 | mkoch@ch13.sdcoxmail.com |

The Chapter 13 Plan

Under Chapter 13, debtors propose a repayment plan to make installments to creditors over a specified time frame. This plan must be approved by the bankruptcy court and tailored to fit the debtor’s financial situation. It allows for a structured and manageable way to handle overwhelming debt, which can help reduce stress and financial anxiety.

Chapter 13 Protection - The Automatic Stay

Filing for Chapter 13 provides an automatic stay, which stops creditors from pursuing collections, garnishments, or foreclosures. This protection is immediate and can provide essential relief from creditor harassment. The automatic stay can also serve as a breathing space, allowing debtors to reorganize their finances without the constant pressure from creditors.

Discharge of Debts

Upon completion of the repayment plan, certain remaining unsecured debts may be discharged. This means that after fulfilling the plan’s obligations, you could be relieved from personal liability for certain debts, providing a fresh financial start. The discharge is a critical benefit of Chapter 13, offering long-term relief and the chance to rebuild your financial health.

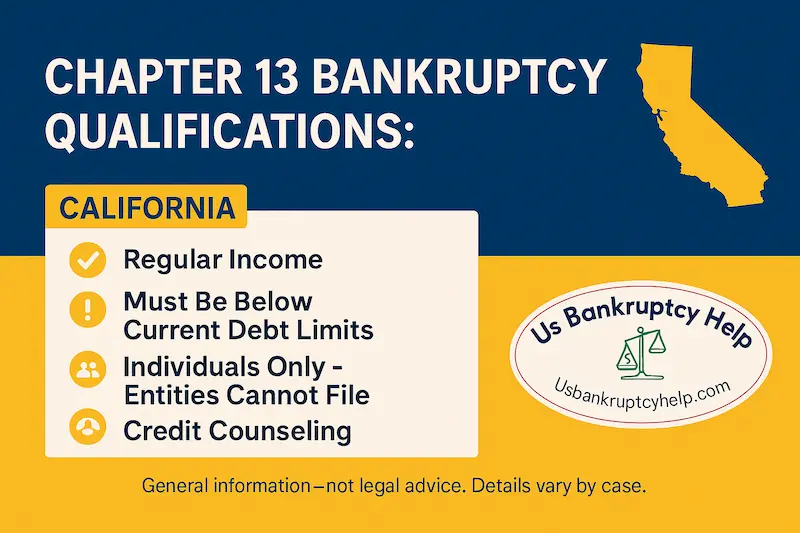

Eligibility for Chapter 13 Bankruptcy

Before filing for Chapter 13 bankruptcy in California, it's important to understand the eligibility requirements. Not everyone qualifies for this type of bankruptcy, and certain criteria must be met. Understanding these criteria can help you determine if Chapter 13 is the right choice for your financial circumstances.

Income Requirements

To file for Chapter 13, you must have a regular income. This can come from various sources such as wages, social security, pensions, or even rental income. The court needs assurance that you can make regular payments under the proposed repayment plan. This requirement ensures that the repayment plan is feasible and that you can realistically meet the financial commitments outlined in the plan.

Debt Limits

For cases filed between April 1, 2025 and March 31, 2028, Chapter 13 is available to individuals with unsecured debts under $526,700 and secured debts under $1,580,125. These limits are set by 11 U.S.C. § 109(e) and adjust periodically under § 104. These limits are adjusted periodically to reflect changes in the consumer price index. It's important to review the most current limits as they can impact your eligibility. Meeting these debt limits is crucial, as exceeding them would necessitate considering other forms of bankruptcy or financial restructuring.

Chapter 13 is Limited to Individuals - No Entities

Entities like corporations are not eligible to file chapter 13. Filers must be individuals.

Credit Counseling Requirement

To be able to file for chapter 13 and not get your case dismissed, you must complete credit counseling within 180 days of filing. These classes can be completed online or over the phone. You will get a certificate when you complete the class. This certificate is usually filed with your chapter 13 petition.

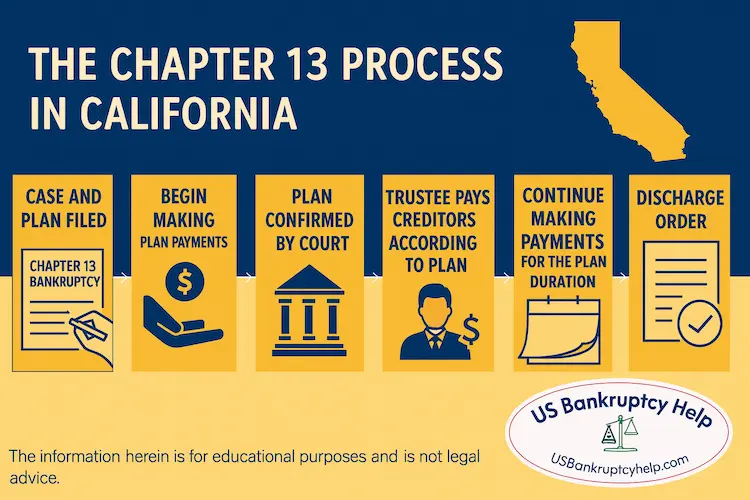

The Chapter 13 Bankruptcy Process

Understanding the Chapter 13 process in California can help you navigate the system more smoothly. Here's a step-by-step overview that can guide you through the complexities of the bankruptcy filing, ensuring you are well-prepared at each stage.

Filing the Petition

The process begins with filing a petition with the bankruptcy court serving your area. This includes schedules of assets and liabilities, current income and expenditures, contracts and unexpired leases, and a statement of financial affairs. Accurate and complete documentation is crucial as it forms the basis of your case and helps the court assess your financial situation. It’s beneficial to work with a legal professional to ensure all paperwork is correctly filled out and submitted.

Creating a Repayment Plan

With the assistance of a Chapter 13 bankruptcy attorney, you'll propose a repayment plan that outlines how you intend to repay your debts. This plan must be submitted within 14 days of filing your petition. The plan should be realistic and tailored to your financial capabilities, taking into account your monthly expenses and income. Working closely with your attorney can help you craft a plan that meets legal requirements and is acceptable to creditors.

Court Approval

A bankruptcy judge will evaluate your proposed repayment plan. Creditors may raise objections, but ultimately, the judge decides whether the plan is feasible and meets legal requirements. This step involves negotiation and may require adjustments to the original plan to satisfy both the court and creditors. Successfully navigating this stage is crucial, as court approval allows you to begin the repayment process under legal protection.

Making Payments

Once the plan is approved, you begin making regular payments to a trustee, who distributes the funds to creditors according to the plan. It's crucial to adhere to the payment schedule to avoid dismissal of your case. Consistent payments demonstrate your commitment to resolving your debts and are essential for maintaining the protections afforded by Chapter 13. Failing to make payments can result in the dismissal of your case, leading to renewed creditor actions.

Completion and Discharge

After successfully completing the repayment plan, any remaining eligible debts may be discharged, freeing you from personal liability for those obligations. This final step marks a significant milestone in your financial recovery, offering the opportunity to rebuild your credit and financial stability. The discharge is the ultimate goal of Chapter 13, providing a fresh start and relief from the burdens of past financial difficulties.

Benefits of Chapter 13 Bankruptcy

Chapter 13 bankruptcy offers several advantages for those struggling with debt in California. Understanding these benefits can help you make informed decisions about whether this bankruptcy option aligns with your financial goals and needs.

Payment of Secured Debts and Arrears

Many Californians use chapter 13 to catch up secured debts they've fallen behind on including mortgage arrears, and vehicle loan arrears. Often filers put the arrearages of these debts into their payment plan so that their monthly plan payments pay off the amounts due, thereby preventing foreclosure or repossession. Similarly, filers use chapter 13 to get better interest rates, or even reduce the principal amount owed on vehicle loans. This is known as a cram down and is a powerful tool for those who have unfavorable vehicle loans.

Debt Consolidation

Chapter 13 consolidates debts into one manageable payment, simplifying the repayment process. This consolidation can reduce the stress of juggling multiple payments and creditors, providing a more straightforward path to debt resolution. It can also improve your budgeting and financial planning by offering a clear overview of your repayment obligations.

Protection from Foreclosure

If you're facing foreclosure, Chapter 13 can halt proceedings and allow you to catch up on missed mortgage payments over time. This aspect of Chapter 13 can be particularly beneficial for those at risk of losing their homes, offering a chance to stabilize housing situations. The ability to prevent foreclosure can provide peace of mind and protect your most valuable asset.

Interest and Penalties Reduction

Interest and Penalties Reduction: The plan may reduce or eliminate interest and penalties on unsecured debts, making repayment more manageable. This reduction can significantly lower the total amount you owe, easing the burden of repayment. By minimizing additional costs, Chapter 13 can make it easier to achieve financial stability and recovery.

The Chapter 13 Discharge

If you make all of your chapter 13 plan payments and you otherwise qualify for discharge, the chapter 13 discharge order applies to all of your general unsecured creditors (like credit cards and medical bills). This discharge order effectively eliminates all general unsecured debt.

Finding a Chapter 13 Bankruptcy Lawyer

While it's possible to file for Chapter 13 bankruptcy without legal representation, working with a knowledgeable attorney can significantly improve your chances of success. An experienced lawyer can navigate the complexities of bankruptcy law and advocate effectively on your behalf, ensuring that your rights are protected throughout the process.

Choosing the Right Attorney

When selecting a Chapter 13 bankruptcy attorney in California, consider the following:

- Experience: Look for a lawyer with a proven track record in handling Chapter 13 cases. An experienced attorney will have a deep understanding of the local bankruptcy courts and can provide strategic guidance tailored to your case.

- Reputation: Check reviews and ask for referrals to gauge the attorney's reputation and client satisfaction. A well-regarded lawyer is more likely to provide quality service and have established relationships with court officials and trustees.

- Communication: Ensure the lawyer communicates clearly and is responsive to your questions and concerns. Effective communication is vital for a smooth bankruptcy process, as it ensures you understand each step and can make informed decisions.

Taking the Next Steps: Chapter 13 Bankruptcy in California

Chapter 13 bankruptcy in California offers a viable solution for individuals seeking to manage their debts without losing their assets. By understanding the eligibility requirements, process, and benefits, you can make informed decisions about your financial future. If you're considering this path, consulting with a Chapter 13 bankruptcy attorney can provide the guidance and support you need to navigate the complexities of the bankruptcy system successfully.

Remember, while bankruptcy can offer a fresh start, it's essential to approach it with careful consideration and professional advice to ensure the best possible outcome for your financial situation. Making informed decisions and seeking expert guidance can help you leverage the benefits of Chapter 13 to achieve financial recovery and stability.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin