Understanding Chapter 7 Bankruptcy in Florida

If you’re considering Chapter 7 in Florida, start here

This page is educational. It highlights the Florida-specific pieces people usually need first—what property is protected, how qualification is checked, and where a case is filed—using official sources when possible.

- Fastest “where do I begin” step: Review Florida’s exemption system, because it often determines what you can keep. Florida is an opt-out state, so most filers use Florida exemptions. Jump to Florida’s exemptions guide.

- Qualification is tied to the means test: Median income figures change periodically. Jump to the Florida median income snapshot below, and compare it to the U.S. Trustee Program’s means-testing guidance.

- Collections pressure: Filing generally triggers the automatic stay, which can pause many collection actions (11 U.S.C. § 362). Some matters are exceptions, so it helps to confirm how it applies to your situation.

- Where your case is handled: Florida is split into the Northern, Middle, and Southern bankruptcy districts. Jump to where you file in Florida for the district/division overview and court resources.

- Need the national basics first: For the general Chapter 7 process overview and federal background, see the main Chapter 7 guide and U.S. Courts bankruptcy basics.

If you’re looking at Chapter 7 in Florida, you’re probably trying to answer a few practical questions quickly: what happens after you file, what property you may be able to keep under Florida exemptions, and how the means test works for your household. This article walks through those Florida-specific points in plain language and links to primary sources where helpful, so you can understand the process and make more informed next-step decisions.

What’s Different in Florida for Chapter 7

The Chapter 7 process is federal, but a few Florida-specific rules and court details can make a big difference in what happens in your case—especially what property is protected and where you file. Here are the main Florida items most people look for first.

- Florida is an opt-out state for exemptions: Most filers use Florida’s exemption system (not the federal exemption list). That’s why the exemptions section is usually the best place to start if you’re worried about a home, car, or personal property. See Florida’s exemptions.

- Qualification depends on the means test and Florida median income figures: The “below-median / above-median” comparison uses Florida’s numbers for your household size, and those figures update periodically. Jump to Florida median income and, for official background, the U.S. Trustee Program’s means-testing page.

- Where you file depends on Florida’s three bankruptcy districts: Florida cases are filed and administered in the Northern, Middle, or Southern District. Your county (and division) typically determines the correct location for filing and the §341 meeting. Jump to where you file in Florida.

- Florida-specific exemption highlights are commonly discussed early: Many Florida filers focus first on the homestead protection and then look at vehicle and personal property coverage. If you want the broader federal overview (timelines, steps, discharge basics), use the main Chapter 7 guide.

- Collections relief is governed by federal law: Filing generally triggers the automatic stay, which can pause many collection actions (11 U.S.C. § 362). This is the same nationwide, but how it affects a specific situation can depend on the facts.

Florida Median Income Snapshot

Below are the U.S. Trustee Program’s Census-based median family income figures for Florida. These numbers are used for the Chapter 7 means test for cases filed on or after May 15, 2025.

| Household Size | Annual Median Income (USD) |

|---|---|

| 1 | $68,085 |

| 2 | $84,305 |

| 3 | $95,039 |

| 4 | $111,819 |

| Median income figures are updated periodically. Always confirm the current numbers for your filing date. | |

Source: U.S. Trustee Program — Median Family Income updated February 3, 2026

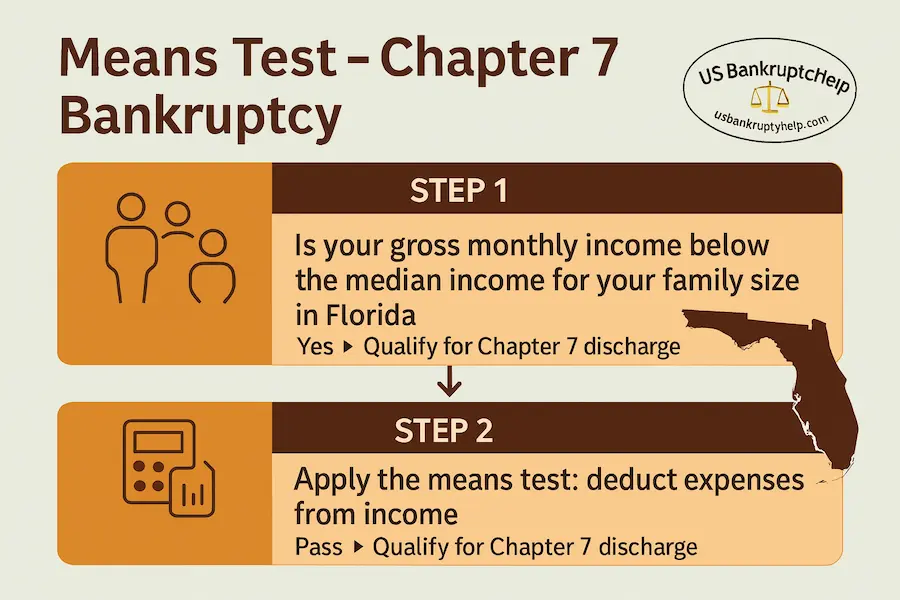

If you’re above the median for your household size, you may still qualify after allowed expenses are applied under the means test. For the full federal overview, see our guide on the means test.

Exemptions in Chapter 7 in Florida

Exemptions are the rules that say what property is protected in a Chapter 7 case. Because Florida is an opt-out state, most people filing in Florida use Florida’s exemptions (not the federal exemption list). If you’re worried about keeping a home, car, or everyday household items, this is usually the most important section to understand first.

- Homestead: Florida’s homestead protection is a major reason many Florida cases are “no-asset.” (There are eligibility and acreage rules, and some federal limits can apply in certain situations.)

- Motor vehicle exemption: Florida law includes a motor vehicle equity exemption (Fla. Stat. § 222.25).

- Personal property: Florida’s Constitution provides a personal property exemption (Fla. Const. art. X, § 4).

- Wildcard: Florida law provides a “wildcard” that can protect additional personal property in some situations (Fla. Stat. § 222.25).

- How exemptions are applied matters: Exemptions typically protect a certain amount of equity (value minus loans/lien balances), not the total value of an item.

For a full, Florida-focused breakdown (including common categories and links), visit Florida’s bankruptcy exemptions.

Protecting a Home and Car

If you’re thinking about filing Chapter 7 in Florida, it’s normal for your first questions to be about the things you rely on every day—your home and your vehicle. In most cases, the conversation comes down to equity (what something is worth minus what you still owe) and which Florida exemption applies.

If you own a home

Florida’s homestead protection is one of the reasons many Florida Chapter 7 cases are “no-asset.” Whether it applies can depend on facts like whether the property is your primary residence and whether any special limits or eligibility rules apply. If you want a deeper, Florida-only explanation, see our dedicated homestead article: Florida homestead exemption explained.

- Start with the basics: Is the home your primary residence, and what’s your estimated equity?

- Why equity matters: Exemptions generally protect equity, not the full market value.

- Common “what if” situations: Recent moves, recent purchases, and property size/location can affect how homestead rules apply.

If you have a car (or need one to work)

Vehicles are often essential for commuting, school drop-offs, and medical appointments. Florida has a motor vehicle exemption that can protect a certain amount of vehicle equity. The key is calculating equity correctly (vehicle value minus any loan balance).

- Calculate equity: Estimated vehicle value − auto loan balance = vehicle equity.

- Florida vehicle exemption source: Fla. Stat. § 222.25.

- If equity is higher than expected: People often look next at whether other Florida exemptions may help cover the difference (for example, personal property or wildcard coverage in certain situations).

If you’re mainly worried about everyday items or savings

Many people are less concerned about valuables and more concerned about practical things—household goods, basic electronics, bank account balances, and a small cushion for bills. Florida’s personal property and wildcard rules are commonly used to protect these kinds of items, depending on your situation.

- Personal property source: Fla. Const. art. X, § 4.

- Wildcard source: Fla. Stat. § 222.25.

For a step-by-step Florida breakdown (including common categories and how equity is typically calculated), see Florida’s bankruptcy exemptions.

Where You File Chapter 7 in Florida

People often wonder where to file a bankruptcy case. Cases are often filed electronically, but some cases are filed in person. Whatever the case may be, bankruptcy is filed in federal court. In Florida, Chapter 7 cases are handled in one of three bankruptcy districts: Northern, Middle, or Southern. Your county (and the court’s division rules) typically determine where you file and where your case is administered, including where the §341 meeting is scheduled.

- Northern District of Florida — Divisions include Pensacola, Tallahassee, Gainesville, and Panama City.

- Middle District of Florida — Divisions include Jacksonville, Orlando, Tampa, and Fort Myers.

- Southern District of Florida — Divisions include Miami, Fort Lauderdale, and West Palm Beach.

Official court websites (recommended): For current filing instructions, division rules, addresses, and §341 meeting information, use the official court sites below:

- U.S. Bankruptcy Court — Northern District of Florida

- U.S. Bankruptcy Court — Middle District of Florida

- U.S. Bankruptcy Court — Southern District of Florida

If you’re looking for general background on how bankruptcy courts are organized nationally, the U.S. Courts overview is a helpful reference: U.S. Courts — Bankruptcy.

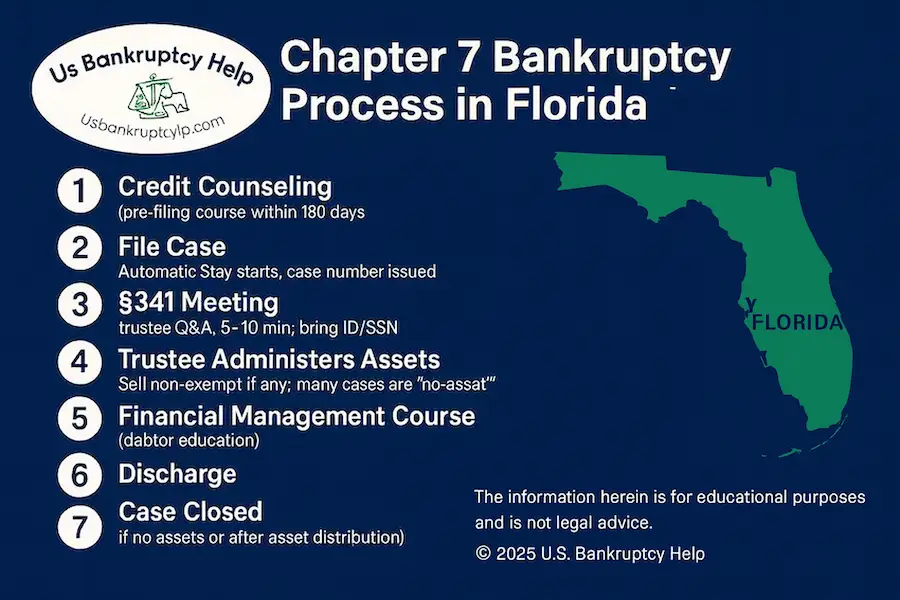

Process Overview and Next Link

If you’re trying to plan ahead, it helps to know the “big picture” steps most people go through in a Chapter 7 case. This is a high-level overview (details can vary by situation and by court).

- Credit counseling: Complete a credit counseling course from an approved provider before filing.

- File the case: Filing begins the case and generally triggers the automatic stay (11 U.S.C. § 362).

- §341 meeting: Attend a short meeting where the trustee asks questions under oath and confirms your paperwork.

- Debtor education: Complete a second required course (financial management) after filing.

- Discharge and case closing: If there are no objections or extra issues, the court enters a discharge and the case is closed afterward.

For the full federal overview (forms, timelines, what debts are typically discharged, and what to expect), see the main Chapter 7 guide and the official U.S. Courts Chapter 7 basics page.

Comprehensive Guide to Florida Bankruptcy Laws

Get detailed, reliable information on Florida bankruptcy from experienced attorneys to help you make informed financial decisions.

Florida Chapter 7 FAQs

These are some of the most common Florida Chapter 7 questions people look up. This page is educational, and the best answers often depend on details like your income, household size, where you live in Florida, and what property you own.

Who qualifies for Chapter 7 in Florida?

Qualification is based on the means test. Many people start by comparing their average household income to Florida’s median income for the same household size. If income is above the median, the means test may still allow a Chapter 7 filing after allowed expenses are applied. (See the Florida median income snapshot above and the U.S. Trustee Program’s means-testing guidance.)

Will I lose my home or car if I file Chapter 7?

Not necessarily. Many Florida cases are “no-asset,” meaning nothing is sold. Whether something is at risk usually depends on your equity and whether Florida exemptions protect it. For homeowners, Florida’s homestead rules are often the key issue. See Florida’s exemptions guide.

Do I use Florida exemptions or federal exemptions?

Florida is an opt-out state, so most people filing in Florida use Florida exemptions. Which exemptions apply can also be affected by residency rules and timing, so it’s important to confirm you’re using the correct exemption system for your situation.

How long does a Florida Chapter 7 case usually take?

Many no-asset cases finish in a few months from filing to discharge. Timing can vary if paperwork needs updates, if there are creditor objections, or if there are non-exempt asset issues. For an official, national overview, see the U.S. Courts Chapter 7 basics page.

What happens to collections, garnishments, and lawsuits when I file?

Filing generally triggers the automatic stay, which can pause many collection actions (11 U.S.C. § 362). Some matters are exceptions, and the effect can depend on the facts, so it helps to confirm how it applies in your situation.

Which debts are usually discharged, and which usually aren’t?

Chapter 7 often clears unsecured debts like credit cards and medical bills, but some categories commonly survive (for example, domestic support obligations and many student loans). For a fuller federal overview, see the main Chapter 7 guide and U.S. Courts Chapter 7 basics page.

How does Chapter 7 affect my credit, and how do I rebuild?

Chapter 7 can stay on a credit report for a number of years, but many people start rebuilding sooner by keeping balances low, paying on time, and monitoring reports for accuracy. Rebuilding timelines vary widely, but post-filing payment history and keeping new debt manageable are often the biggest factors.

Your Next Steps in Florida

If you’re using this page to make a plan, the most helpful next step is usually narrowing things down to a few facts about your situation—what you own, what you owe, and where you live in Florida—so you can focus on the sections that matter most.

- Start with exemptions (what you may be able to keep): Florida bankruptcy exemptions and, for homeowners, Florida homestead exemption explained.

- Check qualification: Compare your household income to Florida’s median income snapshot, then learn how the means test works via the U.S. Trustee Program’s means-testing page.

- Confirm where you file: Use the district guidance in Where You File in Florida and double-check any current filing instructions on the official court website for your district.

- Get the national overview (forms, timelines, discharge basics): Chapter 7 bankruptcy guide and U.S. Courts Chapter 7 basics.

Florida Chapter 7 Sources and References

This page is designed for education and general information. If you want the official, primary-source versions of the rules discussed above, these links are a good place to start.

- Automatic stay (federal law): 11 U.S.C. § 362

- Means testing (official guidance): U.S. Trustee Program — Means Testing

- Median income table (official data): U.S. Trustee Program — Median Family Income updated February 3, 2026

- Official Chapter 7 overview: U.S. Courts — Chapter 7 bankruptcy basics

- Florida motor vehicle / wildcard statute: Fla. Stat. § 222.25

- Florida personal property / homestead (constitutional text): Fla. Const. art. X

Explore Our Florida Bankruptcy Guides

Explore Some of Our National Bankruptcy Guides

- Chapter 7 Bankruptcy: National Guide

- Chapter 13 Bankruptcy: National Guide

- Chapter 7 vs Chapter 13 Bankruptcy: National Guide

- Can Just One Spouse File Bankruptcy?

- Can You File Bankruptcy and Keep Your House?

- Can You File Bankruptcy and Keep Your Car?

- How Often Can You File Bankruptcy?

- Chapter 13 Vehicle Cramdown

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin