How Many Times Can You File Bankruptcy?

Understand how frequently you can file under Chapter 7 or Chapter 13, what waiting periods apply, and how multiple filings affect your automatic stay and discharge eligibility.

Bankruptcy: How Many Times Can You File It?

Filing for bankruptcy is a big deal, and if done right it can provide individuals and businesses with a much-needed fresh start when faced with overwhelming debt. It offers a legal solutions to manage and eliminate debt, giving you a chance to start over. Sometimes multiple bankruptcies are necessary, or you find yourself in financial trouble again after filing for bankruptcy once. How many times can you file bankruptcy, and what are the rules governing multiple filings? Let's break it down.

Understanding Bankruptcy Types

Before diving into how often you can file for bankruptcy, it's essential to understand the two most common types of bankruptcy filings for individuals: Chapter 7 and Chapter 13. Each type serves different purposes and is suited to different financial situations.

Chapter 7 Bankruptcy

Chapter 7, is typically a quicker process and can discharge most unsecured debts, such as credit card debt and medical bills, within a few months. This type of bankruptcy is generally suited for individuals with limited income who cannot repay their debts.

The primary advantage of Chapter 7 is that it provides a relatively fast discharge of debts, allowing individuals to quickly move on from their financial burdens. However, not all debts are dischargeable, and individuals may lose some of their assets in the process, depending on what is considered non-exempt. It's crucial for debtors to understand which of their assets might be at risk before proceeding with a Chapter 7 filing.

Chapter 13 Bankruptcy

Chapter 13 is known as "reorganization bankruptcy." This type allows individuals to keep their property and repay debts over a three to five-year period based on a court-approved repayment plan. It's often chosen by those with a regular income who can afford to pay off some of their debts over time. This form of bankruptcy is ideal for individuals who have fallen behind on secured debts like mortgage payments but wish to retain their property.

The repayment plan under Chapter 13 helps debtors catch up on missed payments and manage their debts in a more controlled manner. This process requires a commitment to a strict budget, as a portion of the debtor’s income will be allocated to the repayment plan. The successful completion of the plan results in the discharge of remaining eligible debts, allowing individuals to regain control of their financial situation.

How Many Times Can You File Chapter 7 Bankruptcy?

The rules for filing Chapter 7 bankruptcy multiple times are governed by the Bankruptcy Code. You can file for Chapter 7 bankruptcy as many times as needed, but there are time restrictions between filings to prevent abuse of the system.

Eight-Year Rule: After you receive a discharge from a Chapter 7 bankruptcy, you must wait eight years from the filing date of the previous Chapter 7 case before you can file another Chapter 7 bankruptcy (11 U.S.C. § 727(a)(8)). This period ensures that individuals have a substantial period to attempt to manage their finances before seeking another discharge.

This rule ensures that debtors are not abusing the bankruptcy system by repeatedly discharging debts without a significant time gap. It encourages individuals to use the relief provided by bankruptcy to genuinely attempt to reorganize their financial affairs and avoid future financial distress.

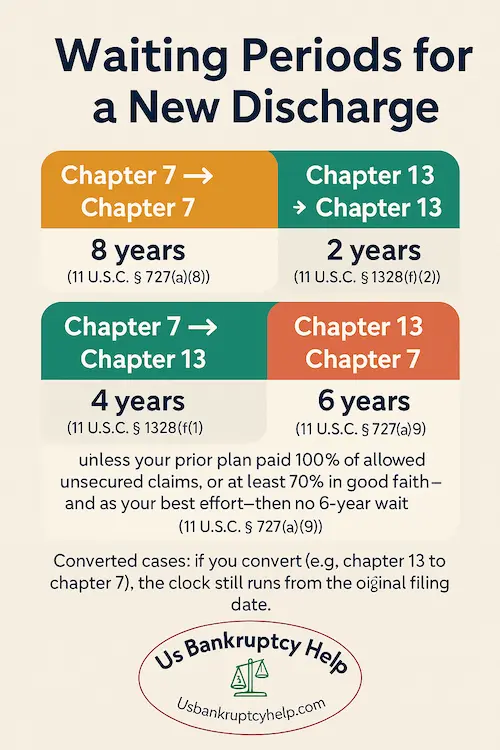

At-A-Glance: Waiting Periods For A New Discharge

- Chapter 7 ➜ Chapter 7: 8 years between filing dates (11 U.S.C. § 727(a)(8)).

- Chapter 13 ➜ Chapter 13: 2 years between filing dates (11 U.S.C. § 1328(f)(2)).

- Chapter 7 ➜ Chapter 13: 4 years between filing dates to receive a chapter 13 discharge (11 U.S.C. § 1328(f)(1)).

- Chapter 13 ➜ Chapter 7: 6 years between filing dates unless your prior plan paid 100% of allowed unsecured claims, or at least 70% in good faith and as your best effort—then no 6-year wait (11 U.S.C. § 727(a)(9)).

Converted cases: if you convert (e.g., chapter 13 to chapter 7), the clock still runs from the original filing date of the case.

How Many Times Can You File Chapter 13 Bankruptcy?

Chapter 13 bankruptcy allows for more frequent filings compared to Chapter 7, reflecting its focus on debt repayment rather than debt discharge.

Two-Year Rule: You can file for Chapter 13 bankruptcy as many times as necessary, but if you received a discharge in a previous Chapter 13 case, you must wait at least two years from the filing date of the previous case to file a new Chapter 13 case (11 U.S.C. § 1328(f)(2)). This rule allows individuals to reorganize their debts more frequently and provides an opportunity to readjust their repayment plans if their financial situation changes.

This shorter period allows individuals to reorganize their debts more frequently, reflecting the nature of Chapter 13 as a repayment-focused process. It acknowledges that financial circumstances can change rapidly, and offers a flexible solution for those who are committed to repaying their debts under a structured plan.

Filing Chapter 13 After Chapter 7

Filing for Chapter 13 after a Chapter 7 discharge is commonly referred to as a "Chapter 20" bankruptcy, though this is not an official term. This strategy can be useful in managing debts that were not discharged under Chapter 7 or in dealing with new financial challenges.

Four-Year Rule: If you've received a discharge from a Chapter 7 case, you must wait four years from the filing date of the Chapter 7 case before filing for Chapter 13 bankruptcy and obtaining a discharge (11 U.S.C. § 1328(f)(1)). This timeline allows debtors to address any remaining debts and protect important assets like a home from foreclosure.

This strategy is often used when a debtor has more debt to manage after a Chapter 7 discharge or when they need to protect assets like a home from foreclosure. It provides a legal framework to restructure debts and offers a pathway to regain financial stability while maintaining crucial assets.

Filing Chapter 7 After Chapter 13

If you have filed for Chapter 13 and received a discharge, you can file for Chapter 7 under certain conditions. This sequence might be appropriate for individuals who initially attempted to repay their debts but later encountered insurmountable financial challenges.

Six-Year Rule: You must wait six years from the filing date of your previous Chapter 13 case to file for Chapter 7, unless you paid off 70% of your unsecured debts in the Chapter 13 case (11 U.S.C. § 727(a)(9)). This rule incentivizes debtors to complete their repayment plans and emphasizes the importance of fulfilling financial obligations before seeking another discharge.

This rule encourages debtors to fulfill their repayment plans in Chapter 13 before seeking another discharge through Chapter 7. It underscores the importance of demonstrating a sincere effort to repay debts, which can positively influence future bankruptcy filings and financial credibility.

Can You File for Bankruptcy Twice?

Yes, you can file for bankruptcy multiple times, but the timing and type of bankruptcy matter. The key is understanding the waiting periods between filings and the impact each type of bankruptcy can have on your financial situation. It's important to approach each filing with a clear understanding of the legal requirements and potential outcomes.

By being aware of the rules and limitations, individuals can strategically plan their bankruptcy filings to maximize the benefits while minimizing the drawbacks. Consulting with a bankruptcy attorney can provide valuable insight and help navigate the complexities of multiple filings.

Frequently Asked Questions

How Soon Can You File Chapter 13 After Filing Chapter 7?

You can file for Chapter 13 four years after filing a Chapter 7 case, as long as you abide by the waiting period rules to receive a discharge. This allows debtors to address any remaining financial obligations and adjust their repayment strategies accordingly.

Can I File Chapter 7 After Filing Chapter 13?

Yes, but the six-year rule applies unless you met specific repayment conditions in your Chapter 13 case. Meeting these conditions can allow for an earlier filing, offering flexibility for those who have made significant efforts to repay their debts.

How Often Can You Declare Bankruptcy?

While there is no maximum number of times you can declare bankruptcy, the waiting periods between filings ensure that debtors use this option responsibly. These rules are designed to balance the need for financial relief with the potential for abuse, promoting a fair and effective bankruptcy system.

Navigating Multiple Bankruptcy Filings for Long-Term Financial Stability

Bankruptcy can be a powerful tool for financial recovery, but it's important to understand the implications of multiple filings. The rules governing how often you can file for bankruptcy are designed to prevent abuse of the system while providing opportunities for individuals to manage their debts effectively. Each filing should be considered carefully, with attention to the long-term impact on your financial health.

If you're considering filing for bankruptcy again, it's wise to consult with a bankruptcy attorney to navigate the complexities of the process and determine the best course of action for your financial future. Remember, bankruptcy is not the end; it can be the beginning of a new financial chapter with careful planning and guidance. With the right approach, bankruptcy can serve as a stepping stone toward financial stability and freedom.