Arizona Bankruptcy Exemptions Explained

Arizona Bankruptcy Exemptions — At a Glance

Quick reference only — amounts and rules change; verify current law before filing.

- • Homestead: Up to $425,000 equity in your primary residence (A.R.S. § 33-1101). Federal law may cap recently acquired equity (1,215-day rule: 11 U.S.C. § 522(p)). Sale proceeds are generally protected for up to 18 months if handled properly (A.R.S. § 33-1101(C)).

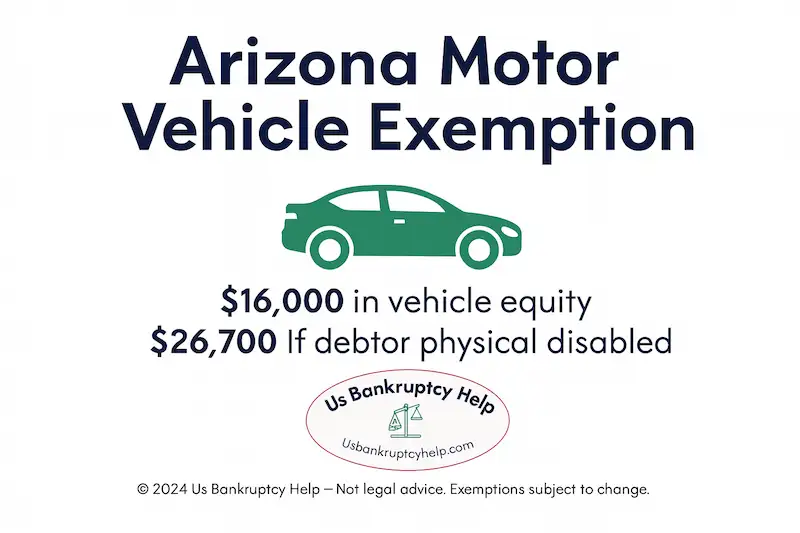

- • Motor vehicle: Up to $16,000 equity; up to $26,700 if the debtor or a dependent is physically disabled (A.R.S. § 33-1125(8)).

- • Household goods & personal property: Many household items are protected (amounts can be CPI-adjusted) (A.R.S. § 33-1123; A.R.S. § 33-1126).

- • Tools of the trade: Up to $5,000 in tools/equipment needed for work (A.R.S. § 33-1130).

- • Public benefits: Social Security, unemployment, and workers’ comp benefits are commonly protected under Arizona and/or federal law.

- • Retirement: Many qualified retirement plans are protected; IRAs can involve federal caps in some situations (11 U.S.C. § 522(n)).

- • Wildcard: Arizona does not have a general wildcard exemption.

- • Residency requirement: To use Arizona exemptions, you generally must have lived in Arizona for 730 days (2 years) before filing (11 U.S.C. § 522(b)(3)(A)).

- • Chapter 7 vs. Chapter 13: In chapter 7, exemptions help decide what you keep. In chapter 13, non-exempt equity can increase the minimum amount paid to unsecured creditors through the plan.

If you’re googling “Arizona bankruptcy exemptions,” you’re probably trying to answer one practical question: “If I file bankruptcy in Arizona, what do I get to keep?” Bankruptcy doesn’t mean losing everything. Exemptions are the rules that protect certain property so you can get debt relief without losing the basics you need to live and work.

Arizona is an opt-out state. That means most Arizona residents use Arizona’s exemption statutes instead of the federal exemption list. Residency timing matters: to use Arizona exemptions, you generally must have lived in Arizona for at least 730 days (2 years) before filing. If you moved recently, federal domicile rules may require another state’s exemptions (and in some situations a federal option can come into play).

The tables below list common Arizona bankruptcy exemptions by category. Amounts can change, and outcomes depend on your facts, so confirm current figures as of your filing date.

Caution Regarding Arizona Bankruptcy Exemptions

Before you rely on any exemption list, a few cautions matter in real cases:

- • Exemption amounts can change and some categories are adjusted over time. Always confirm current figures.

- • Exemptions are not automatic—you must claim the correct statute on your bankruptcy forms.

- • Arizona has no broad wildcard exemption, so matching assets to the correct statute is especially important.

This guide explains the major Arizona bankruptcy exemptions and how they’re typically used in consumer cases. It is informational only—not legal advice.

Whether you’re considering Chapter 7 or Chapter 13, understanding exemptions is key. Exemptions can affect what you keep in chapter 7 and can affect plan math in chapter 13.

How Arizona Bankruptcy Exemptions Work

Exemptions are the rules that decide what you can protect when you file bankruptcy in Arizona. In most cases you list assets on your bankruptcy schedules and claim exemptions by citing the correct Arizona statute. The trustee reviews the paperwork and looks for non-exempt equity or inconsistent valuations.

Key idea: exemptions protect equity (value minus liens), not the purchase price. Fair-market values and clean documentation help cases go smoothly.

Arizona Opts Out of Federal Bankruptcy Exemptions

Arizona is an opt-out state, meaning most filers must use the Arizona exemption list rather than the federal list (A.R.S. § 33-1133). Recent movers may have different results because of federal domicile rules (11 U.S.C. § 522(b)(3)(A)).

Who Qualifies for Bankruptcy Exemptions in Arizona?

Qualification is usually about domicile and timing. To use Arizona exemptions, you generally need to have lived in Arizona for at least 730 days (2 years) immediately before filing (11 U.S.C. § 522(b)(3)(A)).

- • Individuals: Most consumer filers in chapter 7 or chapter 13 can claim exemptions if domicile rules are satisfied.

- • Recent movers: If you don’t meet the 730-day rule, another state’s exemptions may apply.

- • Businesses: Corporations/LLCs do not claim personal exemptions the way individuals do.

Overview of Common Arizona Exemptions

Arizona exemptions are often easiest to understand in four buckets below. Amounts shown are the figures referenced in this page’s source content. Some Arizona exemptions are adjusted over time, so confirm the adjusted figure as of your filing date.

Real Property

These rules focus on your primary residence. In most cases, the key number is equity: market value minus valid liens.

| Exemption | What It Protects | Amount | Statute | Practical Notes |

|---|---|---|---|---|

| Homestead | Equity in your primary residence (home/condo/manufactured home) | Up to $425,200 equity (referenced figure; verify current amount) | A.R.S. § 33-1101 | Only one homestead per person/couple. Sale proceeds have special rules; federal law can cap certain newly acquired equity in some cases. |

Official statute text: A.R.S. § 33-1101

Motor Vehicle

This exemption protects equity in a vehicle, not the purchase price. Equity is generally fair market value minus the loan payoff.

| Exemption | What It Protects | Amount | Statute | Practical Notes |

|---|---|---|---|---|

| Motor Vehicle | Equity in one motor vehicle used for personal/family/household purposes | Individual: Up to $16,000 equity Disability: Up to $26,700 if the debtor or a dependent is physically disabled (as described in the statute) | A.R.S. § 33-1125(8) | Use a defensible value (KBB/market comps, photos, condition notes). Filing-date values matter. |

Official statute text: A.R.S. § 33-1125

Personal Property

These exemptions cover the “stuff of daily life” and work essentials. Values are typically fair market value (what it would sell for), not replacement cost.

| Exemption | What It Protects | Amount | Statute | Practical Notes |

|---|---|---|---|---|

| Household Goods & Appliances | Furniture, household goods (including consumer electronics), and appliances | Around $16,000 aggregate fair market value (referenced figure; verify current amount) | A.R.S. § 33-1123 | Inventory + photos help. Use realistic resale values. |

| Tools of the Trade | Tools/equipment/instruments/books needed for your work | Up to $5,000 aggregate fair market value | A.R.S. § 33-1130 | Document necessity (receipts/photos/work use). Tools generally do not include a personal-use vehicle. |

| Engagement & Wedding Rings | Engagement and wedding rings | Up to $2,000 aggregate fair market value | A.R.S. § 33-1125(4) | Use fair market value, not sentimental value. |

| Computer / Bicycle / Sewing Machine / Bible / Burial Plot (Grouped) | One computer, one bicycle, one sewing machine, a family bible, or a burial plot | Up to $2,000 aggregate fair market value | A.R.S. § 33-1125(7) | List what you’re claiming in the category so it’s clear. |

| Firearms | Firearms used for personal/family/household purposes | Up to $2,000 aggregate fair market value | A.R.S. § 33-1125(10) | Value is fair market value; list items clearly. |

| Wearing Apparel | Clothing | Up to $500 fair market value | A.R.S. § 33-1125(1) | Usually not contested unless luxury items are involved. |

Official statute text: Arizona Revised Statutes (Title 33)

Financial Assets

These exemptions involve money: cash in accounts, certain refunds/credits, wages, and retirement. This category often drives timing decisions in chapter 7.

| Exemption | What It Protects | Amount | Statute | Practical Notes |

|---|---|---|---|---|

| Cash in One Bank Account | Cash held in a single account at any one financial institution | Up to $5,200 in one account (referenced figure; verify current amount) | A.R.S. § 33-1126(A)(9) | Filing date and payday timing can matter in chapter 7. |

| Earned Income / Child Tax Credits (Refund Portion) | Certain earned income and child tax credits/refund portions (as described in the statute) | Exempt up to the lesser of total combined refunds or total combined eligible credits claimed | A.R.S. § 33-1126(A)(11) | Refund timing is a major planning issue. Bring recent returns and refund estimates. |

| Retirement Plans (Many Types) | Many retirement plans described in Arizona and federal law | Generally exempt, with exceptions (including certain recent contributions referenced in statute language) | A.R.S. § 33-1126(B) | Plan type and contribution timing matter; confirm details for your specific accounts. |

| Prepaid Rent / Security Deposit (If No Homestead Claimed) | Prepaid rent and security deposit for your residence if you do not claim a homestead exemption | Up to $2,000 | A.R.S. § 33-1126(C) | Designed for renters; useful when you’re not using homestead. |

| Wages (Garnishment Limit) | Limits how much weekly disposable earnings can be taken by process (outside support orders) | Generally the lesser of 10% of disposable earnings, or the amount above 60× the applicable minimum hourly wage | A.R.S. § 33-1131(B)–(C) | Support orders are treated differently; minimum wage changes can move the threshold. |

Statutes: Arizona Revised Statutes, Title 33 (Property). For the official text, start at azleg.gov/arstitle and navigate to Title 33, Chapter 8 (Exemptions).

Homestead Exemption

The Arizona homestead exemption can protect a significant amount of equity in your primary residence. The key number in bankruptcy is equity (market value minus liens), not what you originally paid.

If you sold a home and are holding proceeds, special rules and timing can apply. If you are anywhere near a limit—or dealing with sale proceeds—this is a place where getting experienced legal guidance matters.

Calculating Home Equity for the Homestead Exemption

Equity is generally: fair market value − mortgages/liens. If you are close to a limit, having defensible valuation support (market comps or an appraisal, plus payoff statements) can matter.

How Arizona Bankruptcy Exemptions Work in Chapter 7 vs. Chapter 13

If you’re researching Arizona bankruptcy exemptions, it’s important to understand that exemptions play a different role depending on whether you file chapter 7 or chapter 13. The statutes are the same, but how they affect your case—and your risk—can be very different.

Chapter 7: Exemptions Decide What You Keep

In a Chapter 7 bankruptcy in Arizona, exemptions are critical because the trustee’s job is to look for non-exempt equity. You must disclose everything you own; exemptions determine what property is protected from liquidation.

If an asset is fully covered by an Arizona exemption and valued reasonably, it is typically protected. If an asset has non-exempt equity, the trustee may require a buyback, additional payment into the estate, or—less commonly—the sale of the asset.

Key chapter 7 takeaway: Exemptions are about risk. Accurate valuations, correct statute selection, and timing can make the difference between a smooth case and one that becomes expensive or stressful.

Chapter 13: Exemptions Affect the Minimum Plan Payment

In a Chapter 13 bankruptcy in Arizona, exemptions usually don’t determine whether you keep property. Instead, they influence the minimum amount that must be paid to unsecured creditors through your repayment plan.

Here’s why: chapter 13 includes a “best interests of creditors” test. If you have non-exempt equity, your plan generally must pay unsecured creditors at least as much as they would have received in a hypothetical chapter 7 case. That makes exemption analysis and valuations just as important—but for different reasons.

Key chapter 13 takeaway: Exemptions are about math. Non-exempt equity doesn’t usually force liquidation, but it can increase the required plan payment and affect feasibility.

Why This Comparison Matters in Real Arizona Cases

- • Someone with borderline home or vehicle equity may be at risk in chapter 7, but may safely reorganize in chapter 13.

- • Overvaluing assets can unnecessarily increase a chapter 13 plan payment.

- • Underestimating equity in chapter 7 can invite trustee scrutiny or objections.

If you’re deciding between chapters, exemptions are often one of the biggest factors in that decision. For a deeper, Arizona-specific breakdown, these are our primary guides:

- • Chapter 7 Bankruptcy in Arizona — Complete Guide

- • Chapter 13 Bankruptcy in Arizona — Complete Guide

Bottom line: Arizona bankruptcy exemptions apply in both chapters, but they shape outcomes differently. Understanding that difference is essential before choosing how to file.

Common Mistakes to Avoid When Claiming Exemptions

Exemptions reward precision. Common issues include incomplete disclosures, inconsistent values, using the wrong statute, and assuming Arizona has a wildcard exemption when it does not.

Arizona Bankruptcy Exemptions: FAQs

Do exemptions mean I keep everything I own?

No. Exemptions protect specific property up to certain limits. If an asset has non-exempt equity, that can create risk in chapter 7 or affect plan payments in chapter 13.

Can I use the federal exemptions instead?

Arizona is an opt-out state, so most Arizona filers use Arizona exemptions. Recent movers may have a different outcome because of federal domicile rules.

How long do I need to live in Arizona to use Arizona exemptions?

Typically 730 days (2 years) before filing, under federal domicile rules.

Does filing jointly double the homestead exemption?

Not always. Some exemptions can be applied in ways that increase protection, but certain Arizona exemptions are not automatically doubled just because spouses file together. This often depends on ownership, community property rules, and how the statutes apply.

What is a wildcard exemption, and does Arizona have one?

A wildcard exemption is a flexible exemption that can be applied to many types of property. Arizona does not currently have a broad, general wildcard exemption.

For informational purposes only, not legal advice. Exemption outcomes depend on facts, timing, and current law. Always seek advice from a qualified Arizona bankruptcy attorney.

Explore Our Arizona Bankruptcy Guides

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin