Understanding Chapter 13 Bankruptcy in Florida

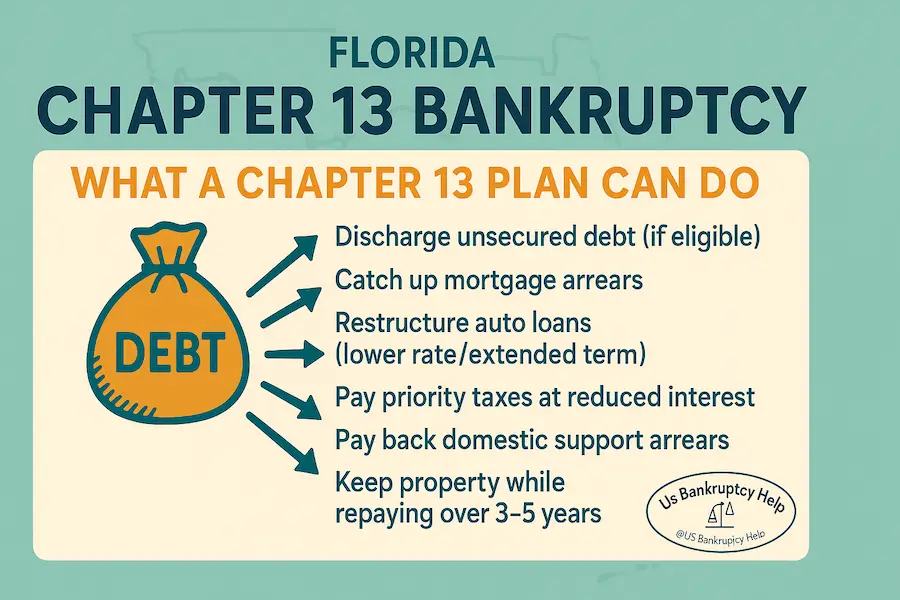

Chapter 13 bankruptcy is a diverse chapter that provides lots of options for Florida filers. It allows individuals with a regular income to create a plan to repay all or part of their debts over a period of three to five years.

Unlike chapter 7, which provides a quick discharge of unsecured debts at the expense of the reconciliation of non-exempt assets, chapter 13 discharges unsecured debt after a 3 to 5 year plan payment period. However chapter 13 filers have many options in chapter 13. They can pay debts that otherwise would not be discharged, catch up home and car payments and many other great options.

Where Chapter 13 Cases Are Filed and Administered in Florida

Florida is divided into three federal bankruptcy districts—Northern, Middle, and Southern. Each district is organized into divisions that determine where you file, where hearings are held, and which Chapter 13 trustee administers your case.

- Northern District of Florida — Pensacola, Tallahassee, Gainesville, Panama City (division).

- Middle District of Florida — Jacksonville, Orlando, Tampa, Fort Myers (division).

- Southern District of Florida — Miami, Fort Lauderdale, West Palm Beach.

Court Locations (By District & Division)

- Northern District — Divisions: Pensacola, Tallahassee, Gainesville, Panama City (filings/operations routed via Tallahassee or Pensacola as posted by the court).

- Middle District — Jacksonville (300 N Hogan St), Orlando, Tampa (801 N Florida Ave), Fort Myers (2110 First St; filings handled via Tampa per court notice).

- Southern District — Miami (301 N Miami Ave), Fort Lauderdale (299 E Broward Blvd), West Palm Beach (1515 N Flagler Dr).

Chapter 13 Standing Trustees Serving Florida

- Northern District of Florida — Leigh A. Duncan (district-wide).

- Middle District of Florida

- Jacksonville Division — Douglas W. Neway.

- Orlando Division — Laurie K. Weatherford.

- Tampa Division — Kelly Remick.

- Tampa & Fort Myers Divisions — Jon M. Waage (also administers Fort Myers cases).

- Southern District of Florida

- Miami Division — Nancy K. Neidich.

- Fort Lauderdale & West Palm Beach Divisions — Robin R. Weiner.

Filing chapter 13 in Florida depends on your district and division—Northern, Middle, or Southern—each with specific courthouse locations and a designated Chapter 13 Standing Trustee who collects plan payments and oversees your case.

How Does Chapter 13 Work in Florida?

Basic Overview of the Chapter 13 in Florida

Chapter 13 bankruptcy starts with a case being filed in bankruptcy court. Once the case is filed, the automatic stay kicks in, and all creditors are barred from further activity while the case is active, without gaining the bankruptcy court's permission.

Filers, also known as "petitioners" or "debtors," submit a chapter 13 plan with their petition. This plan outlines the debtor's payment plan. Plans last for 36 to 60 months.

In a chapter 13 plan, debtors are to pay their "disposable monthly income" to the chapter 13 trustee. The trustee then distributes the funds to creditors.

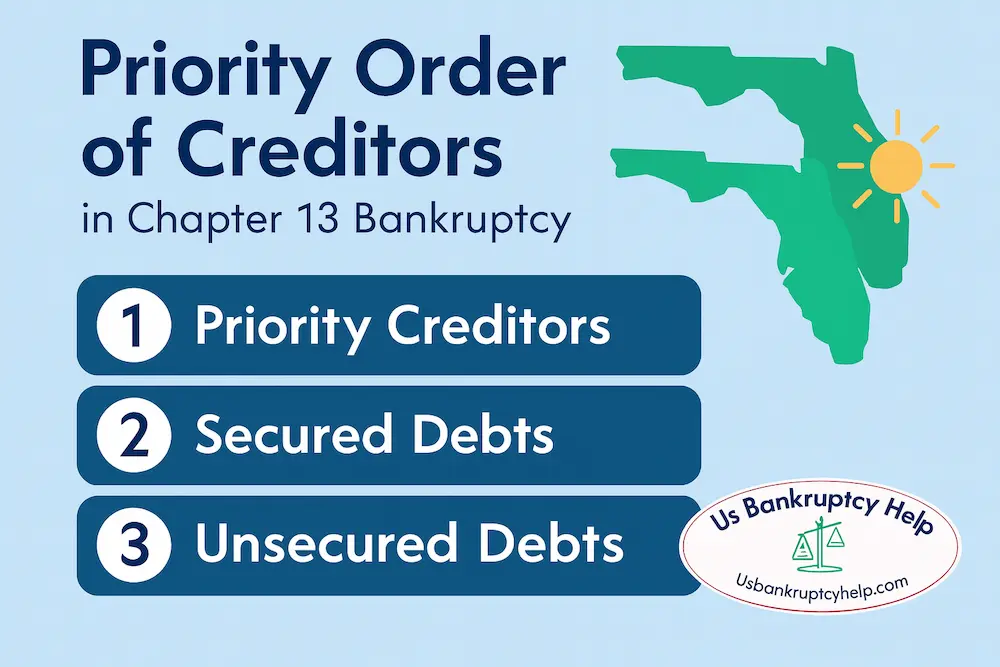

These funds can go toward different creditors. There is a hierarchy of creditors, therefore certain creditors get paid before others. Debtors use this to their advantage.

Hierarchy of Creditors Used

Priority creditors are paid first, followed by secured creditors, and finally unsecured creditors. This allows debtors who owe non-dischargeable debts, such as back taxes or child support, to use their disposable income to pay these debts in full. This also allows debtors to pay off certain secured debts, like vehicle loans, sometimes at reduced interest and sometimes even reduced principal.

In Florida Plan Payments Can Be Used to Pay Back Arrearages

Debtors may also use chapter 13 to pay back arrears on their primary residence, their vehicle, and domestic support obligations. This is especially useful for those who are faced with foreclosure or repossession. Filing the chapter 13 case would stop the foreclosure or repossession with the automatic stay, and then allow the debtor to catch up their home or vehicle payments.

Unsecured Creditors May Get Paid Little or Nothing

After priority and secured creditors are paid, the Florida chapter 13 trustee may then pay any remaining dischargeable debts. Often times, there are limited funds left over for unsecured creditors, and most plans usually end with them getting paid a small fraction of what they are owed.

Chapter 13 Plans Must Be Confirmed by the Court

Chapter 13 plans go through a confirmation process. When the plan is filed with the court, it is sent to all the creditors the debtor lists. These creditors may object to the plan. If creditors object, the objection has to be resolved, either by negotiation or by court decision.

The chapter 13 trustee also has an opportunity to object to the plan. If the trustee objects to the plan, the debtor can adjust the plan to address the trustee's concerns. The Debtor can also set a confirmation hearing to argue the trustee's objections, and the court can decide to confirm the plan, or not to confirm the plan. In the majority of cases, the trustee stipulates to confirmation of the plan, once the debtor addresses the trustee's concerns, and there is no need for a confirmation hearing.

Making Payments Under the Chapter 13 Plan and Discharge

By the time the plan is confirmed, the debtor has already made a few plan payments. The debtor will then carry on making plan payments until the plan is over. Most often the debtor will also have to submit tax returns and tax refunds to the chapter 13 trustee, each year they are in the plan. These refunds are usually treated as "supplemental plan payments" to benefit unsecured creditors.

Once the plan is completed, the debtor receives a discharge of any remaining unsecured debt.

How to Qualify for Chapter 13 in Florida

To qualify for Chapter 13 bankruptcy in Florida, you must meet specific requirements. These criteria ensure that Chapter 13 is an appropriate solution for your financial situation and that you can make the plan payments.

Credit Counseling

Before filing, you must complete credit counseling through an approved agency. This counseling must occur within 180 days before filing for bankruptcy. This can be done online or over the phone. These classes usually take around an hour and a half to complete. Once your class is over you will receive a certificate. This certificate is usually filed with your case along with a declaration.

Regular Income

You must have a regular source of income to be in a chapter 13 case. The reason is obviously because if you don't have regular income, you probably won't be able to make regular plan payments, which is essential to chapter 13. This income can come from employment, self-employment, or other sources such as Social Security.

If you do not have regular income, but will in the near future, you usually can still file the case and schedule your payments according to when you will start receiving income. This is beneficial to people who have lost a recent source of income, but have a new job starting soon to replace that income.

Debt Limits

To qualify for chapter 13 in 2025, your liquidated debts must be under separate limits: unsecured debts less than $526,700 and secured debts less than $1,580,125 (effective for cases filed on or after April 1, 2025, per 11 U.S.C. §109(e) and the triennial adjustments under §104).

These debt thresholds are periodically adjusted to reflect economic conditions. They help differentiate cases that are appropriate for Chapter 13 from those that may require different legal strategies, such as Chapter 11 for larger debts. Understanding these limits helps you determine whether Chapter 13 is the right path for your financial recovery.

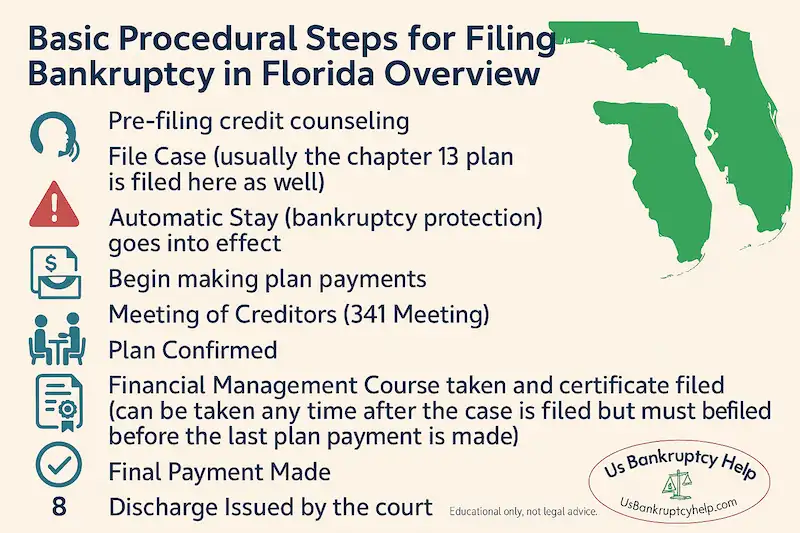

Basic Procedural Steps for Filing Bankruptcy in Florida Overview

Here is a list of the steps to complete chapter 13 in Florida:

- 1. Pre-filing credit counseling

- 2. File Case (usually the chapter 13 plan is filed here as well)

- 3. Automatic Stay (bankruptcy protection) goes into effect

- 4. Begin making plan payments

- 5. Meeting of Creditors (341 Meeting)

- 6. Plan Confirmed

- 7. Financial Management Course taken and certificate filed (can be taken any time after the case is filed but must be filed before the last plan payment is made)

- 8. Final Payment Made

- 9. Discharge Issued by the court

Challenges of Chapter 13 Bankruptcy

While chapter 13 bankruptcy offers many benefits, it's essential to consider the challenges. Understanding these potential drawbacks can help you prepare for the process and make an informed decision.

Long-Term Commitment

A repayment plan can last three to five years, requiring a long-term commitment to staying on track with payments. This extended time frame demands discipline and perseverance, as any missed payments could jeopardize your case.

Committing to a multi-year repayment plan necessitates careful planning and a commitment to financial responsibility. It requires adherence to the budget and payment schedule set forth in the plan, which can be challenging in the face of unexpected life changes or financial emergencies. However, with consistent effort and careful management, the long-term commitment can lead to successful completion and financial recovery.

Strict Budgeting

You'll need to adhere to a strict budget during the repayment period, which may require significant lifestyle changes. This budgeting is necessary to ensure that you can meet your repayment obligations and successfully complete the Chapter 13 plan.

Living within a strict budget can be challenging, but it also promotes financial discipline and awareness. The constraints of the budget encourage thoughtful spending and prioritization of needs over wants. By embracing these changes, you can develop lasting financial habits that support your long-term goals and stability.

Florida Chapter 13 Bankruptcy: Is It Right for You?

Filing Chapter 13 bankruptcy in Florida can be a viable option for individuals seeking to manage their debts while retaining valuable assets. By understanding the process, requirements, and benefits, you can make an informed decision about whether Chapter 13 is right for you. This knowledge empowers you to take control of your financial future and pursue a path toward stability and recovery.

As you consider your options, consulting with a bankruptcy attorney can provide valuable insights and guidance tailored to your specific situation. An attorney can help you navigate the complexities of chapter 13 bankruptcy, offering advice on crafting a feasible repayment plan and ensuring compliance with legal requirements. With the right support, you can successfully navigate the chapter 13 process and take definitive steps toward financial stability.

Florida Chapter 13 Success Stories

Miami Homeowner Stops Foreclosure and Catches Up on Mortgage

A Miami family fell six months behind after a medical issue. Filing chapter 13 triggered the automatic stay, paused the foreclosure sale, and let them spread the arrears over a 60-month plan while resuming regular payments. They kept the house, paid priority taxes through the plan, and finished with a manageable budget and a current mortgage.

Tampa Driver Keeps Car and Lowers Monthly Payment

After hours were cut at work, a Tampa filer was close to repossession on a reliable commuter car. Chapter 13 allowed a reduced interest rate and an extended repayment term inside the plan, which lowered the monthly car cost and prevented repo. With credit cards paid only a small percentage, the plan fit the paycheck—and the filer kept the car needed to stay employed.

Orlando Wage Earner Repays Support Arrears and Finishes Debt-Free

An Orlando parent owed domestic support arrears and had mounting credit card balances. Through chapter 13, all support arrears were repaid in full on a court-approved schedule while staying current on new support. Unsecured debts received a partial dividend and the rest was discharged at completion, giving the filer a clean slate and steady cash flow.

Florida Chapter 13 Bankruptcy FAQs

How long does a Florida chapter 13 plan last?

Most Florida chapter 13 plans run 3 to 5 years. If your household income is below your state’s median, a 36-month plan may be possible; if it’s above, a 60-month plan is typical. Plans can sometimes finish sooner if all allowed claims are paid in full.

Can a Florida chapter 13 stop a foreclosure?

Yes. Filing triggers the automatic stay, which pauses most foreclosure activity. To keep the home, you generally resume regular mortgage payments and use the plan to cure past-due amounts over time. Missed post-filing payments or other exceptions (like repeat filings) can affect the stay, so timing and compliance matter.

What debts are handled in a Florida chapter 13?

The plan can catch up secured arrears (mortgage, vehicles), restructure certain auto loans (often lowering interest and, if the loan is older than 910 days, sometimes the principal), and pay priority debts such as recent taxes and domestic support. Unsecured debts (credit cards, medical bills, personal loans) are typically paid a portion through the plan, with any unpaid eligible balance discharged at the end.

How are my chapter 13 payments calculated in Florida?

Your monthly payment is based on disposable income, required repayment of priority debts, any secured arrears, and administrative costs like trustee fees. Payments usually start within 30 days after filing and are made to the standing trustee assigned to your division. A confirmed plan locks in the terms as long as you stay current.

Where will my Florida chapter 13 case be filed, and what do I need to do before/after filing?

Florida cases are filed in the Northern, Middle, or Southern District based on your county; each district assigns a trustee for your division. Before filing, you must complete a credit-counseling course. After filing—and before you finish payments—you must complete a debtor-education (financial management) course to receive a discharge.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin