Understanding Tennessee Bankruptcy Exemptions in Detail

Anyone considering filing bankruptcy in Tennessee must understand how Tennessee bankruptcy exemptions work. These exemptions allow individuals to protect certain assets from creditors. Tennessee is an opt-out state, so if you have been domiciled in Tennessee for the last730 days (2 years), you generally must use the exemptions provided in the Tennessee Code Annotated, Title 26, Chapter 2, rather than the federal exemption list in 11 U.S.C. § 522(d). (If you have not lived in Tennessee for the full 730 days, federal choice-of-law rules may point you to another state’s exemptions; and in the rare case that this would leave you with no available exemptions, the Code allows use of the federal § 522(d) set.)

Tennessee Bankruptcy Exemptions — At a Glance

- Homestead: $35,000 (individual) or $52,500 total for joint owners who live in the home (Tenn. Code Ann. § 26-2-301).

- Wildcard (any personal property): $10,000 per debtor (use for vehicle equity and other items) (Tenn. Code Ann. § 26-2-103).

- Motor vehicle: No standalone car exemption—use the wildcard.

- Tools of the trade: Up to $1,900 (Tenn. Code Ann. § 26-2-111(4)).

- Personal property: Wearing apparel, family Bible/schoolbooks, portraits, prescribed health aids (Tenn. Code Ann. §§ 26-2-104; 26-2-111(5)).

- Public benefits: Social Security, unemployment, veterans’ benefits, disability/illness benefits (Tenn. Code Ann. § 26-2-111(1)).

- Retirement: ERISA plans excluded; IRAs protected (federal cap $1,711,975 for cases filed 4/1/2025–3/31/2028; rollovers unlimited).

- chapter 7 vs. chapter 13: Exemptions keep property in chapter 7; in chapter 13, non-exempt equity sets minimum plan payout.

Here’s how these protections work together in real cases—and how to stack them to keep your home, car, tools, and retirement intact.

Tennessee’s exemptions are real shields, not fine print. The homestead exemption can protect up to $35,000 of home equity for one owner—or $52,500 total when joint owners live in the home as their principal residence. Pair that with Tennessee’s powerful $10,000 wildcard (per debtor) and you can often protect the essentials—equity in your car, cash in the bank, even gaps in other categories. We’ll show you exactly how these protections add up in real-world scenarios.

Everyday life stays intact, too. Clothing, basic household goods, family keepsakes, and prescribed health aids are covered, and there’s a $1,900 tools-of-the-trade protection for your work gear. No guesswork—just clear rules you can use to keep what you actually need.

Your future matters most. Most ERISA-qualified retirement plans (like 401(k) and 403(b)) are protected, and IRAs have a generous nationwide cap—$1,711,975 for cases filed April 1, 2025–March 31, 2028—with rollover amounts protected without a dollar limit. As you read on, we’ll map out how to stack exemptions the right way, avoid timing pitfalls (730-day residency and the 1,215-day homestead cap), and come away with a plan that preserves your home, your car, and your retirement.

What Are Bankruptcy Exemptions in Tennessee?

Bankruptcy exemptions in Tennessee serve a significant role in a debtor's financial recovery. By using these exemptions, you can protect crucial assets during the bankruptcy process.

Exemptions help maintain everyday living necessities so you aren’t left without your essential possessions. In Tennessee, knowing which assets are exempt is extremely important. Exemptions include a range of property types and can cover homes, vehicle equity, and personal belongings.

Here are Tennessee's major exemptions and their amounts:

| Exemption Type | Amount | Statute | Notes |

|---|---|---|---|

| Homestead (primary residence) | $35,000 (individual); $52,500 combined cap for joint owners. | Tenn. Code Ann. § 26-2-301 | Age/child-based tiers repealed. If married, waiver requires joint consent. Federal 40-month homestead cap may apply if recently acquired. |

| Burial Plot / Family Cemetery | Up to 1 acre (family cemetery) or a burial lot/mausoleum space | Tenn. Code Ann. § 26-2-305 | Exempt from levy/attachment (subject to homestead exceptions). |

| Wildcard (any personal property) | $10,000 aggregate | Tenn. Code Ann. § 26-2-103 | Use to cover otherwise nonexempt items or supplement other categories. |

| Specific Personal Property | Clothing; family pictures/portraits; Bible; certain schoolbooks; prescribed health aids. | Tenn. Code Ann. §§ 26-2-104; 26-2-111(5) | Protected in addition to the wildcard. |

| Wages (earned, unpaid) | Lesser of 25% of disposable earnings or amount over 30× federal minimum wage; plus $2.50/week per dependent child under 16. | Tenn. Code Ann. §§ 26-2-106; 26-2-107 | Applies per pay-period equivalent for non-weekly payrolls. |

| Tools of the Trade | Up to $1,900 (implements, professional books, tools) | Tenn. Code Ann. § 26-2-111(4) | Applies to debtor’s trade or a dependent’s trade. |

| Motor Vehicle (equity) | No standalone vehicle exemption. Protect equity using the $10,000 personal property wildcard (per debtor). | Tenn. Code Ann. § 26-2-103; see § 26-2-112 (opt-out) | Apply wildcard to one or more vehicles. Joint filers may each claim $10,000 (potentially $20,000 total). Equity = fair market value minus liens. |

| Injury & Certain Awards (aggregate) | Aggregate $15,000: up to $5,000 crime-victim award; up to $7,500 personal bodily injury (excluding pain/suffering & pecuniary loss); up to $10,000 wrongful death (if debtor was a dependent). | Tenn. Code Ann. § 26-2-111(2)(A)–(C); (3) | Loss of future earnings protected to the extent reasonably necessary for support. |

| Insurance Benefits | Accident/health/disability benefits; many life-insurance/annuity interests for spouse/dependents; fraternal benefits; homeowners’ proceeds to limited amount. | Tenn. Code Ann. §§ 26-2-110; 56-7-203; 56-25-403 | Verify beneficiary classes and policy terms. |

| Public Benefits & Workers’ Comp | Social Security, unemployment, local public assistance, veterans’ benefits, disability/illness benefits, workers’ comp (subject to support obligations). | Tenn. Code Ann. § 26-2-111(1)(A)–(C); § 50-6-223 | Many are fully exempt; some have program-specific limits. |

The table makes one thing clear: each Tennessee exemption has specific limits, conditions, and timing rules. How you stack them (homestead + wildcard + category protections) often decides whether you keep your home equity, car equity, tools, and cash on hand. Exemptions also shape strategy—whether chapter 7 is cleanly feasible or whether chapter 13’s plan math (best-interest test) is the better path. Because statutes update and case law refines the edges, work with a Tennessee bankruptcy attorney to apply the rules to your facts and avoid avoidable objections or loss of equity.

Tennessee vs. Federal Bankruptcy Exemptions

Tennessee is an opt-out state. If you’ve been domiciled in Tennessee for the last 730 days, you generally must use the Tennessee list in Title 26, Chapter 2—not the federal § 522(d) list. That said, several federal rules still matter in every Tennessee case, and there’s a narrow safety-valve where the federal list can apply.

What You Use in Tennessee

- Tennessee set (default): Homestead ($35,000 individual / $52,500 total for joint owners living in the home), $10,000 wildcard per debtor (often used for vehicle equity/cash), $1,900 tools-of-the-trade, plus protected categories (wearing apparel, schoolbooks, portraits, prescribed health aids, etc.).

- No standalone car exemption: Vehicle equity is typically covered with the wildcard.

- chapter 7 vs. chapter 13: In chapter 7, non-exempt equity risks liquidation; in chapter 13, non-exempt equity sets the plan’s minimum payout to unsecured creditors.

Federal Rules That Still Affect Tennessee Cases

- 730-day domiciliary rule: If you moved within two years, a look-back may point you to another state’s exemptions instead of Tennessee’s.

- “No-exemptions” safety valve: If the choice-of-law result would leave you with no applicable exemptions, the Code allows use of the federal § 522(d) list as a fallback.

- 1,215-day homestead cap: Recently acquired home equity can be capped by federal law, even when you’re using Tennessee’s homestead.

- Retirement protections: Most ERISA-qualified plans (401(k), 403(b), many pensions) are excluded from the estate; IRAs are protected nationwide up to $1,711,975 for cases filed Apr 1, 2025 – Mar 31, 2028, with rollover amounts protected without a dollar cap.

- Public benefits: Social Security and certain other federal benefits retain strong protection; keep funds traceable to avoid commingling issues.

Quick Scenarios (How the Rules Play Out)

- Car equity, no car exemption: FMV $12,000 − lien $4,000 = $8,000 equity. Apply Tennessee’s $10,000 wildcard (per debtor) to cover it and keep the vehicle in chapter 7.

- New to Tennessee: Moved 15 months ago—choice-of-law may require using your prior state’s exemptions. If none apply, the federal § 522(d) list can become available via the safety valve.

- Recent home purchase: Bought within 1,215 days—federal cap may limit the homestead amount you can protect, even under Tennessee law.

Bottom line: Tennessee’s exemptions are generous when deployed in the right order, at the right time, and with the right documentation. Strategy—and timing—can be the difference between protecting equity and risking it.

The Tennessee Homestead Exemption Explained

The homestead exemption is the centerpiece of protecting your house in bankruptcy. In Tennessee, it shields a defined slice of your principal residence equity—so the question isn’t “Will I lose my home?” but “How much equity can I legally protect?”

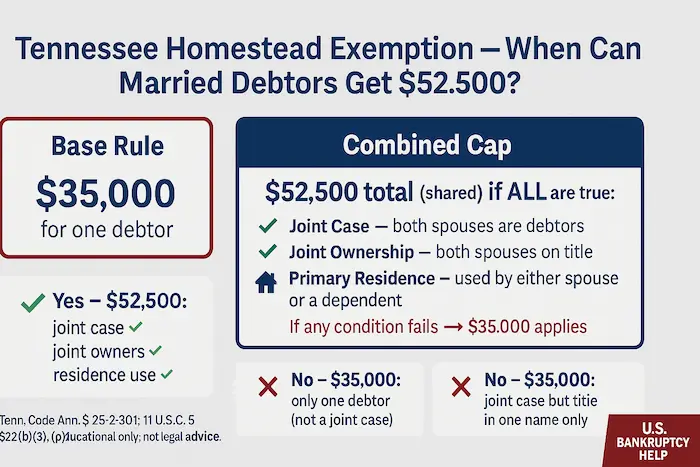

Tennessee’s homestead exemption protects $35,000 of equity for an individual owner, or $52,500 total whenjoint owners live in the home as their principal residence (allocated between them when claimed together). See Tenn. Code Ann. § 26-2-301.

Tennessee recently simplified the homestead rules, retiring the old age- and child-based tiers. Result: cleaner planning for chapter 7 and chapter 13, and a faster path to knowing exactly how much equity is protected.

Homestead Exemption: Key Rules & Quick Example

- Must be your principal residence: Vacation or rental property doesn’t qualify.

- Joint amount requires joint owners who live there: To use the $52,500 total, both owners must occupy the home as a principal residence (and, in practice, claim it together).

- How to calculate equity: Fair market value − valid liens = equity. Example: $310,000 FMV − $270,000 mortgage = $40,000 equity → an individual could protect all $40,000 with the $35,000 homestead + part of the $10,000 wildcard.

- Federal timing cap: If you acquired your home within 1,215 days before filing, a federal cap may limit how much recent equity you can shield even while using Tennessee’s homestead.

Tennessee's Exemptions and Vehicles

Tennessee does not provide a dedicated motor-vehicle exemption. Instead, most people protect car or truck equity with the state’s $10,000 “wildcard” per debtor under Tenn. Code Ann. § 26-2-103. If both spouses file jointly and both are on title, each may generally use a separate $10,000 wildcard—often enough to fully cover typical vehicle equity.

How to Protect Your Car: The Simple Math

- Step 1 — Find equity: Fair market value (private-party) − payoff on the lien = your equity.

- Step 2 — Apply the wildcard: Use up to $10,000 per debtor to cover equity. If there’s still non-exempt equity left, talk to counsel about strategy (chapter choice, buy-back offers, or moving equity to covered categories).

- Step 3 — Document value: Screenshots from KBB/NADA, mileage photos, condition notes, and repair estimates help support your number and avoid objections.

Quick Tennessee-Specific Examples

- Single filer: SUV FMV $13,500 − lien $6,000 = $7,500 equity. Apply the $10,000 wildcard → equity fully protected.

- Joint filers, both on title: Sedan FMV $22,000 − lien $4,000 = $18,000 equity. Each spouse uses their $10,000 wildcard(total $20,000 available) → equity fully protected with room to spare.

- Negative equity: If payoff > FMV, there’s no equity to exempt. You may choose to reaffirm, redeem, or surrender depending on goals and budget.

Chapter 7 vs. Chapter 13: Vehicle Strategy

- Chapter 7: Keep and pay (if current), reaffirm the loan (keeps contract terms), or redeem under 11 U.S.C. § 722 by paying the vehicle’s present value in a lump sum (often via specialized lenders). If any non-exempt equity remains after the wildcard, trustees may request a small buy-back or consider sale—planning matters.

- Chapter 13: You can cure arrears, stretch payments over 3–5 years, and typically reduce the interest rate (Till formula).No cramdown of a purchase-money loan on a personal-use vehicle acquired within 910 days before filing; older/non-PMSI or business-use vehicles may be eligible for cramdown to value.

Common Pitfalls to Avoid

- Title mismatch: To stack wildcards, both spouses generally need to be on title. If only one is on title, only that debtor’s wildcard applies.

- Cross-collateralization: Some credit unions secure credit cards or personal loans with your vehicle. Payoff may be higher than you think—verify before filing.

- Overstated value: Use condition-appropriate private-party values; don’t use dealer retail unless that reflects reality. Photos and repair estimates help.

- Insurance & budget: Keeping a car means keeping it insured and budgeted in your means test/plan—build these costs into your case strategy.

Bottom line: Tennessee’s $10,000 wildcard per debtor is the workhorse for protecting vehicle equity. With accurate valuation, clean title work, and the right chapter strategy, most people keep the car they need to get to work and rebuild.

Personal Property Exemptions in Tennessee

Tennessee protects everyday essentials with a mix of specific category exemptions and a flexible $10,000 “wildcard” per debtor. Used together, these let most people keep the things that power daily life: furniture, appliances, basic electronics, work gear—and even plug small gaps in vehicle equity.

Here are the core Tennessee personal-property protections you’ll use most often:

- Wildcard (any personal property): Up to $10,000 per debtor you can allocate to household goods, electronics, bank funds, or to top off other categories that come up short (Tenn. Code Ann. § 26-2-103).

- Wearing apparel, family portraits, Bible/schoolbooks: Specifically protected by statute—these sit outside the wildcard and usually need no extra coverage (§§ 26-2-104; 26-2-111(5)).

- Tools of the trade: Up to $1,900 in implements, pro books, and tools used in your occupation (or a dependent’s) (§ 26-2-111(4)).

- Professionally prescribed health aids: Protected for the debtor and dependents—keep devices tied to prescriptions/documentation (§ 26-2-111).

How the Wildcard Works with Everyday Items

- Step 1 — List & value: Use fair-market/replacement values for household goods as of the filing date.

- Step 2 — Apply category protections first: Clothes, portraits, Bible/schoolbooks, and prescribed health aids are typically covered without spending wildcard.

- Step 3 — Patch gaps with the wildcard: Allocate only what you need (you can save the remainder for cash on hand, checking balances, or to bolster vehicle equity).

Real-World Example: Self-Employed Creative

Maya, a self-employed photographer in Knoxville, files bankruptcy. Her family’s everyday clothing, children’s schoolbooks, and family Bible/portraits are specifically protected—no wildcard needed. She uses the tools-of-the-trade ($1,900) to cover light stands, clamps, and a calibration kit. Her prescribed CPAP and orthopedic brace are protected as professionally prescribed health aids. One camera body exceeds the tools cap by $400, so she applies $400 of her $10,000 wildcard and keeps the remaining wildcard for cash-on-hand and her checking balance.

- ✔ Clothing, portraits, Bible/schoolbooks → specifically protected (no wildcard spend).

- ✔ Light stands/clamps/calibration tools → covered up to $1,900 (tools of the trade).

- ✔ CPAP and orthopedic brace → exempt as prescribed health aids.

- ✔ Camera overage → $400 from the $10,000 wildcard to close the gap.

Proof & Pitfalls: Make Your Exemptions Stick

- Document values: Photos, receipts, repair estimates, and quick price comps support fair-market/replacement values.

- Avoid commingling cash: Keep bank funds traceable (e.g., separate Social Security deposits) to reduce objections.

- Track titles/ownership: For shared items, match ownership to the person claiming the exemption (matters for wildcard allocation).

- Use only what you need: Don’t over-allocate wildcard early—you may want the remainder for cash or vehicle equity.

Bottom line: Tennessee’s category protections do the heavy lifting for everyday life, and the $10,000 wildcard per debtorgives you the flexibility to finish the job—so you keep the things you live and work with.

Tennessee Wildcard Exemption

Think of Tennessee’s wildcard as your precision tool for plugging gaps. You can apply up to $10,000 per debtor to any personal property that needs extra coverage—cash in checking, a laptop, jewelry, or the equity in your car—especially when a category limit runs out (Tenn. Code Ann. § 26-2-103). In a joint case, each spouse generally brings a separate $10,000 wildcard to the table.

Key Rules (What the Wildcard Can and Can’t Do)

- Personal property only: The wildcard applies to personal property (e.g., car equity, cash, electronics)—not to real estate; your home is covered by the homestead exemption.

- Per debtor, per case: Each filing spouse gets a separate $10,000. To stack on the same asset, both spouses generally must have an ownership interest in it.

- Stacking is allowed: Use category protections first (e.g., tools of the trade), then apply the wildcard to cover any remaining value on that item.

- Ownership matters: You can’t apply your wildcard to property you don’t own. Title and documentation should match who is claiming the exemption.

How to Use the Wildcard (Simple, Tennessee-Specific Math)

- Step 1 — Find equity: Fair market value − payoff = equity (use private-party value, condition-adjusted).

- Step 2 — Apply category first: If an item has a category cap (e.g., $1,900 tools of the trade), apply that first.

- Step 3 — Plug the gap with the wildcard: Allocate only what’s needed to reach zero non-exempt equity; save the rest for cash or other items.

Real-World Example (Single Filer)

Your car is worth $12,000 and you owe $5,000 → $7,000 equity. Tennessee has no stand-alone car exemption, so you use $7,000 of your wildcard to cover it. You still have $3,000 of wildcard left for a laptop and your checking balance. If a camera exceeds the $1,900 tools-of-the-trade cap by $400, allocate $400 of wildcard to top it off.

Using the Wildcard in Joint Filings

Joint-filer example: Alex and Jordan file together. Each has a $10,000 wildcard (total $20,000 available). They can apply their separate wildcards across jointly owned items—or to assets they own individually.

- • SUV equity (joint title): $9,000 → Alex uses $5,000, Jordan uses $4,000.

- • Sedan equity (Jordan only): $6,000 → Jordan uses $6,000 (Alex can’t exempt an asset he doesn’t own).

- • Savings (joint): $3,000 → Split however they prefer—e.g., Alex uses $1,000, Jordan uses $2,000.

Result: Both vehicles and the savings are fully protected without a stand-alone motor-vehicle exemption.

Smart Pairings With the Wildcard

- Tools of the trade + wildcard: Apply $1,900 first, then wildcard the overage.

- Cash & bank balances: Reserve some wildcard for day-of-filing balances to avoid non-exempt cash.

- Household goods: Most are modestly valued—use category protections first, wildcard only if needed.

- Vehicle equity: The wildcard is the workhorse for Tennessee car equity—especially for reliable, paid-down vehicles.

Avoidable Pitfalls

- Title surprises: Verify who is on title before allocating joint wildcards to one asset.

- Cross-collateralization: Credit-union loans may tie credit cards or personal loans to your car—confirm payoff is accurate.

- Over-valuing items: Use condition-appropriate private-party values and keep screenshots/photos to support them.

- Spending the wildcard too soon: Don’t exhaust it before checking cash on hand and bank balances as of filing day.

Bottom line: the Tennessee $10,000 wildcard per debtor gives you the flexibility to finish protecting what matters—so you keep driving to work, keep your equipment earning income, and keep enough cash on hand to land on your feet.

Retirement Accounts, Pensions, and Public Benefits

Are Retirement Accounts Protected in Tennessee Bankruptcy?

Good news: most retirement savings and many income-support benefits are protected in bankruptcy. In Tennessee, ERISA-qualified employer plans (like 401(k), 403(b), and most traditional pension plans) are generally excluded from the bankruptcy estate under federal law, so they don’t become part of what creditors can reach.

Separately, IRAs (Traditional and Roth) are protected by a federal retirement-funds exemption that applies in every state; for cases filed April 1, 2025 through March 31, 2028, the combined cap is $1,711,975 per person. Rollovers from qualified employer plans into an IRA retain unlimited protection, and SIMPLE/SEP IRAs are treated as fully protected retirement funds. (Note: non-spousal inherited IRAs aren’t protected under the federal retirement-funds exemption.)

Tennessee Protections for Pensions and Public Benefits

Tennessee law also shields specific benefits and certain pension interests. State statutes protect categories like Social Security, unemployment compensation, veterans’ benefits, disability/illness benefits, and other public assistance, plus provide additional protection for state and certain other retirement plan funds. These rules help ensure you keep core support and long-term savings intact while you recover.

Commonly protected assets:

- ERISA-qualified employer plans (e.g., 401(k), 403(b), defined-benefit pensions)

- Traditional & Roth IRAs (aggregate cap $1,711,975 for 2025–2028; rollovers unlimited)

- SEP & SIMPLE IRAs (treated as protected retirement funds)

- Public benefits: Social Security, unemployment, veterans’ benefits, disability/illness benefits, local public assistance

Practical Tip for Maximizing Protection

Practical tip: Protection depends on plan type, funding source, and timing (for example, withdrawals may lose protection). A local bankruptcy attorney can help you stack state and federal rules to maximize what you keep.

How Exemptions Work in chapter 7 vs. chapter 13 Bankruptcy

The Big Picture

Exemptions decide how much of your property you can keep when you file bankruptcy in Tennessee (an opt-out state that generally uses Tennessee exemptions). In chapter 7, exemptions protect specific assets from being sold by the trustee. In chapter 13, exemptions help set the floor for what unsecured creditors must receive through your repayment plan.

Chapter 7: Protect What You Can Keep

In chapter 7, you list each item’s fair market value on the filing date, subtract any liens, and then apply Tennessee exemptions (for example, the homestead, tools-of-the-trade, and the $10,000 wildcard per debtor). Any equity that isn’t covered is “non-exempt” and could be administered by the trustee. Accurate valuation and smart use of exemptions are what keep everyday essentials off the table.

Chapter 13: Exemptions Drive the Plan Minimum

Chapter 13 uses a repayment plan instead of selling property. Here, exemptions matter because of the “best-interest-of-creditors” test: your plan must pay unsecured creditors at least as much as they would have received if you filed chapter 7. Put simply, non-exempt equity = minimum plan dividend (subject to disposable-income and feasibility rules).

Quick Example

You have $6,000 of equity in household goods and tools. Tennessee exemptions cover $5,500, leaving $500 non-exempt. In chapter 7, that $500 could be at risk. In chapter 13, your plan must pay at least $500 (total) to unsecured creditors over the life of the plan—often manageable once spread out over 36–60 months.

Key Differences at a Glance

- Chapter 7: Exemptions protect property from administration; non-exempt equity may be turned over or settled.

- Chapter 13: Exemptions set the plan’s minimum payout to unsecured creditors (best-interest test); you keep property by paying the non-exempt amount through the plan.

How to Claim Bankruptcy Exemptions in Tennessee (With a Lawyer, The Right Way)

Competitors may frame this like a do-it-yourself checklist. It isn’t. Tennessee exemptions are powerful if you apply them precisely; mistakes can cost equity. Below is the process your attorney will lead—so you know what’s happening and why— while you avoid the traps that trip up pro se filers.

Step 1 — Build a Complete, Defensible Asset List

Inventory everything: home and land, vehicles, bank and cash balances (day-of-filing), household goods, tools/equipment, crypto, collectibles, and legal claims (tax refunds, injury claims). Use fair-market or replacement values as of the filing date and back them up (photos, receipts, online guides, appraisals). Thin documentation = easy objections.

Step 2 — Confirm You Can Use Tennessee Exemptions

Tennessee is an opt-out state, but federal choice-of-law still controls who gets to use Tennessee’s list. Your attorney checks the 730-day domiciliary rule (and look-back if you moved) and flags the federal 1,215-day homestead capon recently acquired equity. Getting this wrong can knock you out of Tennessee’s protections entirely.

Step 3 — Match Each Asset to the Optimal Protection

- • Home: Tennessee homestead ($35,000 individual / $52,500 total for joint owners who live there).

- • Vehicle equity: No stand-alone car exemption—use the $10,000 wildcard per debtor.

- • Tools/equipment: $1,900 tools-of-the-trade, then top off with wildcard if needed.

- • Everyday items: Wearing apparel, family Bible/schoolbooks, portraits, prescribed health aids—specifically protected.

- • Cash/bank balances: Reserve enough wildcard for day-of-filing balances so you don’t leave cash unprotected.

Step 4 — File the Schedules So They All Agree

You formally claim exemptions on Schedule C (Official Form 106C). Values on Schedules A/B and lien data on Schedule D must align with what you’re exempting on Schedule C. Trustees and creditors cross-check these line by line. Your lawyer keeps the story consistent.

Step 5 — Watch Deadlines & Handle Objections

After the 341 meeting, trustees/creditors typically have a short window (often 30 days) to object. Many issues are fixable via amendment, but preventable errors can risk assets or drag out your case. Preparation = protection.

Avoid These Costly DIY Pitfalls

- • Title mismatches: You can’t stack a spouse’s wildcard onto an asset they don’t own.

- • Over-valuing vehicles or gear: Use condition-appropriate private-party values and keep screenshots.

- • Forgetting day-of-filing cash: Check balances the morning you file; protect with wildcard.

- • Cross-collateralization surprises: Credit-union loans may tie cards/personal loans to your car—verify payoff.

- • Residency timing errors: Misreading the 730-day rule can force you out of Tennessee exemptions.

Quick, Attorney-Guided Checklist

- • Complete asset list with supportable, current values and photos/docs.

- • Verify Tennessee applies (730-day domicile; homestead 1,215-day timing).

- • Assign the best Tennessee exemption to each item; use wildcard to fill gaps.

- • Align Schedules A/B, C, D—no contradictions.

- • Prepare proof for the trustee (titles, statements, appraisals, screenshots).

Bottom line: You get one chance to file it right. An experienced Tennessee bankruptcy attorney turns a risky checklist into a strategy that keeps what you need and avoids needless fights.

Tennessee Bankruptcy Exemptions: FAQs

Can I Keep My Car In Bankruptcy If Tennessee Has No Car Exemption?

Yes—most debtors protect vehicle equity with Tennessee’s $10,000 wildcard (per debtor). Figure out your equity (fair market value minus lien) and apply the wildcard to cover it. Joint filers can each use a $10,000 wildcard if both own the vehicle.

Does Tennessee Let Me Use Federal Exemptions?

No. Tennessee is an opt-out state, so most filers use Tennessee’s exemptions. You may still rely on federal protections that apply nationwide for retirement funds and certain federal caps (for example, the 1,215-day homestead cap), but not the federal exemption set in § 522(d).

Which Residency Rules Decide If I Can Use Tennessee Exemptions?

To use Tennessee exemptions, you generally must have been domiciled in Tennessee for at least 730 days before filing. If you moved within two years, a look-back rule may point you to a prior state’s law. Separately, venue to file in a Tennessee court usually requires living here for most of the 180 days before filing.

How Much Home Equity Does The Tennessee Homestead Exemption Protect?

$35,000 for an individual owner, or $52,500 total when joint owners live in the home as their principal residence. Tennessee repealed the old age/child-based tiers. A separate federal rule can cap recently acquired homestead equity if you’ve owned the home less than 1,215 days.

What About Everyday Personal Property?

Clothing, the family Bible and schoolbooks, family portraits, and prescribed health aids are specifically protected. You can also claim up to $1,900 for tools of the trade. If a category limit isn’t enough, add your wildcard to fill the gap.

Are Retirement Accounts And Pensions Protected?

Most ERISA-qualified employer plans (401(k), 403(b), many pensions) are excluded from the bankruptcy estate. Traditional and Roth IRAs are protected nationwide up to an inflation-adjusted cap ($1,711,975 for cases filed 4/1/2025–3/31/2028), with rollover amounts protected without a dollar cap. Inherited IRAs (non-spousal) are not covered by the federal retirement-funds exemption.

How Do Exemptions Work Differently In chapter 7 Versus chapter 13?

In chapter 7, exemptions decide what you keep; non-exempt equity may be administered by the trustee. In chapter 13, exemptions help set your plan’s minimum payout to unsecured creditors (the “best-interest” test): non-exempt equity becomes the floor you must pay through the plan.

How Do I Value My Property For Exemptions?

Use fair market value as of the filing date (what an informed buyer would pay). For household goods, replacement value is typical. Support values with online guides, appraisals, photos, and receipts. Accurate values reduce objections.

What If The Trustee Or A Creditor Objects To My Exemptions?

They must object within a short deadline (often 30 days after the 341 meeting). Courts usually allow amendments to fix issues, but getting it right the first time avoids delay, risk, and extra cost.

Do I Have To List Every Asset?

Yes. You must disclose all assets and claims (including tax refunds, bonuses, and injury claims). Omissions can lead to objections or worse. You can’t exempt what you don’t list.

How Do Joint Filers Use Exemptions?

Spouses generally claim exemptions individually where ownership and the statute allow—for example, each spouse has a $10,000 wildcard. For the homestead, Tennessee provides a $52,500 combined cap when joint owners live in the home as their principal residence.

Are Public Benefits Like Social Security Protected?

Yes. Social Security, unemployment compensation, veterans’ benefits, and many disability/illness benefits are protected under Tennessee law and federal statutes. Keep these funds identifiable; commingling can create tracing issues.

Should I File On My Own Or Hire A Lawyer?

Because residency look-backs, homestead timing, valuations, and plan tests can be tricky, it’s wise to work with an experienced Tennessee bankruptcy attorney. The right strategy can maximize what you keep and minimize plan costs or asset risk.

Final Thoughts: Using Tennessee Exemptions for a True Fresh Start

Tennessee’s exemption system is designed to protect what lets you live and earn—your home equity (up to $35,000 for one owner or $52,500 total for joint owners who live there), your $10,000 wildcard per debtor for vehicles, cash, and essentials, and specific protections for tools, clothing, and prescribed health aids. When used in the right order, these rules turn a stressful filing into a plan to keep your life intact.

The details matter: the 730-day domiciliary rule controls whether you can use Tennessee’s list; the 1,215-day federal cap can limit newly acquired homestead equity; and in chapter 13, non-exempt equity drives the minimum plan payout. This is strategy—not paperwork—and the outcome hinges on values, titles, timing, and how your schedules line up.

What To Do Next

- • Get a complete, documented asset list (values that you can defend).

- • Verify Tennessee applies (730-day rule) and check homestead timing (1,215 days).

- • Stack exemptions smartly: category protections first, $10,000 wildcard to fill gaps.

- • Choose the chapter that fits your goals—keep an eye on plan math in chapter 13.

You get one chance to file it right. An experienced Tennessee bankruptcy attorney will apply the rules to your facts, protect the equity you’ve built, and steer you to a filing that truly resets your finances.

Explore Our Tennessee Bankruptcy Guides

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin