Understanding Texas Bankruptcy Exemptions: A Guide

One of the first worries that Texas residents have when they are considering filing for bankruptcy is whether or not they are going to lose everything they own. It's easy to go down that rabbit hole—and that’s a healthy worry. After all, no one wants to lose their stuff. Luckily for Texans, Texas bankruptcy exemptions are some of the most generous in the nation.

This guide will help you understand these exemptions and how they apply to your situation. You'll learn about the Texas homestead exemption, which protects your home, and personal property exemptions. These can safeguard items like furniture and tools.

We’ll also cover how the federal wildcard works if you choose the federal exemption scheme, which can add flexibility for protecting various assets. Knowing your options can make a significant difference.

With the right knowledge, you can make informed decisions to protect your business and personal assets. Let's explore Texas bankruptcy exemptions together.

What Are Texas Bankruptcy Exemptions and Why Do They Matter?

Texas exemptions are designed to protect your essential assets, allowing you to keep what you need even when you're facing financial difficulty. Whether it's your home, personal belongings, or tools of your trade, Texas law provides these robust protections to help you get back on your feet. Without exemptions, creditors might claim everything you own, leaving you with nothing. They provide a safety net during financial difficulties.

Choosing the right exemptions can maximize your protection. Knowing how they work allows you to make informed decisions.

Texas Exemptions Residency Eligibility Rules

To be able to claim Texas bankruptcy exemptions, or have the ability to choose between Texas or federal exemptions, eligibility criteria must be met. Residency is the first hurdle. You must have lived in Texas for at least 730 days before filing. Be aware that, as we will discuss below, in order to claim the full Texas homestead exemption, and not be capped by federal law, you must have owned the Texas property for at least 1,215 days.

Texas Bankruptcy Exemptions or Federal Exemptions - Your Choice

Not only are bankruptcy exemptions in Texas friendly, if you don't like them, you don't have to use them. You can choose to use the federal bankruptcy exemptions instead. But you have to choose one or the other. To be able to have this choice (choosing Texas or federal exemptions), you must have lived in Texas for at least 730 days before filing your bankruptcy case.

Texas exemptions are often more generous, especially for homeowners. But federal exemptions might offer better protection for other assets. Consider what you need to protect when choosing. Here's a quick comparison:

Your decision significantly impacts which assets remain safe. Careful evaluation can help you optimize your financial protection. Seek legal advice if uncertain, as the implications of this choice are substantial. Properly choosing your exemptions can lay the foundation for post-bankruptcy recovery and stability.For small business owners, understanding these exemptions ensures your business remains operational during financial setbacks.

Texas Bankruptcy Exemption Chart

Below are some of the most common and important bankruptcy exemptions in Texas:

| Category | Statute | Amount / Details | Notes |

|---|---|---|---|

| Homestead | Tex. Prop. Code § 41.002; Tex. Const. art. XVI, § 50 | Unlimited equity* Federal cap: for homestead interest acquired within 1,215 days before filing, 11 U.S.C. § 522(p) limits the protected equity to $214,000 (cases filed 4/1/2025–3/31/2028); certain bad-act scenarios also cap at $214,000 under § 522(q). | *Acreage: up to 10 acres (urban) or 100 (rural single), 200 (rural family). |

| Personal Property | Tex. Prop. Code § 42.001 | Up to $50,000 (single) / $100,000 (family) | Clothing, furniture, tools, firearms, etc. (aggregate cap; exclusive of liens) |

| Motor Vehicle | Tex. Prop. Code § 42.002(9) | One vehicle per licensed household member | Counts toward the personal-property aggregate cap. |

| Retirement / Pension | Tex. Prop. Code § 42.0021 | Exempt for tax-qualified plans (ERISA plans, IRAs, HSAs, 529/ABLE as specified) | Subject to tax-qualification and statutory conditions. |

| Wages | Tex. Const. art. XVI, § 28 | Current wages exempt from garnishment (state law) | Exceptions under Texas law include court-ordered child support and spousal maintenance; separate federal law allows wage collection for certain federal debts (e.g., IRS levies and federal student-loan administrative wage garnishment). |

| Insurance Benefits | Tex. Ins. Code ch. 1108 | Generally exempt | Life-insurance proceeds and annuities typically protected, subject to statutory exceptions. |

| College Savings (529 Plans) | Tex. Prop. Code § 42.0022; § 42.0021(a)(8)–(10) | Exempt if designated for a beneficiary in a qualified program | Timing and contribution rules apply. |

| Tools of the Trade | Tex. Prop. Code § 42.002(a)(4) | Included under personal-property limit | Items reasonably necessary for your occupation. |

Federal Bankruptcy Exemption Chart (11 U.S.C. § 522(d))

Below are the most common and important federal bankruptcy exemptions.

| Category | Statute | Amount / Details | Notes |

|---|---|---|---|

| Homestead | 11 U.S.C. § 522(d)(1) | $31,575 equity | Amount doubles in a joint case under § 522(m). Consider § 522(p), (q) caps in certain situations. |

| Personal Property | § 522(d)(3) | Household goods, clothing, appliances, books, etc. — aggregate up to $16,850; per-item cap $800 | Jewelry is separate under § 522(d)(4) up to $2,125. Wildcard (below) can supplement. |

| Motor Vehicle | § 522(d)(2) | $5,025 equity in one vehicle | Wildcard can be stacked if needed. |

| Retirement / Pension | § 522(d)(12); § 522(n) | Tax-qualified retirement funds fully exempt; IRAs capped in aggregate at $1,711,975 | ERISA-qualified plans are generally protected; certain benefits also covered under § 522(d)(10)(E). |

| Wages | No stand-alone § 522(d) wage exemption | Post-petition earnings in ch.7 are not estate property (§ 541(a)(6)); CCPA limits garnishment generally to 25% of disposable earnings. | Pre-petition unpaid wages may be protected via wildcard (§ 522(d)(5)) or other specific provisions; ch.13 includes wages in the estate. |

| Insurance Benefits | § 522(d)(7)–(8), (11)(C) | Unmatured life-insurance contract loan value up to $16,850; certain life-insurance proceeds to a dependent exempt to the extent reasonably necessary | Other specified benefits (e.g., crime-victim awards, support) are covered under § 522(d)(10)–(11). |

| College Savings (529 Plans) | § 541(b)(5)–(6) | **Excluded from the estate** if contributed > 720 days before filing; contributions made 365–720 days before filing excluded up to **$8,575** per beneficiary | Contributions < 365 days before filing are not excluded. Exclusion applies regardless of state exemption choice. |

| Tools of the Trade | § 522(d)(6) | $3,175 | Books, tools, or implements needed for your occupation. |

| Wildcard | § 522(d)(5) | $1,675 + up to $15,800 of unused homestead → max $17,475 | Can be applied to any property, including cash or to boost other categories. |

Texas vs. Federal Bankruptcy Exemptions: Making the Right Choice

As seen above, Texas exemptions are often more generous, especially for homeowners. But federal exemptions might offer better protection for other assets.

Your decision significantly impacts which assets remain safe. Careful evaluation can help you optimize your financial protection. Some say you should seek legal advice if you are seriously considering using any of these exemptions. I say, you should ALWAYS seek legal advice if you are considering using these exemptions. Not only should you seek legal advice, but you should get it from a Texas bankruptcy lawyer in your area. There are a bunch of different ways you could get hurt if you file a bankruptcy case and don't know what you're doing.

The Texas Homestead Exemption: Protecting Your Home

Here's an example. The Texas homestead exemption seems pretty straight forward. It provides "unlimited homestead protection." That means unlimited equity is protected by it. That all seems fine and dandy, but what if you haven't lived in Texas for the last 730 days? What if you haven't lived in Texas for the last 1,215 days? Well if that were the case, you couldn't claim the Texas homestead exemption and if you filed your case not fully knowing how the exemption is applied, a chapter 7 trustee would be more than happy to take your unprotected equity, pay it to creditors and use it to pay his attorney's fees, and his fees. He would probably go to the local saloon to celebrate your loss.

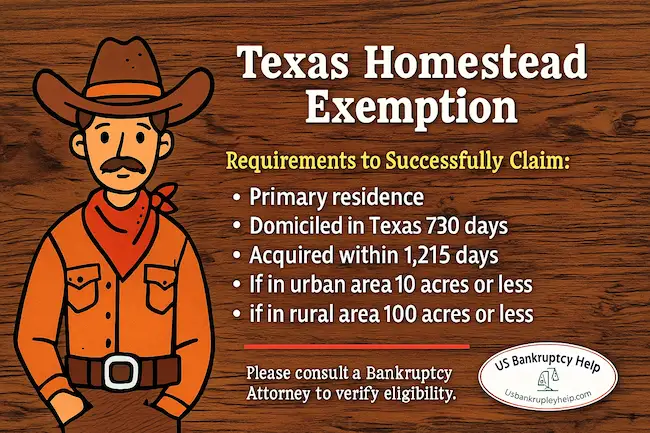

Is your property in an urban area? How do you know? Is it 10 acres or less? If it's in a rural area, is it 100 acres or less? These are all questions that have to be answered in order to successfully claim the Texas homestead exemption.

To qualify for the full Texas homestead exemption, your home must be your primary residence. If it's in an urban area it must be 10 acres or less. If it's in a rural area it must be 100 acres or less. To claim Texas this exemption you must have been domiciled in Texas for at least 730 days. Additionally, if you have lived in Texas less than 1,215 days, the federal exemption will kick in and block you from claiming the full homestead exemption. See the infographic below for a simple reference of these requirements.

Texas Personal Property Exemptions: What You Can Keep

Texas law allows you to protect a substantial amount of personal property during bankruptcy. These exemptions are designed to keep your day-to-day life intact.

Texas personal property exemptions support both individuals and families. Individuals can exempt up to $50,000, while families can protect $100,000 worth of property.

The exemptions cover a wide range of personal items. This includes furniture, clothing, and even home electronics. Such items are crucial for maintaining a comfortable standard of living.

Here are some of the key exemptions:

- Family Protection: Up to $100,000

- Single Adult Protection: Up to $50,000

Additionally, specific items receive further protection. For instance, tools necessary for your trade are typically exempt. This is advantageous for business owners who rely on specific equipment.

Exemptions also extend to food and certain livestock. Thus, basic needs and small-scale agricultural efforts are safeguarded. Understanding these exemptions can greatly aid financial recovery efforts.

Texas exemptions underscore the importance of protecting personal property. By utilizing these exemptions wisely, you can retain vital resources and preserve daily living essentials.

Does Texas Have a Wild Card Exemption?

A wildcard exemption offers flexibility when protecting assets. It's particularly useful for items not covered by other specific exemptions. These exemptions allow debtors to apply it to any property of their choosing. It's a strategic tool for safeguarding assets that might otherwise be vulnerable.

Does Texas have a wild card exemption? Technically, no. However, in Texas, you can claim a wild card exemption under the federal exemption scheme, but not the Texas exemption scheme. This federal wildcard exemption provides a certain monetary amount you can allocate as needed. This freedom ensures you can protect what matters most.

Key Aspects of the Federal Wildcard Exemption:

- Flexibility: Apply it to any unprotected asset.

- Strategic Use: Protect essential yet non-exempt property.

- Monetary Limit: Varies based on total exemption value.

Understanding and utilizing the wildcard exemption can significantly enhance your bankruptcy strategy. It offers an additional layer of protection for valuable assets.

Exemptions for Motor Vehicles

Choosing between the Texas motor vehicle exemption or the federal exemption depends on your specific situation and how much you need to protect.

Texas Vehicle Exemptions

Under Texas law, you may exempt one motor vehicle per licensed household member (or for an unlicensed member who relies on another to drive). The vehicle’s value counts toward the aggregate personal-property cap ($50,000 single / $100,000 family). This helps ensure you can maintain mobility and is vital for commuting or running a business.

Federal Vehicle Exemption

Texans who choose to use the federal exemption scheme, may exempt up to $5,025.00 of vehicle value. The federal wildcard exemption can be used in addition to the motor vehicle exemption.

Retirement Accounts, Insurance, and Other Protected Benefits

Texas offers robust protections for retirement accounts, safeguarding your future financial security. Accounts like IRAs and 401(k)s typically enjoy full exemption from bankruptcy claims.

This means your retirement savings remain untouched, supporting long-term financial stability. Moreover, these exemptions extend to other forms of future security.

Certain insurance benefits, including life insurance policies, also qualify for protection under Texas exemptions. These safeguards ensure financial support for your beneficiaries.

Protected Benefits Include:

- Retirement Accounts: Full exemptions for IRAs, 401(k)s.

- Insurance Policies: Coverage for many types, including life insurance.

- Annuities and Benefits: Specific conditions may apply, maintaining essential support.

Such exemptions play a vital role in your overall financial planning during and after bankruptcy proceedings.

How Exemptions Work in Chapter 7 vs. Chapter 13 Bankruptcy

Understanding the nuances between Chapter 7 and Chapter 13 bankruptcy is vital when it comes to exemptions. In chapter 7, the primary concern is liquidating non-exempt assets. These assets pay off creditors.

Chapter 13, however, involves creating a repayment plan to pay debts over time. This means you typically retain most of your property, including exempt assets.

Exemptions in Chapter 7 determine which assets you can keep. Non-exempt assets are sold, and the proceeds go toward debt settlement.

In contrast, Chapter 13 focuses on reorganizing debts, allowing you to safeguard more assets. The strategic choice between Chapters 7 and 13 depends on individual circumstances and goals.

Key Differences in Exemption Usage:

- Chapter 7: Asset liquidation; exemptions protect key property.

- Chapter 13: Debt reorganization; higher asset retention possible.

- Strategy: Choice depends on personal financial goals and asset protection needs.

Common Mistakes and How to Avoid Them

Navigating the Texas exemption scheme can be tricky, and mistakes can happen. Remember, while these appear pretty straight forward at first glance, there might be something you don't know that could get you in hot water. I can' say it enough: get yourself a Texas bankruptcy lawyer who knows what they are doing! It could be the smartest thing you've ever done.

Know How Long You've Lived in Texas.

torI've often been surprised at how many people have no idea how long they've lived in the state they are living in. I get it if you've lived in a state for consecutive decades. But if you are relatively new to Texas, or have lived in Texas, and moved back for example, you have to know exactly how long you've lived in Texas. You have to be able to know if you've lived in Texas for over 730 days to be able to claim these Texas exemptions.

Valuing Your Property Accurately

One of the hardest thing for people to pin down is the value of their property. I can't tell you how many times I've had an appointment with someone and they have no idea how much their car or house is worth. It's important to know this so you know which exemptions are best for you, and so you can also share this information with your lawyer.

Mistakes to Avoid:

- Not choosing the right exemption system.

- Incomplete or inaccurate documentation.

- Misunderstanding exemption values and limits.

By carefully reviewing these points, you can steer clear of common setbacks.

Maximizing Protection and Planning for the Future

Navigating bankruptcy in Texas requires a strategic approach. Understanding exemptions can significantly enhance your asset protection.

With careful planning, you can use these exemptions to secure crucial personal and business assets. Legal guidance is essential.

By staying informed and utilizing exemptions wisely, you set the groundwork for financial recovery. Protecting key assets supports long-term stability.

Texas Bankruptcy Exemptions: Frequently Asked Questions

Can I Use Both Texas and Federal Exemptions in the Same Case?

No. You must choose one system—either Texas exemptions or the federal exemptions—for your case. In a joint case, spouses must use the same system. To use Texas exemptions, you generally must have been domiciled in Texas for the 730 days before filing.

Does the Texas Homestead Exemption Stop a Foreclosure?

The homestead exemption protects equity from most creditors, but it does not by itself stop a mortgage lender from foreclosing if you are in default. If you need time to cure arrears, chapter 13 can often let you catch up over time while keeping the home, provided you can afford the plan payments.

What If I Bought My Home Recently—Does the Federal 1,215-Day Cap Apply?

Yes. Even in Texas, equity attributable to homestead interests acquired within 1,215 days before filing can be capped under federal law (11 U.S.C. § 522(p)). For cases filed April 1, 2025 through March 31, 2028, that cap is $214,000. This is separate from Texas’s acreage limits.

How Are Vehicles Treated Under Texas Exemptions?

Texas allows one motor vehicle per licensed household member (or per unlicensed member who relies on another to drive). The vehicle’s value counts toward the overall personal-property cap—$50,000 for a single adult or $100,000 for a family.

Does Texas Have a Wildcard Exemption?

Texas does not provide a wildcard in its state scheme. If you choose the federal exemption system, there is a wildcard that can be applied to any property (a base amount plus additional unused homestead amount). You cannot mix systems—choosing federal to use the wildcard means you use federal amounts across the board.

How Do Exemptions Work Differently in chapter 7 Versus chapter 13?

In chapter 7, non-exempt assets can be sold by the trustee; exemptions determine what you keep. In chapter 13, you usually keep your property, but your plan must pay unsecured creditors at least the value of your non-exempt assets (the “best-interest” test). Exemptions still matter because they influence the required plan payout.

Are Retirement Accounts, Life Insurance, and 529 Plans Protected?

Most tax-qualified retirement accounts (e.g., 401(k)s, IRAs) are protected. Many life-insurance and annuity benefits are exempt under Texas law, subject to specific conditions. Qualified 529 college-savings contributions may be protected or excluded from the estate depending on timing rules. Review your accounts with a Texas bankruptcy attorney before filing.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin