Bankruptcy Chapter 7 in Wisconsin: A Practical Guide

If you're googling bankruptcy chapter 7 in Wisconsin, chances are you're tired of collection calls, worried about lawsuits or garnishments, and just want some straight answers. This guide is designed to walk you through how chapter 7 bankruptcy Wisconsin cases actually work in real life — not just in legal jargon.

Bankruptcy Chapter 7 in Wisconsin — At a Glance

- What Chapter 7 Is in Wisconsin — quick, liquidation-style fresh start for qualifying consumers (most cases discharge unsecured debt in about 3–6 months).

- Who Qualifies for Chapter 7 — Wisconsin chapter 7 means test, median-income comparison, and when higher-income filers can still qualify after allowed expenses.

- Income Limits & Means Test Details — current Wisconsin median-income table by household size and how the federal means-test formula under 11 U.S.C. § 707(b)(2) works in practice.

- Chapter 7 vs. Chapter 13 in Wisconsin — fast discharge and little non-exempt equity vs. a 3–5 year repayment plan to cure mortgage and car arrears and protect more property.

- Chapter 7 Process Overview — eligibility review, filing in the Eastern or Western District of Wisconsin, automatic stay, trustee review, 341 meeting, and discharge.

- Filing Chapter 7 Step-by-Step — documents to gather, required credit counseling, preparing the petition and schedules, and post-filing debtor-education course.

- Wisconsin Exemptions & Property Protection — choosing between Wisconsin exemptions (Wis. Stat. §§ 815.18 & 815.20) and the federal exemptions under 11 U.S.C. § 522(d), and how homestead and personal-property caps protect equity.

- Debts Discharged vs. Not Discharged — which unsecured debts (credit cards, medical bills, personal loans) usually go away, and which obligations (support, most student loans, recent taxes) typically survive.

- How Often You Can File Chapter 7 — the eight-year filing-to-filing rule between chapter 7 discharges and how prior chapter 13 cases can affect timing.

- Life After Chapter 7 in Wisconsin — credit-report impact, rebuilding strategy, budgeting, and using the discharge as a turning point instead of a quick fix.

- Working With a Wisconsin Chapter 7 Attorney — why local practice, trustees, and exemption choices matter, and how counsel helps you avoid means-test and exemption mistakes.

- FAQ & Common Concerns — timelines, keeping a house or car, impact on a non-filing spouse, and case costs.

- Typical Wisconsin Chapter 7 Outcomes — anonymized success stories for single filers, couples, and retirees facing lawsuits and collection pressure.

- Is Chapter 7 Bankruptcy in Wisconsin Right for You? — pulling together the means test, exemptions, debt mix, and long-term goals to decide on your best path.

For most people chapter 7 feels like hitting a financial reset button. In many cases you can eliminate credit cards, medical bills, and other unsecured debts while keeping essential property. For families searching phrases like "chapter 7 Wisconsin" online late at night, the real question is simple: will this give me a fresh start without losing everything?

In Wisconsin, specific rules and income limits apply. The chapter 7 income limits Wisconsin uses are built into the Wisconsin chapter 7 means test, a formula that compares your household income to state median income and then looks at your allowed expenses. The chapter 7 bankruptcy Wisconsin means test is often the first big hurdle—if your income is below the median, qualifying is usually straightforward.

It's also important to understand chapter 7 vs chapter 13 Wisconsin options. With chapter 7, the focus is on wiping out qualifying debts relatively quickly. With chapter 13, you commit to a 3–5 year repayment plan to catch up on things like mortgages and car loans. Neither chapter is "better" for everyone—the right choice depends on your income, assets, and long-term goals.

Filing chapter 7 in Wisconsin involves more than just filling out a few forms. You'll complete required credit counseling, file a formal petition with the U.S. Bankruptcy Court (Eastern or Western District of Wisconsin), and work with a court-appointed trustee who reviews your paperwork and identifies any non-exempt property.

The good news is that Wisconsin bankruptcy laws provide exemptions that protect many everyday assets. Depending on your situation, exemptions can cover a portion of your home equity, a vehicle up to a certain value, household goods, retirement accounts, and more. Understanding how these exemptions work before you file can make the difference between feeling terrified and feeling in control.

Because the stakes are high, many people choose to work with a chapter 7 bankruptcy attorney in Wisconsin. A knowledgeable local attorney can help you understand the chapter 7 means test Wisconsin uses, protect as much property as possible, and avoid costly mistakes. Even a single consultation can give you a clearer picture of your options and whether chapter 7 fits your path to a real fresh start.

What Is Bankruptcy Chapter 7 in Wisconsin?

At its core, bankruptcy chapter 7 in Wisconsin is a legal process that lets you wipe out certain debts and reset your finances. In a typical chapter 7 bankruptcy case in Wisconsin, you file papers with the U.S. Bankruptcy Court, disclose your income, assets, and debts, and allow a court–appointed trustee to review your situation.

Chapter 7 is sometimes described as a liquidation process, but for most people it doesn't mean someone shows up to take everything you own. In most Wisconsin cases, exemptions protect essentials like household goods, some equity in a vehicle, and retirement accounts, while credit cards, medical bills, and personal loans are discharged.

One reason people in chapter 7 Wisconsin cases choose this chapter is speed. The process is relatively quick—often three to six months from filing to discharge. Once it's complete, most unsecured debts are legally eliminated, giving you room to breathe and rebuild.

Eligibility for chapter 7 depends in part on the means test. This test compares your income to the Wisconsin median and then looks at your necessary living expenses. If your income falls below the median, qualifying is usually straightforward; if it's higher, the analysis is more detailed but you may still qualify.

Key features of chapter 7 include:

- Fast timeline: Most chapter 7 cases in Wisconsin are finished in about three to six months, not years.

- Relief from unsecured debt: Credit cards, medical bills, and many personal loans can be discharged so you can move forward.

- Trustee oversight: A court–appointed trustee reviews your paperwork, checks for non–exempt assets, and makes sure the process follows bankruptcy rules.

Chapter 7 is often best suited for individuals or families with limited income, significant unsecured debt, and few non–exempt assets. It can offer a real fresh start, but it also impacts your credit and requires careful planning. Understanding how chapter 7 works in Wisconsin is the first step to deciding whether it fits your situation.

Who Qualifies for Chapter 7 Bankruptcy in Wisconsin?

A big question for many people is whether they even qualify for chapter 7. If you're searching for things likechapter 7 income limits Wisconsin, what you're really asking is whether your income and situation fit what the court allows.

In Wisconsin, qualification starts with your household income compared to the state median for your family size. If you are below the median, chapter 7 is often available. If you are above it, you may still qualify by passing the Wisconsin chapter 7 means test, which looks more closely at your income and necessary expenses.

Your assets also matter. As a Wisconsin resident, the exemption system determines what you can keep and what, if anything, a trustee might sell. Most everyday filers have most or all of their property protected, but it's important to know how those rules apply to you.

In general, eligibility for chapter 7 in Wisconsin often includes:

- Meeting the income rules: Your income is at or below the state median, or you pass the means test after allowed expenses are considered.

- Limited non-exempt assets: Most of what you own is covered by Wisconsin or federal exemptions, so there is little or nothing for a trustee to liquidate.

- No recent chapter 7 discharge: You haven't received a chapter 7 discharge in the last eight years.

In the next section, we'll go deeper into how the chapter 7 income limits Wisconsin uses and thechapter 7 means test Wisconsin applies are calculated, so you can see how the numbers work in practice.

Chapter 7 Income Limits and the Means Test in Wisconsin

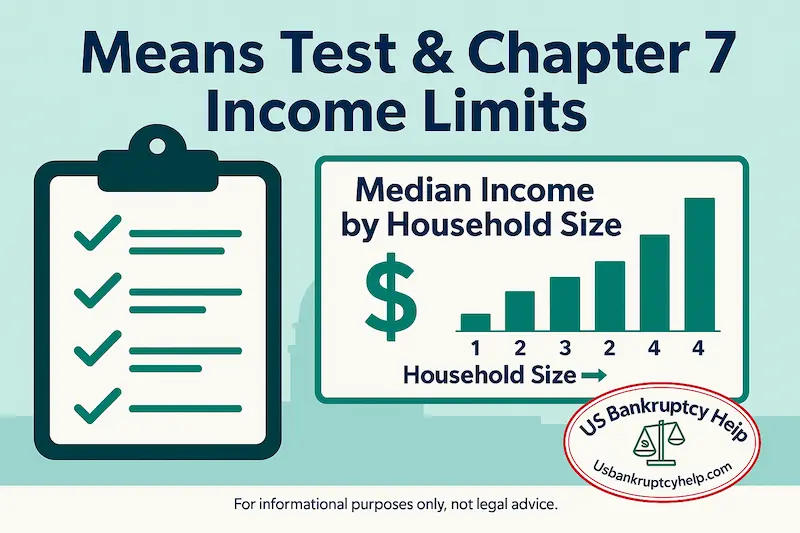

The chapter 7 income limits in Wisconsin are based on median family income figures published by the U.S. Trustee Program. These numbers are updated regularly and are a key part of the Wisconsin chapter 7 means test, which helps determine whether you qualify for chapter 7 based on your income and household size.

The means test looks at your average income for the six months before you file and compares it to the median income for a Wisconsin household of your size. If your income is below the median, qualifying for chapter 7 is usually straightforward. If it's above the median, the chapter 7 bankruptcy Wisconsin means test then factors in allowed expenses (like housing, food, and transportation) to see how much real disposable income you have left.

As of November 1, 2025, the median income figures used for the chapter 7 means test Wisconsin applies are:

| Household Size | Annual Median Income (USD) |

|---|---|

| 1 | $69,343 |

| 2 | $87,938 |

| 3 | $105,734 |

| 4 | $129,964 |

| Add $11,100 for each person over 4. | |

Effective for cases filed on or after November 1, 2025. Always verify against the latest U.S. Trustee Program table: UST Median Family Income by Family Size.

If your annualized income is below the figure for your household size, you generally pass the income portion of the means test. If you are above it, the test isn't over—you move into a second stage where your allowed expenses are applied to see whether there's enough disposable income to pay a meaningful portion of your unsecured debts.

Key factors that affect your chapter 7 means test in Wisconsin include:

- Average monthly income: The court looks at your average income from all sources over the six months before filing, then annualizes that number for the test.

- Household size and median income: Your family size determines which median income figure applies, and even small changes in household size can matter.

- Allowed living expenses: Standardized expense figures (plus some actual expenses) for housing, utilities, food, transportation, and certain other costs are deducted to calculate your disposable income.

Understanding how these chapter 7 income limits Wisconsin uses fit together with the means test can make the process feel much less mysterious. An experienced chapter 7 bankruptcy attorney can plug your real numbers into the Wisconsin means test and tell you quickly whether chapter 7 is likely to be available—or whether another strategy might make more sense.

Chapter 7 vs Chapter 13 Bankruptcy in Wisconsin

When people start comparing chapter 7 vs chapter 13 in Wisconsin, they're usually trying to answer one core question: “Do I need a fast fresh start, or a structured plan to catch up and keep certain assets?” Both chapters stop most collection activity, but they solve problems in very different ways.

In a typical Wisconsin chapter 7 case, the focus is on wiping out unsecured debt quickly. If you qualify under the means test and your property is mostly covered by exemptions, chapter 7 can discharge credit cards, medical bills, and many personal loans in roughly three to six months. It's usually a better fit for people with limited income, significant unsecured debt, and little non-exempt equity in a home or other assets.

Chapter 13 works differently. Instead of a quick discharge, you propose a 3–5 year repayment plan approved by the court. That plan can help you catch up on mortgage arrears, stop a foreclosure, save a car from repossession, or pay certain priority debts over time. For many Wisconsin homeowners or car owners who are behind but have regular income, chapter 13 can be the tool that protects property chapter 7 might put at risk.

At a glance, some of the practical differences in Wisconsin look like this:

- Chapter 7: Short timeline (often 3–6 months), focuses on eliminating unsecured debt, works best when most of your property is exempt and you don't need a long-term catch-up plan.

- Chapter 13: Longer timeline (3–5 years), uses a court-supervised payment plan to cure mortgage or vehicle arrears, protect non-exempt equity, and reorganize debts while you keep more assets.

This page focuses on how those choices play out under Wisconsin's income rules and exemption laws. For a deeper, national-level breakdown of the differences, you can also review our full comparison guide: Chapter 7 vs. Chapter 13 Bankruptcy.

The Chapter 7 Bankruptcy Process in Wisconsin

The chapter 7 bankruptcy process in Wisconsin follows a fairly predictable path, but it can feel overwhelming when you're living through it. Think of this as a big-picture overview of what happens in a typical chapter 7 bankruptcy Wisconsin case—not a do-it-yourself instruction manual.

Most cases start with confirming that you qualify under the means test and that chapter 7 is the right fit for your goals. From there, your attorney prepares and files a petition with the U.S. Bankruptcy Court for the Eastern or Western District of Wisconsin. As soon as the case is filed, the automatic stay kicks in and most collection activity has to stop.

After filing, a court-appointed trustee is assigned to your case. The trustee reviews your paperwork, checks for accuracy, and looks at your assets to see what is protected by exemptions and what, if anything, could be sold for the benefit of creditors. In many Wisconsin cases, exemptions cover most or all of a person's property.

You'll also attend a short hearing called the 341 meeting (or meeting of creditors). In most cases, it lasts only a few minutes. The trustee asks you questions under oath about your finances, and creditors technically have the right to appear and ask questions, though many never do.

Very generally, the chapter 7 process in Wisconsin often looks like this:

- Confirm eligibility: Review income, expenses, and assets to make sure chapter 7 fits your situation and goals.

- File the case: Your petition and schedules are filed with the Wisconsin bankruptcy court, triggering the automatic stay.

- Work with the trustee: The trustee reviews your documents, asks follow-up questions, and evaluates any non-exempt assets.

- Attend the 341 meeting: You appear (often by phone or video) to answer questions under oath about your finances and paperwork.

- Receive a discharge: If everything goes smoothly, eligible debts are wiped out and your case is closed.

Throughout this process, having an experienced chapter 7 bankruptcy attorney in Wisconsin guiding you is critical. The rules are technical, deadlines matter, and small mistakes can have big consequences. This overview can help you understand the road ahead, but it's not a substitute for personalized legal advice.

Filing Chapter 7 in Wisconsin: Step-by-Step Overview

Filing chapter 7 in Wisconsin is not just a matter of filling out a few forms and hoping for the best. It's a legal process with strict paperwork requirements, court rules, and real-world consequences. The steps below are meant as a broad overview so you know what to expect—not as a do-it-yourself guide.

Before anything is filed, most people start by gathering key financial documents and speaking with a lawyer. A chapter 7 bankruptcy attorney in Wisconsin can review your pay stubs, tax returns, bank statements, and debt information to confirm that chapter 7 is appropriate and that your property will be protected as much as possible.

From a high-level, filing chapter 7 in Wisconsin often involves:

- Collecting financial information: Pay stubs, tax returns, bank statements, creditor statements, and a list of your assets and monthly expenses.

- Completing required credit counseling: Taking an approved credit counseling course before filing, as required by federal law, and obtaining a certificate of completion.

- Preparing the petition and schedules: Working with your attorney to list all of your debts, income, expenses, and assets accurately, and to choose the best exemption scheme for your situation.

- Filing the case with the court: Submitting your chapter 7 petition to the Wisconsin bankruptcy court, which immediately triggers the automatic stay and stops most collection actions.

- Completing follow-up requirements: Attending the 341 meeting, responding to any trustee questions, and taking the post-filing debtor education course required for discharge.

A good attorney does more than just shuffle paperwork—they help you avoid costly mistakes, protect as much property as possible, and use chapter 7 strategically as part of your overall financial reset. Reading about the process is a helpful start, but if you are serious about filing chapter 7 in Wisconsin, a consultation with a qualified local bankruptcy lawyer should be your next step.

Wisconsin Bankruptcy Exemptions: What Can You Keep?

One of the biggest fears people have about chapter 7 is, “Am I going to lose everything?” In Wisconsin, bankruptcy exemptions exist so that doesn't happen. These rules protect certain property from being taken and sold in a chapter 7 case, giving you a basic foundation to rebuild your life after bankruptcy.

Instead of starting from zero, exemptions are meant to let you keep essentials—things like a place to live, basic household goods, and transportation to get to work. Exactly how much you can protect depends on which exemption system applies to you and how your assets are structured, but most everyday filers keep far more than they expect.

Very generally, the types of property Wisconsin exemptions often protect include:

- Equity in a home: A portion of the value in your primary residence, often referred to as the homestead exemption.

- Equity in a vehicle: Some value in a car or truck you use for everyday transportation.

- Essential personal property: Clothing, basic household goods, and similar items you need to live and work.

- Tools of the trade: Certain tools or equipment you rely on to earn a living.

This page is only giving a high-level overview. For a current, itemized list, limits, and explanations of Wisconsin's exemption scheme, you can review our Wisconsin bankruptcy exemption reference guide.

Because exemptions can be technical, it's wise to review your property with an experienced chapter 7 bankruptcy attorney in Wisconsin before you file. A good attorney can help you choose the right exemption scheme, protect as much as possible, and avoid surprises with the trustee.

Debts Discharged and Not Discharged in Chapter 7

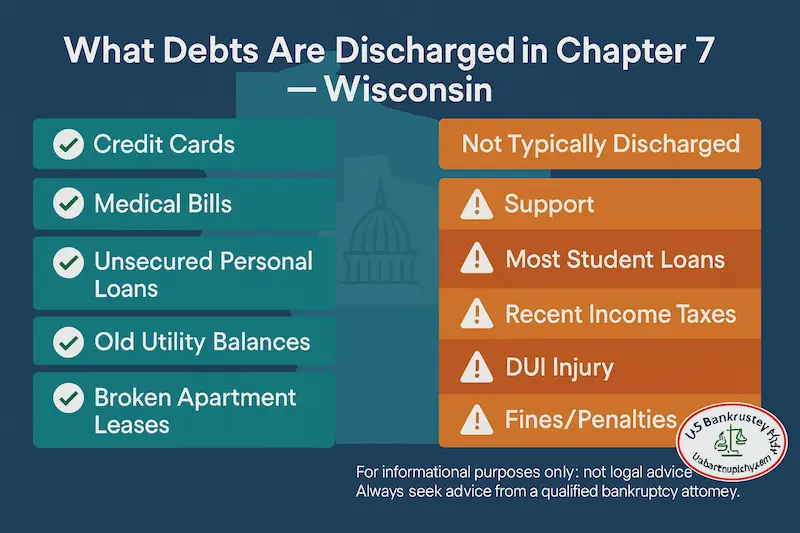

In a chapter 7 bankruptcy Wisconsin case, one of the most important questions is which debts you can actually erase. When a debt is “discharged,” you are no longer legally obligated to pay it, and the creditor can't collect it from you. Getting clear on this helps set realistic expectations and avoids disappointment later.

The good news is that many unsecured debts are typically dischargeable. For people dealing with persistent collection calls, wiping out high-interest credit cards, old medical bills, and personal loans can be life-changing and can make a real fresh start possible.

However, not every debt goes away in chapter 7. Federal bankruptcy law carves out specific categories of non-dischargeable obligations—things that usually survive even after your case is finished. These often include domestic support obligations, most student loans, and certain tax debts. There are nuances and exceptions, but you should not assume that every line on your credit report will vanish.

Commonly discharged debts in chapter 7 often include:

- Credit card balances: Regular revolving cards, store cards, and many unsecured lines of credit.

- Medical bills: Hospital, clinic, and doctor charges that have piled up over time.

- Personal loans: Signature loans, payday loans, and many other unsecured personal obligations.

Debts that are often not discharged in chapter 7 include:

- Child support and alimony: Domestic support obligations remain fully enforceable after bankruptcy.

- Most student loans: Federal and private student loans are generally not discharged absent very specific circumstances and separate court findings.

- Certain tax debts and recent taxes: Recent income taxes, some penalties, and other tax-related obligations can survive chapter 7.

There are additional categories—such as some debts tied to fraud, intentional injuries, or certain court judgments—that may also be non-dischargeable. The rules are technical, and how they apply in a Wisconsin case depends on your specific history. A knowledgeable chapter 7 bankruptcy attorney in Wisconsin can review your full debt list and explain, line by line, what is likely to be discharged and what probably is not.

How Often Can You File Chapter 7 in Wisconsin?

If you've filed before, it's natural to wonder how often can you file chapter 7 in Wisconsin. The basic rule comes from federal bankruptcy law: you generally must wait eight years between chapter 7 discharges. That eight-year clock runs from the filing date of your last chapter 7 case to the filing date of your new one.

That doesn't mean you can never seek help again during that time, but you may need to look at other options—such as chapter 13 or non-bankruptcy strategies—if you're still within the waiting period. The timing rules can also interact with prior chapter 13 cases in ways that affect what type of discharge you can receive.

At a high level, here are the key timing points to keep in mind:

- Eight-year rule: You generally must wait eight years from the filing date of your last chapter 7 case before filing another chapter 7 and receiving a new discharge.

- Filing vs. discharge date: The clock is calculated from filing date to filing date, not from the date your previous discharge was entered.

- Other chapter combinations: If your prior case was chapter 13, different timeframes may apply for how soon you can receive a chapter 7 discharge or another chapter 13 discharge.

Because these timing rules are technical and fact-specific, it's smart to talk with a chapter 7 bankruptcy attorney in Wisconsin before assuming you're eligible—or ineligible—to file again. If you're outside the eight-year window, they can help you evaluate whether chapter 7 makes sense now. If you're still within it, they can explain alternative tools for dealing with aggressive creditors or new financial setbacks.

Life After Chapter 7 Bankruptcy in Wisconsin

Filing for chapter 7 bankruptcy in Wisconsin can feel like finally coming up for air after being underwater for a long time. Many debts are wiped out, collection calls stop, and you get a real chance at a fresh start. What happens next depends a lot on how you approach life after the discharge.

Rebuilding credit is a major part of that next chapter. Your credit score will take a hit, but it doesn't stay frozen in time. Paying bills on time, keeping balances low, and being selective about new credit accounts can all help your score recover over the months and years after your case closes.

Just as important is changing the habits and circumstances that led to the need for bankruptcy in the first place. That might mean building an emergency fund, adjusting spending, dealing with irregular income, or planning more intentionally for taxes or medical costs. A good chapter 7 case doesn't just erase old debt—it creates space to do things differently going forward.

Practical steps for life after chapter 7 in Wisconsin often include:

- Monitoring your credit: Check your credit reports, verify that discharged debts are reported correctly, and watch your progress over time.

- Building a realistic budget: Map out income and expenses so you're not relying on high-interest credit cards to cover everyday costs.

- Using credit cautiously: If you take on new credit, start small, pay on time, and avoid carrying balances you can't comfortably pay off.

- Getting help when needed: Talking with a financial planner, credit counselor, or trusted professional can give you a roadmap for the next few years.

By treating your chapter 7 discharge as a turning point—not just a one-time event—you can move from crisis mode toward real long-term stability and a healthier relationship with money.

Do You Need a Chapter 7 Bankruptcy Attorney in Wisconsin?

Technically, you're allowed to file chapter 7 on your own. Practically, most people are far better off working with an experienced chapter 7 bankruptcy attorney in Wisconsin. Bankruptcy is a federal court process with detailed forms, strict deadlines, and local rules that can be unforgiving if you make a mistake.

A good attorney doesn't just “fill out paperwork.” They help you decide whether chapter 7 is truly the right fit, analyze the chapter 7 means test Wisconsin uses with your real numbers, and make sure your property is protected as much as possible under Wisconsin or federal exemptions. They also spot issues—like recent transfers, lawsuits, or tax problems— that could cause trouble if not handled correctly.

Some of the ways a Wisconsin chapter 7 lawyer can help include:

- Evaluating your options: Confirming whether chapter 7, chapter 13, or a non-bankruptcy approach is best for your situation and timing.

- Protecting your assets: Applying Wisconsin exemption rules correctly so you keep as much property as the law allows.

- Handling the court process: Preparing and filing your petition, responding to trustee questions, and guiding you through the 341 meeting.

- Avoiding costly mistakes: Helping you steer clear of errors—like omitting assets, repaying the wrong creditors before filing, or misclassifying debts—that can delay or jeopardize your discharge.

This page gives you a solid overview of how chapter 7 bankruptcy Wisconsin cases work, but it can't replace personalized legal advice. A short consultation with a local attorney can give you clear answers about your risks, your options, and your best path to a genuine fresh start.

Frequently Asked Questions About Chapter 7 Bankruptcy in Wisconsin

Most people don't go into a bankruptcy chapter 7 in Wisconsin case very often—if ever—so it's normal to have a lot of questions. Here are some of the common ones that come up when people are first considering chapter 7.

How long does a typical chapter 7 case take?

In many Wisconsin cases, the timeline from filing to discharge is about three to six months, assuming everything is filed correctly and there are no disputes. You'll usually have one 341 meeting a few weeks after filing, and then wait for the court to issue your discharge if all requirements are met.

Will chapter 7 ruin my credit forever?

Chapter 7 does stay on your credit report for up to ten years, but that doesn't mean you'll have bad credit for ten years. Many people start rebuilding with on-time payments and careful use of new credit within a year or two after discharge. Lenders look at your recent history and current income, not just the fact that you filed.

Can I keep my house or car if I file?

It depends on how much equity you have, what you owe, and whether you're current on payments. Wisconsin exemption laws and your loan terms play a big role. In many chapter 7 Wisconsin cases, people are able to keep a modest home or vehicle, but this is very fact-specific and something you should review with an attorney before filing.

Will filing chapter 7 in Wisconsin affect my spouse?

If only one spouse files, the non-filing spouse's separate debts are not discharged, but household finances and jointly owned property can still be affected. How this plays out can be complicated, especially with joint debts and shared assets, so it's important to discuss your marital situation with a lawyer before deciding who should file.

Are there costs and fees involved?

Yes. There is a court filing fee for chapter 7, plus attorney's fees if you hire a lawyer. In some situations, the court can approve fee waivers or installment payments for the filing fee. A Wisconsin bankruptcy attorney can explain their fee structure up front so you understand the total cost before you decide to move forward.

How often can you file chapter 7 bankruptcy in Wisconsin?

The short answer is that you generally have to wait eight years between chapter 7 cases. In other words, when people askhow often can you file chapter 7 bankruptcy in Wisconsin, the rule is usually once every eight years, measured from the filing date of your last chapter 7 case to the filing date of your new one. There are additional timing rules if your prior case was a different chapter, so it's smart to have a Wisconsin bankruptcy attorney look at your full filing history before you assume you can—or cannot—file again.

Every case has its own twists, so if you don't see your question here—or if your situation is more complex—it's worth getting specific, fact-based advice from a chapter 7 bankruptcy attorney in Wisconsin.

Real-World Chapter 7 Success Stories in Wisconsin

Reading about bankruptcy chapter 7 in Wisconsin in the abstract is one thing. Seeing how it has helped real people in situations like yours can make it easier to picture what a fresh start might actually look like. The examples below are based on common fact patterns Wisconsin attorneys see again and again; details are simplified and anonymized, but the outcomes are very typical of well-planned chapter 7 cases.

These examples are for illustration only. They don't predict or guarantee what will happen in any particular case, and your results will always depend on your own facts and finances.

Single Parent in Milwaukee Overwhelmed by Credit Cards

A single parent in Milwaukee had fallen behind after a job loss and medical issues. Credit card balances had grown to more than $35,000, and collection calls were constant. They were current on rent and a modest car payment, but there was no realistic way to catch up on the unsecured debt.

After reviewing income and expenses, a Wisconsin chapter 7 attorney confirmed they passed the means test and that their car and household goods were fully exempt. The chapter 7 case discharged the credit cards and medical bills in about four months. With the pressure gone, they were able to keep the car, stay in their rental, and redirect income toward day-to-day living instead of minimum payments.

Green Bay Couple Saving a Modest Home

A married couple near Green Bay had a small home with limited equity and significant unsecured debt from a prior business venture. They were current on the mortgage but barely making minimum payments on more than $60,000 in credit cards and personal loans. They worried that filing chapter 7 would mean losing the house.

A local attorney walked them through Wisconsin exemptions and confirmed that the homestead exemption was enough to protect their equity. They filed chapter 7, kept their home and vehicles, and discharged the unsecured debt. Within a year of discharge, they had a workable budget and had started rebuilding credit with a small secured card paid in full each month.

Retired Madison Resident on Fixed Income

A retired person in Madison living on Social Security and a small pension was facing collection lawsuits over old credit card and medical debts. They had no real estate and drove an older paid-off vehicle. Much of their anxiety came from not knowing whether a creditor could take their limited income or their car.

After a consultation, a chapter 7 bankruptcy attorney in Wisconsin explained that Social Security income is generally protected and that their vehicle and basic property were within exemption limits. They filed chapter 7, the lawsuits stopped, and the unsecured debts were discharged. Their monthly cash flow didn't increase, but the fear of garnishments and judgments was gone.

These examples don't guarantee any particular outcome—every case is different—but they show how chapter 7 Wisconsin cases can be used thoughtfully to protect essential property and wipe out unmanageable debt. An experienced attorney can help you understand what a realistic “success story” might look like in your own situation.

Is Chapter 7 Bankruptcy in Wisconsin Right for You?

Deciding whether to file chapter 7 bankruptcy Wisconsin is a big decision. For some people, it's the clean break they need from years of high-interest debt, lawsuits, or garnishments. For others, a different strategy—chapter 13, debt negotiation, or simply more time—may make more sense.

The key is to look at your whole picture: income, household size, the chapter 7 income limits Wisconsin uses, your assets and exemptions, the types of debts you have, and your long-term goals. When you put those pieces together, the right path usually becomes clearer.

This guide is meant to give you a grounded overview of how filing chapter 7 in Wisconsin works and what it can and cannot do. The next step, if you're seriously considering it, is to talk with a qualified chapter 7 bankruptcy attorney in Wisconsin who can review your specific facts and help you choose the best way forward.

Chapter 7 is a tool—not a failure. Used wisely and with good advice, it can be the starting point for a more stable and sustainable financial life.

Explore Some of Our National Bankruptcy Guides

- Chapter 7 Bankruptcy: National Guide

- Chapter 13 Bankruptcy: National Guide

- Chapter 7 vs Chapter 13 Bankruptcy: National Guide

- Can Just One Spouse File Bankruptcy?

- Can You File Bankruptcy and Keep Your House?

- Can You File Bankruptcy and Keep Your Car?

- How Often Can You File Bankruptcy?

- Chapter 13 Vehicle Cramdown

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin