Understanding Tennessee Bankruptcy Laws and Procedures

At a Glance: Bankruptcy in Tennessee

- Automatic stay stops most collections, lawsuits, and garnishments (11 U.S.C. § 362).

- Eligibility is means-test driven; business-debt and certain disabled-veteran cases may be exempt (UST means test).

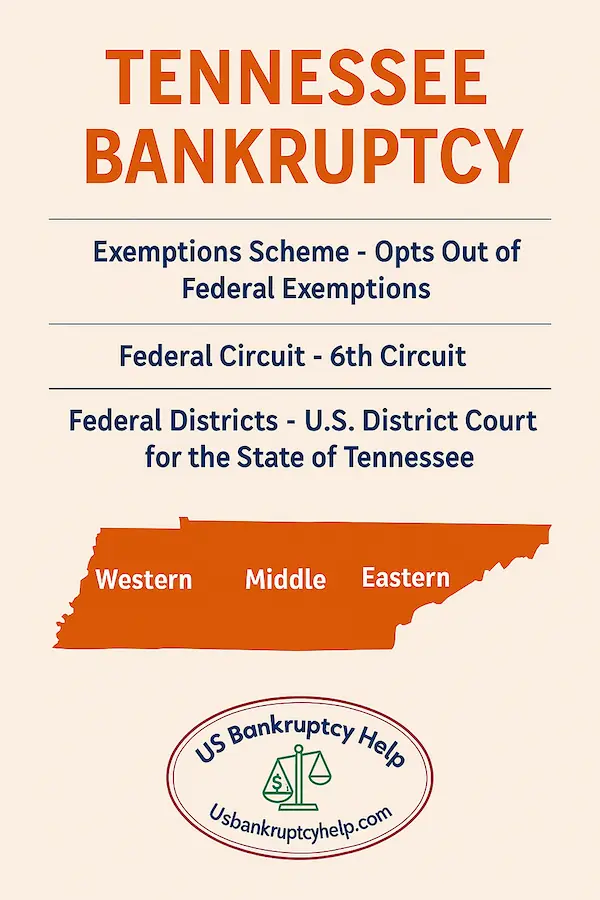

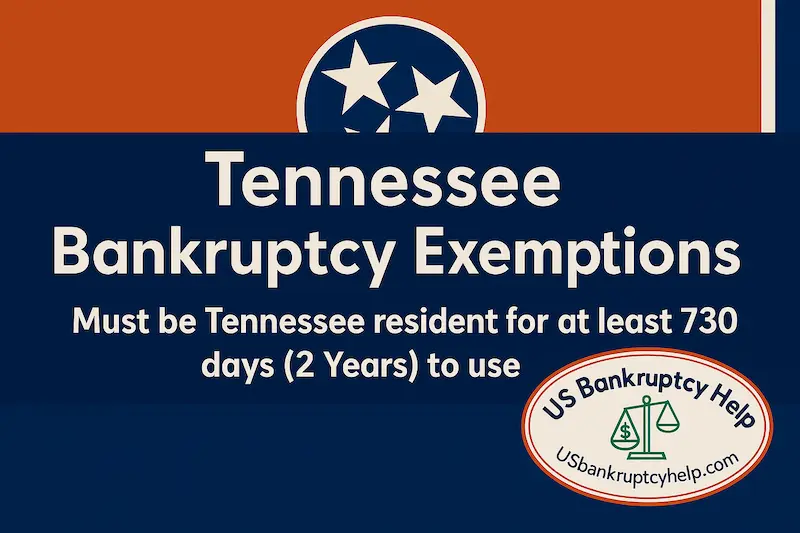

- Tennessee is an opt-out state—use Tennessee exemptions (not the federal set) (Tenn. Code Ann. § 26-2-112).

- Venue & local practice by district: Eastern / Middle / Western (E.D. Tenn. / M.D. Tenn. / W.D. Tenn.).

- Typical chapter 7 timeline for simple cases is ~4–6 months (U.S. Courts).

- Required courses: pre-filing credit counseling and post-filing debtor education (approved providers).

- 341 meetings are commonly held by video (Zoom) in Tennessee districts—check your notice for details (UST notice).

- Common nondischargeables: support, many recent taxes, most student loans, and debts from fraud/willful injury (11 U.S.C. § 523).

- Liens on collateral can survive discharge; consider reaffirmation or redemption where appropriate.

- Credit reports can show a bankruptcy for up to 10 years (15 U.S.C. § 1681c).

- Plan timing around tax refunds and funds on deposit—these can be property of the estate (see Bankruptcy Basics).

- Consult an experienced Tennessee bankruptcy lawyer—rights and exemptions are at stake.

The thought of going through the bankruptcy process can be intimidating. Understanding Tennessee bankruptcy laws is very important for not only making informed decisions, but also making bankruptcy seem like less of a nightmare.

Filing for bankruptcy in Tennessee involves several steps and legal considerations. It's essential to know the types of bankruptcy available, such as chapter 7 and chapter 13. Each type has distinct processes and implications for your assets.

This guide aims to demystify Tennessee bankruptcy laws and procedures. It will help you protect your business and personal assets. Making informed decisions is key to navigating financial challenges effectively. If you are considering filing for bankruptcy in the Volunteer State, it is always best to get guidance from a Tennessee bankruptcy lawyer.

Overview of Bankruptcy in Tennessee

In Tennessee, bankruptcy provides a legal mechanism for businesses and individuals to address insurmountable debts. The bankruptcy process is primarily overseen by federal courts but incorporates specific Tennessee state laws. These laws define exemptions and procedures unique to Tennessee. To be eligible to file bankruptcy in Tennessee, you must have been a resident of Tennessee for at least 91 days (the greater part of 180 days).

There are several types of bankruptcy options, each suited for different circumstances. For individuals and families, chapter 7 and chapter 13 are the most common types of bankruptcy filed. Understanding which applies to your situation is really important before you make any big decisions.

Tennessee Bankruptcy Court Districts

Tennessee is divided into three bankruptcy court districts: Eastern, Middle, and Western. Knowing the appropriate jurisdiction is also important. Each court jurisdiction has specific rules and procedures. Familiarizing yourself with these can prevent costly mistakes. By understanding these fundamental aspects, individuals and small business owners can better navigate the complexities of bankruptcy law in Tennessee.

Common Chapters of Bankruptcy in Tennessee

Most individuals and families in Tennessee file under one of two chapters of the Bankruptcy Code. Each chapter has a different purpose and a different impact on your property, your budget, and your long-term plan. The summaries below are a starting point only.

Chapter 7

Chapter 7 bankruptcy is the most common chapter filed by Tennesseans. It provides a way to wipe out unsecured debts (like credit cards and medical bills) relatively quickly. In chapter 7, a trustee reviews your case and reconciles any non-exempt assets (sold or settled) to pay creditors. In practice, unwanted liquidation is rare in well-prepared cases, because Tennessee bankruptcy exemptions protect most everyday assets when they are used correctly.

For this reason, knowledge of Tennessee bankruptcy exemptions is very important. If you are seriously considering chapter 7, the best next step is to review our dedicated Tennessee Chapter 7 guide and speak with an experienced Tennessee bankruptcy attorney so you do not lose anything unnecessarily in your filing.

Chapter 13

Chapter 13 bankruptcy also addresses unsecured debts, but it operates as a 3 to 5 year repayment plan under court supervision. Chapter 13 is often used to catch up on mortgage arrears, car loans, and other secured debts that might be at risk in chapter 7. It can also help manage certain tax debts and domestic support obligations that are not easily resolved in chapter 7.

In chapter 13, you propose a plan payment that fits your budget and is reviewed by the trustee and the court. Many of the same concepts apply in Tennessee as in other states—means test, exemptions, and trustee review—but the details are very fact-specific. Our national Chapter 13 guide explains the basics; a Tennessee-specific chapter 13 guide will build on that foundation.

Tennessee Bankruptcy Courts: Districts and Jurisdictions

Understanding the jurisdiction of Tennessee bankruptcy courts is essential for filing. Tennessee's bankruptcy courts are divided into three districts: Middle, Western, and Eastern. Each district handles cases based on the debtor's location. Bankruptcy courts in Tennessee operate under federal law. However, state specific exemptions are applied in proceedings. These courts play a crucial role in administering the bankruptcy process.

Key Districts Include:

- Tennessee Middle Bankruptcy Court: Covers the central region of the state.

- Bankruptcy Court Memphis Tennessee (Western District): Serves the western part of Tennessee.

- US Bankruptcy Court Eastern District of Tennessee: Oversees cases in the eastern region.

Choosing the correct court is vital for procedural compliance. The jurisdiction depends on where the business or individual resides. Accurate filing ensures that the case is heard promptly. Understanding these jurisdictions can help in navigating the legal landscape effectively. Ensuring the correct filing location streamlines the process and provides clarity.

Tennessee Middle Bankruptcy Court

The Tennessee Middle Bankruptcy Court is located in Nashville. It handles cases from the central part of Tennessee. This includes areas such as Davidson and surrounding counties. It's crucial for businesses and individuals in this area to file here. Doing so ensures jurisdictional correctness and speeds up the proceedings. Access to this court provides an efficient legal avenue for central Tennessee cases.

Middle District of Tennessee

| Courthouse / Location | Address | Phone | Website |

|---|---|---|---|

| Nashville — U.S. Customs House (Clerk’s Office) | 701 Broadway, Room 170, Nashville, TN 37203 | (615) 736-5584 | tnmb.uscourts.gov |

| Columbia — Federal Building & Courthouse (Unstaffed) | 815 South Garden St, Columbia, TN 38401 | — | tnmb.uscourts.gov |

| Cookeville — L. Clure Morton P.O. & Courthouse (Unstaffed) | 9 E Broad St, Cookeville, TN 38503 | — | tnmb.uscourts.gov |

Filing correctly in this jurisdiction is essential. It facilitates a smoother bankruptcy process for local businesses. Ensuring this can prevent unnecessary delays or complications.

Bankruptcy Court Memphis Tennessee (Western District)

The Bankruptcy Court in Memphis oversees the Western District. This court covers areas like Shelby County and surrounding regions. For businesses situated in this region, filing here is mandatory.

Western District of Tennessee

| Courthouse / Location | Address | Phone | Website |

|---|---|---|---|

| Memphis — Clerk’s Office | 200 Jefferson Ave, Suite 500, Memphis, TN 38103 | (901) 328-3500 | tnwb.uscourts.gov |

| Jackson — U.S. Courthouse | 111 South Highland Ave, Suite 107, Jackson, TN 38301 | (731) 421-9300 | tnwb.uscourts.gov |

The court provides dedicated services for western Tennessee residents. Navigating this court involves understanding local rules and exemptions. For many, it offers a clear path to manage financial distress legally.

Proximity to Memphis ensures easy access for court appearances. It simplifies administrative tasks involved in the bankruptcy process. Businesses can consult local legal experts for guidance specific to this district.

US Bankruptcy Court Eastern District of Tennessee

The Eastern District covers a broad area, including Knoxville and Chattanooga. This court handles bankruptcy cases from these and nearby areas. Its jurisdiction is extensive, covering the eastern landscape of Tennessee.

Eastern District of Tennessee

| Courthouse / Location | Address | Phone | Website |

|---|---|---|---|

| Chattanooga — Historic U.S. Courthouse | 31 East 11th St, Chattanooga, TN 37402-2722 | (423) 752-5163 | tneb.uscourts.gov |

| Knoxville — Howard H. Baker Jr. U.S. Courthouse | 800 Market St, Suite 330, Knoxville, TN 37902 | (865) 545-4279 | tneb.uscourts.gov |

| Greeneville — James H. Quillen U.S. Courthouse | 220 West Depot St, Suite 218, Greeneville, TN 37743-4924 | (423) 787-0113 | tneb.uscourts.gov |

| Winchester — U.S. Post Office & Courthouse (Unstaffed) | 200 South Jefferson St, Second Floor Courtroom, Winchester, TN 37398 | (423) 752-5163 | tneb.uscourts.gov |

Residents and businesses in this region must file here. This ensures that their cases are managed by the appropriate authorities. Filing in the correct district ensures adherence to the legal process.

The Eastern District is key for those in this part of the state. It provides access to federal court resources tailored to eastern Tennessee needs. Consulting with local attorneys can ensure proper compliance and understanding.

Key Steps in Filing Bankruptcy in Tennessee

Plain-English overview, not a DIY guide: The outline below explains the typical stages of a Tennessee bankruptcy case so you know what to expect. It is not a do-it-yourself filing kit. Bankruptcy in Tennessee is technical and deadline-driven, and mistakes can cost you money or even your discharge.

In a real case, a Tennessee bankruptcy lawyer will walk you through each step, prepare and file the forms, and communicate with the trustee and the court on your behalf. Your job is to tell the truth, gather documents, and follow your attorney’s instructions; your lawyer handles the legal strategy and paperwork.

At a high level, most Tennessee chapter 7 and chapter 13 cases move through the same core stages: deciding which chapter fits, gathering documents, completing required courses, filing with the correct Tennessee district court, attending the 341 meeting, and then moving toward discharge or plan completion.

Key Steps Include:

- 1. Initial strategy consult and chapter choice. You and your attorney review income, debts, assets, and goals to decide whether chapter 7 or chapter 13 makes the most sense in Tennessee.

- 2. Gather documents. Your lawyer gives you a checklist (pay stubs, tax returns, bank statements, creditor list, leases, titles, etc.) and organizes this information into the formats the court and trustee expect.

- 3. Complete required credit counseling. Before filing, you take an approved credit counseling course and provide the certificate so it can be filed with your case.

- 4. Prepare and file your petition with the correct Tennessee district. Your attorney drafts and files the petition, schedules, means-test forms, and exemption elections with the Eastern, Middle, or Western District of Tennessee, depending on where you live.

- 5. Automatic stay and trustee review. As soon as the case is filed, the automatic stay usually stops most collections while the trustee reviews your paperwork and supporting documents.

- 6. Attend the 341 meeting of creditors. You appear (often by phone or Zoom, depending on the division) to answer the trustee’s questions under oath. Your lawyer attends with you and helps you prepare.

- 7. Complete debtor education and move toward discharge or plan completion. After filing, you take a debtor education course. In chapter 7 you typically receive a discharge a few months after the 341 meeting; in chapter 13 you complete your court-approved payment plan before discharge.

The big picture: you don’t have to manage these steps alone. A Tennessee bankruptcy attorney can organize your documents, prepare accurate forms, file in the correct district, and guide you through the 341 meeting and any follow-up requests from the trustee.

Your role is to be honest, responsive, and thorough; your lawyer’s role is to handle the legal details, protect exempt property, and keep your case on track to discharge or successful plan completion.

Gathering Required Documents

Not a DIY checklist: The list below is meant to show you the kinds of paperwork that usually matter in a Tennessee bankruptcy case. It is not a do-it-yourself filing guide. In a real case, a Tennessee bankruptcy lawyer will tell you exactly what to bring, organize it for the court, and use it to complete your petition, schedules, and means-test forms.

Your main job is to track down honest, complete records. Your attorney’s job is to sort, analyze, and plug that information into the right places so the trustee and court get a clear, accurate picture of your finances.

Essential Documents to Gather

- Recent federal and state tax returns.

- Pay stubs, benefit letters, and recent bank statements.

- A list of all debts and creditors with balances and mailing addresses.

- A list of assets (home, vehicles, bank accounts, retirement, personal property).

- Personal identification (photo ID and proof of Social Security number).

- Business financial statements and records (if you own or recently owned a business).

These documents give your lawyer, the trustee, and the Tennessee bankruptcy court a clear picture of where you stand right now—income, expenses, assets, and debts. Accurate records help your attorney choose the right chapter, apply Tennessee exemptions correctly, and avoid surprises at the 341 meeting.

A good Tennessee bankruptcy lawyer will usually provide a written checklist and help you prioritize what to gather first. If you start pulling these items together early—and share them promptly—you make it much easier for your attorney to file a clean, well-supported case that moves smoothly toward discharge or plan approval.

Completing Credit Counseling and Debtor Education

Every consumer bankruptcy case filed in Tennessee requires two short educational courses: credit counseling before you file and debtor education after you file. You take these courses yourself, but most people complete them under the guidance of a Tennessee bankruptcy attorney who recommends approved providers and makes sure the certificates get filed on time.

Think of these courses as part of the overall process your lawyer manages for you. They are required by law, but they also give you tools to make better financial decisions going forward.

Credit Counseling Requirements (Before Filing)

- Completing a session with an approved credit counseling agency before your case is filed.

- Reviewing income, expenses, and debts with the counselor and discussing possible alternatives.

- Receiving a certificate of completion and providing it to your attorney for filing with your petition.

Credit counseling is usually done online or by phone and takes about an hour. It is not a test you have to “pass,” but your case cannot be filed without a current certificate. A Tennessee bankruptcy lawyer will typically suggest a reliable provider and time the course so the certificate does not expire.

Debtor Education Requirements (After Filing)

- Completing a separate debtor education or “financial management” course after your case is filed.

- Learning practical strategies for budgeting, saving, and using credit responsibly after bankruptcy.

- Obtaining a second certificate of completion and making sure it is filed before discharge.

This post-filing course focuses on life after bankruptcy—how to protect your fresh start and avoid the same debt traps. If the debtor education certificate is not filed, the court can close your case without granting a discharge. A Tennessee bankruptcy attorney will track that deadline and make sure the certificate reaches the court.

In practice, your role is to complete two brief courses; your lawyer’s role is to integrate those requirements into your overall case strategy so your Tennessee bankruptcy moves smoothly from filing to discharge.

Filing Bankruptcy Forms and Fees

Filing bankruptcy in Tennessee involves a substantial packet of official forms plus a court filing fee. These forms are how you tell the court and trustee your entire financial story—income, expenses, assets, debts, and recent transactions. Most people complete and file them with the help of a Tennessee bankruptcy lawyer, because even small errors can lead to delays or follow-up from the trustee.

Your attorney will usually draft the petition, schedules, and statements for you to review and sign, then file them electronically with the appropriate Tennessee bankruptcy district (Eastern, Middle, or Western). The same filing typically includes your credit counseling certificate and other required documents.

Steps in Filing

- Review and approve the petition, schedules, and statements your lawyer prepares.

- Have your attorney file the signed forms with the correct Tennessee bankruptcy court.

- Pay the court filing fee in full, through installments, or ask your lawyer whether you qualify for a fee waiver.

The court’s filing fee is set by federal schedule and is the same anywhere in Tennessee; attorney fees are separate and depend on the complexity of your case. A good Tennessee bankruptcy lawyer will explain the total cost up front, help you choose the right timing, and make sure your forms are accurate so the case is opened cleanly the first time.

Your role is to provide complete information and ask questions; your lawyer’s role is to translate that information into legally correct forms, choose the right exemptions, and file everything with the proper court along with the required fees or fee-waiver request.

The 341 Meeting of Creditors

The 341 meeting of creditors is a short, mandatory meeting where you answer questions under oath about your finances. It is not a court hearing—there is no judge present—but it is still a serious, recorded part of your Tennessee bankruptcy case. Your Chapter 7 or Chapter 13 trustee runs the meeting, and your attorney attends with you to make sure you are prepared and comfortable.

Key Aspects of the 341 Meeting

- Usually scheduled about 20–40 days after filing, depending on the Tennessee district and trustee.

- You must bring a government ID, proof of Social Security number, and any documents the trustee requested.

- The trustee confirms your identity, asks questions about your petition and schedules, and may invite creditors to ask limited questions.

A Tennessee bankruptcy lawyer will typically walk you through common questions in advance, review your paperwork with you, and make sure the trustee has the documents they requested before the meeting. For many people, the 341 meeting lasts around 10–15 minutes when everything is complete and accurate.

Your job at the meeting is to listen carefully, answer honestly, and provide any follow-up documents promptly if the trustee asks for them. Your lawyer’s job is to prepare you, be present during the questions, and help resolve any issues that come up so your case can move to discharge or plan confirmation as smoothly as possible.

How Tennessee Exemptions Fit Into Your Bankruptcy Case

Tennessee exemption laws are a big part of any bankruptcy case—they help determine what property you can keep and how much your creditors can reach. Rather than trying to memorize a long list of categories and dollar amounts here, the best way to understand them is to review our dedicated Tennessee bankruptcy exemptions guide, which is the main resource on this site for exemption details and tables.

In broad terms, exemptions work differently in chapter 7 and chapter 13. In chapter 7, they help decide which assets are protected from sale by the trustee. In chapter 13, they influence how much you must pay unsecured creditors through your repayment plan. Either way, the exact exemption amounts and how they apply to your facts can make a big difference.

Tennessee is an opt-out state, so you generally use Tennessee exemptions rather than the federal set. The numbers change from time to time, and some protections increase based on age, marital status, or dependents, which is why we keep the full, current breakdown on the separate exemptions page instead of repeating it here.

Examples of What Tennessee Exemptions Can Protect

- A homestead protection that can shield a portion of equity in your primary residence, subject to eligibility rules and caps.

- Personal property allowances for everyday items such as clothing, furniture, and basic household goods.

- A wildcard or general personal property exemption that can be applied flexibly to things like vehicle equity, bank balances, or other assets that need extra coverage.

- Broad protection for many tax-qualified retirement accounts, so long-term savings are usually preserved.

This home-page overview is just a high-level introduction. For the specific categories, dollar amounts, and examples of how they work in real Tennessee chapter 7 and chapter 13 cases, use our Tennessee bankruptcy exemptions page as the authoritative source on this site. If you want to see how those protections plug into an actual case, our Tennessee Chapter 7 guide walks through the process step by step.

Costs of Filing Bankruptcy in Tennessee

When people ask, “How much does bankruptcy cost in Tennessee?”, there are really three main buckets to think about: court filing fees, required course fees, and attorney fees. Some of these are fixed by the court; others depend heavily on your chapter, your facts, and how complex your case is.

Court filing fees are the easiest to pin down because they are set nationally. As of 2025, the filing fee is $338 for a chapter 7 case and $313 for a chapter 13 case. These fees can change from time to time, so it is always smart to double-check the current schedule or ask your lawyer to confirm the numbers before you file.

On top of that, you will pay modest fees for the two required courses (credit counseling before filing and debtor education after filing). Many approved providers charge between about $0 and $50 per course, and some offer fee waivers or discounts based on income.

The biggest variable is attorney fees. In Tennessee, chapter 7 attorney fees for consumer cases are often quoted in a flat range that reflects the work involved—things like income complexity, business ownership, lawsuits, non-exempt assets, urgent deadlines, and trustee issues. Chapter 13 cases usually cost more than chapter 7 because your lawyer is helping you design, confirm, and administer a multi-year repayment plan under court supervision.

Our dedicated Tennessee chapter 7 guide walks through chapter 7 fees in much more detail, including why simpler cases tend to land at the lower end of the range and more complex cases cost more. A Tennessee bankruptcy attorney can also explain how payment plans, retainers, and court-approved fee guidelines work in your district.

Key Expenses to Keep in Mind

- Court filing fees: Standard amounts set by the U.S. Bankruptcy Court (e.g., $338 for chapter 7; $313 for chapter 13 as of 2025).

- Attorney fees: Vary based on chapter, complexity, business involvement, lawsuits, and time pressure.

- Credit counseling and debtor education: Two short required courses, typically low cost with possible fee waivers.

- Miscellaneous costs: Occasional appraisal, recording, or document-gathering fees in more complex cases.

The goal of a good Tennessee bankruptcy lawyer is to be upfront about these costs, help you compare chapter 7 and chapter 13 realistically, and structure fees and payment options in a way that fits your budget while your case moves toward discharge or plan approval.

The Bankruptcy Process: Timeline and What to Expect

Every Tennessee bankruptcy case moves through the same basic stages, but the exact timeline depends on the chapter you file, your facts, and how complex your case is. A simple chapter 7 with no major issues looks very different from a multi-year chapter 13 repayment plan. Think of this as a broad overview; in a real case, a Tennessee bankruptcy attorney will map these stages onto your specific situation.

The process usually starts with a strategy consult and document gathering, followed by filing your petition with the correct Tennessee bankruptcy district. Filing triggers the automatic stay, which typically stops most collection efforts—lawsuits, garnishments, and collection calls—while the court and trustee review your case.

A few weeks after filing, you attend the 341 meeting of creditors, where the trustee asks questions under oath about your petition and schedules. Around that same window, you’ll complete the required credit counseling (before filing) and debtor education (after filing) so the court can enter a discharge in chapter 7 or confirm and eventually complete your plan in chapter 13.

Key Stages in the Bankruptcy Process

- 1. Pre-filing planning: Strategy consult, chapter choice (7 vs 13), and document gathering.

- 2. Filing the petition: Your lawyer files your case; the automatic stay usually stops most collections.

- 3. 341 meeting of creditors: Typically 20–40 days after filing; you answer the trustee’s questions under oath.

- 4. Required courses: Credit counseling before filing and debtor education after filing.

- 5. Discharge or plan completion: In chapter 7, discharge usually follows a few months after the 341 meeting; in chapter 13, you complete a 3–5 year repayment plan before discharge.

As a very rough guide, many straightforward chapter 7 cases in Tennessee finish in about four to six monthsfrom filing to discharge, while chapter 13 cases commonly run three to five years because you are making monthly plan payments over time. Complex facts—business ownership, lawsuits, non-exempt assets, or disputed claims—can lengthen the timeline.

A Tennessee bankruptcy attorney will take this general framework and turn it into a custom roadmap for you: which documents to gather, when to file, what to expect at the 341 meeting, and how long it should realistically take to reach discharge or complete a chapter 13 plan based on your income, debts, and goals.

Alternatives to Bankruptcy in Tennessee

Thinking about bankruptcy is a big step, and it makes sense to ask, “Is there any way around it?” There arealternatives—but some are far more helpful than others, and a few can leave Tennesseans in worse shape than if they had filed a straightforward case.

The most important distinction is between nonprofit credit counseling and the glossy, heavily advertised for-profit “debt relief” or debt consolidation companies. In practice, many of those for-profit programs charge high fees to do things you could often do yourself—like simply stopping payments or negotiating settlements—and they do it without the legal protection that a bankruptcy case provides.

Common Alternatives (And Pitfalls)

- Nonprofit credit counseling / debt management plans (DMPs). These agencies work with credit card companies to lower interest rates and roll several cards into one payment, usually over 3–5 years. This can help if most of your debt is credit cards and you can afford the payment. It does not stop lawsuits the way a bankruptcy filing does.

- For-profit “debt relief” or debt consolidation companies. These are the radio, TV, and internet programs that promise one low payment and quick settlements. In real life, they often tell you to stop paying your creditors while you build up a lump sum—late fees, interest, and collection calls pile up, lawsuits get filed, and you pay the company substantial fees to do what many people could negotiate directly. By the time some Tennesseans come to a bankruptcy lawyer, they have paid thousands into these programs and still end up filing.

- DIY settlement or payment plans. In some situations—especially with a small number of debts—you may be able to call creditors yourself and work out reduced balances or extended payment terms. This can work for isolated problems, but you still risk lawsuits and garnishments if agreements fall apart.

- Refinancing or hardship programs with specific lenders. For a mortgage, car loan, or student loan, you might qualify for official hardship, modification, or forbearance options. These can relieve short-term pressure but rarely fix large, multi-creditor debt problems on their own.

These alternatives sometimes make sense when your debt is modest, your income is stable, and you can realistically pay everything off within a few years. But if lawsuits, garnishments, or constant collection calls are already in play,a well-planned Tennessee bankruptcy case is often cheaper, faster, and more predictable than years of fees to for-profit consolidators.

Before signing any long-term “debt relief” contract, it is worth spending a few minutes with a Tennessee bankruptcy attorney or a reputable nonprofit credit counselor. An honest review of your numbers can reveal whether an alternative truly serves you—or whether a clean chapter 7 or chapter 13 filing would get you to a real fresh start with far fewer surprises.

Frequently Asked Questions About Bankruptcy in Tennessee

Tennesseans considering bankruptcy usually have the same core questions: what happens to medical debt, how often you can file, whether you will lose property, and how long it all takes. The questions below are a plain-English overview only—your exact answers will depend on your chapter, your income, and your assets.

Can You File Bankruptcy On Medical Bills In Tennessee?

Yes. Medical bills are usually treated as unsecured debt, and in most Tennessee chapter 7 and chapter 13 cases they can be included and discharged along with other general unsecured debts like credit cards and personal loans. There is no special rule that makes Tennessee medical debt non-dischargeable. The key is to list every provider and collection agency in your paperwork so they receive notice and are bound by the discharge order.

How Often Can You File Bankruptcy In Tennessee?

How often you can file depends on the type of case you had before (chapter 7 vs chapter 13), whether you received a discharge, and how much time has passed since that prior filing—not on Tennessee law alone. For example, there is a different waiting period between a prior chapter 7 and a new chapter 7 than there is between a prior chapter 13 and a new chapter 7. For a detailed, chart-style breakdown of the time gaps between cases, see our national guide How Often Can You File Bankruptcy?, then have a Tennessee bankruptcy attorney apply those rules to your specific filing history and goals.

How Much Does It Cost To File Bankruptcy In Tennessee?

There are three main cost buckets: court filing fees, the two required courses, and attorney fees. As of 2025, the filing fee is $338 for chapter 7 and $313 for chapter 13, set nationally by the U.S. Bankruptcy Court. Credit counseling and debtor-education courses are usually low-cost (often $0–$50 per course, sometimes with fee waivers). Attorney fees in Tennessee vary with the chapter and the difficulty of the case—simple consumer chapter 7 cases tend to fall at the lower end of the range, while cases involving business ownership, lawsuits, non-exempt assets, or urgent deadlines cost more. Our Tennessee chapter 7 guide discusses fee ranges and complexity factors in more detail.

Will I Lose My House Or Car If I File Bankruptcy In Tennessee?

Many people keep their home and vehicle in a Tennessee bankruptcy, but it depends on the chapter, how much equity you have, your loan balance, and how Tennessee exemptions apply. In chapter 7, you generally keep property if equity is fully protected by exemptions and you stay current on the loan. In chapter 13, you can often use a repayment plan to catch up on arrears over time. Tennessee is an opt-out state, so you typically use Tennessee exemptions rather than federal ones; our Tennessee exemptions explainer shows how homestead, wildcard, and personal-property protections can be used to shield equity in real-world cases.

How Long Does Bankruptcy Stay On Your Credit In Tennessee?

A chapter 7 bankruptcy can appear on your credit reports for up to 10 years from the filing date; a typical chapter 13 appears for up to 7 years. That rule is the same in Tennessee as it is in other states. The key point is that scores do not stay “bottomed out” that entire time—many people see gradual improvement within the first year or two after discharge as they add a few carefully chosen accounts, pay on time, and keep balances low relative to limits.

What Is The Tennessee Chapter 7 Means Test?

The chapter 7 means test is a federal formula, applied with Tennessee-specific income figures, that helps decide whether you qualify for chapter 7. Step one compares your last six months of income (annualized) to the current Tennessee median income for your household size. If you are below median, you generally pass. If you are above median, a second step subtracts allowed expenses (including standardized amounts and certain actual payments) to see whether there is enough disposable income to repay creditors in chapter 13 instead. Our Chapter 7 Means Test Guide and Tennessee chapter 7 page walk through current Tennessee median-income numbers and how the test works in practice.

Do Both Spouses Have To File Bankruptcy Together In Tennessee?

No. One spouse can file alone in Tennessee, and the other spouse’s separate credit report is not automatically affected if they do not join the case. However, household income still counts for the means test, and a non-filing spouse who is co-signed on particular debts can remain fully liable for those accounts. A Tennessee bankruptcy attorney can compare single vs. joint filing, including how it affects eligibility, property, and which debts are best addressed in the case.

Do I Have To Go To Court If I File Bankruptcy In Tennessee?

Most filers in Tennessee never see a judge in a courtroom. You are required to attend the 341 meeting of creditors, which is usually held by phone, Zoom, or in a meeting room rather than a courtroom. Your trustee runs that meeting and asks questions under oath about your petition and schedules. In more complex cases—such as disputes over exemptions, reaffirmation agreements, or plan confirmation hearings in chapter 13—your attorney may appear before the judge, but for a straightforward consumer case your only mandatory appearance is the 341 meeting itself.

Rebuilding Credit and Financial Health After Bankruptcy

A Tennessee bankruptcy is a reset button, not the end of your financial story. Once your case is over, the focus shifts from putting out fires to rebuilding: protecting your fresh start, restoring your credit, and creating a budget that actually works in real life.

Credit scores do take a hit, but they are not frozen in time. Many people see steady improvement within the first year or two after discharge when they follow a simple plan: pay everything on time, keep balances low, and only open a few carefully chosen accounts.

Practical Steps to Rebuild Credit

- 1. Clean up your credit reports. After your discharge, pull reports from Equifax, Experian, and TransUnion. Make sure discharged accounts show a $0 balance and “included in bankruptcy.” Dispute obvious errors so you are rebuilding on a clean foundation.

- 2. Add one or two starter accounts. Many people begin with a secured credit card or a small credit-builder loan. Use the card for something predictable (like gas or a streaming bill) and set up automatic payments in full each month so you never miss a due date.

- 3. Keep utilization low. Aim to use no more than about 10–20% of your available credit at any given time. Low balances relative to limits signal that you are using credit carefully, not leaning on it to survive.

- 4. Build a simple, realistic budget. Track income and fixed bills first, then set aside money for savings and variable expenses. The goal is to avoid “swiping to fill gaps” and to have a small cushion for car repairs, medical costs, or other surprises.

- 5. Protect your progress. Consider freezing your credit to prevent new accounts being opened in your name without permission, and schedule a quick review of your credit reports every few months to catch mistakes early.

You do not need dozens of accounts or complex tricks to recover after a Tennessee bankruptcy. A handful of well-managed tradelines, on-time payments every month, and a budget you can actually stick to are usually enough to move scores in the right direction over time. Many people find that, a few years after discharge, their credit is stronger and more stable than it was before they filed.

When to Seek Legal Help: Choosing a Bankruptcy Attorney

Most people in Tennessee wait too long to talk with a bankruptcy attorney. By the time they reach out, they have already drained savings, borrowed from family, or paid thousands to for-profit “debt relief” companies. In reality, the right time to talk with a lawyer is as soon as you suspect you cannot realistically pay everything back within the next few years.

A skilled Tennessee bankruptcy attorney does much more than fill out forms. They help you decide whether bankruptcy is appropriate at all, which chapter fits your situation, how Tennessee exemptions apply to your home, vehicle, and other property, and how to time your filing so you get the most protection from a single case. Your job is to tell the truth and gather documents; your lawyer’s job is to turn that information into a clean, well-planned case.

What to Look For in a Tennessee Bankruptcy Lawyer

- Deep experience with Tennessee cases. Ask how many chapter 7 and chapter 13 cases they handle in the Eastern, Middle, and Western Districts of Tennessee and how familiar they are with local trustees and judges.

- Clear, plain-English communication. A good lawyer should explain options, risks, and timelines in a way that makes sense—and respond promptly to questions as your case moves forward.

- Transparent, written fee information. You should know what your fee covers, how payment plans work, and what might cost extra (if anything) before you sign an engagement agreement.

- Focus on protecting assets and avoiding surprises. Look for someone who talks about exemptions, means-test strategy, and potential red flags (like recent transfers or lawsuits), not just “getting the case filed.”

If you are dealing with lawsuits, garnishments, or sleepless nights over debt, a short consult with a Tennessee bankruptcy attorney can give you a roadmap and real numbers to compare—so you can stop guessing and start deciding whether chapter 7, chapter 13, or a different approach is the right move for you.

Making Informed Decisions About Filing Bankruptcy in Tennessee

Deciding whether to file bankruptcy in Tennessee is a big step, but it does not have to be a guess. The goal is not just to “get a case filed,” but to choose the chapter and timing that actually protect your home, car, income, and long–term goals. That means looking honestly at your numbers, understanding how Tennessee exemptions and the means test apply to you, and comparing bankruptcy to the for–profit “debt relief” options being sold online and on TV.

As you weigh your options, it can help to walk through a simple checklist: What would it cost—and how long would it take—to pay everything back on your own? Are lawsuits, garnishments, or repossessions already in play? How would a Tennessee chapter 7 or chapter 13 change your monthly budget, your timeline to get out of debt, and your ability to keep key assets?

- • Compare the real cost and timeline of “doing nothing” versus filing.

- • Look at how Tennessee exemptions would protect your home, vehicle, and savings.

- • Be skeptical of expensive for-profit “debt relief” programs that do not stop lawsuits or garnishments.

- • Get a clear, written explanation from a Tennessee bankruptcy attorney before you decide.

In the end, bankruptcy is simply a legal tool—one that helps many Tennesseans wipe out unmanageable debt and rebuild on solid ground. When you pair good information with advice from an experienced Tennessee bankruptcy lawyer, you can make a calm, informed decision about whether filing is the right move for you and your family—and, if it is, follow a clear plan from filing to discharge and credit recovery.

Explore Our Tennessee Bankruptcy Guides

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin