California Chapter 13 Trustees: Contacts, Roles & Tips

Below you’ll find a verified list of California Chapter 13 trustees with contact details and links to their offices. Use the guidance on this page to understand what a trustee does and how to collaborate effectively so your chapter 13 repayment plan stays on track.

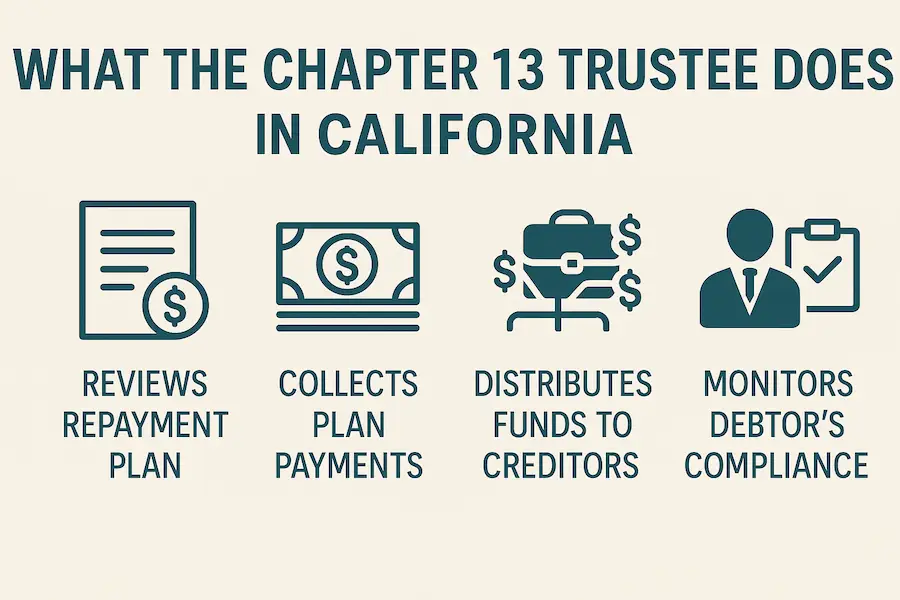

What Chapter 13 Trustees Do

- Case Review & Eligibility: Verifies schedules, income, expenses, tax returns, and plan feasibility.

- §341 Meeting Administration: Conducts your meeting, asks questions under oath, and confirms required documents are complete.

- Payment Collection & Distribution: Receives monthly plan payments and pays creditors under the confirmed plan.

- Monitoring Compliance: Ensures you stay current on plan payments, file required tax returns, and meet ongoing duties.

- Recommendations to the Court: Supports confirmation or raises concerns if the plan is not feasible or compliant.

Who Are Chapter 13 Trustees?

A Chapter 13 trustee is a court-appointed fiduciary who administers your case. The trustee reviews your petition and plan, conducts the §341 meeting of creditors, collects monthly plan payments, and distributes funds to creditors according to the confirmed plan. Trustees also flag missing documents, request clarifications, and make recommendations to the court about plan feasibility and compliance.

| Trustee | District / Jurisdiction | Address | Phone | Email / Website |

|---|---|---|---|---|

| Amrane Cohen | Central District of California — Santa Ana Division | 770 The City Drive South, Suite 8500, Orange, CA 92868 | (714) 621-0200 | amrane@ch13ac.com 13Network – Cohen |

| Nancy K. Curry | Central District of California — Los Angeles | 1000 Wilshire Blvd., Suite 870, Los Angeles, CA 90017 | (213) 689-3014 | ncurry@trusteecurry.com curry.trustee13.com |

| Kathy Anderson Dockery | Central District of California — Los Angeles | 801 Figueroa Street, Suite 1850, Los Angeles, CA 90017 | (213) 996-4400 | TRUSTEE@LATRUSTEE.COM latrustee.com |

| Elizabeth F. Rojas | Central District of California — San Fernando Valley & Northern Divisions | 15260 Ventura Blvd., Suite 830, Sherman Oaks, CA 91403 | (818) 933-5700 | lrojas@ch13wla.com ch13wla.com |

| Rodney A. Danielson | Central District of California — Riverside | 3787 University Avenue, Riverside, CA 92501 | (951) 826-8000 | rodd@rodan13.com rodan13.com |

| David P. Cusick | Eastern District of California — Sacramento Division | P.O. Box 1858, Sacramento, CA 95812 | (916) 856-8000 | legalmail@cusick13.com cusick13.com |

| Lilian G. Tsang | Eastern District of California — Fresno & Modesto Divisions | P.O. Box 3051, Modesto, CA 95353-3051 | (209) 576-1954 | info@mod13.com mod13.com |

| Martha G. Bronitsky | Northern District of California — Oakland | P.O. Box 5004, Hayward, CA 94540 | (510) 266-5580 | 13trustee@oak13.com oak13.com |

| David E. Burchard | Northern District of California — San Francisco & Santa Rosa | P.O. Box 8059, Foster City, CA 94404 | (650) 345-7801 | administrator@burchardtrustee.com burchardtrustee.com |

| Devin Derham-Burk | Northern District of California — San Jose | P.O. Box 50013, San Jose, CA 95150-0013 | (408) 354-4413 | faxlt@ch13sj.com 13Network – San Jose |

| Michael Koch | Southern District of California — San Diego & Imperial Counties | 402 West Broadway, Suite 1450, San Diego, CA 92101 | (619) 338-4006 | mkoch@ch13.sdcoxmail.com casb.uscourts.gov/trustees |

How Trustee Assignments Work in California

California has four federal districts—Northern, Eastern, Central, and Southern— and each district is divided into divisions (for example, Los Angeles, Riverside, San Jose, Sacramento, San Diego). Your trustee is assigned based on the division where your case is filed. Use the contact table below to locate the correct office and follow that office’s website instructions for payments and documents.

How To Work Successfully With Your Trustee

Before You File

- Get Documents Ready: Gather recent pay stubs, bank statements, tax returns, and proof of expenses.

- Be Accurate: Make sure schedules list all income, debts, assets, and transfers; accuracy prevents delays.

- Credit Counseling: Complete the required counseling from an approved provider before filing.

Right After Filing

- Start Payments Immediately: Make your first plan payment on time—even before confirmation—using the method your trustee requires (wage order or approved online portal).

- Read Trustee Instructions: Each trustee’s website lists payment addresses, online payment systems, and document-upload portals.

- Prepare for the §341 Meeting: Bring a valid photo ID and proof of Social Security number; know the basics of your schedules and plan.

During Your Plan

- Stay Current: Make every payment on time and keep proof. Late payments can trigger motions to dismiss.

- Taxes: File annual tax returns. Many plans require you to submit returns and sometimes turn over part of refunds.

- Report Changes: Tell your attorney promptly about income changes, new debts, large purchases, or windfalls (like an inheritance).

- Insurance & Assets: Maintain insurance on vehicles and real property when required by your plan or local practice.

- Debtor Education: Complete the financial management course before your last payment so discharge is not delayed.

Common Mistakes To Avoid

- Mailing Payments to the Wrong Address: Always use the address or online system specified by your trustee.

- Missing Documents: Promptly respond to trustee document requests to avoid continuances or objections.

- Taking New Debt Without Approval: In chapter 13, court approval is often required before new borrowing.

- Ignoring Income Changes: If your income shifts, ask your attorney about a plan modification rather than falling behind.

Payment & Correspondence Essentials

- Use Official Channels: Follow the payment portal or wage order instructions on your trustee’s website.

- Include Identifiers: Put your full name and case number on all payments and correspondence.

- Never Send Cash: Use the payment types your trustee accepts; keep receipts or confirmations.

- Confirm Remit vs. Mailing Address: Some offices use different addresses for payments and correspondence.

When To Contact Your Attorney (Not the Trustee)

- Plan payment trouble or job/income changes that may require a plan modification.

- Questions about buying/selling a car or home, taking on new credit, or refinancing.

- Tax issues, domestic support obligations, or claims disputes.

- Any motion, objection, or notice you do not fully understand.

California Chapter 13 Trustees: Contact Table

Use the table below to find the correct trustee for your division. Follow the linked website for each office’s latest payment instructions, forms, and document upload options.

Final Tips

- Set calendar reminders for payment due dates, tax filings, and any deliverables requested by the trustee.

- Keep your mailing address, phone, and email updated with your attorney so you never miss notices.

- Retain copies of everything you submit and save payment confirmations for your records.

This information is for educational purposes and is not legal advice. Always consult your attorney about your specific situation and your trustee’s current requirements.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin