Understanding Chapter 7 Bankruptcy in Virginia

When bills keep piling up, collection calls won’t stop, and you feel like you’re out of options, it’s normal to wonder whether Chapter 7 bankruptcy in Virginia could give you a real fresh start. Chapter 7 is a legal process that can wipe out many unsecured debts, including credit cards, medical bills, and personal loans. To use it safely and effectively in Virginia, you need to understand how federal bankruptcy rules, Virginia bankruptcy laws for chapter 7, and income limits all work together.

Chapter 7 Bankruptcy in Virginia — At a Glance

- What Chapter 7 Does: A federal court process under Title 11, Chapter 7 of the U.S. Code that can wipe out many unsecured debts (credit cards, medical bills, personal loans) for eligible Virginia residents and end most collection activity through a discharge.

- Who Qualifies in Virginia: Most people qualify by passing the Chapter 7 bankruptcy Virginia means test—typically by having household income at or below the Virginia median, or by showing little disposable income after allowed expenses if they are above median.

- Chapter 7 Income Limits 2025 Virginia: Uses official U.S. Trustee median income figures for Virginia (updated periodically). If your annualized six-month income is below the median for your household size, you usually pass the income portion of the means test.

- Virginia Exemptions and What You Keep: Virginia chapter 7 bankruptcy exemptions—drawn from Title 34 of the Code of Virginia and other laws—help protect home equity, vehicle equity, household goods, many retirement accounts, and tools of the trade in a Chapter 7 case.

- Timeline for a Typical Case: Many straightforward Chapter 7 Virginia cases take about 3–4 months from filing to discharge, with credit counseling before filing, a short 341 meeting, debtor education afterward, and then the discharge order.

- Chapter 7 Bankruptcy Virginia Cost: Court filing fee of $338, required counseling and education courses, plus attorney fees that often range from about $1,000–$3,500+ for consumer cases, depending on the number of creditors, means-test complexity, assets, and exemption issues.

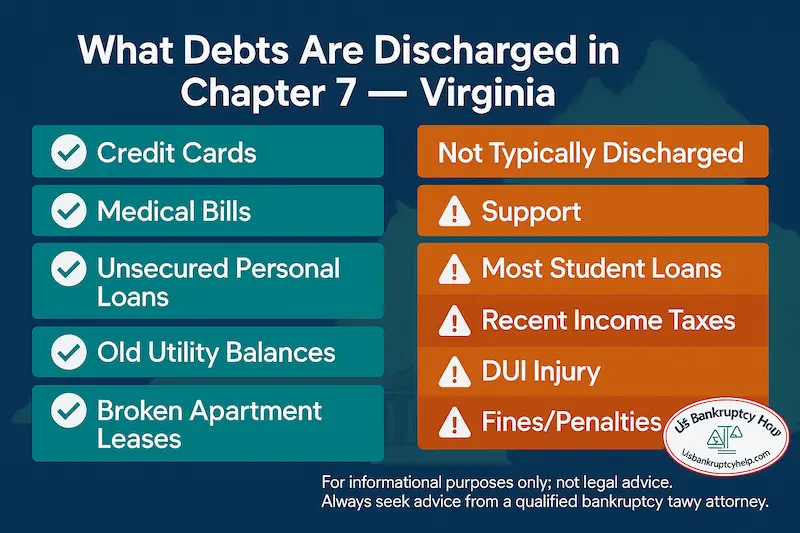

- Debts Wiped Out vs. Debts That Survive: Most unsecured debts can be discharged, but obligations like child support, many taxes, most student loans, criminal fines, and some fraud-based debts usually survive Chapter 7.

- How Often You Can File: To receive another Chapter 7 discharge, you usually must wait eight years from the filing date of your prior Chapter 7 case; different waiting periods apply if you move between Chapter 7 and Chapter 13.

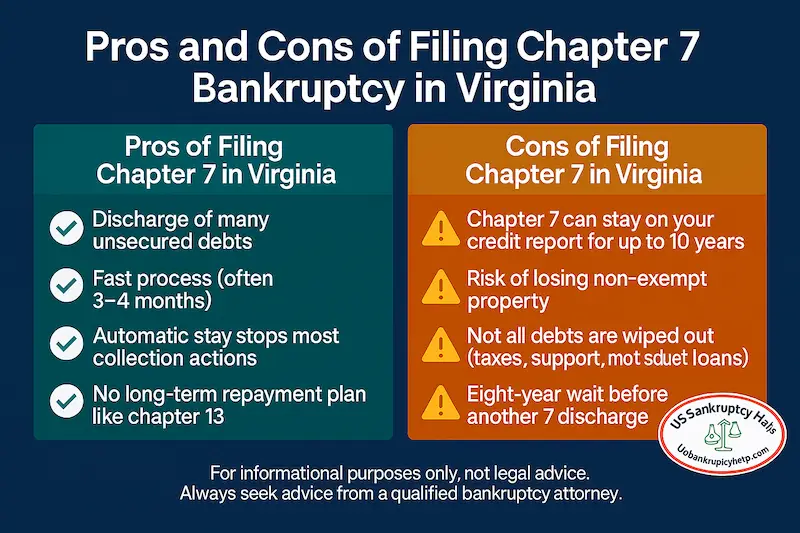

- Key Pros and Cons: Pros include fast relief and discharge of many unsecured debts with no long-term payment plan; cons include a 10-year credit report notation, potential risk to non-exempt assets, and the fact that not all debts are eliminated.

- Why a Virginia Bankruptcy Attorney Matters: Chapter 7 involves strict deadlines, means-test math, exemption strategy, and trustee review. An experienced Virginia bankruptcy lawyer can help you decide if Chapter 7 is the right fit, protect assets where possible, and guide you toward a smooth discharge of unsecured debt.

Chapter 7 in Virginia is not a magic button, and it isn’t right for everyone. To qualify, Virginia residents must pass a means test, disclose all income, property, and debts, and apply the correct Virginia chapter 7 bankruptcy exemptions to protect essential assets. Knowing how the Virginia means test works, what property you can keep, and how filing Chapter 7 in Virginia fits into your bigger financial picture can help you make informed, confident decisions instead of guessing in the dark.

The cost of filing Chapter 7 in Virginia includes a court filing fee and attorney fees, and many people understandably ask, “How much does Chapter 7 bankruptcy cost in Virginia, and is it worth it?” This guide is designed to walk you through how to file Chapter 7 in Virginia, what Chapter 7 bankruptcy Virginia cost typically looks like, how the Chapter 7 bankruptcy Virginia means test and income limits (including 2025 updates) work, and how Virginia chapter 7 exemptions may help you protect what matters most.

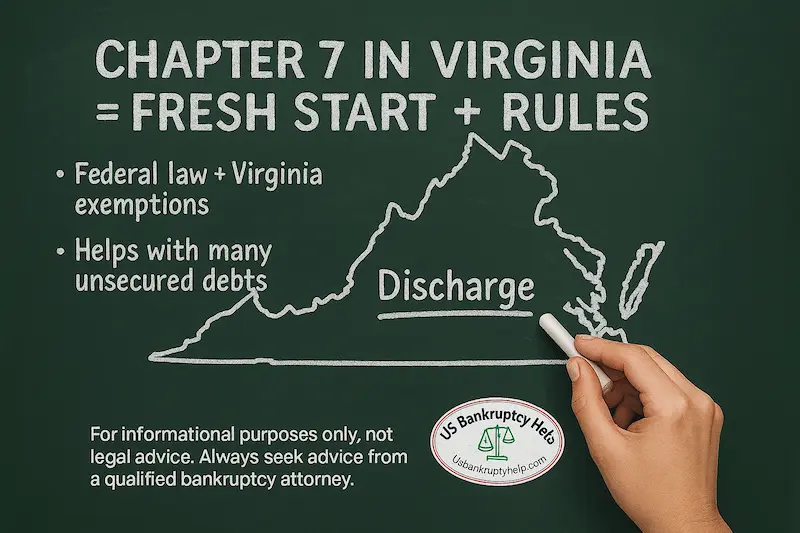

What Is Chapter 7 Bankruptcy in Virginia?

Chapter 7 bankruptcy in Virginia is a court-supervised process under federal law that allows eligible individuals to erase many unsecured debts when repayment is no longer realistic. Chapter 7 comes from federal bankruptcy law— specifically Title 11, Chapter 7 of the United States Code—and those nationwide rules apply in every Chapter 7 Virginia case. The ultimate goal of a Chapter 7 case is to receive a discharge of qualifying unsecured debt so you can move forward without the pressure of those old balances.

At the same time, Virginia bankruptcy chapter 7 cases are heavily influenced by Virginia exemption statutes, which help determine what property you can keep. These include provisions in Title 34 of the Code of Virginia (Homestead Exemption of Householder), along with other Virginia exemption laws that affect how Chapter 7 is administered in Virginia. Your case begins when you file a bankruptcy petition with the appropriate Virginia bankruptcy court, listing all assets, liabilities, income, expenses, and recent financial activity so the court and the trustee can see your full financial picture.

Key features of Chapter 7 bankruptcy in Virginia include:

- Discharge of many unsecured debts, including credit cards and medical bills

- Appointment of an independent bankruptcy trustee to review your case

- Possible liquidation of non-exempt property, if there is anything worth selling

- Completion of required credit counseling and debtor education courses

Filing Chapter 7 involves trade-offs. In a small percentage of cases, the Chapter 7 trustee may sell non-exempt property and use the proceeds to pay creditors. However, many Virginia Chapter 7 cases are "no-asset" cases, meaning nothing is sold because everything is covered by Virginia chapter 7 exemptions or is not worth administering. Those protections are designed to help you keep essential belongings while you use Chapter 7 bankruptcy Virginia relief to move toward a more stable financial future.

Who Qualifies for Chapter 7 Bankruptcy in Virginia?

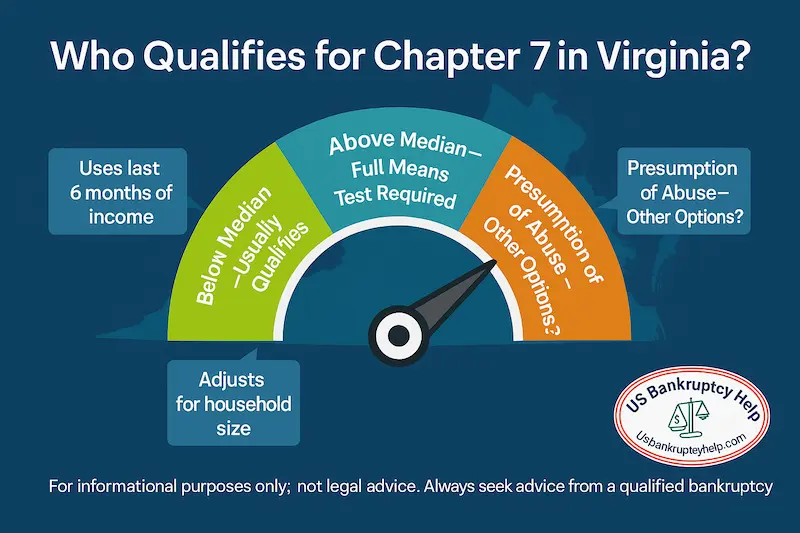

Not everyone who is stressed about debt will qualify for a Chapter 7 bankruptcy in Virginia, but many more people qualify than they expect. For most individuals, eligibility for a Chapter 7 discharge turns on the Chapter 7 bankruptcy Virginia means test, along with a few basic requirements like credit counseling and honest disclosure of your finances.

The means test compares your household income to the Chapter 7 income limits 2025 Virginia uses for cases filed in the current period. If your average income for the six months before filing is below the Virginia median income for your household size, you usually qualify for Chapter 7 based on income alone. In other words, there is generally no presumption of abuse under 11 U.S.C. § 707(b), and you can move forward to focus on exemptions and the rest of your case.

If your income is above the Virginia median, you may still qualify for a Chapter 7 discharge, but the means test digs deeper into your allowed expenses (housing, food, transportation, taxes, secured debts, and more) to see whether you truly have money left over to pay unsecured creditors. Careful and accurate budgeting is crucial here.

Key criteria for qualifying for Chapter 7 in Virginia include:

- Household income below the Virginia median income (or passing the full means test if above median)

- Completion of an approved pre-filing credit counseling course

- Filing complete and accurate documents with full disclosure of assets, debts, income, and expenses

- Following all Chapter 7 filing requirements and deadlines set by the bankruptcy court

Beyond the numbers, honesty and transparency are critical. You’ll need to disclose all assets and liabilities, even if you think something is minor or fully exempt. Incomplete or inaccurate information can cause serious problems in a Virginia Chapter 7 case, including delays, loss of exemptions, or in extreme cases, denial of discharge.

Chapter 7 Bankruptcy Virginia Means Test and Income Limits (2025)

The Chapter 7 bankruptcy Virginia means test is a two-step calculation designed to separate those who can genuinely benefit from a Chapter 7 discharge from those who may be steered toward chapter 13. The test looks at your average gross income over the last six full months, adjusts it to an annual figure, and compares it to the Virginia median family income for your household size.

For cases filed on or after November 1, 2025, the U.S. Trustee Program publishes the official Virginia median income figures used in the means test. These Chapter 7 income limits for 2025 in Virginia are reproduced in the table below.

| Household Size | Annual Median Income (USD) |

|---|---|

| 1 | $76,479 |

| 2 | $98,577 |

| 3 | $120,001 |

| 4 | $141,113 |

| Add $11,100 for each person over 4. | |

If your annualized income (based on the last six months) is below the amount shown for your household size, you typically pass the income portion of the Chapter 7 means test in Virginia and are usually eligible to pursue a Chapter 7 discharge, assuming you meet the other legal requirements. If your income is above these limits, the second part of the means test allows deductions for allowed expenses and certain secured and priority payments to determine whether there is a “presumption of abuse” under 11 U.S.C. § 707(b).

Because these numbers change periodically, it’s important to confirm the current Chapter 7 income limits 2025 Virginia uses as of your intended filing date or to work with a bankruptcy attorney who checks the latest U.S. Trustee data before your petition is filed.

Virginia Chapter 7 Bankruptcy Exemptions

Even if you clearly pass the Virginia chapter 7 means test, the next critical question is what property you can keep. Virginia chapter 7 bankruptcy exemptions are the state-law rules that determine how much equity in your home, car, and other property can be protected in a chapter 7 case. For a deeper dive, see our Virginia Bankruptcy Exemptions guide, which is the primary resource on this site for how Virginia exemptions work in chapter 7.

In Virginia, exemptions come from both federal bankruptcy law and state statutes, including provisions in Title 34 of the Code of Virginia. These laws outline Virginia chapter 7 exemptions that can apply to your case, such as the homestead exemption, vehicle exemption, household goods, and certain retirement accounts.

The homestead exemption in Virginia protects a portion of the equity in your primary residence (or sometimes other qualifying property), which can be especially important if you are trying to save your home while filing chapter 7. The amount you can protect depends on several factors, including your age, marital status, and whether you have filed a homestead deed correctly and on time.

Vehicles are also covered under Virginia’s exemption scheme. The vehicle exemption allows you to protect a set amount of equity in a car, truck, or other qualifying vehicle so that filing chapter 7 does not automatically mean losing reliable transportation.

Personal property exemptions typically cover everyday items such as clothing, basic household goods, modest furniture, and in some cases tools of the trade or professional equipment you need to work. Many tax-qualified retirement accounts are protected as well under federal and state law, reflecting a policy choice to avoid stripping away long-term retirement savings in most chapter 7 cases.

Here are some key exemption categories to keep in mind when evaluating a Virginia chapter 7 filing:

- Homestead: Potential protection for equity in your primary residence (subject to Virginia’s homestead rules)

- Vehicle: Equity protection in a personal motor vehicle up to the applicable Virginia exemption limits

Personal property exemptions may include:

- Everyday clothing and household goods

- Tools of the trade or work-related equipment

- Many retirement accounts and certain other protected benefits

How these Virginia chapter 7 bankruptcy exemptions apply in practice can be highly fact-specific. Small differences in timing, titling, or equity can change the analysis, so most people benefit from getting legal advice before filing. A Virginia bankruptcy attorney can help you map your assets to the correct exemptions and reduce the risk of losing property unnecessarily in a chapter 7 case. If you’re comparing options, start with our Virginia chapter 7 bankruptcy exemptions guide.

The Chapter 7 Bankruptcy Process in Virginia

Filing for Chapter 7 bankruptcy in Virginia is a structured, step-by-step process. In a typical straightforward case, the timeline from filing to discharge is often around three to four months, though three to six months is common. Understanding how filing Chapter 7 in Virginia actually works can make the experience less stressful and help you avoid mistakes.

The first step is preparation. Before you can file, you must complete a pre-filing credit counseling course from an approved provider. This is mandatory and must be done within 180 days before your petition is filed. During this time, you or your attorney also gather key documents such as pay stubs, tax returns, bank statements, and a complete list of your creditors so the paperwork for your case is accurate.

Next, you (and your attorney, if you have one) prepare and submit your bankruptcy petition and schedules to the correct Virginia bankruptcy court. These documents include detailed schedules of assets, liabilities, income, and expenses, plus the Statement of Financial Affairs and the Chapter 7 means test forms. Accuracy and full disclosure are critical here; errors or omissions can delay your case or cause other problems.

Once your Chapter 7 petition is filed, an automatic stay goes into effect. In most cases, this immediately stops collection lawsuits, garnishments, and foreclosure or repossession efforts while your case is pending. The court appoints a Chapter 7 trustee, who reviews your documents, may request additional records, and determines whether there are any non-exempt assets to sell for the benefit of creditors.

About a month after filing, you will attend a meeting of creditors, also called a 341 meeting. This is usually brief and straightforward—often just a few minutes. The trustee will place you under oath and ask questions about your petition, your property, and your financial history. Creditors may attend and ask questions as well, although in many consumer Chapter 7 cases no creditors appear.

After the 341 meeting, you must complete a post-filing debtor education course. If everything is in order and no one files a timely objection to your discharge, the court will issue a discharge order wiping out eligible unsecured debts. That order is the end goal of the Chapter 7 process in Virginia.

Key steps in the Chapter 7 bankruptcy process in Virginia include:

- Completing an approved pre-filing credit counseling course

- Preparing and filing the Chapter 7 petition, schedules, and means test forms

- Triggering the automatic stay to stop most collection activity

- Attending the 341 meeting of creditors and answering the trustee’s questions

- Finishing a post-filing debtor education course and receiving the discharge order

Understanding how to file Chapter 7 in Virginia—and what each of these steps really means in practice—can make the process more manageable and help you focus on the end result: a discharge of qualifying unsecured debt and a chance to rebuild.

Costs of Filing Chapter 7 Bankruptcy in Virginia

One of the first questions people ask is, “How much does Chapter 7 bankruptcy cost in Virginia?” The total cost of filing Chapter 7 bankruptcy in Virginia has several parts: the court filing fee, required credit counseling and debtor education courses, your credit report, and (if you hire one) attorney fees. Understanding these pieces up front makes it easier to decide whether a Chapter 7 filing is realistic for your budget.

The court filing fee for a Chapter 7 case is currently $338 nationwide. That total includes the basic filing fee, an administrative fee, and a small trustee surcharge set by federal law. Because these numbers can change from time to time, it’s always smart to confirm the current amount on the official U.S. Courts website or with the clerk of the Virginia bankruptcy court before you file.

In addition to the filing fee, you must complete a pre-filing credit counseling course and apost-filing debtor education course from approved providers. Each course typically costs between about $15 and $50, and some providers offer reduced fees or waivers based on income. Many filers also pay a modest charge for a tri-merge credit report used to capture all creditors accurately.

The largest part of the overall Chapter 7 bankruptcy Virginia cost for many people is the attorney fee. For a straightforward consumer Chapter 7 in Virginia, attorney fees often fall in a general range of roughly $1,000 to $3,500 or more. Where your case lands in that range depends heavily on complexity: how many creditors you have, whether qualification under the means test is clear or close, whether any exemptions are tight or uncertain, and whether the trustee is likely to scrutinize assets, request extensive documents, or consider a Rule 2004 examination. Business-related Chapter 7 cases, or cases involving significant assets, disputed exemptions, or tax issues, can be substantially more expensive than a simple wage-earner case with few creditors.

Here’s a quick breakdown of common Chapter 7 costs in Virginia:

- Court filing fee: about $338 for a Chapter 7 case

- Credit counseling and debtor education: roughly $15–$50 per course

- Credit report and document-gathering costs: usually a modest additional amount

- Attorney fees: typically the largest component, often in the $1,000–$3,500+ range for consumer cases, and higher for complex or business-related Chapter 7 filings

If you truly cannot afford the filing fee all at once, the court may allow you to pay the fee in installments, and in some low-income cases the fee can be partially or fully waived. Many Virginia bankruptcy attorneys also offer payment plans for their own fees. Budgeting for these costs in advance, and asking specifically how complexity affects the fee during your consultation, can make filing Chapter 7 in Virginia much more manageable.

Chapter 7 Virginia: What Debts Can and Cannot Be Discharged?

A big part of deciding whether filing Chapter 7 in Virginia makes sense is understanding exactly what debts it can wipe out and what it generally cannot. The discharge is powerful, but it is not a blanket eraser for every kind of obligation. Knowing the difference up front helps you set realistic expectations and plan your next steps.

In most Virginia Chapter 7 cases, the discharge can eliminate many types of unsecured debt, including:

- Credit card balances and store cards

- Medical bills and hospital accounts

- Most personal loans and payday loans

- Utility and old cell phone bills

- Some old judgments based on discharged unsecured debts

These debts are typically wiped out at the end of the case unless a creditor successfully objects to discharge of a particular debt based on fraud or other misconduct. After discharge, creditors on those debts can no longer legally collect from you.

Certain debts, however, are generally not discharged in a Chapter 7 case, either automatically under 11 U.S.C. § 523 or because a creditor brings a successful nondischargeability action. Common examples include:

- Recent income taxes and certain other tax debts: Some older income tax debts may be dischargeable if they meet strict timing and filing rules, but many tax obligations survive Chapter 7.

- Domestic support obligations: Child support and spousal support/alimony are not discharged and must continue to be paid.

- Most student loans: Federal and private student loans are not discharged in a standard Chapter 7 case unless you file a separate lawsuit (an adversary proceeding) and prove “undue hardship” under a demanding legal standard.

- Debts for fraud, embezzlement, or intentional harm: Certain debts arising from fraud, willful and malicious injury, or similar misconduct can be excepted from discharge if a creditor files a timely complaint and wins.

- Criminal fines, restitution, and many court penalties: These are typically not discharged.

Secured debts—like a mortgage or car loan—are a special category. Chapter 7 can wipe out your personal liability on those debts, but the lien usually survives. That means the lender can still foreclose or repossess the collateral if payments are not made, even after your personal obligation has been discharged.

Because the discharge rules are detailed and fact-specific, it’s wise to review your full list of debts with a knowledgeable bankruptcy attorney. A Virginia bankruptcy lawyer can help you understand which obligations are likely to be wiped out, which ones will survive, and how that fits into your overall strategy for getting back on stable financial ground.

Pros and Cons of Filing Chapter 7 in Virginia

Filing for chapter 7 bankruptcy in Virginia can be life-changing in the right circumstances. For many people who are buried in credit cards, medical bills, and other unsecured debts, chapter 7 Virginia relief can stop collection pressure and wipe out balances in a matter of months instead of years. But chapter 7 is a powerful tool, not a painless one, and it has real trade-offs you should understand before you file.

On the positive side, a successful Virginia chapter 7 case usually ends with a discharge of qualifying unsecured debt, an immediate halt to most collection actions, and a clean break from accounts that have been dragging you down for a long time. On the negative side, chapter 7 can stay on your credit report for up to ten years, you may have to surrender non-exempt property in some cases, and you will not be able to file another chapter 7 for eight years after your discharge.

Here’s a quick overview of the pros and cons of filing chapter 7 in Virginia:

Pros:

- Discharge of most unsecured debts: Credit cards, medical bills, personal loans, and similar debts are often wiped out completely at the end of the case.

- Relatively fast process: Many straightforward Virginia chapter 7 cases go from filing to discharge in about three to four months, with no ongoing payment plan.

- Immediate relief from creditors: The automatic stay usually stops lawsuits, garnishments, and most collection calls as soon as your case is filed.

- No required repayment plan: Unlike chapter 13, there is typically no three- to five-year repayment plan in chapter 7.

Cons:

- Credit impact and public record: A chapter 7 filing can appear on your credit report for up to ten years, and bankruptcy filings are part of the public record.

- Risk to non-exempt assets: If you own property that is not fully protected by Virginia exemptions, the chapter 7 trustee may have the power to sell it for the benefit of creditors.

- Not all debts are wiped out: Certain obligations—such as most student loans, recent taxes, child support, and alimony—generally survive a chapter 7 discharge.

- Waiting periods for future filings: After receiving a chapter 7 discharge, you usually must wait eight years before you can receive another chapter 7 discharge.

Because these pros and cons play out differently depending on your income, assets, and goals, it’s important to look at more than just the short-term relief. A Virginia bankruptcy attorney can help you compare chapter 7 with other options—such as chapter 13, or non-bankruptcy workouts—and decide whether filing chapter 7 in Virginia is the right move for your long-term financial recovery.

How to File Chapter 7 in Virginia: Step-by-Step Guide

Filing Chapter 7 in Virginia involves several key steps, from pre-filing counseling to your discharge. The outline below is a broad overview of how to file Chapter 7 in Virginia, not a substitute for legal advice. The actual process can be detailed and technical, and a Virginia bankruptcy attorney can guide you through every step and help you avoid costly mistakes.

To start, you must complete a credit counseling course approved by the U.S. Trustee Program. This is mandatory and must be done within 180 days before filing your case. At the same time, you should gather your most important financial records—pay stubs, tax returns, bank statements, and a complete list of creditors and debts—so that your paperwork is accurate.

The next step in filing Chapter 7 in Virginia is preparing your bankruptcy petition and schedules. These forms disclose your assets, debts, income, expenses, and recent financial history, and they include the Chapter 7 means test. Once the petition is filed with the Virginia bankruptcy court and the filing fee (or approved installment plan) is in place, the case is officially opened and the automatic stay goes into effect.

Here’s a simple breakdown of the basic steps:

- Complete an approved pre-filing credit counseling course

- Gather financial documents (income, assets, debts, tax returns, bank statements)

- Prepare and file the Chapter 7 petition, schedules, and means test forms

- Pay applicable filing fees or obtain court approval to pay in installments

- Attend the creditors’ meeting (341 meeting) and answer the trustee’s questions

- Complete a post-filing debtor education course and await your discharge

Every one of these steps has its own rules, deadlines, and potential pitfalls. Filing Chapter 7 in Virginia on your own means you are held to the same standards as an attorney when it comes to accuracy and compliance. Because Chapter 7 bankruptcy is a complex federal court process, most people are better served by working with an experienced Virginia bankruptcy lawyer who can explain your options, prepare the paperwork correctly, deal with the trustee, and help you move toward a discharge of unsecured debt as smoothly as possible.

Frequently Asked Questions About Chapter 7 Bankruptcy in Virginia

Chapter 7 bankruptcy in Virginia raises a lot of understandable questions. The answers below are a broad overview and not a substitute for legal advice, but they can help you get oriented before you speak with a Virginia bankruptcy attorney about your specific situation.

How long does a Chapter 7 bankruptcy case take in Virginia?

In a typical consumer case, a Chapter 7 bankruptcy in Virginia lasts about three to four months from the day you file until the discharge is entered, although three to six months is a common range. You complete credit counseling before filing, attend a brief 341 meeting of creditors about a month after filing, complete a debtor education course, and then wait for the court to issue your discharge order if there are no objections or major complications.

How much does Chapter 7 bankruptcy cost in Virginia?

The total cost of filing Chapter 7 bankruptcy in Virginia has several parts. The court filing fee is currently $338, and you must also pay for a pre-filing credit counseling course and a post-filing debtor education course (often $15–$50 each) plus a modest charge for a credit report and document gathering. The largest part of the Chapter 7 bankruptcy Virginia cost for most people is the attorney fee, which often falls in a general range of about $1,000 to $3,500 or more for consumer cases, depending on factors like the number of creditors, how close you are on the means test, and whether there are complex assets or exemption issues. Business-related or highly complex Chapter 7 cases can cost more. A Virginia bankruptcy attorney can explain the fee structure for your specific situation during a consultation.

Will filing Chapter 7 ruin my credit forever?

No, but it will hurt your credit in the short term. A Chapter 7 bankruptcy can appear on your credit report for up to ten years, and your score often drops at first. However, many people who file are already behind on payments or in collections, so their credit is already heavily damaged. After your discharge, you can begin rebuilding with on-time payments, low credit utilization, and responsible use of new credit. Lenders will see the bankruptcy, but they will also see your post-bankruptcy history over time.

Can I keep my house and car if I file Chapter 7 in Virginia?

It depends on your equity, your loan status, and how Virginia exemption laws apply to your situation. If your home and vehicle equity are within Virginia’s exemption limits and you are current on payments, many people are able to keep their house and car in a Chapter 7 case. If there is significant non-exempt equity or you are far behind on payments, there may be more risk. A Virginia bankruptcy attorney can look at your mortgage balance, home value, car loan, and exemptions to help you understand what is at stake before you file.

How Often Can You File Chapter 7 in Virginia?

When you’re thinking about filing Chapter 7 in Virginia, it’s important to understand how often you can receive a Chapter 7 discharge. These timing rules are set by federal law and apply the same way in Virginia as they do in other states, but how they affect you depends on what you filed before and when.

If you have received a prior Chapter 7 discharge, you generally must wait eight years from the filing date of that earlier Chapter 7 case before you can file another Chapter 7 and receive a new discharge. There are different waiting periods if you are moving between chapters (for example, from Chapter 7 to Chapter 13 or from Chapter 13 to Chapter 7), and those timelines can affect your strategy if you’re dealing with tax debt, secured arrears, or repeat financial hardship.

Because these timing rules can be confusing, it’s smart to look at them in the context of your full filing history. For a broader national overview of how often you can file bankruptcy under different chapters, you can review our guide on how often you can file bankruptcy and then talk with a Virginia bankruptcy attorney about how the specific waiting periods apply to you before you file another case.

Do I have to go to court in front of a judge?

Most Virginia Chapter 7 filers never appear in a formal courtroom or in front of a judge. You are required to attend a short, relatively informal meeting of creditors (the 341 meeting), which is usually held by the Chapter 7 trustee in a conference room or via phone or video. A judge normally becomes involved only if there is a dispute, such as a motion filed by a creditor or an objection to exemptions or discharge. Your attorney can prepare you for the 341 meeting and handle any court hearings if they become necessary.

Do I need a Virginia bankruptcy attorney to file Chapter 7?

You are allowed to file Chapter 7 on your own, but the process is technical and the stakes are high. You must meet strict deadlines, complete all required courses, calculate and apply the means test correctly, choose and claim the right exemptions, and respond appropriately to trustee or creditor requests. An experienced Virginia bankruptcy attorney can guide you through each step, help you avoid errors that could cost you money or property, and work to position your case for a smooth discharge of unsecured debt.

Is Filing Chapter 7 Bankruptcy in Virginia Right for You?

Deciding whether chapter 7 bankruptcy in Virginia is right for you is not just a math problem; it’s a big life decision. You have to weigh your current reality—missed payments, collection calls, lawsuits, or garnishments—against the long-term impact on your credit, your ability to buy a home or car in the future, and your overall financial goals. This guide is a broad overview of how chapter 7 bankruptcy Virginia cases work, but it can’t replace advice tailored to your specific income, assets, and debts.

When it fits, chapter 7 can provide a powerful reset by discharging a large amount of unsecured debt in a relatively short time and giving you room to rebuild. When it doesn’t fit, it can expose assets, create timing issues for future filings, or leave you with key debts (like taxes or support) still in place. That’s why it’s important not to make the decision based on fear or pressure from creditors, but on a clear understanding of your options.

A knowledgeable Virginia bankruptcy attorney can walk you through the chapter 7 bankruptcy process step by step, apply the Virginia means test and exemption rules to your actual numbers, and compare chapter 7 with alternatives like chapter 13 or non-bankruptcy workouts. Talking with counsel before you file can help you avoid avoidable risks and decide whether filing chapter 7 in Virginia is truly the best path toward the fresh start you’re looking for.

Explore Our Virginia Bankruptcy Guides

Explore Some of Our National Bankruptcy Guides

- Chapter 7 Bankruptcy: National Guide

- Chapter 13 Bankruptcy: National Guide

- Chapter 7 vs Chapter 13 Bankruptcy: National Guide

- Can Just One Spouse File Bankruptcy?

- Can You File Bankruptcy and Keep Your House?

- Can You File Bankruptcy and Keep Your Car?

- How Often Can You File Bankruptcy?

- Chapter 13 Vehicle Cramdown

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin