Understanding Florida Bankruptcy Exemptions: A Guide

A solid grasp of Florida bankruptcy exemptions is critical. Whether you're considering chapter 7 or chapter 13 bankruptcy. These exemptions protect your essential assets and must be understood.

Florida is a federal bankruptcy exemption opt out state. This means that if you are domiciled in Florida, you cannot use the federal set of bankruptcy exemptions, and must use Florida's bankruptcy exemption scheme.

Whether you're a Florida resident considering bankruptcy or a legal professional, this guide will help you explore how Florida's exemptions can achieve a fresh financial start, for you or your client.

What Are Bankruptcy Exemptions and Why Do They Matter?

Bankruptcy exemptions are laws designed to protect certain assets when you file for bankruptcy. They determine what you can keep despite your financial distress. In Florida, these exemptions are designed to safeguard your possessions from creditors.

Bankruptcy exemptions cover different types of assets, including:

- Your primary residence

- Personal property, like furniture and clothing

- Your Vehicle

- Certain retirement accounts

Understanding Florida's bankruptcy exemptions and their application can greatly affect the outcome of your bankruptcy case. While they may seem straightforward, many times their application is affected by case law and other administrative rules. Also, bankruptcy exemptions can change often. That is why it is highly recommended that anyone considering bankruptcy seek the advice of a Florida bankruptcy attorney.

Who Qualifies for Florida State Bankruptcy Exemptions?

To be able to use Florida state bankruptcy exemptions, you must meet specific residency requirements. You need to have lived in Florida for at least 730 days before filing, to ensure you can claim the state's exemptions.If you haven't lived in Florida for this time period, you will most likely have to use the exemptions of your previous state.

Timing Specific to Florida's Homestead Exemption

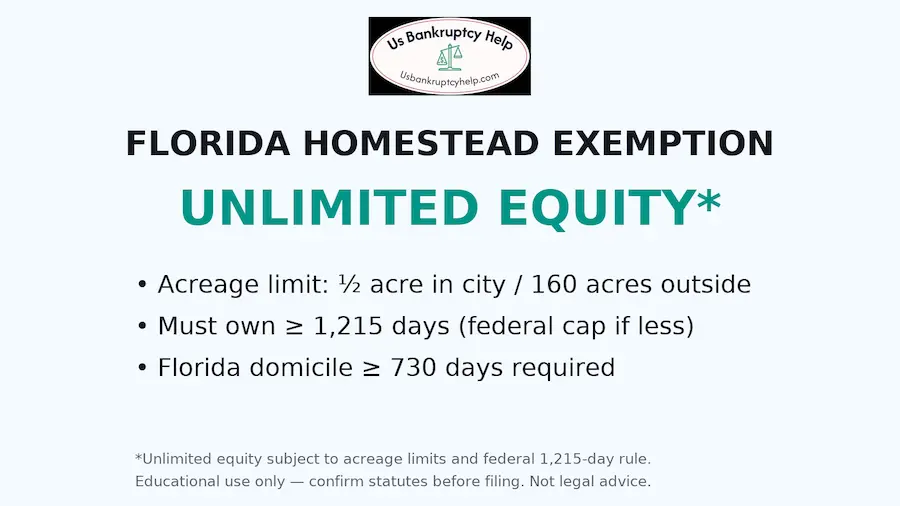

To be able to use the full Florida homestead exemption, you must have owned your home for 1,215 days prior to filing your bankruptcy case. These rules are meant to protect the integrity of the bankruptcy process while ensuring fair protection for genuine Florida residents.

The Florida Homestead Exemption: Protecting Your Home

The Florida bankruptcy homestead exemption provides unlimited equity protection for your primary residence. This is notably one of the most generous exemptions in the United States.

Specific Requirements to Claim this Exemption

To be able to use this robust exemption, the property must be your primary residence. The homestead’s protection is tied to acreage. You can protect up to ½ acre within a municipality, or up to 160 acres outside a municipality.

You must also have been domiciled in Florida for at least 730 days to use this exemption, and you need to have owned the home for at least 1,215 days prior to filing. If you have owned your primary residence for less than 1,215 days, the exemption could be capped by the federal bankruptcy exemption.

Here are the main criteria for qualifying:

- Must be a primary residence.

- Owned for at least 1,215 days before filing.

- Located within Florida.

Personal Property Exemptions in Florida

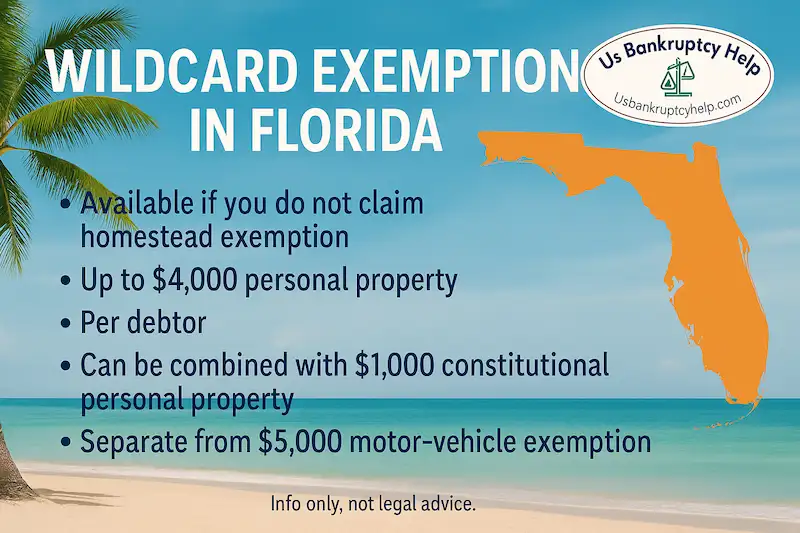

Florida protects some personal property in bankruptcy under both the state Constitution and state statutes. Understanding how these work—especially the “wildcard” for non-homestead filers—can significantly affect your outcome.

Constitutional personal property exemption: Up to $1,000 in total personal property value per debtor (e.g., furniture, electronics, clothing, appliances). Married joint filers can each claim $1,000.

Wildcard (non-homestead) exemption: If you do not claim or receive the benefits of the Florida homestead exemption, you may claim an additional $4,000 in personal property. This is commonly used to cover essentials that exceed the $1,000 constitutional cap.

Note on vehicles: Florida provides a separate motor-vehicle exemption of $5,000 in a single vehicle, which is distinct from the personal-property amounts above.

Examples of personal property that can be covered by these limits include:

- Household furniture

- Clothing

- Appliances

Used together, Florida’s exemptions can help preserve a basic standard of living. If you have little or no protected home equity (or aren’t using the homestead), strategically applying the $4,000 wildcard alongside the constitutional $1,000 can materially increase the personal property you keep.

Example 1: Using Homestead (No Wildcard)

Filer: Single, claims Florida homestead. Result: No wildcard available.

- Household goods & electronics (garage-sale value): $1,600

- Clothing: $300

- Car equity: $6,200

Exemptions:

- $1,000 constitutional personal-property cap covers $1,000 of the $1,900 in household goods + clothing. Balance $900 is non-exempt.

- $5,000 motor-vehicle exemption covers $5,000 of car equity. Balance $1,200 is non-exempt.

Bottom line: $900 (household) + $1,200 (vehicle) = $2,100 non-exempt equity the trustee could require you to resolve (e.g., by buyback or turnover).

Example 2: No Homestead → Wildcard Available

Filer: Single, does not claim homestead (e.g., renting). Result: Gets an extra $4,000 “wildcard” for personal property.

- Household goods & electronics: $2,300

- Clothing: $400

- Car equity: $4,800

Exemptions:

- $1,000 constitutional personal-property exemption.

- $4,000 wildcard (because no homestead) that can be applied to personal property.

- $5,000 motor-vehicle exemption (separate).

Apply them:

- Household + clothing total $2,700 → fully covered by $1,000 + part of the $4,000 wildcard → $0 non-exempt personal property.

- Car equity $4,800 → fully covered by the $5,000 vehicle exemption → $0 non-exempt vehicle equity.

Bottom line: With no homestead, stacking the $4,000 wildcard on top of the $1,000 constitutional amount often protects far more personal property.

Example 3: Married, Filing Jointly, No Homestead

Filers: Married couple, renting (no homestead). Each gets their own exemptions.

- Combined household goods (jointly owned): $3,200

- Two cars: Car A equity $6,200 (titled to Spouse A); Car B equity $3,000 (titled to Spouse B)

Exemptions per spouse:

- Personal property: $1,000 (constitutional) each + $4,000 wildcard each (because no homestead). Total PP protection = $10,000 across both spouses before using the vehicle exemptions.

- Motor vehicles: $5,000 per debtor, applied to the vehicle each one owns.

Apply them:

- Household goods $3,200 → covered within the couples’ combined $10,000 PP bucket.

- Car A $6,200 → $5,000 vehicle exemption covers most; remaining $1,200 can often be covered by that spouse’s unused wildcard/personal-property room.

- Car B $3,000 → fully covered by that spouse’s $5,000 vehicle exemption.

Bottom line: Joint filers can dramatically expand protection because exemptions are generally per debtor.

Important Notes

- The $5,000 motor-vehicle cap is set by statute. Some courts have questioned “stacking” additional wildcard amounts onto the same car beyond that cap; outcomes can be case-specific. When in doubt, allocate wildcard to other items or discuss local practice with counsel.

- Values are the property’s fair-market (used) value—often much lower than retail. Documentation helps.

The Wildcard Exemption: Flexible Protection

Florida’s “wildcard” exemption (Fla. Stat. § 222.25(4)) lets a debtor protect up to $4,000 of personal property if they do not claim or receive the benefits of the Florida homestead exemption. In a joint case, each debtor can each claim this amount.

You can use the wildcard on almost any personal property (for example: cash, bank balances, tax refunds, household goods, jewelry, or vehicle equity) and combine it with other exemptions—just not the homestead.

Key benefits of the Wildcard Exemption include:

- Protecting extra personal property

- Offering strategic asset choices

- Enhancing overall financial security

Using this exemption wisely requires careful planning but maximizes your protection.

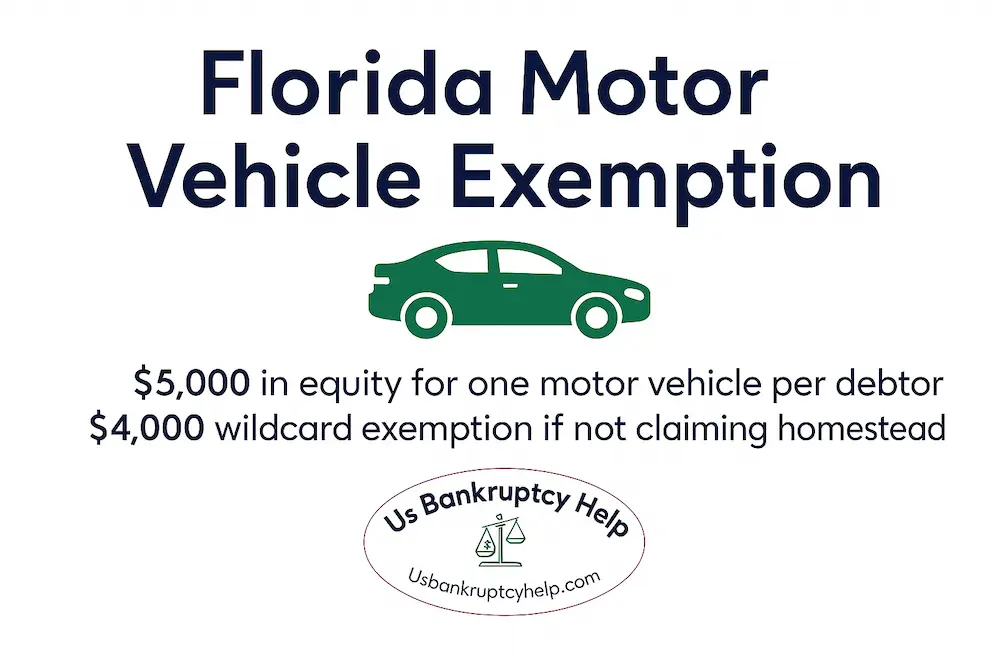

Motor Vehicle Exemption in Florida

Florida provides a $5,000 exemption in equity for a single motor vehicle, and the amount is per debtor. Married joint filers can each claim up to $5,000 on a vehicle they own (typically the one titled in their name).

Here are the main details:

- Protects up to $5,000 of equity in one motor vehicle per debtor.

- Available whether or not you claim the Florida homestead exemption.

- If you are not claiming homestead, you may also use Florida’s $4,000 wildcard exemption to cover extra vehicle equity or other personal property.

Careful application of this exemption (and, when eligible, the $4,000 wildcard) can preserve your vehicle and help maintain mobility during a financial reset.

Wages, Retirement, and Financial Account Exemptions

In Florida, certain exemptions protect wages, retirement accounts, and financial assets from creditors in bankruptcy. These exemptions ensure essential financial stability during a challenging time.

Florida protects the wages of the head of a family from garnishment. This provides a vital safety net, allowing households to cover basic living costs.

Retirement accounts, including IRAs and 401(k)s, are also safe under Florida law. These protections support long-term financial planning and security.

Certain other financial accounts receive exemptions, shielding them from liquidation. Here's a quick list of what's often exempt:

- Wages of the head of a family

- IRAs and 401(k) retirement accounts

- Select financial accounts

These exemptions are significant for maintaining financial dignity. They allow individuals to retain core assets necessary for future stability. Understanding these protections is critical for a successful bankruptcy process.

Insurance, Public Benefits, and Other Special Exemptions

Florida provides valuable exemptions for insurance policies and public benefits during bankruptcy. This reflects the state’s dedication to essential financial protections.

Life insurance policies and annuities typically have exemption status. These ensure that beneficiaries receive needed financial support.

Moreover, specific public benefits are exempt from creditor claims. This includes vital sources of income like Social Security and unemployment benefits. Here's a list of exempt assets:

- Life insurance policies

- Annuities

- Social Security benefits

- Unemployment benefits

These special exemptions safeguard core financial resources. They highlight Florida's commitment to protecting its residents from undue hardship.

Exemptions for Married Couples and Joint Property

Married couples in Florida benefit from special exemptions that apply to jointly owned property. Florida's tenancy by the entirety rule is crucial here. This rule allows couples to protect property from creditors if it's owned jointly.

Assets held as tenants by the entirety are secure from individual creditors. This provides a significant protection avenue. Key benefits include:

- Protection from individual creditors

- More security for jointly owned assets

Such exemptions illustrate Florida’s intent to shield marital property during financial turbulence.

The Process: How to Claim Florida Bankruptcy Exemptions

Claiming exemptions in Florida involves several key steps. First, you must list all your assets in detail on your bankruptcy schedules. Accurate disclosure ensures you do not jeopardize any potential exemptions.

Next, select the appropriate exemptions:

- Identify eligible assets

- Match assets with relevant exemptions

- Complete required forms accurately

It's crucial to verify that you're using state-specific exemptions, not federal ones. Pay attention to deadlines throughout the process. Timely filings prevent complications and help safeguard your assets during bankruptcy proceedings.

When to Seek Legal Advice About Florida Exemptions in Bankruptcy

You should consult a Florida bankruptcy attorney if you are seriously considering filing for bankruptcy relief. Bankruptcy exemptions change often and are affected by case law. While they may seem "straight forward" on their face, they may not be as straight forward as you think.

Legal advice is especially vital if your situation involves significant home equity or joint property. Expert guidance ensures a strategic approach, tailored to your unique circumstances.

Using Florida Bankruptcy Exemptions for a Fresh Start

Understanding and leveraging Florida's bankruptcy exemptions can ease financial distress. These exemptions provide a foundation for rebuilding after bankruptcy, helping preserve essential assets and enabling a fresh financial start.

Florida Bankruptcy Exemptions: Frequently Asked Questions

Who Can Use Florida’s Exemptions?

If you’ve been domiciled in Florida for at least 730 days before filing, you must use Florida’s exemptions (Florida is an opt-out state). If you haven’t met 730 days, you’ll generally use the exemptions of your prior state of residence.

How Does the Florida Homestead Exemption Work?

Florida’s homestead protects unlimited equity in your primary residence, with acreage limits of up to ½ acre in a municipality or up to 160 acres outside. To claim the full Florida homestead, you must have owned the home for at least 1,215 days before filing; otherwise a federal cap may apply.

What Is the Wildcard Exemption and When Can I Use It?

The wildcard allows up to $4,000 of personal property protection per debtor if you do not claim or receive the benefits of the homestead exemption. It can be combined with Florida’s $1,000 constitutional personal-property amount to cover cash, tax refunds, household goods, jewelry, or extra vehicle equity.

How Much Vehicle Equity Can I Protect?

Each debtor may exempt up to $5,000 of equity in a single motor vehicle. If you aren’t claiming homestead, you may also apply any remaining wildcard amount to cover additional vehicle equity. Equity equals fair-market value minus liens.

Do Married Couples Get Separate Exemptions and How Is Joint Property Treated?

Yes. Most exemptions are per debtor, so married joint filers each receive their own amounts (e.g., each can claim a $5,000 vehicle exemption and, if eligible, a $4,000 wildcard). Florida’s tenancy-by-the-entirety rules can also protect certain jointly owned marital property from the creditors of only one spouse.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin