Understanding Chapter 7 Bankruptcy in Indiana

If bills are snowballing and collectors won’t stop calling, Chapter 7 bankruptcy in Indiana can press pause and give you a fresh start. Most people file to wipe out unsecured debts (credit cards, medical bills, personal loans) and to stop lawsuits, garnishments, and utility shut-offs while they regroup.

Chapter 7 Bankruptcy in Indiana — At a Glance

- What chapter 7 does: A federal court process under Title 11, chapter 7 of the U.S. Code that can wipe out many unsecured debts (credit cards, medical bills, personal loans) for eligible Indiana residents and stop most collection activity through a discharge.

- Who qualifies in Indiana: Most people qualify by passing the Indiana chapter 7 means test—usually by having household income at or below the Indiana median for their family size, or by showing little disposable income after allowed expenses if they are above median.

- Indiana chapter 7 income limits 2025: Uses official U.S. Trustee median income figures for Indiana (updated periodically). If your annualized six-month income is below the median for your household size, you usually pass the income portion of the means test.

- Indiana exemptions and what you keep: Indiana chapter 7 bankruptcy exemptions—drawn from Indiana Code § 34-55-10-2 and related rules (including 750 IAC 1-1-1)—help protect portions of home equity, a vehicle, household goods, many retirement accounts, tools of the trade, and some personal property in a chapter 7 case.

- Timeline for a typical Indiana case: Many straightforward Indiana chapter 7 cases take about 4–6 months from filing to discharge, including credit counseling, the petition filing, a short 341 meeting of creditors, debtor education, and then the court’s discharge order.

- Chapter 7 bankruptcy Indiana cost: Court filing fee of $338 (see the U.S. Courts bankruptcy fee schedule), required counseling and education courses, plus attorney fees that often range from about $1,000–$3,500+ for consumer cases, depending on the number of creditors, means-test complexity, assets, and exemption issues.

- Debts wiped out vs. debts that survive: Most unsecured debts can be discharged, but obligations like child support, alimony, many recent taxes, most student loans, criminal fines, and some fraud-related debts usually survive chapter 7.

- How often you can file: To receive another chapter 7 discharge, you usually must wait eight years from the filing date of your prior chapter 7 case; different waiting periods apply if you move between chapter 7 and chapter 13.

- Key pros and cons: Pros include fast relief and discharge of many unsecured debts with no long-term payment plan; cons include a 10-year credit report notation, potential risk to non-exempt assets, and the fact that not all debts are eliminated.

- Why an Indiana bankruptcy attorney matters: Chapter 7 involves strict deadlines, means-test math, exemption strategy, and trustee review. An experienced Indiana bankruptcy lawyer can help you decide if chapter 7 is the right fit, protect assets where possible, and guide you toward a smooth discharge of unsecured debt.

Chapter 7 does not always mean losing everything. While some non-exempt property can be sold to pay creditors, Indiana law lets you protect key assets through state exemptions. Many filers keep all of their property because it’s either fully exempt or not worth administering.

To qualify, you’ll complete the means test, which compares your last six months of household income to Indiana’s median and then accounts for allowable expenses. Passing the test (or qualifying for an exception) is the gateway to a discharge.

The process is structured and straightforward: you’ll complete required forms and courses, file in the appropriate Indiana Bankruptcy Court (Northern or Southern District), and attend a brief 341 meeting with a court-appointed trustee who verifies your paperwork.

Some debts—such as child/spousal support, certain recent taxes, and most student loans—are typically not dischargeable. Knowing what survives helps you plan realistically for life after the case.

Finally, the moment you file, the automatic stay can stop creditors, halting wage garnishments and foreclosures, giving you breathing room while the case moves forward. A knowledgeable Indiana bankruptcy attorney can make each step smoother, ensure your exemptions are maximized, and help you avoid pitfalls.

What Is Chapter 7 Bankruptcy in Indiana?

Chapter 7 bankruptcy in Indiana is a court process that can wipe out many unsecured debts (credit cards, medical bills, personal loans) through a discharge order. In short, if you qualify, eligible unsecured debts are eliminated so you can reset your finances.

Not every debt goes away. Obligations like child/spousal support, certain recent taxes, and most student loans usually remain. It’s crucial to understand what survives your case so you can plan realistically.

For many Hoosiers, the timeline is relatively fast—often about four to six months from filing to discharge—so long as paperwork is accurate and deadlines are met.

Eligibility is determined by the means test, which compares your last six months of household income to Indiana’s median and then accounts for allowed expenses. Passing the means test (or qualifying for an exception) is essential to proceed under chapter 7.

Key Points of Chapter 7 Bankruptcy in Indiana

- Discharges most unsecured debts (credit cards, medical bills, personal loans)

- Some debts are not dischargeable (support, certain taxes, most student loans)

- Typical timeline: about 4–6 months for many cases

- Trustee oversight and a brief “341” Meeting of Creditors

- Eligibility hinges on Indiana’s means test and allowable expenses

Chapter 7 can be a powerful fresh start when used correctly. Understanding what it does—and doesn’t—do helps you make informed decisions from day one.

How Chapter 7 Bankruptcy Works in Indiana

Here’s the Indiana flow from first click to discharge. In practical terms, filing chapter 7 in Indiana means you’ll file in the Northern or Southern District, get immediate protection from collections, meet briefly with a trustee, and—if all goes smoothly—receive a discharge wiping out qualifying unsecured debts.

Step-By-Step Overview

- 1) File your petition and schedules. Your case begins when you file required forms and financial disclosures with the Indiana Bankruptcy Court. Accuracy matters—errors can slow the case or risk dismissal.

- 2) Automatic stay starts immediately. Most collections, lawsuits, foreclosures, utility shut-offs, and wage garnishments must stop the moment you file.

- 3) A trustee is assigned. The trustee reviews your paperwork, verifies your identity, looks for non-exempt assets, and administers the case.

- 4) Exemptions protect property. Indiana exemption laws can safeguard portions of home equity, a vehicle, household goods, and personal items. Properly claiming exemptions helps you keep essential property.

- 5) Non-exempt items (if any) may be sold. If you own non-exempt property with value for creditors, the trustee can liquidate it and distribute funds according to the law. Many Hoosier cases are “no-asset” because everything is exempt or of low value.

- 6) Attend the 341 Meeting of Creditors. This short, usually 5–10 minute meeting is a Q&A with the trustee about your forms, income, assets, debts, and recent financial activity.

- 7) Complete the required courses. Take credit counseling before filing and a debtor education course after filing to remain eligible for discharge.

What Happens to Your Debts and Property

- • Unsecured debts: Most credit cards, medical bills, and personal loans are discharged at the end of the case.

- • Secured debts: If you want to keep collateral (home/car), you’ll decide whether to stay current and keep it, redeem, or reaffirm—otherwise you can surrender it and wipe out the debt.

- • Non-dischargeable items: Support obligations, certain recent taxes, and most student loans typically remain.

Indiana Snapshot: Timing & Outcomes

- • Typical timeline: Many cases finish in about 4–6 months from filing to discharge.

- • Goal: Obtain a court order that permanently eliminates eligible unsecured debts.

- • Your role: Be honest, complete, and on time with forms, documents, the 341 meeting, and both courses.

Understanding each step—and how Indiana exemptions and trustee review work—keeps the process smooth and predictable, so you can focus on rebuilding after discharge.

Who Qualifies for Chapter 7 Bankruptcy in Indiana?

Eligibility for chapter 7 bankruptcy in Indiana centers on the means test and a handful of legal prerequisites. In general, you’ll compare your last six months of household income to Indiana’s median and then subtract allowed expenses to see if you have meaningful disposable income. If you’re under the median, you typically pass; if you’re over, you may still qualify after allowable deductions.

Beyond income, the nature of your debt matters. Chapter 7 is designed primarily for unsecured debts (credit cards, medical bills, personal loans). Secured debts tied to collateral (home or car) are handled differently—you can surrender the collateral or, if you want to keep it, you’ll decide whether to stay current, redeem, or reaffirm.

Documentation is critical. You’ll need pay information (or proof of income if self-employed), tax returns, bank statements, and a complete list of assets, debts, and monthly expenses. Accuracy and completeness reduce the chance of delays or objections.

Core Requirements (Indiana)

- • Means test: Compare household income to Indiana median; apply allowed expense deductions.

- • Debt profile: Mostly unsecured consumer debts (credit cards, medical, personal loans).

- • Residence & venue: File in the proper Indiana district based on where you’ve lived recently.

- • Pre-filing course: Complete approved credit counseling before filing.

Who Usually Qualifies

- • Households below Indiana’s median income for their family size

- • Households above the median but with little or no disposable income after allowed expenses

- • Individuals with primarily consumer unsecured debts and limited non-exempt assets

Who Might Not Qualify (or Face Extra Hurdles)

- • Prior recent bankruptcy discharge (chapter 7 has an 8-year look-back; chapter 13 has separate timing rules)

- • High disposable income after means-test deductions

- • Significant recent luxury charges, cash advances, or transfers that may draw objections

- • Complex asset situations where chapter 13’s repayment plan may be a better fit

Indiana Notes & Practical Tips

- • Household size matters: Include everyone you financially support; accuracy affects the median comparison.

- • Married filers: A non-filing spouse’s income may be partially counted (with a marital adjustment for their separate expenses).

- • Exemptions: Indiana exemptions protect portions of home equity, a vehicle, and personal property—properly claiming them can keep cases “no-asset.”

Meeting these criteria doesn’t guarantee a friction-free case, but it sets the stage. A local Indiana bankruptcy attorney can review your income, expenses, and asset picture, apply the means test correctly, and flag any issues before you file.

Indiana Chapter 7 Income Limits and the Means Test

The means test is the gateway to chapter 7 bankruptcy in Indiana. If your annualized current monthly income is below the Indiana median for your household size, you generally qualify for chapter 7. If your income is above the median, you’ll complete the full means test to subtract allowed expenses and determine whether you still qualify. For the most current figures, see the U.S. Trustee Program’s official table linked below.

| Household Size | Annual Median Income (USD) |

|---|---|

| 1 | $62,808 |

| 2 | $79,884 |

| 3 | $93,175 |

| 4 | $112,691 |

| Add $11,100 for each person over 4. | |

Effective for cases filed on or after November 1, 2025. Always verify against the latest U.S. Trustee Program table: UST Median Family Income by Family Size.

Means Test Steps

- • Calculate the last six months of gross household income and annualize it.

- • Compare to the Indiana median for your household size (see table above).

- • If under the median → you generally qualify for chapter 7.

- • If over the median → complete the full means test to subtract allowed expenses.

- • Keep documentation (pay info, tax returns, bank statements) to support your numbers.

Passing the means test is essential, but it’s not the only requirement. Accurate forms, proper exemptions, and the required courses still matter for a smooth discharge.

The Chapter 7 Bankruptcy Process in Indiana

Broad overview only—this is not legal advice. Here’s how filing chapter 7 in Indiana typically unfolds. Every case is different, and attempting a do-it-yourself bankruptcy can create costly mistakes. Most people are best served by working with a qualified Indiana bankruptcy attorney.

Required Forms and Documentation

Chapter 7 moves fastest when the paperwork is clean and complete. A skilled Indiana bankruptcy attorney will turn your raw documents into accurate petitions, schedules, and statements—reducing delays, objections, and the risk of dismissal. Use this checklist to gather what your lawyer will need.

- • Identification: Government photo ID and proof of Social Security number

- • Income proof: Pay stubs/earnings for the last 6 months; profit-and-loss if self-employed; benefits letters

- • Tax returns: Typically the last 2 years (federal and state)

- • Bank/financial statements: Recent statements (checking, savings, brokerage, crypto, prepaid cards)

- • Debts list: All creditors with mailing addresses, account numbers, and balances (credit cards, medical, loans, collections)

- • Assets & titles: Home deeds/mortgages, vehicle titles/loan statements, retirement accounts, life insurance, valuables

- • Monthly expenses: Housing, utilities, transportation, childcare, insurance, medical, etc.

- • Legal/collection items: Lawsuits, judgments, garnishments, liens, repossessions, foreclosures, tax notices

- • Transfers/payments: Any property transfers or large payments to creditors/insiders in the look-back periods

- • Required course proof: Pre-filing credit counseling certificate (and, later, debtor education)

Your attorney will use these to complete the means test, claim Indiana exemptions, and prepare accurate schedules. Bring everything—even if you’re unsure it’s relevant. Accuracy up front makes the 341 meeting quicker and the path to discharge smoother.

Filing Starts the Case

After accurate paperwork is prepared and filed with the appropriate Indiana Bankruptcy Court, the case officially begins. This filing triggers the automatic stay, which generally pauses most collections, wage garnishments, lawsuits, and foreclosures while the case is pending. For court locations, divisions, and key contacts, see our Indiana courts table in Indiana courts guide.

The Trustee and the 341 Meeting

A court-appointed trustee reviews your filings, verifies your identity, and determines whether any non-exempt assets should be administered. You will attend a brief 341 Meeting of Creditors, where the trustee asks straightforward questions about your forms, income, expenses, assets, and recent financial activity.

What to Expect at the 341 Meeting

- • It’s not in front of a judge; the trustee conducts the meeting.

- • Plan for ~5–10 minutes, though schedules can vary by docket.

- • Bring a government ID and proof of Social Security number.

- • Be ready to confirm your paperwork, income, expenses, assets, and recent transfers.

- • Some meetings are held by phone or video; follow the court’s instructions closely.

341 Meeting Schedules & Trustee Lists (Helpful Links)

- • Southern District of Indiana — 341 Meeting Calendar | 341 Meeting (Zoom) Info

- • Northern District of Indiana — 341 Meeting Locations/Info | List of Case Trustees (Court Site)

- • U.S. Trustee Program — Chapter 7 Panel Trustee Roster (search by district/state)

Exemptions and Property

Indiana exemption laws may allow you to protect essential property. If something is non-exempt and has value for creditors, the trustee may administer it as required by law. Properly claiming exemptions is critical to maximizing protection. We’ll be publishing a full Indiana Exemptions Guide soon; until then, you can review the statutes below.

Indiana Exemption Statutes & Official References

- • Indiana Code § 34-55-10-2 (Bankruptcy Exemptions): Text of § 34-55-10-2

- • Indiana Administrative Code – Dollar amount adjustments referencing § 34-55-10-2: 750 IAC 1-1-1 (amount tables)

- • Southern District of Indiana (court explainer with statute reference): What Are Exemptions?

Required Courses

You must complete credit counseling (before filing) and a debtor education course (after filing) to remain eligible for a discharge. Use the official U.S. Trustee Program lists below and select Indiana to find approved providers.

- • U.S. Trustee — Approved Credit Counseling Agencies

- • U.S. Trustee — Approved Debtor Education Providers

Key Steps

- • File accurate petitions, schedules, and statements with the Indiana Bankruptcy Court

- • Automatic stay takes effect and pauses most collections

- • Trustee review and a short 341 Meeting of Creditors

- • Exemptions applied; non-exempt property (if any) may be administered

- • Complete required counseling and debtor education courses

Why Working With an Indiana Bankruptcy Attorney Matters

Chapter 7 is fast and powerful—but only when it’s done right. A skilled Indiana bankruptcy attorney helps you avoid costly mistakes, protect the property you’re allowed to keep, and move smoothly from filing to discharge. They translate the rules into practical choices and stand with you at every step.

- • Eligibility & Means Test: Correctly calculates household size, income, and deductions so you qualify when you should.

- • Maximizing Exemptions: Chooses and applies Indiana exemptions to protect home equity, vehicles, and essentials.

- • Clean Paperwork: Prepares accurate petitions and schedules that prevent delays, objections, or dismissal.

- • Strategy on Secured Debts: Advises whether to keep/surrender collateral and when to reaffirm or redeem.

- • Issue Spotting: Flags risks like recent transfers, luxury charges, or preference payments before they become problems.

- • 341 Meeting Prep: Prepares you for trustee questions and attends the meeting to protect your interests.

- • Timeline & Compliance: Keeps you on track with documents, deadlines, and the required courses.

The right attorney turns a stressful process into a guided plan—helping you safeguard what matters and secure your fresh start the first time.

Discharge vs. Case Closure

Getting a discharge is the milestone most people care about—it wipes out qualifying unsecured debts. But the court can grant your discharge while the case itself remains open so the trustee can finish administering the bankruptcy estate.

Why a Case May Stay Open After Discharge

- • Administering non-exempt assets: If there are items the trustee can sell (or funds to collect), the trustee will handle marketing, sale, and distribution to creditors.

- • Receiving tax refunds: A portion of your tax refund may belong to the estate (for the pre-petition part of the tax year). The trustee may keep the case open to receive and distribute those funds.

- • Recovering transfers: In some cases, the trustee may pursue recoveries (e.g., preferences) for the benefit of creditors.

- • Final reporting: The trustee must file reports and a final account before the court can close the case.

What This Means for You

- • Your discharge usually arrives first—so collections on discharged debts must stop—even if the case stays open.

- • You must cooperate with reasonable trustee requests (documents, tax returns, refund turnover) until administration is complete.

- • After assets (if any) are collected and distributed and the trustee files a final report, the court will enter an order closing the case.

In short: the discharge gives you relief from personal liability, and the case closure happens later, once any estate administration is wrapped up. An experienced Indiana bankruptcy attorney can help you understand what—if anything—needs to be turned over and how long administration may take in your situation.

Proper preparation streamlines the filing experience. Having organized documentation eases potential stress.

Indiana Bankruptcy Exemptions: What Can You Keep?

Here’s the big picture: Indiana bankruptcy exemptions are the rules that decide how your home equity, vehicle equity, personal property, retirement accounts, and certain benefits are treated when you file bankruptcy in this state. This Chapter 7 overview is designed to be practical, but our dedicated Indiana exemptions guide is where we maintain the most detailed, frequently updated breakdown of the Indiana exemption categories and dollar limits.

High-Level Principles (Overview Only)

- • Exemptions protect certain equity in your residence, vehicle, retirement accounts, and personal items.

- • Any nonexempt value (if there is any) may need to be settled with the trustee for the benefit of creditors.

- • Accurately listing and valuing assets is critical to make full use of the Indiana bankruptcy exemptions.

Where to Verify the Rules

- • Plain-English breakdown and tables: Indiana exemptions guide (US Bankruptcy Help)

- • Indiana Code § 34-55-10-2 (core exemptions statute): statute text

- • Indiana administrative dollar-amount updates referencing § 34-55-10-2: 750 IAC 1-1-1

Why Attorney Guidance Matters

- • Correctly applies the right exemption categories and dollar limits to your specific asset mix.

- • Avoids valuation mistakes that can turn a no-asset Chapter 7 into an asset case or raise your Chapter 13 payment.

- • Coordinates timing, documentation, and strategy if you have borderline, mixed, or higher-value assets.

Key takeaways: exemptions can let you keep what you need, but precision matters. For the most detailed reference, start with our Indiana exemptions guide and then work with a knowledgeable Indiana bankruptcy attorney to apply those rules to your actual assets and keep your case on track.

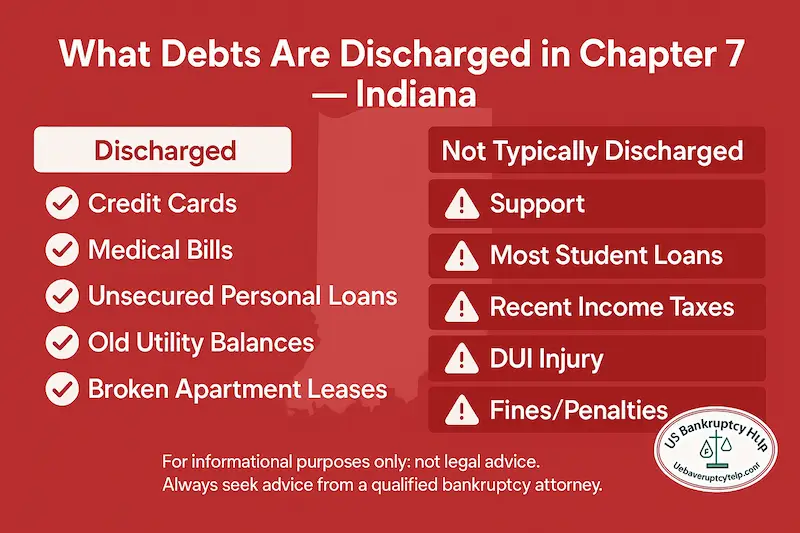

Debts Discharged and Not Discharged in Chapter 7

Chapter 7 bankruptcy in Indiana can erase many unsecured debts through a court-ordered discharge (11 U.S.C. § 727) and bars collection on discharged debts (11 U.S.C. § 524). But some categories are excluded by statute (11 U.S.C. § 523), and there are fact-specific exceptions. An experienced Indiana bankruptcy attorney will help you map your debts to the correct rules.

Discharged Debts (Typical)

- • Credit card balances and lines of credit

- • Medical bills and many personal loans

- • Old utility balances, many collection accounts, most unsecured judgments

Nondischargeable (or Often Not) by Statute

- • Domestic support obligations (child/spousal support): 11 U.S.C. § 523(a)(5)

- • Certain tax debts (recent income taxes and some others): § 523(a)(1)

- • Most student loans absent undue hardship: § 523(a)(8)

- • Debts from fraud/false pretenses: § 523(a)(2)

- • Willful and malicious injury: § 523(a)(6)

- • Death/personal injury from DUI: § 523(a)(9)

- • Certain fines/penalties and other enumerated categories: § 523

Secured Debts (Special Handling)

- • The personal obligation can be discharged, but liens generally survive unless addressed. You and your attorney will decide whether to keep the collateral (and stay current, reaffirm, or redeem) or surrender it.

Bottom line: many unsecured debts are dischargeable, but statutory exceptions are real and fact-dependent. Attorney guidance is crucial for spotting issues early, protecting exemptions, and positioning you for a clean discharge under § 727.

The Role of the Bankruptcy Trustee in Indiana

In Indiana chapter 7 cases, a court-appointed trustee serves as the case administrator and fiduciary for creditors. The trustee verifies your paperwork, looks for non-exempt assets, conducts the 341 meeting, and—if there are assets—collects and distributes funds according to the Bankruptcy Code. Your Indiana bankruptcy attorney is your point guard here: they prepare you, communicate with the trustee, and help resolve any issues quickly.

What the Trustee Actually Does (By Law)

- • Reviews your filings and documents for accuracy and completeness (see debtor duties in 11 U.S.C. § 521).

- • Conducts the 341 meeting—a brief Q&A to confirm your identity and disclosures (11 U.S.C. § 341).

- • Investigates and administers the estate, including collecting and selling non-exempt assets when appropriate (11 U.S.C. § 704).

- • Receives certain funds that belong to the estate (e.g., the pre-petition portion of a tax refund) and distributes them to creditors per priority rules.

- • Files reports and a final account before the case can close.

How Your Attorney Helps With the Trustee

- • Ensures your petitions/schedules are clean, consistent, and fully documented.

- • Preps you for the 341 meeting and attends with you, keeping the discussion focused.

- • Applies Indiana exemptions correctly to keep cases “no-asset” when possible.

- • Addresses trustee follow-ups (clarifications, additional documents, turnover of estate assets) promptly.

Panel Trustees & Local Practice Notes

- • Indiana uses panel trustees appointed by the U.S. Trustee Program for the Northern and Southern Districts.

- • Many 341 meetings are conducted by phone or video; follow your district’s instructions closely.

- • Even after you receive a discharge, the trustee may keep the case open to finish administering assets or receive a tax refund; the case closes once administration is complete.

Bottom line: the trustee’s job is to verify, administer, and close the loop fairly. With the right attorney guiding you, interactions with the trustee are usually straightforward and efficient.

How Long Does Chapter 7 Bankruptcy Take in Indiana?

For many Hoosiers, a straightforward chapter 7 runs about 4–6 months from filing to discharge. That window typically covers filing your petition, completing the required courses, attending the 341 meeting, and waiting out the brief objection period before the court issues your discharge.

What Affects the Timeline

- • Paperwork quality: Clean, consistent schedules and prompt document uploads speed things up.

- • Trustee requests: Quick responses to follow-ups keep your case moving.

- • Court calendars: Local docket timing and 341 scheduling vary by district.

- • Courses: Completing credit counseling (pre-filing) and debtor education (post-filing) on time avoids delays.

Discharge vs. Case Closure (Important)

As discussed above in Discharge vs. Case Closure, you may receive your discharge while the case itself remains open. That happens when the trustee still needs to administer estate assets—often a portion of a tax refund or a non-exempt item. Once administration and final reporting are complete, the court will enter an order closing the case.

A knowledgeable Indiana bankruptcy attorney helps keep your timeline on track—anticipating trustee requests, ensuring your courses are done, and minimizing issues that could slow discharge or prolong administration.

Costs of Filing Indiana Bankruptcy Chapter 7

Here are the common costs you can expect in an Indiana chapter 7 case. Exact amounts vary by facts, but this gives a realistic planning range. (Your attorney can confirm the latest court and course fees and discuss payment options.)

Typical Cost Components

- • Court filing fee: $338 for a chapter 7 petition. Some filers may qualify for a fee waiver or installment plan. (Official fee schedule)

- • Attorney’s fees (consumer cases): typically $1,000–$3,500 in Indiana, depending on complexity and local market.

- • Required courses: credit counseling (pre-filing) and debtor education (post-filing) usually $10–$50 each from an approved provider.

- • Credit reports & incidentals: some firms pull tri-merge reports or use software tools (often $25–$75 total).

What Makes One Case Cost More Than Another

- • Means test complexity: close calls over the median, marital adjustments, variable income, or self-employment

- • Number of creditors & claims issues: dozens of accounts, disputed debts, or garnishments/judgments

- • Assets/exemptions: equity close to Indiana exemption limits, valuation disputes, or potential non-exempt items

- • Secured debt strategy: surrender vs. keep, reaffirmation agreements, or redemption negotiations

- • Risk of objections/adversary proceedings: fraud/misrepresentation allegations, preference/transfer scrutiny

- • Trustee/creditor examinations: the possibility of a Rule 2004 exam or extensive trustee follow-up

Business Chapter 7 (Note)

Business chapter 7 cases can be significantly more expensive. Inventory, accounts receivable, leases, equipment liens, insider transactions, and potential adversary proceedings all add attorney time and administrative work. Ask for a scope-based quote if a business entity is filing.

Paying for Your Case

- • Many firms offer payment plans or staged payments before filing.

- • Some firms use compliant bifurcated arrangements (part of the fee paid after filing) where ethically permissible.

- • Fee quotes should clarify what’s included (e.g., reaffirmations, amendments, adversary work) and what might cost extra.

Hiring an experienced Indiana bankruptcy attorney often saves money overall—by avoiding mistakes, protecting exemptions, and preventing avoidable post-filing issues that can drive up costs. You get what you pay for.

The Impact of Chapter 7 Bankruptcy on Your Credit

A chapter 7 filing appears on your credit report for up to 10 years, but that record does not lock your score in place. Many Hoosiers see credit begin to improve within months by paying every bill on time, keeping balances low, and rebuilding new positive history. Lenders evaluate far more than the single “bankruptcy” entry—payment history, utilization, income stability, and time since filing all matter.

What Shows On Your Credit Report

- • The chapter 7 case is listed as a public record for up to 10 years.

- • Discharged accounts should update to a $0 balance with no further collections reporting.

- • Any errors (e.g., balances that weren’t zeroed out) can be disputed with the bureaus.

How Scores Typically Rebound

- • On-time payments after filing carry significant weight and can raise scores steadily.

- • Lower debt and reduced utilization often improve scores versus pre-filing levels.

- • Adding new, well-managed trade lines (secured card or credit-builder loan) accelerates recovery.

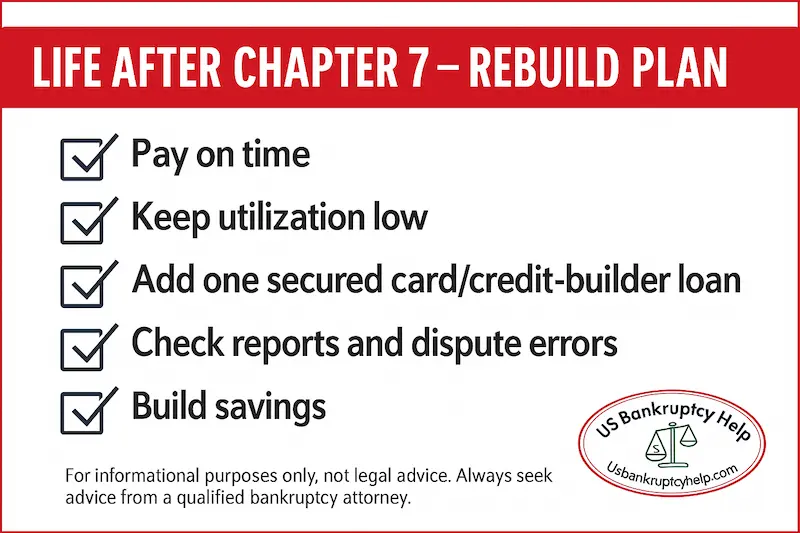

A Practical Rebuild Plan

- • Pay on time, every time. Set autopay or reminders—payment history is the #1 factor.

- • Keep utilization low. Aim under 30% (under 10% is even better) of each card’s limit.

- • Start small. Use a secured card or a credit-builder loan and pay in full monthly.

- • Monitor reports. Pull free reports to verify discharged debts show $0 balances: AnnualCreditReport.com.

- • Dispute inaccuracies. If a creditor keeps reporting a balance or collections after discharge, file a dispute and keep copies of your discharge order. Guidance: CFPB tips.

- • Build savings. A small emergency fund helps avoid new debt and missed payments.

Common Mistakes To Avoid

- • Applying for multiple cards at once (too many hard inquiries).

- • Maxing out a starter card or missing a single payment.

- • Ignoring errors on your credit reports after discharge.

Bottom line: while the chapter 7 entry remains for up to 10 years, disciplined habits can move your score up much sooner. Your Indiana bankruptcy attorney can also flag post-discharge reporting issues and help you document disputes if a creditor fails to update balances properly.

Chapter 7 vs. Chapter 13 Bankruptcy in Indiana

Here’s a quick Indiana-oriented overview. On this site, this Indiana chapter 7 bankruptcy guide and our dedicated Indiana chapter 13 bankruptcy guide are our primary Indiana-specific sources for how these chapters work in real cases. For broader deep dives (pros/cons, eligibility, timelines, examples), read our national guides: Chapter 7 Bankruptcy Guide, Chapter 13 Bankruptcy Guide, and Chapter 7 vs. Chapter 13 Comparison.

Quick Indiana Overview

- • Chapter 7: A faster path that can wipe out many unsecured debts if you qualify under the means test. You’ll attend a short 341 meeting, and Indiana exemptions help protect essential property.

- • Chapter 13: A 3–5 year repayment plan that can help you catch up on mortgage/car arrears, protect non-exempt equity, and manage debts over time.

How to Choose

- • Income & Eligibility: If you’re under Indiana’s median (or pass Part 2 of the means test), Chapter 7 may fit; steady income that needs time to catch up often points to Chapter 13.

- • Assets: Close calls on exemptions or non-exempt equity may favor Chapter 13 to keep property.

- • Goals & Timing: Chapter 7 is typically ~4–6 months; Chapter 13 trades time for property protection and structured repayment.

An experienced Indiana bankruptcy attorney can compare your numbers against state exemptions and the means test, then tailor advice using the Chapter 7 vs. 13 comparison together with this Indiana chapter 7 guide and our Indiana chapter 13 bankruptcy guide so you choose the path that best protects your home, income, and long-term goals.

Life After Chapter 7 Bankruptcy: Rebuilding Your Finances

A chapter 7 discharge is a reset—not the finish line. Many chapter 7 Indiana filers see steady improvement within months by paying on time, keeping balances low, and building new positive credit history. The habits you build now matter far more than the single “bankruptcy” entry on your report.

First 30–60 Days: Stabilize

- • Build a simple budget (income, fixed bills, realistic spending caps).

- • Set up automatic payments on essentials (rent, utilities, phone) to avoid late fees.

- • Start an emergency buffer (even $25–$50 per paycheck builds momentum).

60–120 Days: Clean Up Reports & Add a Builder Line

- • Pull free credit reports and confirm discharged accounts show a $0 balance (dispute errors promptly).

- • Open one responsible starter product: a secured credit card or credit-builder loan—use lightly and pay in full monthly.

- • Consider on-time rent/utility reporting services to add positive payment history.

Months 4–12: Build Consistency

- • Keep utilization under 30% (under 10% is even better) on any card.

- • Avoid multiple new accounts—age of credit matters; add at most one new line in this period.

- • Grow your emergency fund toward 1–3 months of essential expenses.

Smart Moves (Attorney-Backed Tips)

- • If a creditor keeps reporting a balance after discharge, use your discharge order to dispute; your attorney can help escalate if needed.

- • Think twice before reaffirming debts post-filing; get legal advice on pros/cons and alternatives (e.g., redeem vs. surrender).

- • Beware “credit repair” promises and high-fee subprime products—steady on-time payments work better and cost less.

Simple Rebuild Checklist

- • Pay every bill on time (set autopay/reminders).

- • Keep balances low and avoid new high-interest debt.

- • Review credit reports a few times in the first year and dispute inaccuracies.

- • Grow savings a little each month for real resilience.

In summary: disciplined, boring habits win. With clean reporting, one or two well-managed trade lines, and a budget that fits real life, you can rebuild faster than you might expect—and your attorney can help if any post-discharge credit reporting issues pop up.

Frequently Asked Questions About Chapter 7 Bankruptcy in Indiana

Do I qualify if my income is below Indiana’s median?

Generally yes—if your annualized household income is below Indiana’s median for your family size, you typically qualify under Part 1 of the means test. If you’re above the median, you may still qualify after allowed expense deductions. (See our “Indiana chapter 7 income limits” table above).

Will I lose my house or car in chapter 7?

Many filers keep their home and vehicle if equity is within Indiana’s exemptions and payments are current. If there’s non-exempt equity, talk with your attorney about options (e.g., chapter 13, buy-back/settlement with the trustee, or surrender).

How long does a typical Indiana chapter 7 take?

Most straightforward cases take about 4–6 months from filing to discharge. As discussed above, the case can remain open after discharge if the trustee needs to administer assets (e.g., part of a tax refund).

What does the 341 Meeting of Creditors involve?

A brief Q&A run by the trustee (not a judge), usually 5–10 minutes. Your attorney attends with you and prepares you in advance. Bring a government ID and proof of Social Security number and answer truthfully based on your filed schedules.

How much does chapter 7 cost in Indiana?

The court filing fee is $338. Attorney fees for consumer cases typically range from $1,000–$3,500 depending on complexity (means test issues, number of creditors, assets near exemption limits, potential objections, possible Rule 2004 exam). Required courses usually cost $10–$50 each.

Which debts are usually discharged—and which are not?

Most unsecured debts (credit cards, medical bills, personal loans) are dischargeable. Domestic support, certain recent taxes, most student loans, and debts based on fraud or willful/malicious injury are generally not. Your attorney will map each debt to the correct rule before you file.

Do liens go away in chapter 7?

The personal obligation can be discharged, but valid liens generally survive unless specifically addressed. You’ll decide with your attorney whether to keep collateral (stay current, reaffirm, or redeem) or surrender it.

What documents do I need to get started?

Photo ID, proof of Social Security number, last 6 months of income evidence, recent bank statements, last 2 years of tax returns, a full creditor list, and asset/loan documents. Your attorney will turn these into accurate petitions and schedules and complete the means test.

Can I file without a lawyer?

You can, but it’s risky. Errors can cause delays, loss of property, or even case dismissal. An experienced Indiana bankruptcy attorney helps you claim exemptions correctly, avoid red flags, and get to discharge efficiently.

Will my spouse have to file with me?

Not necessarily. One spouse can file alone. However, a non-filing spouse’s income may be partially counted in the means test (with a marital adjustment). Your attorney will advise which approach fits your goals and the numbers.

What if I’m being garnished or facing foreclosure?

The automatic stay usually stops most garnishments and foreclosure activity the moment you file. Timing and strategy matter—talk with your attorney quickly if a sale or hearing is approaching.

Do I have to take classes?

Yes—credit counseling before filing and debtor education after filing. Use the U.S. Trustee’s approved lists and select Indiana providers: Credit Counseling and Debtor Education.

Where can I learn more about exemptions and the means test?

We’ll publish a dedicated Indiana Exemptions Guide soon. Meanwhile, see the statute references above and our Indiana income limits table. For national overviews, visit: Chapter 7 Guide, Chapter 13 Guide, and Chapter 7 vs. 13.

Key points to consider:

- Asset protection: Indiana exemptions can safeguard important items.

- Eligibility: Income limits determine qualification.

- Process duration: Takes about 4 to 6 months.

- Costs: Fees are involved, but payment plans may be available.

Understanding these aspects can ease the anxiety of filing bankruptcy in Indiana.

Real Chapter 7 Success Stories (Indiana)

These illustrative scenarios show how chapter 7 and the Indiana bankruptcy exemptions can work in real life when a case is planned correctly. Names and details are anonymized. Results vary—no result is guaranteed—and attorney guidance was essential in each case.

"A.M." — Garnishment Stopped, Credit Rebuilding Began

A.M. came in after a layoff with wage garnishment already hitting each paycheck for old credit card and medical debts. After filing chapter 7 in Indiana, the automatic stay stopped the garnishment immediately and collection calls quieted down. By carefully using the Indiana personal property and wildcard exemptions, we protected A.M.’s basic household goods, an older paid-off car, and a small checking balance so nothing had to be settled with the trustee. About five months after filing, A.M. received a discharge of unsecured debts and began rebuilding credit with a secured card and strictly on-time payments. The key was a clean means test, accurate income history, and schedules that left the trustee with no surprises.

"J.R." — Kept the Car, Cleared the Cards

J.R. was current on a reliable car loan but buried under several high-interest credit cards and a personal loan. The biggest fear was losing transportation to work. In chapter 7, we confirmed that the auto loan could be kept current and reaffirmed after a detailed discussion about long-term affordability. Indiana’s tangible personal property and wildcard-style exemptions were stacked to cover the car’s equity and essential household items. The trustee had no nonexempt property to administer, so no assets had to be settled. The end result: J.R. kept the car, discharged the unsecured debts, and walked away from the case in a much stronger position to move forward.

"S.K." — Close Call on Exemptions, Still a No-Asset Case

S.K. owned a modest Indiana home with equity uncomfortably close to the homestead limit, plus a second older vehicle and tools used for side work. Rather than guess at values, we pulled realistic market comparables for the house, documented mortgage balances, and used credible valuation sources (NADA-type guides and photos) for the vehicles and tools. We then layered the Indiana homestead exemption on the residence and used the wildcard-style exemption to cover the extra vehicle and work tools. The trustee initially had questions about value, but after reviewing the documentation, treated the case as a no-asset case. S.K. received a discharge without having to buy back equity or settle any property with the trustee. Attorney preparation and documentation made the difference.

"D.P." — Self-Employed, Variable Income, Still Qualified for Chapter 7

D.P. was a self-employed Indiana contractor whose income bounced above and below the state median from month to month. On paper, it was not obvious whether chapter 7 would be available. We completed a detailed means test using a full year of income, properly documented business expenses, and matched everything to tax returns, profit-and-loss statements, and bank records. Indiana’s personal property and wildcard exemptions were then used to protect the work truck, tools, and ordinary household goods. With accurate records and a well-supported means test, the case proceeded as chapter 7, the trustee found no meaningful nonexempt assets to settle, and D.P. obtained a discharge in about six months while keeping the tools and truck needed to keep earning a living.

Disclaimer: These stories are illustrative only. Past outcomes don’t guarantee future results, and every case is unique. Indiana exemption amounts change over time and case law evolves (including unpublished orders). Always speak with an experienced Indiana bankruptcy attorney about your specific situation before relying on any example.

Do You Need a Chapter 7 Bankruptcy Attorney in Indiana?

On paper, you're allowed to file chapter 7 in Indiana without a lawyer. In the real world, most people are far better off working with an experienced chapter 7 bankruptcy attorney in Indiana. Bankruptcy is a federal court process layered with Indiana-specific exemption rules, a detailed means test, and local trustee expectations. A small mistake can cost much more than a reasonable attorney fee.

A good Indiana bankruptcy lawyer does much more than type information into forms. They help you decide whether chapter 7 is actually the right move, apply the Indiana chapter 7 means test using your real income and expenses, and match your assets to the Indiana bankruptcy exemptions so you keep as much property as the law allows. They also spot red flags—recent transfers, lawsuits, tax issues, or business activity—that can derail a case if they aren't handled correctly up front.

Some of the ways an Indiana chapter 7 attorney can help include:

- Choosing the right path: Comparing chapter 7, chapter 13, and non-bankruptcy options based on your income, debts, assets, and timing under Indiana law.

- Protecting your property with Indiana exemptions: Correctly using the Indiana homestead, personal property, wildcard, and retirement exemptions so there is little or nothing left that must be settled with the trustee.

- Managing the court and trustee process: Preparing and filing your petition and schedules, answering trustee questions, and guiding you through your 341 meeting and any follow-up requests.

- Avoiding expensive missteps: Helping you avoid errors like omitting assets, repaying family members before filing, transferring property the trustee can unwind, or misreading the Indiana residency and opt-out rules.

This page gives you a strong overview of how chapter 7 works in Indiana and how the Indiana bankruptcy exemptions fit into the process, but it isn't a substitute for legal advice about your specific facts. A short consultation with a local Indiana bankruptcy attorney can give you clear answers about your risks, your options, and your best path to a real fresh start.

Is Chapter 7 Bankruptcy Right for You?

Chapter 7 can be the clean reset that turns constant collections into breathing room—and then into progress. Whether it’s the right move depends on your income, the types of debts you carry, and how Indiana’s exemptions apply to your property. With the automatic stay, a short timeline, and a discharge at the finish line, chapter 7 is often the most direct path to a fresh start when you qualify.

When Chapter 7 Makes Sense

- • You pass the Indiana means test (or qualify after allowed expense deductions).

- • Your debt is primarily unsecured (credit cards, medical, personal loans).

- • Your assets fit comfortably within Indiana exemption limits.

- • You want the fastest route to eliminate eligible unsecured debts.

When to Consider Chapter 13 Instead

- • You need time to catch up on a mortgage or car loan.

- • You have non-exempt equity you want to keep.

- • Your disposable income after the means test is too high for chapter 7.

Your Smart Next Steps

- • Review the Indiana means test numbers above (and verify via the UST link).

- • Skim our national deep dives for context: Chapter 7 Guide, Chapter 13 Guide, and Chapter 7 vs. 13.

- • Gather the documents in the “Required Forms and Documentation” checklist so your case can move quickly.

- • Talk with an experienced Indiana bankruptcy attorney to apply exemptions correctly, spot risks early, and map the fastest route to discharge.

Done right, chapter 7 replaces chaos with a plan—and a legally enforceable fresh start. With precise means-test analysis, proper exemptions, and a brief 341 meeting, many Hoosiers are debt-free (as to dischargeable debts) in about 4–6 months and already rebuilding credit with on-time payments and low utilization. If you’re ready to see your numbers and options, a short consultation can make the decision clear—and your path forward simple.

Explore Our Indiana Bankruptcy Guides

Explore Some of Our National Bankruptcy Guides

- Chapter 7 Bankruptcy: National Guide

- Chapter 13 Bankruptcy: National Guide

- Chapter 7 vs Chapter 13 Bankruptcy: National Guide

- Can Just One Spouse File Bankruptcy?

- Can You File Bankruptcy and Keep Your House?

- Can You File Bankruptcy and Keep Your Car?

- How Often Can You File Bankruptcy?

- Chapter 13 Vehicle Cramdown

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin