Bankruptcy Chapter 7 vs Chapter 13

Navigating bankruptcy can be daunting. Understanding the differences between Chapter 7 and Chapter 13 is crucial.

Understanding Differences: Chapter 7 vs Chapter 13

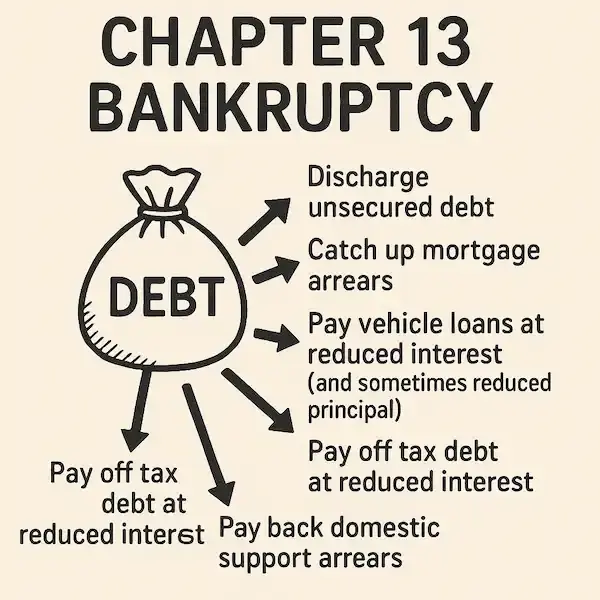

Chapter 7 bankruptcy wipes the slate clean of unsecured debts quickly. These debts often include credit cards, medical bills, and personal loans. Chapter 13 bankruptcy, sometimes called "reorganization bankruptcy," allows debt repayment over time. It also offers a discharge of unsecured debts but after a three to five year period. Chapter 13 has many great options, including the ability to pay certain secured debts at sometimes reduced interest and principal. It also allows filers to gain bankruptcy protection and catch up debt, like home loans, thereby protecting their home. This guide will help you decide which option suits your financial situation best.

Bankruptcy offers a way to address overwhelming debt. It provides a structured path to financial recovery. Understanding the details of Chapter 7 and Chapter 13 is essential.

Each chapter serves different financial needs. Chapter 7 and Chapter 13 have unique processes and benefits. Knowing these can help you make informed choices.

Here's what distinguishes Chapter 7 from Chapter 13:

- Chapter 7: Quickly discharges unsecured debt only. Debtors must maximize their bankruptcy exemptions to protect their assets.

- Chapter 13: Offers a discharge after 3 to 5 years. In the meantime, filers may use the plan payments to catch up arrears (mortgages and vehicle loans), pay off certain secured debts (often at reduced interest and sometimes reduced principal) and pay off certain priority debts (e.g. taxes and domestic support obligations).

Making the right choice depends on your circumstances. Consider factors like income, asset protection, and debt amount. Consulting a bankruptcy attorney can provide personalized guidance on which chapter aligns with your financial goals. This helps ensure a decision tailored to your needs.

Chapter 7 vs Chapter 13: side-by-side essentials

Chapter 7 (fresh-start focus)

- • Typical timeline: about 3–6 months from filing to discharge

- • Best fit: unsecured debt, no large non-exempt assets, want speed

- • Property: protected by exemptions; non-exempt value may be at risk

- • Secured debts: “pay and stay,” reaffirmation, or redeem at current value

- • Eligibility: must qualify under the means test

Chapter 13 (repayment & asset-protection)

- • Plan length: usually 3–5 years (single monthly trustee payment)

- • Best fit: catch up mortgage/car, manage priority taxes, protect equity

- • Tools: cure arrears, potential vehicle cramdown (older loans), lien avoidance

- • Co-signers: limited co-debtor stay for consumer debts during the case

- • Eligibility: regular income; subject to periodically adjusted debt limits

Examples of Situations that Would Influence Which Chapter to File

Mostly unsecured debt and eligible under the means test

If your problem is primarily credit cards, medical bills, or personal loans—and your income fits your state’s standards—chapter 7 is often the most direct path. You’ll complete the means test to confirm eligibility. When you qualify, chapter 7 can deliver a fast discharge and a clean slate without a multi-year plan.

Behind on a mortgage and need time to cure arrears

If saving your home is the top goal, chapter 13 lets you spread missed payments over 3–5 years while you resume the regular mortgage payment. That structure is designed to stop a foreclosure and give you a predictable way to catch up.

Car loan in trouble—or upside down on value

When you’re a few payments behind, chapter 13 can fold the arrears into your plan and stop repossession. If the loan is older and the car is worth less than you owe, some courts allow a vehicle cramdown in chapter 13—paying the current value as the secured amount and treating the rest as unsecured.

Non-exempt equity you don’t want to risk

If you own assets with equity that exceeds your available exemptions, chapter 7 could put those items at risk of sale. Chapter 13 often solves that by letting you keep the property while paying the non-exempt value to creditors over time.

Recent or priority tax debt that won’t go away in chapter 7

Older income taxes may be dischargeable, but recent taxes and certain assessments usually aren’t. Chapter 13 allows you to repay priority taxes in full through your plan—often without new penalties—while stopping aggressive collection actions.

Protecting a co-signer on a consumer debt

If a spouse, parent, or friend co-signed a consumer loan, chapter 13 includes a limited co-debtor stay that can shield that person while your case is pending. Chapter 7 doesn’t offer that protection, so chapter 13 may be the better fit for joint obligations.

High income but heavy allowable expenses

Being over median income doesn’t end the chapter 7 conversation. After deductions for housing, taxes, childcare, insurance, and secured-debt payments, some households still pass the means test and can file chapter 7. If you don’t pass, chapter 13 remains available.

Wholly unsecured junior mortgage on a home

When a second mortgage is entirely “underwater” (the first mortgage exceeds the home’s value), chapter 13 may allow you to treat that junior lien as unsecured and remove it at discharge—something chapter 7 generally can’t accomplish.

Need the fastest route to stop garnishment and erase unsecured debt

If you’re facing wage garnishment or bank levies and don’t need to save a house or car, chapter 7 usually provides the quickest path to relief and discharge—often in a matter of months—once you qualify under the means test.

Recent chapter 7 or other timing issues

If you received a chapter 7 discharge within the last eight years, you can’t file another chapter 7 right away. Chapter 13 can still be an option to manage debt, catch up secured payments, and protect assets while the waiting period runs.

Quick chapter picker (real-world scenarios)

- Mostly unsecured debt + eligible income: If cards/medical bills are the main issue and you pass the means test, lean toward chapter 7 for the fastest clean slate.

- Behind on the mortgage but want to keep the home: chapter 13 lets you cure arrears over 3–5 years while resuming regular payments. See keep your house in bankruptcy.

- Car at risk or payment too high: In chapter 13, you can catch up missed payments and may qualify for a vehicle cramdown (older loans), paying the car’s current value at a court-approved rate. In chapter 7, many keep a car by reaffirming or redeeming.

- Non-exempt equity you don’t want to lose: If your assets exceed available exemptions, chapter 13 often protects property by paying the non-exempt value through the plan.

- Priority taxes or a cosigner to protect: chapter 13 pays recent/priority taxes in full over time and provides a limited co-debtor stay on consumer debts; chapter 7 doesn’t.

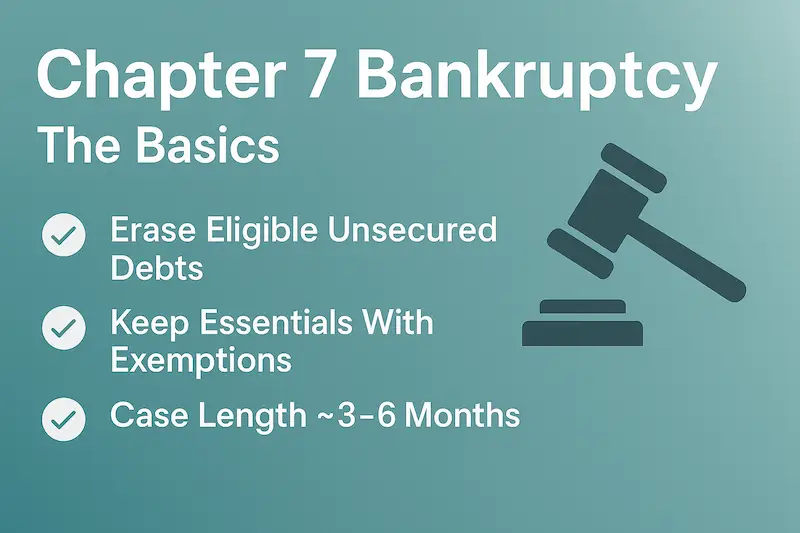

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy discharges unsecured debt (like credit cards, medical bills and personal loans) It is usually a fast procedure, often completed within 3–6 months. This type of bankruptcy considers your assets vs the exemption scheme available in your jurisdiction. If an asset is over-exempt or not covered by an exemption, debtors are required to provide the chapter 7 bankruptcy estate (administered by the chapter 7 trustee) with the fair market value of the asset, or the asset will need to be sold and distributed to creditors.

Key features of Chapter 7 bankruptcy include:

- Discharging most unsecured debts

- Reconciling or Selling non-exempt assets

- No repayment plan required

- Quick resolution time

Despite its benefits, Chapter 7 can lead to property loss if you are over exempt or have assets with no exemptions. State exemptions may vary, impacting which assets are protected. Understanding state-specific laws is crucial.

Filing for Chapter 7 might not discharge all debts. Obligations like student loans and child support remain. Consulting with a bankruptcy attorney is advisable to navigate complex rules.

What Is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy is often referred to as "reorganization bankruptcy." This option lets individuals retain their assets. Instead of liquidating, debtors repay debts over a 3–5 year period.

A court-approved repayment plan is essential. Debtors make consistent payments to a trustee, who distributes funds to creditors. Regular income is necessary for eligibility.

Chapter 13 is ideal for those who want to protect significant assets. It can also prevent home foreclosure, offering a lifeline to homeowners. This chapter allows for debt consolidation into a manageable monthly payment.

Characteristics of Chapter 13 bankruptcy:

- Protects assets from liquidation

- Involves a repayment plan

- Helps prevent foreclosure

- Requires a steady income

This type stays on credit reports for seven years, affecting credit applications. It's a strategic tool for financial recovery, providing debt relief while retaining property. Legal advice can ensure a successful filing process.

Key Differences Between Chapter 7 and Chapter 13 Bankruptcy

Understanding the distinctions between Chapter 7 and Chapter 13 bankruptcy helps in making informed decisions. Each chapter serves different financial needs and situations.

Chapter 7 is often favored for its rapid discharge of unsecured debts. In contrast, Chapter 13 allows repayment flexibility over time, which suits those with regular incomes. The primary difference lies in how debts are resolved.

Chapter 7 Highlights:

- Quick discharge process

- Involves asset liquidation

- Best for those with little income

- Leaves a 10-year mark on credit reports

Chapter 13 Highlights:

- Structured repayment plan

- Protects personal assets

- Requires a steady income

- Leaves a 7-year mark on credit reports

Each chapter has unique eligibility criteria. Chapter 7 requires passing a means test, while Chapter 13 requires proof of regular income. Choosing the right option depends on individual financial circumstances and goals.

Overall, these differences highlight unique paths to regain financial stability. It's essential to weigh each chapter's pros and cons before proceeding.

Eligibility Requirements: Who Can File?

Eligibility criteria for filing bankruptcy differ significantly between Chapter 7 and Chapter 13. These criteria ensure that each option serves its intended financial situations.

For Chapter 7, individuals must pass a means test. This test assesses income levels against state median income to determine eligibility. If income is too high, Chapter 7 may not be an option.

Chapter 13 eligibility is based on regular income capability. Debtors must demonstrate the ability to adhere to a court-approved repayment plan. Additionally, the amount of secured and unsecured debt must not exceed specified limits.

Eligibility Summary:

- Chapter 7: Pass a means test

- Chapter 13: Have regular income

- Debt limits apply

Choosing the right chapter depends heavily on these eligibility criteria. Understanding them ensures you select the bankruptcy chapter best suited to your financial situation.

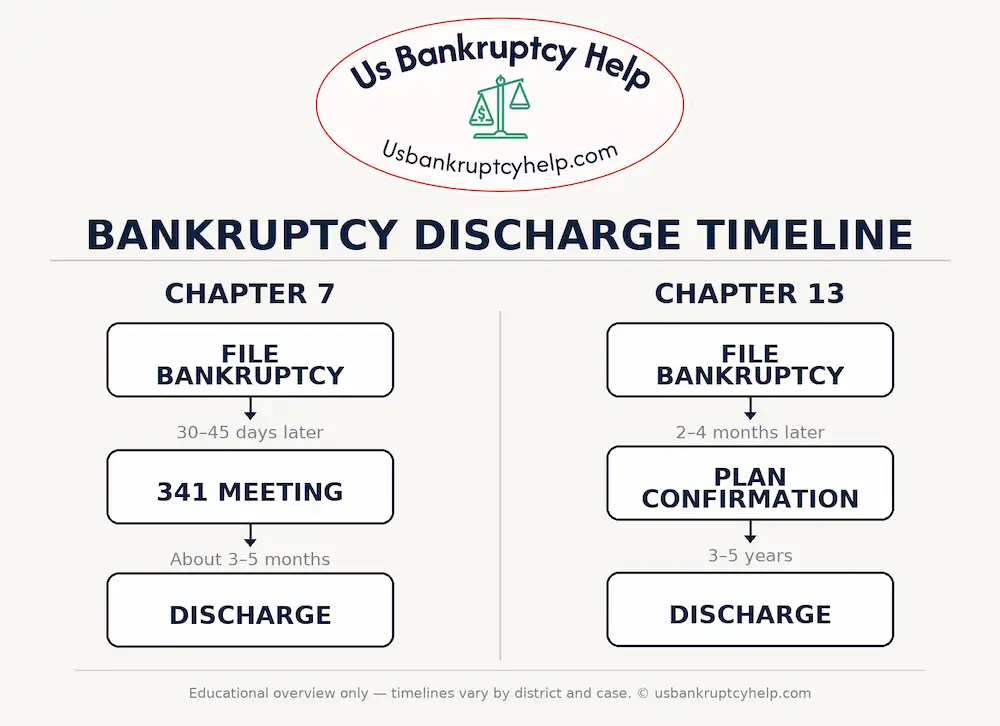

The Bankruptcy Process: Step-by-Step Comparison

Filing for bankruptcy involves a structured process. This varies depending on whether you choose Chapter 7 or Chapter 13.

Chapter 7 is straightforward and often faster. It involves the sale of non-exempt assets by a trustee to discharge debt. This process typically concludes within three to six months.

Conversely, Chapter 13 is more intricate. It begins with proposing a repayment plan, which the court must approve. Over three to five years, you make regular payments as outlined in this plan.

Key Steps in the Bankruptcy Process:

- Chapter 7: File petition and financial documents

- Trustee reviews and sells assets

- Debts are discharged

- Chapter 13: Submit repayment plan for court approval

- Make plan payments

- Discharge remaining debts after plan completion

The appropriate process requires considering your long-term financial recovery strategy.

Impact on Assets and Property

Your assets can be affected differently depending on whether you choose Chapter 7 or Chapter 13 bankruptcy. Under Chapter 7, non-exempt property might be sold to satisfy debts. However, some exemptions protect essential assets from being liquidated.

In contrast, Chapter 13 allows you to retain your property. The court arranges for debt repayments instead of asset liquidation, with payments adjusted according to your income.

Asset Considerations:

- Chapter 7: Potential loss of non-exempt assets

- Some exemptions can protect essentials

- Chapter 13: Retain all property

- Establish a court-approved repayment plan

By assessing the impact on your assets, you can make a more informed decision.

How Each Chapter Affects Your Debts

Both Chapter 7 and Chapter 13 offer debt relief but in distinct ways. Chapter 7 aims to eliminate unsecured debts like credit card balances and medical bills. This can give a fresh start for those overwhelmed by debt but may not cover all obligations.

Chapter 13 focuses on restructuring your debt into manageable payments over several years. This plan helps consolidate debts, enabling a more structured repayment plan without losing assets.

Debt Relief Under Each Chapter:

- Chapter 7: Eliminates unsecured debts

- Provides a "fresh start"

- Chapter 13: Restructures debt repayment

- Helps keep assets while paying back creditors

Choosing the right chapter impacts how your debts are handled and the financial freedom you gain.

Credit Score and Long-Term Financial Impact

Bankruptcy impacts credit scores significantly but differently under Chapter 7 and Chapter 13. Chapter 7 stays on your credit report for ten years, while Chapter 13 remains for seven years.

Both options result in a lower credit score initially. However, they offer a chance to rebuild by eliminating unmanageable debts.

Credit Impact:

- Chapter 7: On credit report for 10 years

- Quick impact on score

- Chapter 13: On credit report for 7 years

- Longer-term repayment helps rebuild score

Understanding the long-term implications is crucial for financial planning.

Costs, Fees, and Legal Considerations

Filing for bankruptcy involves various costs and legal considerations. Chapter 7 usually has lower legal fees than Chapter 13. However, it's crucial to consider additional costs like filing fees and credit counseling.

Hiring a bankruptcy attorney ensures proper filing and compliance with legal requirements. Attorneys can also clarify fee structures and necessary expenses.

Cost Breakdown:

- Filing Fees

- Attorney Fees

- Credit Counseling Fees

Each type of bankruptcy has unique costs, which should be weighed carefully.

Pros and cons: chapter 7 vs chapter 13 bankruptcy

Picking the right chapter isn’t about which one is “better” overall—it’s about which one is better for your goal. Chapter 7 is built for speed and wiping out unsecured debt when your assets are covered by exemptions and you qualify under the means test. Chapter 13 is designed to protect property and catch up on secured debts (home/car) with a structured 3–5 year plan.

Chapter 7 at a glance

- • Typical timeline: about 3–6 months from filing to discharge

- • Best when debt is mostly unsecured (cards/medical/personal loans)

- • No monthly plan payment; you must pass the means test

- • Keep secured items by staying current (or via reaffirmation/redemption)

Chapter 13 at a glance

- • Plan length: usually 3–5 years with one trustee payment each month

- • Catch up mortgage or car arrears while keeping the property

- • Pay priority taxes in full over time; limited co-debtor stay on consumer debts

- • Keep non-exempt equity by paying its value out through the plan

Real-world mini-scenarios

- “Clean-slate sprinter” (chapter 7): A renter with $28k in credit cards and medical bills, no home equity, and income under the means test finishes in four months and frees cash flow for savings.

- “Save-the-home” plan (chapter 13): A homeowner three months behind cures arrears over 60 months while resuming the regular mortgage—foreclosure paused by the automatic stay.

- “Car payment fix” (chapter 13): An older auto loan is upside-down; the plan pays the car’s current value at a court-approved rate and spreads arrears, keeping transportation reliable.

Pros and cons in one view

Chapter 7 — pros

- • Fast discharge of most unsecured debts (no multi-year plan)

- • Immediate relief from most collections via the automatic stay

- • Lower total attorney cost upfront than a multi-year case in many markets

- • Simple path if assets are fully covered by exemptions

Chapter 7 — cons

- • Risk to non-exempt equity (trustee can sell non-exempt assets)

- • No tool to cure mortgage/car arrears over time

- • Credit report notation up to 10 years (you can still rebuild sooner)

- • No co-debtor stay—collectors may pursue a non-filing co-signer

Chapter 13 — pros

- • Protects home/car while catching up missed payments inside the plan

- • Lets you keep non-exempt equity by paying its value over time

- • Pays priority taxes predictably; stops levies and garnishments

- • Limited co-debtor stay can shield a co-signer on consumer debts

Chapter 13 — cons

- • Longer commitment (3–5 years) with strict on-time plan payments

- • Overall cost is typically higher than a short chapter 7

- • Credit report notation up to 7 years

- • Budget must stay stable enough to complete the plan

Bottom line: choose Chapter 7 when speed and unsecured-debt relief are the priority and your assets are protected; choose chapter 13 when keeping a home or car, handling recent taxes, or preserving non-exempt equity is the main goal. If you’re on the fence, start by confirming eligibility with the means test and then map your goals to the chapter that offers the right tools.

Which Bankruptcy Option Is Right for You?

Deciding between Chapter 7 and Chapter 13 bankruptcy depends on your financial goals and situation. Each chapter serves different needs and offers unique benefits.

Consider your ability to make monthly payments. Chapter 13 requires a regular income. If retaining your property is crucial, Chapter 13 may be ideal due to its asset protection.

Here's a quick guide to help:

- Low income, significant debt: Consider Chapter 7

- Stable income, need to keep property: Consider Chapter 13

Evaluate your specific circumstances. Consulting with a bankruptcy attorney can provide tailored advice to ensure you make the best choice.

Frequently Asked Questions: chapter 7 vs chapter 13

Choosing between chapter 7 and chapter 13 depends on your goals, income, assets, and the kind of debt you carry. These FAQs break down the most common differences so you can compare options side-by-side.

Can I keep my house in bankruptcy?

Often, yes—how you keep it differs by chapter. In chapter 13, you can usually cure mortgage arrearsover 3–5 years while you stay current going forward, which is why many homeowners choose a repayment plan. In chapter 7, keeping a home depends on your available exemptions and equity; if all equity is protected and you remain current, many lenders allow you to “pay and stay.” If you’re behind or have non-exempt equity, chapter 13 may be the safer route.

For more detail, see: can you file for bankruptcy and keep your house?

How long will bankruptcy stay on my credit reports, and how fast can I recover?

A chapter 7 notation can appear for up to 10 years; a chapter 13 notation typically appears for up to 7 years. That’s the reporting window—not a “credit timeout.” Many filers see score improvements within months by adding on-time payments (utilities, phone), keeping utilization low, and using a small secured card or credit-builder loan. Mortgage eligibility and interest rates depend on your full profile, not the listing alone.

Are student loans discharged in chapter 7 or chapter 13?

Not automatically. Student loans can be discharged only if you file a separate adversary proceedingand prove undue hardship under standards set by your court. In chapter 13, payments may be managed inside your plan, but the loan typically survives unless hardship is established. Talk with counsel about your facts and current local guidance.

Who qualifies: means test vs. debt limits?

Chapter 7 uses a means test that compares your recent household income to your state median and then allows specific deductions. If you’re under median, you generally qualify; if you’re over, you may still pass after deductions. Chapter 13 requires regular income and is subject to debt limitsthat are adjusted periodically—your attorney will confirm the current thresholds and how your debts are counted (secured vs. unsecured, contingent, or unliquidated).

What happens to car loans under each chapter?

In chapter 7, many people keep a car by reaffirming the loan (continuing payments) or by redeeming the vehicle at its current value with a new loan. In chapter 13, you can cure arrears over time; and if the purchase was long enough ago, some courts allow a cramdown that pays only the car’s present value as the secured amount (with a court-approved interest rate) while the remainder is treated as unsecured.

Will filing stop foreclosure, repossession, or wage garnishment?

Usually, yes. Both chapters trigger the automatic stay, which pauses most collection activity the moment you file. Chapter 13 then gives you tools to catch up on house or car payments through the plan. Note that certain actions (for example, domestic support) aren’t stopped, and creditors can ask the court to lift the stay in limited circumstances.

How long does each chapter take from start to finish?

A straightforward chapter 7 typically runs about 3–6 months from filing to discharge. A chapter 13 plan generally lasts 3–5 years, depending on your income, required distributions, and whether you’re below or above your state’s median income. The trade-off: chapter 13 is longer, but it can save a home or car by spreading catch-up amounts over time.

How are tax debts treated differently in chapter 7 vs. chapter 13?

Some older income taxes may be dischargeable in chapter 7 if strict timing rules are satisfied. Recent income taxes and certain other tax types are priority debts that usually survive chapter 7. In chapter 13, priority taxes must be paid in full through the plan, often without additional penalties, which can make repayment more manageable while stopping levies and liens from escalating.

What about my spouse and co-signers—who’s protected?

Chapter 13 includes a limited co-debtor stay that can protect a non-filing co-signer on consumerdebts while the case is pending. Chapter 7 doesn’t offer that protection; the creditor can pursue the co-signer even if your liability is discharged. Strategy matters for joint debts—ask your attorney which chapter best shields your household.

How do costs differ between chapter 7 and chapter 13?

Court filing fees are fixed nationally, but attorney’s fees vary by case and location. Chapter 7 fees are typically paid up front because there’s no repayment plan. Chapter 13 fees are often paid through the plan in installments, which can improve affordability early on. Always ask for a written fee disclosure so you know what’s included.