Chapter 13 Bankruptcy in Arizona

This page explains how chapter 13 works in Arizona in plain English, including common use-cases, eligibility basics, and what to expect from trustees and the court. For informational purposes only, not legal advice; outcomes depend on your facts and filing history. References include the federal Bankruptcy Code sections cited on this page and official District of Arizona rules and forms, and we update this page when procedures or thresholds change.

Chapter 13 bankruptcy in Arizona is a court-supervised repayment option for people with regular income who need a structured way to deal with debt over time. Instead of trying to resolve each creditor separately, you propose a repayment plan and make payments under court protection. Most plans run three to five years, and the exact payment amount depends on your budget, what you’re trying to protect, and what bankruptcy law requires you to pay.

People often look at Chapter 13 when they need time to catch up on missed mortgage or car payments, stop many collection actions, and keep important property while paying what they can afford each month. Whether Chapter 13 is a good fit depends on your income stability, the types of debts you have, any past-due secured payments, and your long-term financial goals. Outcomes can differ from one Arizona case to another because the numbers—and the plan requirements—are tied to your specific situation.

Chapter 13 Bankruptcy in Arizona: At a Glance

- Who It’s Commonly For: Arizonans with steady income who need time to get current on secured debts—like a mortgage or vehicle—while paying other debts in an organized, court-supervised plan.

- Plan Timeline: most chapter 13 repayment plans last three to five years. The length and payment amount depend on your income, expenses, arrears, and what bankruptcy law requires your plan to pay.

- What It Can Help With: a chapter 13 case can usually pause many collection actions and create a structured path to catch up missed payments, address certain priority debts, and protect equity that could be at risk in a faster case.

- What You Need to Succeed: a realistic monthly budget, reliable plan payments, and staying current on ongoing obligations required by your plan (for example, regular mortgage payments if paid outside the plan).

- Arizona-Specific Note: Arizona exemption laws and local trustee practices can affect plan requirements, especially when you have equity in a home, vehicle, or other property.

What Is Chapter 13 Bankruptcy in Arizona?

Chapter 13 bankruptcy in Arizona is a court-supervised repayment process for individuals with regular income. You propose a repayment plan—most often three to five years—and make payments under court protection while the plan addresses your debts in an organized way. The goal is usually to create a payment structure you can actually maintain while staying protected from many collection actions.

People often consider Chapter 13 when they need time to catch up on missed payments and want to keep important property, such as a home or vehicle. Whether it works well in your case depends on your income stability, the types of debt you have, what you’re behind on, and what bankruptcy law requires your plan to pay.

Unlike chapter 7, which often focuses on discharging qualifying unsecured debts in a shorter timeframe, chapter 13 is built around a custom repayment plan. Your proposed plan payment is based on your income, reasonable living expenses, and what the Bankruptcy Code requires you to repay (including certain priority debts and any amounts needed to keep secured property).

In many cases, Chapter 13 can stop a foreclosure sale long enough for the court to review your situation, spread out missed mortgage or car payments over time, and provide a structured way to deal with certain debts that are difficult to manage outside of court, such as some tax debts or domestic support arrears. You usually keep your home, vehicles, and other essential property as long as you stay current on plan payments and any required ongoing payments.

Because this is Arizona, state-specific rules still matter. Arizona exemption laws — including the Arizona homestead exemption — can affect how much your plan must pay to unsecured creditors in chapter 13, especially when you have equity in property. Local chapter 13 trustees in Phoenix, Tucson, and Yuma may also have procedural preferences that shape how plans are reviewed and what documentation is required.

This guide walks through how chapter 13 works in Arizona step by step—who it helps, how plans are structured, how trustees and judges evaluate your case, and what a successful discharge can look like when you complete the plan.

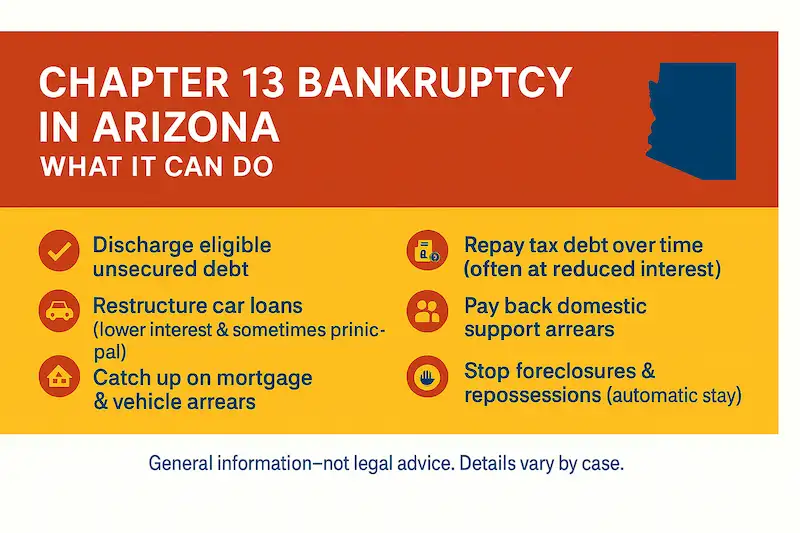

Key Benefits of Chapter 13 Bankruptcy in Arizona

Chapter 13 is not just “chapter 7 with payments.” For some Arizona filers, it’s the better fit because it’s designed for people with steady income who need time and structure—especially if they are behind on secured debts, facing foreclosure or repossession, dealing with tax or support arrears, or sitting on equity that might be at risk in chapter 7. Instead of negotiating with each creditor separately, you propose one court-approved plan and usually make a single monthly payment to a chapter 13 trustee, who distributes funds based on the plan’s terms.

The right plan may help you keep your home, save vehicles, manage certain tax debts, and still discharge eligible unsecured balances at the end of the case. Here’s a practical look at how the main benefits of chapter 13 often apply for Arizona filers:

| Benefit | Meaning in AZ | Who It Helps |

|---|---|---|

| Stop Foreclosure & Catch Up Mortgage Arrears | Filing chapter 13 triggers the automatic stay, which can pause foreclosure activity—including a scheduled trustee sale—while the case gets moving. Past-due mortgage payments are typically spread out over the plan term while you keep making your regular monthly payment going forward. | Arizona homeowners who are behind on payments or facing a scheduled foreclosure but want to keep their house and can afford a catch-up plan. |

| Save Vehicles & Restructure Car Loans | Chapter 13 can stop repossession and roll past-due car payments into the plan. In some cases, federal bankruptcy law may allow changes such as adjusting interest or paying an amount tied to the value of the vehicle, depending on timing, the type of loan, and other required factors. | Drivers who need their car for work or family and are behind or upside-down on one or more auto loans. |

| Manage Taxes & Priority Debts | Certain income tax debts, support arrears, and other priority claims generally must be paid in full. Chapter 13 can allow repayment over the life of the plan, while unsecured debts may receive only a percentage depending on your case. | Arizona filers with IRS or ADOR tax balances, child support or spousal support arrears, or other priority debts that are not usually discharged in chapter 7. |

| Protect Equity & Non-Exempt Assets | If your equity exceeds what Arizona exemption laws protect (for example, in a home, vehicle, or other property), chapter 13 may allow you to keep the asset and pay additional value into your plan for unsecured creditors rather than risk liquidation in chapter 7. | Homeowners and small business owners with borderline or above-limit equity who want to avoid liquidation but still need meaningful debt relief. |

| Consolidated, Court-Supervised Payment | Many debts are addressed through one monthly payment to the chapter 13 trustee. Collection activity is typically paused while the case is active, as long as you remain current with required payments and comply with court rules. | Arizonans with multiple creditors, lawsuits, or garnishments who need structure and accountability instead of ongoing collection pressure. |

| Co-Debtor Stay on Consumer Debts | In many chapter 13 cases, the automatic stay can temporarily protect co-signers on certain consumer debts while the plan is in place and the debt is being handled as proposed. Whether this applies depends on the type of debt and the case details. | Filers who have co-signed with a spouse, parent, or child and want to reduce the risk of collection activity against that person during the case. |

| Discharge of Remaining Unsecured Debt | After you complete required plan payments and meet eligibility rules, the court can issue a chapter 13 discharge for remaining eligible unsecured balances—even if those creditors were paid only a portion through the plan. | Arizona filers who can commit to 3–5 years of structured payments in exchange for a more controlled path out of overwhelming unsecured debt. |

When Chapter 13 May Not Be the Right Fit in Arizona

Chapter 13 is a powerful tool, but it isn’t ideal for everyone. In some Arizona cases, another approach—such as chapter 7 or a negotiated workout—may provide faster or more affordable relief. Here are common situations where chapter 13 deserves a careful second look:

- Income is too unstable to maintain a 3–5 year plan. Chapter 13 requires reliable monthly payments. If income fluctuates dramatically—seasonal work, commission-heavy jobs, or recent unemployment—chapter 7 may be a more realistic path.

- Your assets are fully protected under Arizona exemption laws. If you qualify for Arizona exemption laws and do not need a repayment plan to catch up on secured debts, chapter 13 may add time and cost without adding meaningful protection.

- The plan payment is higher than the problem you’re trying to solve. If you are not behind on a mortgage, do not have tax or support arrears, and do not need to restructure a car loan, the required plan payment may outweigh the benefit.

- Most of your debt is unsecured. If your debt is primarily credit cards, medical bills, or personal loans, chapter 7 can often discharge eligible balances in a short timeframe without the ongoing administrative burden of a multi-year plan.

- You recently filed a prior bankruptcy case. Prior filing history can affect eligibility for a discharge and may limit how quickly the automatic stay applies. Timing can matter if you need protection right away.

- You can’t stay current on ongoing obligations. Chapter 13 usually requires staying current on both plan payments and any direct payments (like a mortgage, vehicle loan, or support). If you can’t keep up with both, the case may be dismissed and collections can resume.

A strong chapter 13 plan is about fit—income stability, goals, assets, arrears, and what Arizona law protects. Many people find it helpful to review the numbers and options with a qualified Arizona bankruptcy attorney before committing to a 3–5 year plan.

Downsides and Tradeoffs to Consider Before You File

Chapter 13 can be an excellent tool when you need time and structure, but it’s also a long commitment. The best outcomes usually come from going in with clear expectations—what chapter 13 solves, what it does not solve, and what you’ll need to do to finish the plan successfully.

A People-First Way to Think About Tradeoffs

Two questions help most people decide: (1) What problem needs solving right now (foreclosure pressure, repossession risk, impossible payments, garnishment, tax or support arrears)? (2) What needs protecting (housing, transportation, income stability, family budget)? chapter 13 is usually a strong fit when protecting something important requires time—and you have a realistic payment plan to get there.

- It’s a 3–5 year commitment (and payment discipline matters): chapter 13 is designed around consistent plan payments. If income is unstable or your budget is already stretched to the breaking point, the case can become stressful and may be at risk of dismissal.

- Your “required payment” may be higher than expected: plan payments aren’t based only on what you want to pay. They can be driven by things like mortgage arrears, vehicle treatment, priority debts (taxes or support), and how Arizona exemption laws apply when you have equity.

- You may have to stay current on more than one payment: many filers must keep up with the plan payment and certain ongoing obligations (for example, a regular mortgage payment if paid outside the plan). The tradeoff is strong protection—but only if the “two-payment reality” is sustainable.

- Life changes can require plan changes: job changes, overtime swings, medical costs, vehicle repairs, or household changes can force a plan modification. That’s normal, but it means chapter 13 works best when your plan has a little breathing room.

- Credit impact is real, but finishing matters: chapter 13 stays on a credit report for years. Many people rebuild gradually by adding new positive history, but the most important “credit event” is completing the plan and keeping core bills current.

Before You File: 3 Quick Reality Checks

- Can your budget handle a plan payment for 3–5 years? If the plan only works “on a perfect month,” it may need to be rethought.

- Are you current on the things you want to keep? If you’re trying to keep a home or vehicle, the plan usually works best when ongoing payments are realistic.

- What problem are you solving first? foreclosure timing, repossession risk, taxes, support arrears, lawsuits—clarity here makes the right chapter (and the right plan) easier to choose.

Common Mistakes That Can Derail a Chapter 13 Plan in Arizona

Chapter 13 is designed to be a structured path forward, but the plan only works if you can stay compliant over time. The goal of this section isn’t to scare anyone—it’s to highlight the issues that most often create avoidable stress, delays, or dismissal risk in real-world chapter 13 cases.

- Missing plan payments (or paying late): Even one missed payment can trigger trustee action or require quick damage control. If your income is variable, it helps to build in a buffer when possible.

- Falling behind on “outside-the-plan” obligations: Many filers must stay current on certain ongoing payments in addition to the plan (for example, a regular mortgage payment if it’s paid outside the plan). When those payments slip, creditors may seek relief from the stay.

- Not providing documents the trustee requests: Arizona trustees commonly request pay stubs, bank statements, tax returns (or proof of filing), and insurance information. Delays can slow confirmation or create objections that could have been avoided.

- Not reporting meaningful changes in income or expenses: Chapter 13 can sometimes be adjusted when life changes, but surprises create problems. Job changes, reduced hours, new household members, or major medical costs are worth flagging early so the plan can be evaluated realistically.

- Assuming the automatic stay is “set it and forget it” protection: Creditors can ask the court to lift the stay, and prior filings can affect how quickly stay protection applies. Staying current and following court requirements is what keeps the protection meaningful.

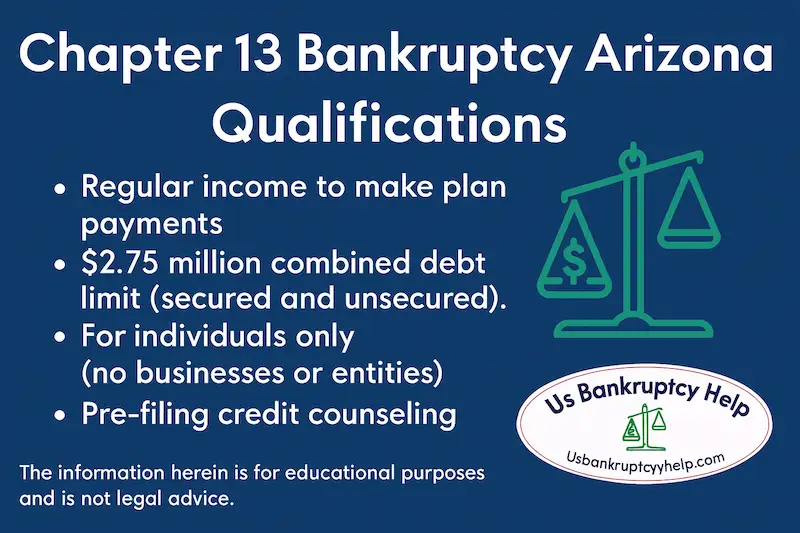

Eligibility Criteria for Chapter 13 Bankruptcy in Arizona

Not everyone can simply decide to file chapter 13 in Arizona and expect a plan to be confirmed. Federal law sets baseline eligibility rules—most importantly 11 U.S.C. § 109(e), § 521, and § 1308—and then your plan still must meet confirmation requirements. In practice, cases in the District of Arizona also come with document and budgeting expectations that affect whether a plan is realistic. Before you invest time and money in a case, it helps to confirm whether chapter 13 is even on the table and whether a workable plan is likely.

Here is a practical snapshot of the main eligibility requirements for a chapter 13 case in Arizona:

| Eligibility Factor | What It Means | AZ Notes |

|---|---|---|

| Regular Income | You must have a reliable source of income (wages, self-employment, pension, Social Security, or a combination) that can support a monthly plan payment and your ongoing living expenses. | Arizona chapter 13 trustees commonly review pay stubs, P&Ls, bank statements, and your projected household budget to evaluate whether a proposed plan is realistically affordable. |

| Debt Limits | Under 11 U.S.C. § 109(e), chapter 13 is only available to individuals with debt below certain ceilings. For cases filed on or after April 1, 2025, secured debts generally must not exceed about $1,580,125 and unsecured debts must be below roughly $526,700. These figures adjust periodically, so the applicable limits depend on your filing date. | Arizona courts enforce these federal limits. If you exceed them, your attorney may discuss chapter 11 or other strategies. |

| Tax Return Compliance | Under 11 U.S.C. § 1308, you generally must file all required tax returns for taxable periods ending within the four-year period before the filing date, and the timing is tied to the first scheduled 341 meeting. Missing returns can delay progress or lead to problems under § 521. | Arizona chapter 13 trustees routinely request copies of recent federal and state returns (or proof of filing) and may not recommend confirmation until the tax-return issue is resolved. |

| Individual (Not Corporation/LLC) | Only individuals (and married couples filing jointly) may file chapter 13. Business entities must file under a different chapter. | Many Arizona small-business owners file chapter 13 personally to reorganize personal guarantees and business-related debts. |

| Prior Case History | If you filed bankruptcy within the last year, 11 U.S.C. § 362(c)(3)–(4) may limit or eliminate the automatic stay. Prior dismissals can also affect discharge eligibility and case strategy. | Arizona attorneys review filing history carefully to determine whether the stay will apply automatically and whether a motion may be needed to extend it. |

| Venue & Residency | You typically file where you have lived or operated your principal place of business for most of the prior 180 days. | Arizona filers generally appear in the District of Arizona, with cases assigned to Phoenix, Tucson, or Yuma/Flagstaff/Bullhead calendars depending on county of residence. |

Even if you check every box on paper, chapter 13 still has to be feasible: your budget must support the required payment, and your plan must satisfy trustee expectations and the confirmation standards under 11 U.S.C. § 1325. A short review with an experienced Arizona bankruptcy attorney can confirm whether chapter 13 is available to you and whether it truly advances your goals better than chapter 7.

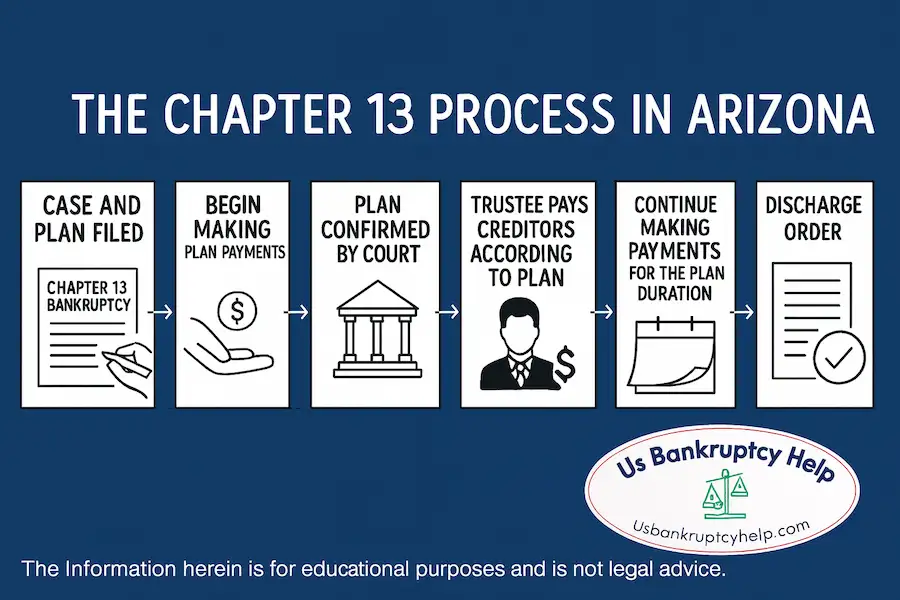

The Chapter 13 Bankruptcy Process in Arizona

A chapter 13 case in Arizona is more than filling out forms and sending a payment. It’s a structured, court-supervised process with clear milestones: filing, the automatic stay, the 341 meeting, plan confirmation, years of payments, and finally a discharge. The federal Bankruptcy Code and Rules provide the framework, but Arizona’s local rules, general orders, and official forms shape how that framework plays out in real life here.

Here’s how a typical chapter 13 case unfolds in Arizona:

Step 1: Credit Counseling (Pre-filing)

Before you can file, you must complete an approved credit-counseling course. This is usually a brief online or phone session that reviews your budget and available options. The certificate is required and must be filed with your petition.

Step 2: Filing the Petition and Plan

Your attorney prepares and files a chapter 13 petition, schedules, and a proposed plan with the U.S. Bankruptcy Court for the District of Arizona. The paperwork lists your income, expenses, assets, debts, and how you propose to treat each creditor over 3–5 years. Once filed, the case is assigned to a specific judge and chapter 13 trustee.

Step 3: Automatic Stay and Immediate Protection

Filing triggers the automatic stay, which often pauses foreclosures, repossessions, wage garnishments, and most lawsuits. Timing and prior filings can affect how the stay applies, so urgent situations (like an upcoming sale date) are typically handled with quick notice to creditors and, when needed, requests to the court.

Step 4: First Plan Payments and the 341 Meeting

Your first plan payment is due within 30 days of filing—even before the plan is confirmed. You also attend a short 341 meeting of creditors, conducted by your chapter 13 trustee (often by Zoom or phone). The trustee verifies your identity, asks questions about your income, expenses, assets, and plan, and may request additional documents such as pay stubs, bank statements, or tax returns.

Step 5: Plan Confirmation Hearing

After the trustee reviews your documents and any creditor or trustee objections are addressed, the court holds a confirmation hearing. In many Arizona cases, you may not need to personally appear if your attorney can resolve issues in advance, but the requirements depend on the judge and the specific issues in the case. The judge decides whether your plan is feasible, proposed in good faith, and compliant with the Bankruptcy Code, the Federal Rules of Bankruptcy Procedure, and Arizona’s local rules and general orders.

Step 6: Ongoing Payments and Trustee Distributions

For the next 3–5 years, you make regular payments to the chapter 13 trustee, who distributes funds according to the confirmed plan—typically covering secured arrears (like mortgage or car catch-up), priority debts (such as taxes and support), trustee fees, and a percentage to unsecured creditors. You generally must also stay current on direct payments required by your plan (for example, ongoing mortgage payments, certain vehicle payments if paid outside the plan, and support obligations).

Step 7: Debtor Education and Discharge

Before the end of your plan, you complete a separate debtor-education course and file the certificate. If you have made all required payments and remain eligible, the court enters a chapter 13 discharge, which eliminates remaining eligible unsecured balances. Your case is then closed, and you move forward with the benefits of cured arrears, resolved priority debts, and a cleaner balance sheet.

The mechanics of this process are also shaped by Arizona local rules, general orders, and official forms, which can change over time. Current versions are published on the court’s Rules, General Orders & Forms page: https://www.azd.uscourts.gov/rules-general-orders-forms. Because local requirements can be technical, many people rely on a knowledgeable Arizona bankruptcy attorney to track updates, draft a plan that fits local expectations, and address trustee questions from filing through discharge.

Who Are the Chapter 13 Bankruptcy Trustees in Arizona, and What Do They Do?

In every chapter 13 case, a court-appointed chapter 13 trustee oversees key parts of the repayment process. Trustees in the District of Arizona are appointed under 11 U.S.C. § 1302 and carry out duties under § 1302 and § 1326. In plain terms, the trustee reviews your plan, conducts your 341 meeting, collects plan payments, and (after confirmation) distributes funds to creditors according to the plan. This section is a broad overview, not a DIY guide—your Arizona bankruptcy attorney is typically the person who communicates with the trustee, responds to document requests, and resolves objections so your plan can move forward.

What Chapter 13 Trustees Do in Arizona Practice

- Review Your Petition, Schedules, and Plan: Trustees compare your income, expenses, assets, and debts with what your plan proposes to pay. If the numbers don’t line up—or if the plan does not satisfy 11 U.S.C. § 1325—they can object or request changes.

- Conduct the 341 Meeting: The trustee runs your section 341 meeting, verifies your ID, places you under oath, and asks questions about your budget, recent financial history, transfers, and the accuracy of your paperwork.

- Collect and Distribute Plan Payments: After you file, plan payments usually start within 30 days. You pay the trustee (often by wage order or an online system), and after confirmation the trustee sends funds to creditors according to your confirmed plan.

- Monitor Ongoing Compliance: Trustees watch for missed payments, changes in income, tax return issues, and insurance gaps. They can ask the court for action—including dismissal—if required payments or documents are not provided.

- Apply Local Rules and General Orders: Trustees also apply Arizona local rules, general orders, and court-approved plan forms in day-to-day practice, which is why plans should be drafted with local expectations in mind.

Arizona Chapter 13 Trustees & Practice Pointers

Arizona currently has three standing chapter 13 trustees. Your trustee is assigned based on where your case is filed. Always follow your official notice of bankruptcy case and the trustee’s most recent written instructions; addresses, lockboxes, and portals can change over time.

- Russell A. Brown — Chapter 13 Trustee (Phoenix Division)

Office: 3838 N. Central Ave., Suite 800, Phoenix, AZ 85012-1965

Phone: (602) 277-8996

Website: chapter13.info

Practice pointer: the site typically lists payment methods, document-upload instructions, and trustee forms used in ongoing cases. - Edward J. Maney — Chapter 13 Trustee (Phoenix Division)

Correspondence: 101 N. First Ave., Suite 1775, Phoenix, AZ 85003

Phone: (602) 277-3776

Website: maney13trustee.com

Practice pointer: payment lockbox/portal details should be taken from your case notice and the trustee’s current instructions, not from an old envelope or a prior case. - Dianne C. Kerns — Chapter 13 Trustee (Tucson & Yuma Divisions)

Correspondence: 31 N. 6th Ave., #105-152, Tucson, AZ 85701

Phone: (520) 544-9094

Website: dcktrustee.com

Practice pointer: the site typically provides plan-payment instructions, required-document lists, and FAQs tailored to cases assigned to this trustee.

How Arizona Chapter 13 Trustees Apply Local Rules in Day-to-Day Cases

The trustee’s duties come from federal law, but Arizona chapter 13 trustees apply those duties through the lens of local rules, general orders, and standing practices. Common issues they focus on include:

Comprehensive Arizona Bankruptcy Guidance & Resources

Expert insights and clear information to guide you through bankruptcy in Arizona, from Phoenix and Tucson to every community statewide.

- Budgets that are too tight (or too generous): If a budget leaves no room for ordinary surprises—or shows unusually high discretionary spending—expect questions and requests for clarification.

- Mortgage and HOA treatment: Trustees may flag plans that do not properly cure arrears, misclassify HOA dues, or conflict with Arizona’s homestead and exemption laws.

- Non-exempt equity and plan base: If you have significant non-exempt equity, trustees often focus on the “best interests of creditors” test under § 1325(a)(4) when evaluating what the plan must pay.

- Tax returns and refunds: Missing returns, inconsistent income, or large expected refunds commonly trigger document requests or plan changes.

- Insurance on homes and vehicles: Trustees often require proof that property securing a loan is insured throughout the case.

On top of that, the District of Arizona publishes its own local rules, general orders, and forms, which are updated from time to time on the court’s Rules, General Orders & Forms page: https://www.azd.uscourts.gov/rules-general-orders-forms. Many people rely on a knowledgeable Arizona bankruptcy attorney to track updates, draft plans that fit local expectations, and respond quickly if trustee concerns come up.

More Resources

For a complete overview, you can also review the U.S. Trustee Program region 17 resources (which includes Arizona), the court’s local rules, and our own national chapter 13 guide and chapter 7 vs. chapter 13 comparison. Together, these give you both the high-level rules and the Arizona-specific practice details that shape how chapter 13 works on the ground.

Life After Chapter 13 Bankruptcy in Arizona

Finishing a chapter 13 plan in Arizona is a meaningful milestone. You’ve made years of court-supervised payments, caught up critical debts, and received a discharge of remaining eligible balances. A chapter 13 case generally appears on your credit report for up to 7 years from the filing date, but the long-term impact is often driven by what you do next: building consistent on-time payments, keeping balances manageable, and sticking to a budget you can sustain.

Rebuilding Credit After Chapter 13

- Start small: choose one or two rebuilding tools such as a secured credit card or a credit-builder loan. Use them for predictable expenses and pay on time.

- Keep reported balances low—often under 10%–30% of the limit. Utilization isn’t the only factor in credit scoring, but it’s one you can control.

- Review your credit reports periodically and dispute obvious errors, including accounts that still report inaccurately after discharge.

Day-to-Day Financial Management

- Write a simple budget for housing, transportation, food, insurance, and an emergency cushion. Even a modest reserve can help prevent new high-interest debt when surprises hit.

- Automate key payments—especially rent or mortgage, car, and insurance—to reduce the risk of late marks caused by timing mistakes.

- Be cautious with products marketed to recent filers (high-fee cards, “credit repair,” or buy-here-pay-here car lots). If the terms are expensive or confusing, it can recreate the same pressure that led to bankruptcy.

Big Picture: Housing, Vehicles, and Lending

- Some Arizona filers qualify for auto financing after discharge (and sometimes earlier), but rates and terms vary widely. Keeping payments affordable and revisiting refinancing later can help.

- For mortgages, lenders often look for a period of clean history after bankruptcy depending on the loan program. A steady record of on-time housing and utility payments can help when you apply.

- Landlords, lenders, and insurers may ask for discharge paperwork, so keep a clean digital copy handy for applications and underwriting.

The goal after chapter 13 is not just to “get through” the bankruptcy, but to use it as a turning point. With a realistic budget, an emergency cushion, and a small number of well-chosen credit tools, many people see their credit profile stabilize and gradually improve over time.

Why Local Guidance Matters in Arizona Chapter 13

Chapter 13 in Arizona is not just math on a worksheet. A workable plan depends on details that vary from case to case—how Arizona exemption laws apply to your assets, how local chapter 13 trustees review your budget and documentation, and how the court applies the Bankruptcy Code alongside local rules and general orders. Small differences (like how you document income, how arrears are treated, or how equity is valued) can change what a confirmable plan looks like.

That’s why many people choose to work with an experienced Arizona bankruptcy attorney. A good local attorney can help you compare chapter 7 and chapter 13 side by side, stress-test your budget, and build a plan that matches what trustees in the District of Arizona typically expect to see. If income or expenses change while your case is pending, your attorney can also help you adjust course through the proper court process. The goal is not just to “file a case,” but to complete your plan, keep the property Arizona law allows you to protect, and earn a discharge that meaningfully improves your financial situation.

Frequently Asked Questions About Chapter 13 Bankruptcy in Arizona

Where are Arizona chapter 13 hearings held, and can I appear by phone or video?

Chapter 13 hearings for Arizona cases are scheduled by the U.S. Bankruptcy Court for the District of Arizona. The court has offices in Phoenix, Tucson, and Yuma, and it also hears matters in locations such as Flagstaff and Bullhead City depending on the case and calendar. Whether you can appear by phone or video depends on your judge and the type of hearing.

Your Notice of Hearing controls (date, time, location, and appearance instructions). You can also cross-check upcoming settings on the court’s public calendar, but always confirm against your case docket because schedules can change.

Note: Courts typically prohibit recording, photographing, or screen-capturing proceedings. Follow the instructions on your hearing notice and any courtroom rules for your division.

Where are § 341 “meeting of creditors” held for Arizona chapter 13 cases, and how do I attend?

For District of Arizona chapter 13 cases, § 341 meetings are conducted virtually by Zoom for cases filed on or after May 1, 2024 (with a phone option available for many meetings). Your official notice lists the date and time plus the Zoom link or Meeting ID, passcode, and any dial-in numbers.

To make it smoother: have a government photo ID and proof of your Social Security number ready, test your connection, and join a few minutes early. If you miss the meeting or arrive unprepared, your trustee may continue it to another date.

What are the current chapter 13 debt limits in Arizona?

Eligibility is set by federal law and applies statewide. For cases filed April 1, 2025 through March 31, 2028, you generally must have no more than $526,700 in unsecured debt and no more than $1,580,125 in secured debt (noncontingent, liquidated). These amounts adjust periodically, so if you’re filing later, confirm the limits that apply to your filing date.

How long does a chapter 13 repayment plan last in Arizona, and how are payments set?

Most Arizona chapter 13 plans run 3 to 5 years (often described as 36 to 60 months). Your plan length and monthly payment are based on your income, allowed expenses, and what the Bankruptcy Code requires you to repay—especially secured arrears (like past-due mortgage or car payments) and certain priority debts.

Many filers propose a 36-month plan when household income is below the Arizona median; if household income is above median, a 60-month plan is commonly required unless the plan pays required amounts sooner. The exact plan structure depends on your numbers and the issues in your case.

Will chapter 13 stop foreclosure or repossession in Arizona?

Filing a chapter 13 case usually triggers an automatic stay that pauses foreclosures, repossessions, and many other collection actions. Chapter 13 can also provide a structured way to catch up missed mortgage or car payments over time through your plan (subject to court approval).

Keep in mind: creditors can ask the court to lift the stay, and prior bankruptcy filings can affect how quickly stay protection applies. Staying current on required payments and following the confirmed plan are key to maintaining protection.

Next Steps: Is Chapter 13 Right for You in Arizona?

Chapter 13 gives Arizona filers tools that chapter 7 in Arizona often doesn’t—like creating a structured way to catch up a mortgage, keep vehicles, address certain tax or support arrears over time, and protect equity that could be at risk if you filed a faster case. Whether it’s the right fit depends on your income stability, budget, goals, and how Arizona exemption laws apply to your assets.

If you’re deciding between chapter 13 and other options, it can help to gather a few basics before you talk with anyone: how far behind you are on a mortgage or vehicle, your current monthly take-home income, a realistic household budget, and a list of priority debts (like recent taxes or support). A brief strategy session with a knowledgeable Arizona bankruptcy attorney can then focus on the questions that matter most: whether a plan payment is feasible, what you must pay to keep secured property, and what outcome is realistic if you complete the plan.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin