Understanding Chapter 13 Bankruptcy in New York

Chapter 13 bankruptcy offers New Yorkers flexible options to keep assets, catch up on arrears, and get back on track financially.

Chapter 13 Bankruptcy in New York: A Comprehensive Guide

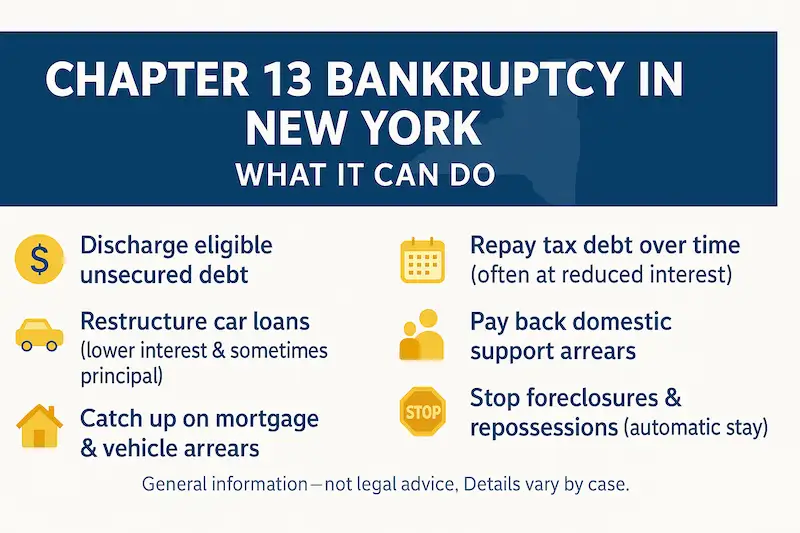

Financial distress is tough—but New Yorkers are tougher. Chapter 13 has helped countless residents in recent years. It offers much more than discharging unsecured debt; chapter 13 provides flexible tools, not a one-size-fits-all solution.

Chapter 13 is designed for New Yorkers with regular income. This type of bankruptcy helps manage debt while keeping and servicing loans on assets. It provides a three-to-five-year payment plan that can address many different debt issues.

Our Other Chapter 13 Resources

If you’re diving into what chapter 13 has to offer, check out our national section on chapter 13 bankruptcy. You may also be comparing the most common chapters—see chapter 7 vs chapter 13 bankruptcy.

Understanding the nuances of chapter 13 is crucial. It differs from chapter 7, which involves asset liquidation. Chapter 13 focuses on debt reorganization—often the better fit for people with significant assets.

Filing in New York involves several steps, careful planning, and strict timelines. Consulting a bankruptcy attorney is strongly advised; they’ll guide you through the process and requirements.

This article explores eligibility, benefits, and the filing process in New York so you can make informed decisions.

What Is Chapter 13 Bankruptcy?

Chapter 13 is a legal method to reorganize and manage debts. It’s designed for individuals with steady income—the classic “wage earner’s plan”—so you can repay over time without losing assets.

In chapter 13, a debtor proposes a repayment plan (usually three to five years) and makes regular payments to a bankruptcy trustee, who distributes funds to creditors.

Plans account for income and necessary expenses, prioritizing housing and utilities. Unsecured debts like credit cards and medical bills may be partially repaid and sometimes discharged at the end.

Key features of chapter 13:

- Structured debt reorganization

- Retention of personal property

- Three-to-five-year repayment

- Protection from foreclosure and other creditor actions

Chapter 13 can be a solid path to recovery—provided you stay current on plan payments and comply with court orders.

Bankruptcy in New York: Your Complete Resource

Reliable information and expert guidance for individuals and families considering bankruptcy in New York. Get answers, understand your options, and take the next step toward financial relief—whether you're in NYC, Buffalo, Rochester, or anywhere in the Empire State.

Chapter 7 Bankruptcy in New York: Fast Debt Relief

Chapter 13 Bankruptcy in New York: Save Your Home & Reorganize Debt

New York Bankruptcy Exemptions: Protect Your Property

Specific Examples of How People Use Chapter 13 Bankruptcy in New York

Chapter 13 has many practical benefits. Beyond the discharge after a three-to-five-year plan, you can reduce car-loan interest, catch up on mortgage arrears, and more. Below are examples of how New Yorkers use chapter 13.

The House Going Into Foreclosure

Bob and Jane are six months behind on their mortgage after Jane couldn’t work for a year. She’s back to work, but they received a foreclosure notice.

Bob and Jane File Chapter 13 and Cure Mortgage Arrears in Their Plan

They visit usbankruptcyhelp.com, request a free consultation, and speak with a local New York attorney. They learn they don’t have to lose their home.

Bob and Jane file chapter 13 and place six months of mortgage arrears into the plan. By the end of the plan, they’re current on the mortgage and also discharge $50,000 in credit-card debt.

Car Payments and a Repossession Threat

Sam bought the car of his dreams, then was laid off and missed three payments. He receives a repossession notice and neighbors report a tow truck circling the block.

Sam Files Chapter 13 and Keeps His Car

Sam uses U.S. Bankruptcy Help to find an attorney, files chapter 13, and places the missed payments into his plan—stopping repossession.

Sam “Crams Down” the Car — Pays Less Principal Through His Chapter 13 Plan

The car is worth about $20,000, but he owes $35,000 at 10% interest. He has owned the car for more than 910 days, so he’s eligible for a vehicle cramdown. In the plan he pays the $20,000 value (not $35,000) at ~4% interest.

At plan completion, Sam has discharged $30,000 of credit-card debt and owns the car free and clear.

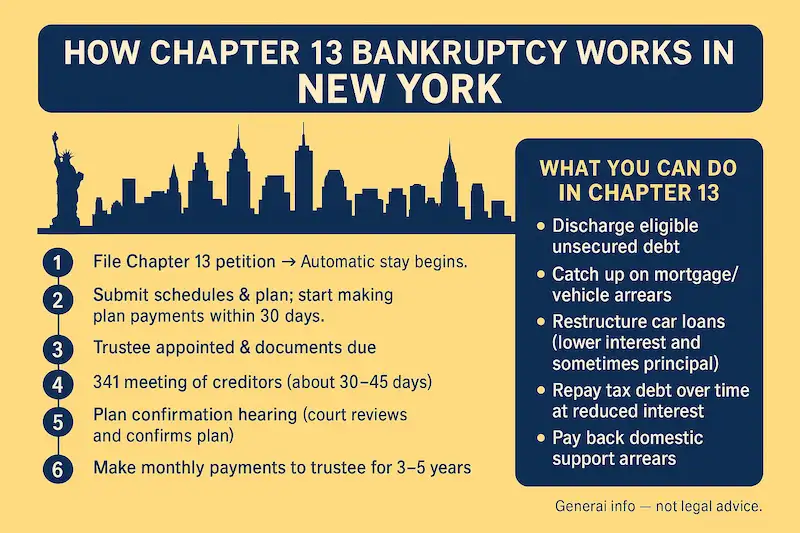

How Chapter 13 Bankruptcy Works in New York

Chapter 13 gives individuals a framework to repay creditors over time—typically three to five years—while protecting key assets.

The process starts by filing a petition with detailed financial schedules (income, expenses, assets, liabilities). Accuracy is vital.

Filing triggers the automatic stay, halting foreclosures, garnishments, and lawsuits. You’ll then submit a repayment plan; the trustee reviews feasibility, creditors may object, and the court decides at the confirmation hearing.

Typical aspects of the process:

- Filing a bankruptcy petition

- Automatic stay stopping creditor actions

- Proposing and obtaining approval of a repayment plan

Success requires consistent plan payments and compliance with the court’s orders.

Eligibility Requirements for Chapter 13 in New York

Not everyone qualifies for chapter 13. Regular income is essential, and debt limits apply.

Current federal limits (periodically adjusted): unsecured debts up to $465,275 and secured debts under $1,395,875. Always verify the latest figures before filing.

Recent case dismissals (within 180 days) may restrict filing, and you must complete a credit-counseling course within 180 days before filing.

Key eligibility points:

- Regular income

- Debt amounts within the statutory limits

- Completion of a pre-filing credit-counseling course

The Chapter 13 Bankruptcy Process Step-By-Step

File the petition and schedules; develop a feasible three-to-five-year plan. The automatic stay begins immediately.

The trustee reviews your plan for compliance; if needed, you’ll make amendments. At the confirmation hearing, the judge decides whether to approve it.

After approval, make timely payments to the trustee. When you complete the plan and required courses, remaining eligible unsecured debts are discharged.

Key steps:

- File petition and submit financial documents

- Develop an affordable repayment plan

- Attend the confirmation hearing

Key Benefits of Filing Chapter 13 Bankruptcy in New York

Major advantages include keeping your property, stopping foreclosure while catching up on arrears, consolidating debts into one payment, and protecting certain co-signers.

Highlights:

- Keep your home and car (subject to plan feasibility)

- Stop foreclosure while curing arrears

- One structured monthly payment

- Co-debtor stay protection for qualifying debts

Chapter 13 vs. Chapter 7 Bankruptcy in New York

Understanding the differences matters. Chapter 7 Bankruptcy is fast and targets unsecured debt (be mindful of New York bankruptcy exemptions). Chapter 13 reorganizes debts over time so you can keep assets.

Key differences:

- Asset retention (chapter 13) vs potential liquidation (chapter 7)

- Income requirements and plan duration

- Complexity and court oversight

For a deeper comparison, see chapter 7 vs chapter 13 bankruptcy.

What Debts Can and Cannot Be Discharged?

Many unsecured debts (credit cards, medical bills, personal loans) can be reduced or discharged in chapter 13. Some debts are generally not dischargeable.

Typically not discharged:

- Child support and alimony

- Most student loans (rare exceptions)

- Certain taxes

- Debts arising from fraud or willful injury

Protecting Your Home and Assets Under Chapter 13

Chapter 13 lets you stop foreclosure and catch up on missed mortgage payments over time. You can also restructure certain secured debts (like car loans) within the plan.

Examples of protected priorities:

- Mortgage arrears

- Car loans (including potential cramdowns, when eligible)

- Retirement accounts and other exempt assets

The Role of the Bankruptcy Trustee

The trustee reviews your plan, collects payments, addresses objections, and distributes funds according to the confirmed plan. Stay responsive and current on payments.

New York Chapter 13 Trustees (By District)

New York has four federal bankruptcy districts. Below are the standing chapter 13 trustees for each district with websites and contact details. Always follow the instructions on your official court notice for payments and 341-meeting logistics.

Eastern District of New York (Brooklyn & Central Islip)

Michael J. Macco — Standing Chapter 13 Trustee

2950 Express Drive South, Suite 109, Islandia, NY 11749

Phone: (631) 549-7908

Website: maccochapter13trustee.comKrista M. Preuss — Standing Chapter 13 Trustee

100 Jericho Quadrangle, Suite 127, Jericho, NY 11753

Phone: (516) 622-1340 • Email: info@ch13edny.com

Website: ch13edny.com

Southern District of New York (Manhattan, Bronx, Westchester, etc.)

Thomas C. Frost — Standing Chapter 13 Trustee

399 Knollwood Road, Suite 102, White Plains, NY 10603

Phone: (914) 328-6333

Website: frostsdny13.com

Northern District of New York (Albany, Syracuse, Utica, Binghamton)

Andrea E. Celli — Standing Chapter 13 Trustee (Albany Division)

7 Southwoods Blvd., Albany, NY 12211 • Phone: (518) 449-2043

Email: inquiries@ch13albany.com

Website (case info & office resources): 13Network – Andrea CelliMark W. Swimelar — Standing Chapter 12 & 13 Trustee (Syracuse Division)

250 South Clinton Street, Suite 203, Syracuse, NY 13202

Phone: (315) 471-1499 • Email: trustee@cnytrustee.com

Website: cnytrustee.com

Western District of New York (Buffalo & Rochester)

Julie A. Philippi — Standing Chapter 13 Trustee (Buffalo Division)

170 Franklin St., Suite 600, Buffalo, NY 14202 • Phone: (716) 854-5636

Website: buffalo13.comGeorge M. Reiber — Standing Chapter 13 Trustee (Rochester Division)

3136 South Winton Road, Suite 206, Rochester, NY 14623 • Phone: (585) 427-7225

Website: (no public site listed by the U.S. Trustee; use the phone and address above)

Note: Chapter 13 trustees are private standing trustees (not government employees). Assignments are by division and judge; always confirm the trustee on your official court notice.

Life During and After Chapter 13 Bankruptcy

Living under chapter 13 means adapting to a budget and making regular payments to the trustee. Staying organized helps you avoid missteps.

When you complete the plan, you may receive a discharge of remaining eligible unsecured debts and a cleaner financial slate.

Advantages after completion:

- Discharge of certain remaining debts

- Potential credit recovery over time

- Stronger financial habits

Common Mistakes and How to Avoid Them

Missed payments can derail a case. Keep records, update the court on major income/expense changes, and communicate with your attorney.

Quick tips:

- Track every plan payment

- Stick to a realistic budget

- Alert your attorney to changes promptly

Frequently Asked Questions About Chapter 13 Bankruptcy in New York

Common questions include whether all debts can be discharged (no), whether foreclosure stops (the stay pauses it while arrears are handled in the plan), and how credit is affected (varies by case).

Things people ask:

- Can my car be repossessed during chapter 13?

- How will bankruptcy affect my credit score?

- Is there a limit to how much debt I can have?

When to Consult a New York Bankruptcy Attorney

Speak with a New York bankruptcy attorney early—especially if you’re facing foreclosure, repossession, or need help drafting a feasible plan.

- Unsure about eligibility or process

- Facing foreclosure or a vehicle repossession

- Need assistance building a repayment plan

Is Chapter 13 Bankruptcy Right for You?

The best chapter depends on your income, debts, and assets. An experienced attorney can help you evaluate whether chapter 13 aligns with your goals and protections available under New York and federal law.

Get Bankruptcy Help for Your City in New York State

We’ve compiled helpful resources for individuals in major cities across New York. Click below for localized information:

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin