Chapter 7 Bankruptcy in Texas

Shopping is a Texas tradition, just like watchin’ high school football and goin’ two-steppin’. This tradition comes at a steep price. Texas households have one of the highest average credit card debt loads in the country. Most credit cards have sky-high interest rates. Additionally, many families struggle with medical debt. Most healthcare providers quickly sell unpaid debts to relentless debt-buyers who make life miserable. If you’re researching chapter 7 bankruptcy Texas, you’re not alone—plenty of Texans look to this option when interest and collections won’t let up.

Chapter 7 Bankruptcy Texas: What It Means and How It Works

In as little as six months, a chapter 7 bankruptcy in Texas discharges (forgives) most unsecured debts. Instead of paying hundreds of dollars a month on credit card minimum payments and never making a dent in the UPB (unpaid principal balance), bankruptcy chapter 7 in Texas allows families to put this money to good use elsewhere. Chapter 7 has many other benefits as well.

Qualifying for Chapter 7 Bankruptcy in Texas

Since way back in 2005, credit card companies have successfully spread the myth that chapter 7 bankruptcy is only available in extreme situations, and most people shouldn’t even bother considering filing for chapter 7 bankruptcy in Texas. As is often the case, myth is far different from reality. Most people easily meet the formal and informal qualifications for a Texas chapter 7.

Formal Qualifications and the Means Test in Texas

All bankruptcy debtors must complete a pre-filing credit counseling course. Most people complete such a class before they reach out to a bankruptcy lawyer.

Additionally, to receive a discharge, all chapter 7 filers in Texas must complete a post-filing budgeting class. Such classes are usually available online at a very low cost.

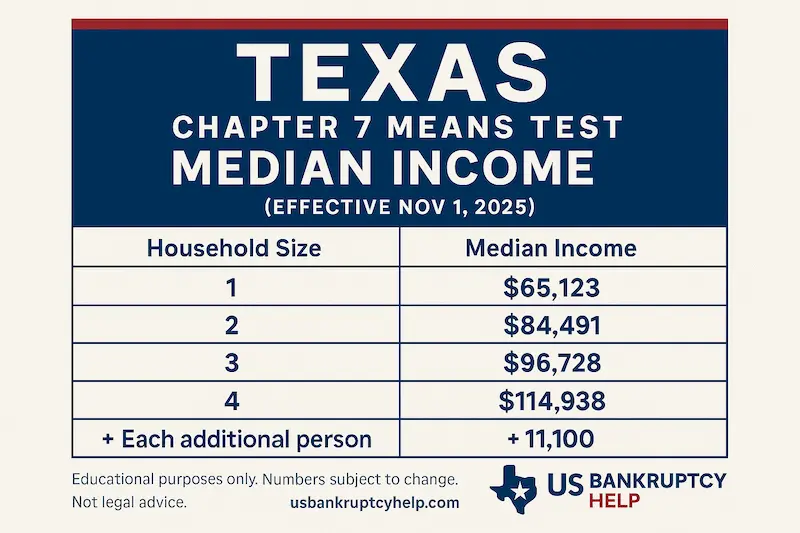

The 2005 bankruptcy reform laws also created the means test for chapter 7. Debtors automatically qualify for this form of relief if their income is lower than the statewide average for that household size. For cases filed May 15–Oct 31, 2025, the 4-person median is $110,719; for cases filed on or after Nov 1, 2025, it’s $114,938.

Current Median Income Levels in Texas by Family Size

These are the U.S. Trustee Program’s current Census-based median family income figures for Texas. These numbers are used for the chapter 7 means test for cases filed on or after November 1, 2025.

- 1 person: $65,123

- 2 people: $84,491

- 3 people: $96,728

- 4 people: $114,938

- 5 people: $126,038

- 6 people: $137,138

- 7 people: $148,238

- 8 people: $159,338

Heads-up: The U.S. Trustee Program updated the median family income figures effective November 1, 2025. For Texas, the new annual medians are: $65,123 (1 person),$84,491 (2 people), $96,728 (3 people), $114,938 (4 people); add $11,100 for each person over four. If your case will be filed on or after 11/1/2025, use these numbers.

Quite frankly, if household income is significantly higher, chapter 7 bankruptcy may not be the best solution to a family’s financial problems. Other alternatives, such as chapter 13 bankruptcy, and non-bankruptcy debt negotiation, are available. Non-bankruptcy alternatives are especially attractive if the debtor faces no immediate extreme adverse action, such as repossession or a creditor lawsuit.

If you saw that $110k number and immediately thought chapter 7 is unavailable, think again. A back door may be available.

When a debtor’s income is only marginally higher and/or extreme adverse actions are either looming or ongoing, chapter 7 in Texas may still be an option. Sometimes, a lawyer uses the debtor’s actual monthly income and expenses, from Schedules I and J (forms of the bankruptcy petition where you enter income and expenses) to satisfy the means test qualification. Generally, the cost of living inside the Texas Triangle (Dallas/Fort Worth to San Antonio to Houston to Dallas/Fort Worth) is higher than the cost of living in other areas of the Lone Star State.

Informal Qualifications for Chapter 7 Bankruptcy in Texas

The formal qualifications are fixed by federal law and are identical in all bankruptcy court jurisdictions in Texas. Informal qualifications vary slightly, but they’re usually about the same.

An excessive number of reaffirmation agreements could disqualify a debtor from chapter 7. Almost all debtors reaffirm (voluntarily agree to keep paying) monthly bills, such as auto loans, car loans, and ISP (internet service provider) bills. If a debtor also reaffirms other obligations, such as credit card bills or medical bills, many trustees (people who manage bankruptcies for judges) could question the debtor’s need to file chapter 7.

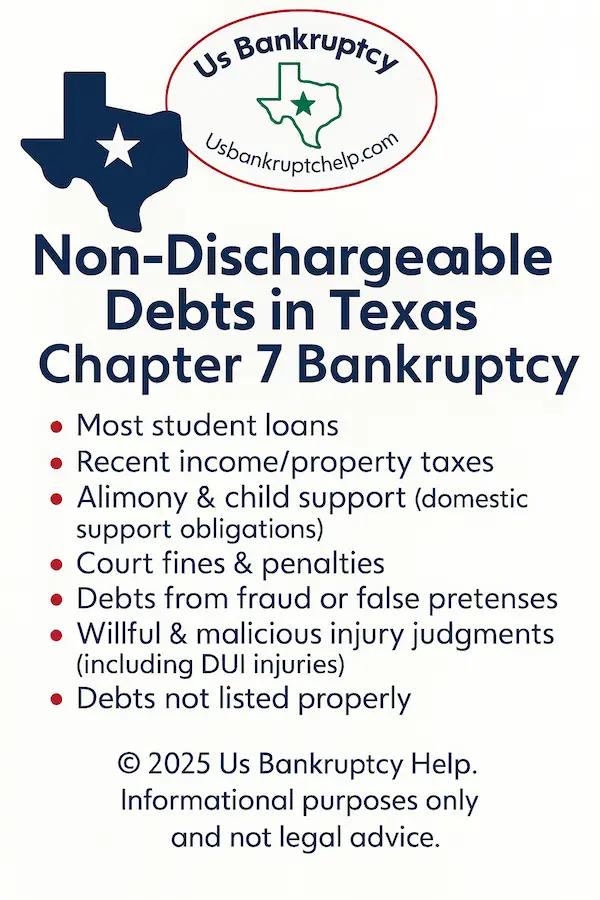

Some unsecured debts, such as past-due child support, are either not dischargeable or others are only dischargeable in some situations (taxes for example). The Automatic Stay (bankruptcy protection) still applies to these obligations. After discharge, any adverse actions, such as lawsuits, may restart.

To many trustees, Schedule I (monthly income) and Schedule J (monthly expenses) imbalance is also a red flag. Debtors in the red each month are clearly in financial distress and clearly need to make radical changes. Debtors in the black each month simply do not appear distressed.

Chapter 7 bankruptcy trustees in Texas also look for other red flags during a mandatory meeting with debtors. More on that below.

Preparing to File for Chapter 7 Bankruptcy in Texas

Around 2005, preparing to file a chapter 7 bankruptcy petition in Texas was often the most time-consuming portion of a case. Technology has quickened the pace, but attention to detail is still very important at this stage.

Notice to creditors is a good example. All creditors must receive actual notice of the filing. One debt could involve many creditors. For example, if Brenda is behind on her car payments, potential creditors include not only the bank but also the servicing company, a debt-buyer, and a towing company.

So much information is now available at our fingertips that sending notice letters seems like an arcane and ridiculous requirement. But it’s still part of the process.

Automatic Stay

The moment a lawyer files a petition, Section 362 of the Bankruptcy Code takes effect. This section of the law prohibits most creditor adverse actions, such as:

- • Wage garnishment,

- • Foreclosure,

- • Creditor lawsuits,

- • Repossession, and

- • Creditor harassment.

Technically, Section 362 prohibits most creditor-to-debtor communications. To many creditors, “communication” includes ACH and other automatic debit arrangements. If these debits stop, debtors must make manual payments on their own.

As a general rule, adverse actions like foreclosure and repossession are almost impossible to undo. So, if you’re behind on these payments, speak to a lawyer about chapter 7 bankruptcy in Texas straightaway.

Texas Bankruptcy Exemptions and Chapter 7

We mentioned some myths about chapter 7 bankruptcy in Texas. Another one is that these people lose most or all of their assets. That result may be true in a board game like Monopoly. But real life is much different.

Texas has some of the most generous property exemptions in the country. These property exemptions include:

- • Unlimited Homestead Exemption: Texas protects up to 10 urban acres (contiguous lots) or 100 rural acres for a single adult / 200 rural acres for a family. Proceeds from a homestead sale are exempt for 6 months.

- • Personal Property: Up to $50,000 (single) or $100,000 (family) across eligible items listed in §42.002, exclusive of liens.

- • Motor Vehicle: One vehicle per household member with a license (or for an unlicensed dependent who relies on another to drive), counted toward the personal-property cap.

- • Retirement Accounts and Government Benefits: ERISA-qualified plans are generally fully exempt, and Social Security benefits are protected. Traditional/Roth IRAs are exempt up to $1,711,975 (federal cap, adjusted 4/1/2025).

Texas allows you to choose either Texas state exemptions or the federal exemption system—but not both. You must be a Texas resident for at least 730 days to use the Texas bankruptcy exemption scheme. Check out our detailed guide on Texas bankruptcy exemptions to find out more.

Do these exemptions not work for you? No problem. Texas is one of the few states that allows debtors to select state or federal exemptions (not both). In terms of categories, the federal exemptions are much the same. By the numbers, they’re a little different.

- • Homestead: Federal §522(d)(1) protects up to $31,575 in equity (doubles for joint filers who co-own).

- • Motor vehicle: Up to $5,025 under §522(d)(2).

- • Household goods: Up to $16,850 aggregate, with a $800 per-item cap (§522(d)(3)).

- • Wildcard: $1,675 in any property plus up to $15,800 of unused homestead (§522(d)(5)).

Retirement accounts: ERISA-qualified plans are generally fully exempt; traditional and Roth IRAs are exempt up to$1,711,975 (§522(n), adjusted 4/1/2025).

Because of these differences, most bankruptcy lawyers recommend that long-time homeowners use state exemptions, and others (new homeowners or renters) use federal exemptions.

In some jurisdictions, additional informal exemptions are available. The best interests of creditors rule is a good example.

Alternatives to chapter 7 bankruptcy in Texas include non-bankruptcy debt negotiation, chapter 13 bankruptcy, and, if back taxes are an issue, IRS Fresh Start Program initiatives.

Assume Rick has a camper worth $1,000. The camper needs several hundred dollars in repairs. Moreover, the trustee must pay all sales expenses, such as repossession, storage, and marketing costs. The trustee must also pay auction fees and other such expenses. When all is said and done, the cost of liquidating the camper may well exceed its sales price. Therefore, seizure is not in the creditors’ best interest and prohibited by the Bankruptcy Code.

The Trustee in a Chapter 7 Bankruptcy in Texas

A trustee has a small, but important, role in a Texas chapter 7 bankruptcy. Trustees and debtors, along with their lawyers, usually meet about six weeks after the petition is filed.

Prior to the meeting, most debtors must produce documents for inspection, such as tax returns and insurance declaration pages. At the meeting, debtors must verify their identities, usually with a Social Security card, and answer a few scripted yes/no questions.

If the trustee sees no signs of possible fraud, such as unexplained income changes or the aforementioned red flags, the judge typically enters a discharge order without holding a hearing.

Debt Discharge

A discharge order eliminates the legal obligation to repay an unsecured debt. The purpose of bankruptcy is to give honest debtors a fresh start. By wiping out unsecured debts like credit cards and medical bills, a discharge allows you to focus on rebuilding your finances instead of drowning in old obligations. Think of it as clearing the slate so you can move forward with more stability and peace of mind.

At the end of the day, the discharge is not about escaping responsibility—it’s about giving you the legal and financial tools to start over. Use that fresh start wisely, and you’ll be in a much better position to rebuild your credit, regain financial confidence, and plan for the future.

Frequently Asked Questions About Texas Chapter 7 Bankruptcy

Who can file for chapter 7 bankruptcy in Texas?

Any individual, married couple, or small business owner facing overwhelming debt may qualify for chapter 7 bankruptcy in Texas. Eligibility depends on the means test, which compares your household income to the state median, as well as your overall financial situation.

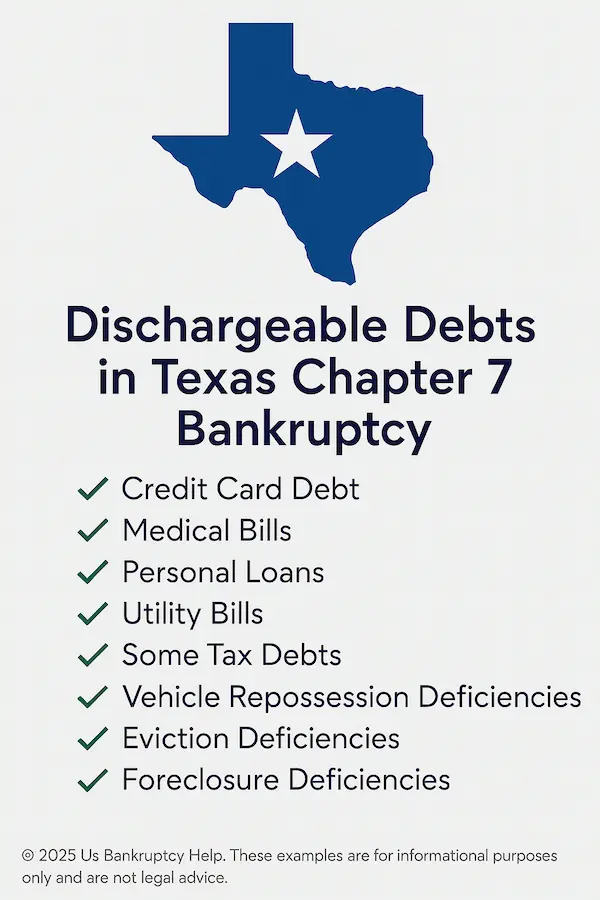

What debts are typically discharged in a Texas chapter 7 case?

Most unsecured debts such as credit cards, medical bills, payday loans, utility balances, and personal loans are eliminated through a chapter 7 discharge. Certain obligations like recent taxes, student loans, child support, and alimony generally remain non-dischargeable.

How long does chapter 7 bankruptcy take in Texas?

A typical Texas chapter 7 case takes about four to six months from filing to discharge. Timelines may vary depending on how quickly paperwork is completed, trustee requests, and whether creditors challenge any part of your petition.

Will I lose my home or car if I file for chapter 7 bankruptcy in Texas?

Texas has some of the most generous exemption laws in the country. Homeowners can protect unlimited homestead equity (subject to acreage limits), and each household member may keep a motor vehicle. In many cases, filers keep both their home and car if payments are current.

What is the means test for chapter 7 bankruptcy in Texas?

The means test compares your household income to the Texas median income for your family size. If you fall below the median, you qualify automatically. If you are above, allowable expenses may still bring you within range. For cases filed May 15–Oct 31, 2025, the 4-person median is $110,719; for cases filed on or after Nov 1, 2025, it’s $114,938.

How will filing chapter 7 affect my credit in Texas?

A chapter 7 bankruptcy remains on your credit report for up to ten years. However, many filers begin rebuilding credit within months by making timely payments on secured debts, using new credit responsibly, and maintaining stable income. The discharge often improves your debt-to-income ratio, which can help long-term.

Can I choose between Texas and federal bankruptcy exemptions?

Yes. Texas filers may elect either Texas state exemptions or the federal exemption system, but not both. Long-time homeowners often benefit from state exemptions due to the unlimited homestead protection, while renters or new homeowners sometimes find the federal exemptions more flexible.

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin