Chapter 7 Bankruptcy Arizona: A Practical Guide

- What this page covers: Arizona-specific points that commonly matter in Chapter 7, including the Arizona exemption system, the Arizona median-income snapshot used in the means test, and where cases are filed in the District of Arizona.

- Primary sources used: We link to official sources whenever possible—such as Arizona statutes (A.R.S. Title 33) and the U.S. Trustee Program median-income tables.

- Keep data current: Some figures (like median income and exemption limits) can change. We provide effective dates and link out to the official source tables and statute pages so you can verify the latest information.

If you’re staring at bills, garnishment notices, or a bank account that never seems to catch up, it’s normal to wonder whether chapter 7 could actually give you a clean reset—or create new problems you didn’t see coming. This guide is written to help you get oriented fast, using plain-English explanations and Arizona-specific details that can change how a case plays out (like which exemption rules apply, how the Arizona means test snapshot works, and where you file in the District of Arizona). The goal isn’t to push you toward filing—it’s to help you understand the moving parts so you can ask smarter questions, spot red flags early, and walk into a consultation feeling prepared.

Not sure if Chapter 7 is a fit? Ask about eligibility, Arizona exemptions, and alternatives like Chapter 13.

Chapter 7 in Arizona — Summary

This Arizona page focuses on the parts that are most state-specific—especially which exemption system applies, the Arizona median-income snapshot used in the means test, and where cases are filed. For the federal overview and nationwide rules, see the Chapter 7 bankruptcy national guide.

- Exemption system: Arizona generally requires filers to use Arizona exemptions (the state “opt-out” approach), which affects what property may be protected.

- Median income jump: Go to Arizona median income snapshot for the current table by household size.

- Where you file jump: See where you file in Arizona for the official court/venue info.

- State exemptions link: Use Arizona bankruptcy exemptions for the current categories and limits.

- National guide link: For process, timelines, discharge basics, and common FAQs, visit Chapter 7 bankruptcy.

What’s Different in Arizona for Chapter 7

Chapter 7 is federal law, so the core process (petition, trustee review, the 341 meeting, and discharge rules) is broadly similar nationwide. What tends to feel “different” from state to state is mostly about property protection, local filing logistics, and a few Arizona-specific practical considerations.

- Arizona uses state exemptions (opt-out): Arizona generally requires filers to use Arizona’s exemption statutes instead of the federal exemption list. The opt-out provision is commonly referenced at A.R.S. § 33-1133(B).

- What you can protect depends on Arizona categories and limits: Home equity, vehicles, household goods, tools of the trade, and retirement accounts are handled through Arizona’s exemption framework. For the current categories and up-to-date limits, use our Arizona bankruptcy exemptions page.

- Median income figures are state-specific: The means test is federal, but the median-income table used as a first checkpoint varies by state and household size. Jump to Arizona’s median income snapshot to see the current figures cited on this page.

- Filing is handled in the District of Arizona: Court location and local procedures (including where hearings/meetings are scheduled) are specific to Arizona. See where you file in Arizona for the official court/venue section.

- Community property can affect the “big picture” in Arizona: Arizona’s community-property rules can matter when one spouse files, how some debts are treated, and how certain assets are categorized. If that’s your situation, see Can Just One Spouse File Bankruptcy?.

For the nationwide overview of Chapter 7 (process, timelines, discharge basics, and common FAQs), visit our Chapter 7 bankruptcy national guide.

Arizona Median Income Snapshot

A common first checkpoint in the Chapter 7 means test is whether your household income falls below Arizona’s median income for your family size. If your income is above the median, you may still qualify, but the means-test paperwork is typically more involved.

| Household Size | Annual Median Income (USD) |

|---|---|

| 1 | $72,039 |

| 2 | $86,745 |

| 3 | $102,274 |

| 4 | $118,067 |

| Add $11,100 for each person over 4. | |

These figures reflect cases filed on or after November 1, 2025, and they are updated periodically. Always verify against the latest U.S. Trustee Program table: UST Median Family Income by Family Size.

- Helpful note: The means test looks at more than gross income (it also considers certain allowed expenses). Being above the median does not automatically mean you can’t file Chapter 7.

Exemptions in Chapter 7 in Arizona

In a Chapter 7 case, exemptions are the rules that help determine what property you may be able to protect. Arizona is different from some states because it generally requires filers to use Arizona’s state exemptions instead of the federal exemption list (often called the “opt-out” approach).

Arizona’s exemption statutes are in A.R.S. Title 33, and the opt-out provision is commonly cited at A.R.S. § 33-1133(B).

- Why this matters: If an asset is protected by an applicable exemption, it is typically treated as protected property in the case. If an item is not protected (or is only partially protected), that can raise questions about non-exempt value.

- Limits change over time: Exemption categories and amounts can be updated, which is why we keep the detailed, current list in one place.

- Start here for current limits: See Arizona bankruptcy exemptions for categories, current dollar limits, and examples.

If your main concern is protecting a home, also see Arizona Homestead Exemption Explained.

Protecting a Home and Car in Arizona

For many people, the biggest practical concern in Chapter 7 is whether they can protect a primary residence or a vehicle. In Arizona, those protections are tied to Arizona’s exemption statutes in A.R.S. Title 33.

- Home (homestead): Arizona’s homestead protection is addressed in A.R.S. § 33-1101. Whether it applies (and how much equity may be protected) depends on your facts and the current statutory limits.

- Car (vehicle equity): Arizona’s vehicle exemption is commonly cited at A.R.S. § 33-1125. The key issue is typically your equity in the vehicle (what it’s worth minus what you owe), not just the monthly payment.

- Keep the numbers current: Exemption limits can change, so we keep the current limits and examples in the Arizona bankruptcy exemptions hub.

For a focused walkthrough of how Arizona’s homestead protection works (including common terms and practical examples), see Arizona Homestead Exemption Explained.

Where You File in Arizona

Chapter 7 cases for Arizona are filed in the U.S. Bankruptcy Court for the District of Arizona. The court has divisional offices in Phoenix, Tucson, and Yuma, and cases are generally assigned based on county. The court also hears cases in additional locations (for example, Flagstaff and Bullhead City).

- Start with the court’s official “Where do I file?” guidance: Where do I file? (District of Arizona Bankruptcy Court)

- Divisional office pages (addresses, hours, phone numbers): Phoenix, Tucson, Yuma.

- Forms and filing basics: The court’s forms page is a good starting point for official forms and court-provided resources.

- Electronic filing (CM/ECF): If you’re looking for the court’s electronic filing portal and related information, see District of Arizona Bankruptcy Court CM/ECF.

If you want a broader overview of how Chapter 7 works nationwide (process, timelines, and common questions), see the Chapter 7 bankruptcy national guide.

The Chapter 7 Process in Arizona

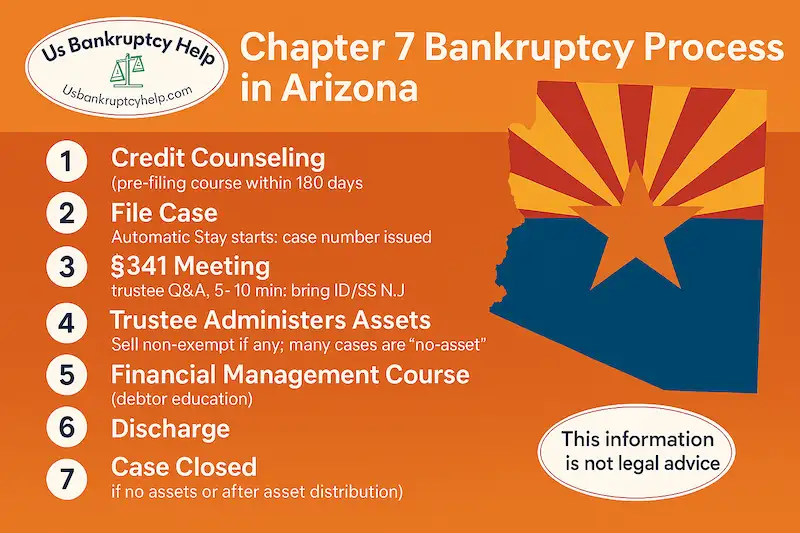

Below is a high-level overview of what Chapter 7 typically looks like in practice. It’s meant to help you understand the flow of a case and what comes next—not to replace official instructions or professional guidance.

- Prepare the information: Most cases start with gathering key documents (income records, recent tax returns, bank statements, a full list of debts, and a basic inventory of assets).

- Complete the required credit counseling: A pre-filing credit counseling course is required before the case is filed.

- File the case: Filing the petition and schedules starts the case and usually triggers the automatic stay, which pauses most collection activity.

- Trustee review: A Chapter 7 trustee reviews the filings and follows up if documents are missing or if asset/exemption questions need to be clarified.

- The 341 meeting: You attend a short recorded Q&A meeting where the trustee confirms identity and asks about the information in the paperwork.

- Complete debtor education: After filing, a debtor education course is required before a discharge can be entered.

- Discharge and closing: If requirements are met and no objections are sustained, the court enters the discharge order and the case is later closed.

For a deeper, nationwide walkthrough (timelines, discharge basics, common issues, and FAQs), see our Chapter 7 bankruptcy national guide.

Arizona Chapter 7 FAQs

These FAQs cover common, Arizona-relevant questions people ask when comparing options and planning a Chapter 7 filing. The underlying rules are mostly federal, but the answers are written for Arizona readers (including Arizona’s community-property context and Arizona exemption links).

How often can you file Chapter 7 bankruptcy in Arizona?

The timing rules are federal and apply in Arizona the same way they apply nationwide. In general, you must wait 8 years between Chapter 7 cases (measured petition date to petition date) to receive another Chapter 7 discharge.

If your prior case was Chapter 13, the timing is different. Typically, you must wait 6 years from the Chapter 13 filing date to file Chapter 7 and receive a discharge—unless the Chapter 13 plan paid 100% to unsecured creditors, or paid at least 70% in good faith using best efforts.

How long does a Chapter 7 case take in Arizona?

Many straightforward Chapter 7 cases run about 4–6 months from filing to discharge. Cases can take longer if additional documents are requested, if assets need closer review, or if other issues (like reaffirmation agreements) need to be addressed.

Can inherited property affect a Chapter 7 case in Arizona?

Yes. If you become entitled to an inheritance within 180 days after filing, it typically becomes part of the bankruptcy estate. Whether an inheritance is protected depends on the type of asset and what exemptions may apply. Because the timing can be important, it’s critical to disclose changes promptly and review the issue carefully.

Can I file Chapter 7 without my spouse in Arizona?

Yes—one spouse can file alone. Arizona is a community-property state, so a single-spouse filing can still affect community assets and how certain debts are treated. If you’re deciding whether to file jointly or individually, see Can Just One Spouse File Bankruptcy?.

Where can I find Arizona exemption information?

Arizona generally requires filers to use Arizona exemptions (rather than the federal list). For the current categories, limits, and examples, start with Arizona bankruptcy exemptions.

Next Steps and Options in Arizona

If you’re considering Chapter 7 in Arizona, the most helpful “next step” is usually getting clear on fit: whether you’re likely to qualify under the means test, how Arizona exemptions apply to what you own, and whether another option (like Chapter 13) better matches your goals.

- Confirm the basics: Review the Arizona median income snapshot and gather a simple list of your debts, income sources, and monthly expenses.

- Inventory what you own: Make a list of major assets (home, vehicles, bank balances, retirement accounts, tax refunds, and valuable personal property). Then compare that list to Arizona bankruptcy exemptions to understand what categories may apply.

- If you own a home: Review how the Arizona homestead works and the common terms that affect equity calculations on our Arizona Homestead Exemption Explained page.

- Compare alternatives: If you’re behind on a mortgage or car, have nondischargeable debts, or don’t qualify for Chapter 7, compare against Chapter 13 in Arizona.

- Use the official court resources: For filing/venue basics and official pages, see where you file in Arizona.

For more nationwide questions and a deeper walkthrough of Chapter 7, visit our Chapter 7 bankruptcy national guide.

Explore Our Arizona Bankruptcy Guides

Explore More National Bankruptcy Guides

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin