Understanding Florida's Bankruptcy Homestead Exemption

Bankruptcy is a rigorous process, and if done right can lead to a great fresh start for you and your family. In Florida, the bankruptcy homestead exemption can offer you that lifeline. This robust exemption allows residents to protect their primary residence from creditors. It's one of the most generous in the United States.

Bankruptcy exemptions change often and case law can affect interpretation of them. Always contact a local Florida bankruptcy attorney if you are considering bankruptcy.

If you are thinking about filing bankruptcy in Florida, you of course need to understand all of Florida's bankruptcy exemptions but if you own a home, you especially need to have a solid grasp on this exemption. It can significantly impact your financial future. While it may seem straight forward, there are some caveats that can be complex. It is always recommended to consult with a qualified bankruptcy attorney to navigate these waters.

This guide will help you understand the Florida bankruptcy homestead exemption. We'll explore its benefits, limitations, and how it applies in bankruptcy cases. Whether you're a homeowner, legal professional, or financial advisor, this information is vital.

What is the Florida Bankruptcy Homestead Exemption?

The Florida bankruptcy homestead exemption protects your home during bankruptcy. It shelters your primary residence from creditors seeking payment. This means you may retain your home even in financial distress.

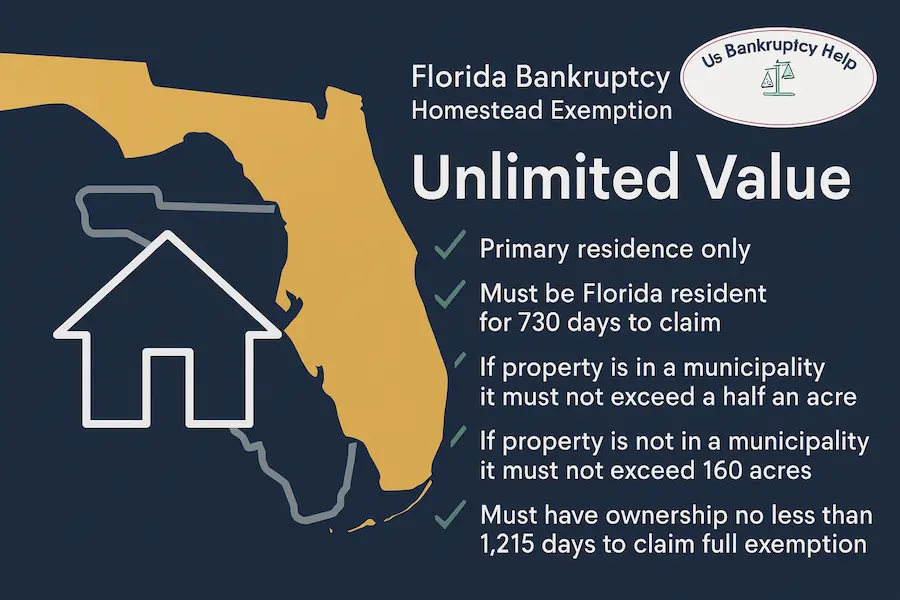

Florida's homestead exemption protects an unlimited amount of home equity, with specific requirements. This robust exemption is truly unique and highly useful if you have need and have the ability to use it.

This exemption offers significant protection. It can prevent foreclosure and allow you to keep your home. However, there are specific rules and qualifications to consider.

Key Requirements to Qualify for the Homestead Exemption

Qualifying for the Florida homestead exemption in bankruptcy involves meeting specific criteria. All of the requirements below must be met, or the exemption does not apply.

The Property Must Be Your Primary Residence

The property in question must be your primary residence. It cannot be an investment property or commercial investment property. The purpose behind the exemption is to make sure Florida residents have a place to live.

If the Property is within a Municipality it Must Be Under 1/2 Acre

If the property in question lies within a municipality,it must not exceed a half an acre. Be sure to understand the location of the property. Is it within a municipality limits? If so you cannot get the full exemption if it is over 1/2 an acre. Make sure you have a full understanding of where your property lies before you even think about filing a bankruptcy case.

To Claim the Full Exemption You Must Have Owned the Home for at Least 1,215 Days

You also need to consider the duration of property ownership. To claim the full exemption, you must have owned the home for at least 1,215 days before filing for bankruptcy. This period equals about three years and four months.

You've Been Domiciled in Florida for at Least 730 Days Before Filing for Bankruptcy

Another key criterion is residency. You must have lived in Florida for at least 730 days before filing for bankruptcy to utilize Florida's exemption scheme. Otherwise you may have to use the exemptions for your previous state of residence. This ensures that only bona fide Florida residents benefit.

Here’s a summary of the key points:

- • Protects your primary residence

- • Provides unlimited value protection

- • Has specific location and acreage limits

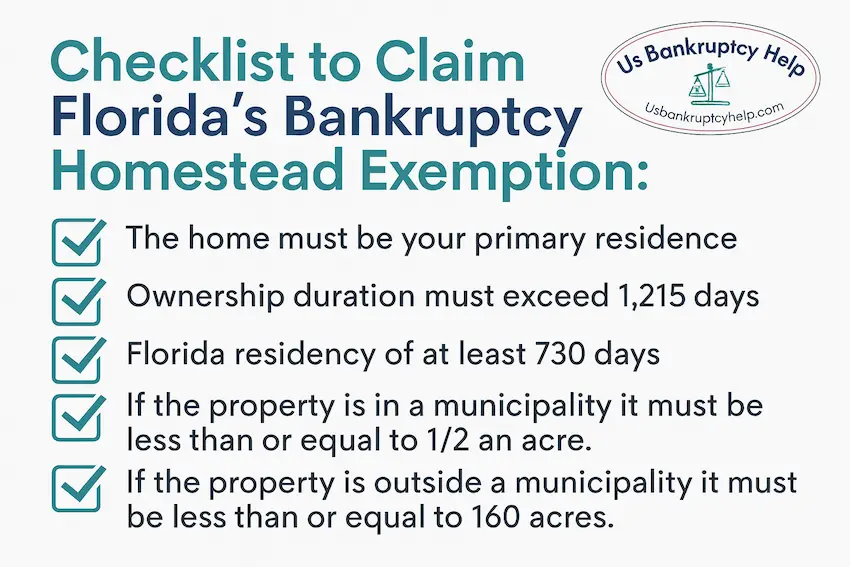

Checklist of Qualification Criteria

Here’s a checklist for qualification:

- The home must be your primary residence

- Ownership duration must exceed 1,215 days

- Florida residency of at least 730 days

- If the property is in a municipality it must be less than or equal to 1/2 an acre.

- If the property is outside a municipality it must be less than or equal to 160 acres.

These criteria are essential to ensure the full Florida homestead bankruptcy exemption. If any of these fail, the exemption does not apply. Understanding these requirements helps you plan your bankruptcy strategy effectively. Contact a local Florida bankruptcy attorney to discuss your specific situation.

How the Homestead Exemption Works in Chapter 7 and Chapter 13 Bankruptcy

Understanding the nuances of bankruptcy types is crucial when applying the Florida homestead exemption. Chapter 7 and Chapter 13 bankruptcies offer different protections and processes.

In chapter 7 bankruptcy, the exemption is vital for retaining your home. It protects equity from liquidation to pay creditors. If your home equity is covered by the exemption, you can likely keep the house.

Meanwhile, chapter 13 bankruptcy involves reorganization of debts. Here, the exemption helps determine how much you repay through a plan. Unsecured creditors may get less if your home is fully protected.

It’s important to understand how exemptions influence these bankruptcy proceedings. Proper planning ensures the best use of legal protections available. You can find out more about chapter 7 bankruptcy, and chapter 13 bankruptcy here on our website.

To summarize key effects:

- • Chapter 7: Protects home equity from liquidation

- • Chapter 13: Influences repayment plans

- • Proper planning maximizes protection

Both bankruptcy types use the exemption strategically, but each offers unique benefits and challenges.

Strategic Considerations: Planning for Bankruptcy in Florida

Before filing for bankruptcy in Florida, consider how the homestead exemption influences your strategy. It's vital to protect assets and align with your financial goals. Evaluate your debts and assets carefully.

Strategic planning involves understanding all available exemptions. Balance these against your liabilities. This can guide the choice between Chapter 7 or Chapter 13 bankruptcy. Each has unique implications on your assets.

Consider these steps when planning:

- • Review your assets' eligibility for exemptions.

- • Consult with a bankruptcy attorney.

- • Determine the impact on your financial recovery.

Florida Homestead Exemption Success Stories

1) Orlando Family Keeps Their Bungalow After Job Loss

After a sudden layoff, “Maria” and “Luis” fell three months behind on their Orlando bungalow’s mortgage. They had lived in the home as their primary residence for more than 1,215 daysand had been Florida residents for over 730 days. With rising unsecured debt and a pending foreclosure, they filed chapter 13 to catch up on arrears over time.

Their attorney confirmed the property sat inside city limits and on less than ½ acre, so the Florida homestead exemption fully protected their equity. In chapter 13, the exemption reduced the amount owed to unsecured creditors and allowed a realistic repayment plan focused on curing the mortgage. Result: they kept their home, stopped collection calls, and finished a budget they could live with while rebuilding credit.

2) Miami Retiree Protects Condo Equity From Medical Debt

“Victor,” a retiree in Miami, faced aggressive medical collections despite having substantial equity in his condo. He had owned the unit for five years and used it as his primary residence. Because the condo is within a municipality and sits well under the ½-acre limit, the homestead exemption applied in full.

In chapter 7, the Florida homestead exemption shielded Victor’s equity from unsecured creditors. The trustee could not access the value of the condo to pay medical bills, and Victor walked away from the case still owning his home. Result: discharge of unsecured medical debt while preserving his condo, HOA standing, and financial stability on a fixed income.

3) Alachua County Homeowner Saves Rural Property From Creditor Lawsuit

“Samantha” inherited a modest house on 8 acres outside a municipality near Gainesville (well under the 160-acre rural cap). After using the property as her primary residence for over three years and establishing Florida domicile more than two years ago, she was sued over old business credit cards.

She filed chapter 7. Because her land is outside city limits and below the rural acreage threshold— and she met the 1,215-day ownership and 730-day residency rules—her equity was fully protected by the Florida homestead exemption. Result: the lawsuit pressure ended, unsecured debt was discharged, and she kept her rural home for future family use.

Note: Details are illustrative. Exemptions and outcomes depend on precise facts. Speak with a qualified Florida bankruptcy attorney about your situation.

Protecting Your Home and Your Future

Understanding Florida's bankruptcy homestead exemption is crucial for maintaining stability during financial struggles. This protection offers a valuable shield for your primary residence amidst debt challenges.

Choosing the right bankruptcy path in Florida requires careful consideration of all exemptions, including the homestead. Consulting with a legal expert is advisable. Doing so ensures you leverage these protections effectively to safeguard your home and plan a secure financial future.

Frequently Asked Questions About the Florida Bankruptcy Homestead Exemption

What Does Florida’s Bankruptcy Homestead Exemption Protect?

It protects equity in your primary residence during bankruptcy. If your home qualifies, its equity is shielded from most creditors, which can help you keep the property in both chapter 7 and chapter 13 cases (with different effects on liquidation vs. plan payments).

Who Qualifies as a Florida Resident for This Exemption?

You must be domiciled in Florida for at least 730 days (two years) before filing to use Florida’s exemptions. If you haven’t met that period, you may have to use another state’s exemptions based on the federal look-back rules.

Are There Limits on Property Size or Location?

Yes. If the property is inside a municipality, the homestead may cover up to ½ acre. If it is outside a municipality, it may cover up to 160 acres. The home must serve as your primary residence in either case.

How Long Must I Own the Home to Claim the Full Exemption?

You generally need to have owned the home for at least 1,215 days before filing to claim the fullprotection. Shorter ownership may limit how much equity can be exempted under federal caps.

How Does the Exemption Work Differently in chapter 7 vs. chapter 13?

In chapter 7, the exemption helps protect your home’s equity from being used to pay creditors. In chapter 13, it influences the minimum amount unsecured creditors must receive through your repayment plan—fully protected equity can reduce plan exposure. Always review specifics with a Florida bankruptcy attorney.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin