Florida Bankruptcy: A Complete Guide

Navigating the complex world of bankruptcy can be daunting, especially when you're trying to understand how it works in a specific state like Florida. Whether you're considering filing for bankruptcy or just want to understand the laws better, this guide will break down the essentials of bankruptcy laws in Florida. This comprehensive overview will provide insights into the types, processes, exemptions, and implications of bankruptcy in the Sunshine State, empowering you to make informed financial decisions.

Understanding Bankruptcy Laws in Florida

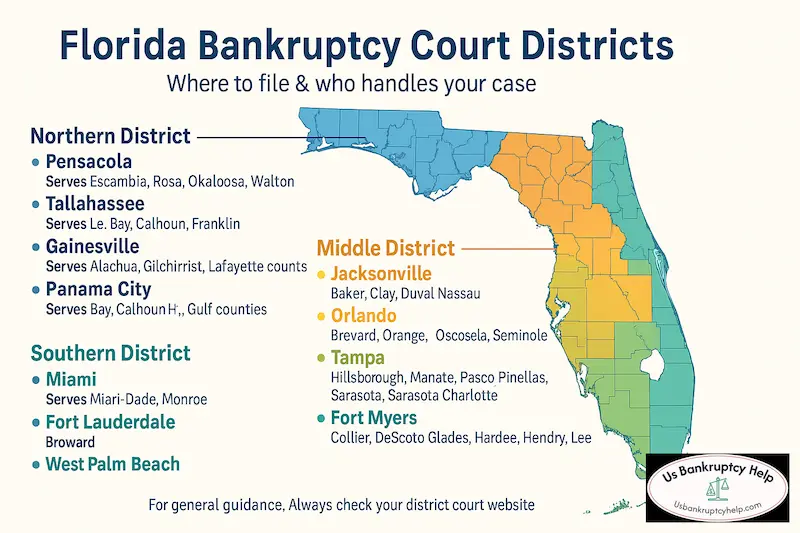

In Florida, bankruptcy is administered in the federal courts. For bankruptcy administration, the state is divided into three districts: Northern, Middle, and Southern. + Florida sits in the Eleventh Circuit for federal appeals. Florida sits in the Eleventh Circuit for federal appeals.

Defining Bankruptcy

Bankruptcy is a legal mechanism designed to offer a fresh start to debtors who are overwhelmed by financial liabilities. It involves the assessment and liquidation of assets or the restructuring of debt, guided by federal and state laws. The primary goal is to relieve the debtor from the burden of unmanageable debt while ensuring a fair distribution of assets to creditors.

The Role of Bankruptcy Courts

Bankruptcy proceedings are handled in specialized federal courts known as bankruptcy courts. These courts have the authority to rule on cases, issue judgments, and oversee the administration of bankruptcy filings. They ensure that the process is conducted fairly, and that both debtors and creditors adhere to the stipulated legal frameworks.

Types of Bankruptcy

In the United States, the most common types of bankruptcy for individuals are Chapter 7 and Chapter 13. Each serves different needs and situations, providing distinct methods for debt relief and asset management.

Chapter 7 Bankruptcy in Florida

Chapter 7 bankruptcy wipes the slate clean of unsecured debts like credit cards and medical bills. In this process, a trustee is appointed to administer the caes which includes gathering proceeds for non exempt assets (if any) and distributing them to creditors. Florida has specific exemptions that can protect most of your property. To find out more about chapter 7 in Florida, read our complete guide on filing Chapter 7 bankruptcy in Florida.

Comprehensive Guide to Florida Bankruptcy Laws

Get detailed, reliable information on Florida bankruptcy from experienced attorneys to help you make informed financial decisions.

Florida Bankruptcy Exemptions

One of the most critical aspects of Chapter 7 bankruptcy in Florida is the state's exemptions. Exemptions determine what property you can keep even after filing for bankruptcy. Florida is known for its generous exemptions:

- Homestead Exemption: Florida's bankruptcy homestead exemption allows you to exempt an unlimited amount of equity in your primary residence. This means your home cannot be taken to satisfy debts.

- Personal Property Exemption: Up to $1,000 in personal property. If you do not claim the homestead exemption, you may instead use the state “wildcard” exemption of up to $4,000 (per filer) on any personal property.

- Vehicle Exemption: You can protect up to $5,000 of equity in a motor vehicle.

These exemptions are crucial for anyone considering Chapter 7 bankruptcy in Florida as they determine what you can keep post-bankruptcy. Learn more details about Florida bankruptcy exemptions here.

Chapter 13 Bankruptcy in Florida

Chapter 13 bankruptcy, or "reorganization bankruptcy," is suitable for individuals with a regular income who want to keep their property and pay their debts over time. This type of bankruptcy allows you to propose a repayment plan to make installments to creditors over three to five years.

Crafting a Repayment Plan

In Chapter 13, debtors work with their attorneys to create a feasible repayment plan that addresses their debts while covering living expenses. This plan is submitted to the court for approval, ensuring it is fair and achievable based on the debtor's income and financial obligations. Learn more about chapter 13 bankruptcy in Florida here.

The Florida Bankruptcy Process

Filing for Bankruptcy

Filing for bankruptcy in Florida involves several steps. First, you must complete a credit counseling course from an approved agency. This course is mandatory and must be completed within 180 days before filing.

Completing the Credit Counseling Course

The credit counseling course is designed to help debtors assess their financial situation and explore alternatives to bankruptcy. This educational step ensures that individuals are making informed decisions and understand the implications of filing for bankruptcy.

Gathering Financial Documentation

Before filing, it's essential to compile comprehensive financial records, including income statements, debt lists, and asset inventories. Accurate documentation is crucial for completing bankruptcy forms and ensuring a smooth filing process.

Submitting Bankruptcy Forms

Once all documents are prepared, the next step is to file the bankruptcy forms with the court and pay the associated fees. This formal submission initiates the bankruptcy process, placing the debtor under the court's protection.

The Role of the Trustee

The trustee plays a vital role in the bankruptcy process. They will review your case, look for any discrepancies, and oversee the sale of any non-exempt property in Chapter 7 bankruptcies. In Chapter 13 cases, the trustee will collect payments according to your repayment plan and distribute them to creditors.

Life After Bankruptcy

Filing for bankruptcy in Florida can provide a fresh financial start. In the long-term your credit will improve over time. A bankruptcy will remain on your credit report for up to 10 years, depending on the type you file. However, many find that their credit improves quicker than they expected as long as they make on-time payments and are proactive about establishing new credit.

Secured credit cards are valuable tools for rebuilding credit, as they offer a controlled environment for demonstrating financial responsibility. By maintaining a low balance and paying off charges promptly, individuals can gradually improve their credit profiles. Staying informed about your credit status is critical for recovery. Regularly reviewing credit reports allows you to track progress, identify errors, and ensure that discharged debts no longer impact your creditworthiness.

Long-Term Financial Planning

Post-bankruptcy, developing a long-term financial plan is essential for stability. This involves setting achievable financial goals, creating an emergency fund, and investing wisely to secure a prosperous future.

Florida Bankruptcy Guidance: Where to Go From Here

Understanding bankruptcy laws in Florida is essential for anyone considering this financial step. Whether it's Chapter 7 or Chapter 13, knowing the exemptions, process, and long-term effects can guide you in making the best decision for your financial future.

If you're contemplating bankruptcy, consider consulting with a qualified bankruptcy attorney in Florida to explore your options and ensure you're making an informed choice. An attorney can provide personalized advice, helping you navigate the complexities of bankruptcy with confidence and clarity.

Florida Bankruptcy Attorney Blog

Check out our latest articles on bankruptcy insights.

How Much is Miami?

What does it cost to live in Miami?

Living in Miami can be expensive. High rents, fluctuating job markets, and unexpected bills can overwhelm residents. Explore how bankruptcy under Florida law can offer relief. Read More

Florida's Migration Growth & Cost of Living Impact

Florida's Migration Growth and Cost of Living Impact

Florida gained nearly 1.8 million residents in five years, driving up housing and insurance costs. Learn how bankruptcy filings have responded to these pressures. Read More

Florida Hurricane Season

How Hurricane Season Affects Bankruptcy Filings

Florida hurricanes can devastate property and finances. Explore how storm‑related damage and lost wages can leave residents overwhelmed with debt—and discover when filing for bankruptcy might help. Read More

Frequently Asked Questions

Where do I file for bankruptcy if I live in Florida?

Florida is divided into three federal districts—Northern, Middle, and Southern. You must file in the division that covers your county (e.g., Tampa in the Middle District, Miami in the Southern District). The bankruptcy clerk’s office for your district receives all petitions, fees, and required forms.

What’s the difference between chapter 7 and chapter 13 bankruptcy in Florida?

Chapter 7 quickly erases qualifying unsecured debt after a brief liquidation review, while chapter 13 sets up a three‑ to five‑year repayment plan that lets you keep property, catch up on secured debt, and discharge remaining balances at the end of the plan. A Florida bankruptcy attorney can help you choose which chapter fits your income, assets, and long‑term goals.

How does the Florida homestead exemption protect my house?

Florida’s homestead exemption shields unlimited equity in your primary residence— provided the property sits on no more than half an acre inside a municipality (or 160 acres elsewhere) and you’ve owned it for the required timeframe. As long as you keep mortgage payments current, the court cannot force a sale.

What happens to my car if I file chapter 7 bankruptcy in Florida?

Florida’s motor‑vehicle exemption lets you protect up to $5,000 in car equity (double if you file jointly). If you do not claim a homestead exemption, you may also apply the$4,000 “wildcard” exemption to cover additional vehicle value or other personal property.

Do I have to take a credit‑counseling course before filing?

Yes. Federal law requires you to complete an approved credit‑counseling session within 180 days before filing your petition. You’ll receive a completion certificate that must be submitted to the court.

How long will bankruptcy stay on my credit report?

A chapter 7 filing remains on your credit report for up to 10 years, while a chapter 13 filing remains for 7 years. With responsible credit use—such as secured credit cards and on‑time payments—many Floridians see score improvements much sooner.

Will bankruptcy stop creditor calls and wage garnishments?

Yes. The moment you file, the court issues an automatic stay that halts most collection actions, including phone calls, lawsuits, wage garnishments, and foreclosures. Creditors must obtain court permission to resume any collection activity.

How does a chapter 13 repayment plan work in Florida?

You (and your attorney) propose a budget‑based plan that pays secured debts in full and a portion of unsecured debts over three to five years. The trustee collects your monthly payment and distributes funds to creditors according to court‑approved priorities. After completing the plan, remaining eligible balances are discharged.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin