Understanding Chapter 7 Bankruptcy in Michigan

At a Glance: Chapter 7 Bankruptcy in Michigan

- Automatic stay can stop lawsuits, garnishments, shutoffs, and most collections (11 U.S.C. § 362).

- Eligibility is means-test driven; business-debt and certain disabled-veteran cases may be exempt (UST means test).

- Choose one system of asset protections: Michigan or federal exemptions—no mixing (MCL 600.5451 / 11 U.S.C. § 522).

- Eastern vs. Western District venue affects local procedure and trustee (E.D. Mich. / W.D. Mich.).

- Typical timeline for straightforward chapter 7 cases is ~4–6 months (U.S. Courts).

- Required courses: pre-filing credit counseling and post-filing debtor education (approved providers).

- 341 meeting is usually brief; format varies by district (creditors seldom appear) (overview).

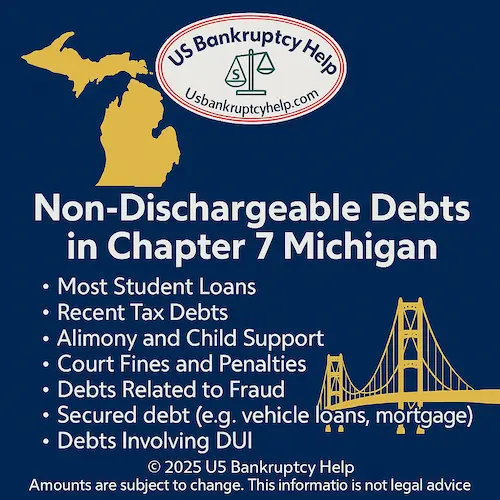

- Common nondischargeables: support, many recent taxes, most student loans, and debts from fraud/willful injury (11 U.S.C. § 523).

- Liens on collateral can survive discharge; consider reaffirmation/redemption where appropriate.

- Credit report impact can last up to 10 years, but scores often improve with on-time payments and low utilization (15 U.S.C. § 1681c).

- Timing matters: tax refunds and funds on deposit can be property of the estate; plan with counsel (see U.S. Courts).

- Consult an experienced Michigan bankruptcy lawyer—rights and exemptions are at stake.

Considering chapter 7 bankruptcy in Michigan usually starts with urgent questions like: will this stop the calls and garnishments? In most cases, yes—the moment you file, the federal automatic stay pauses most collection activity while your case moves forward.

Where you file depends on where you live. Michigan has two bankruptcy districts—Eastern (Detroit, Flint, Bay City) and Western (Grand Rapids, Marquette, Kalamazoo, Lansing, Traverse City). Each court posts its locations and practical details for filers: see the Eastern District and the Western District.

Chapter 7 is built to eliminate most unsecured debts (credit cards, medical bills, and similar) if you complete the required pre-filing credit counseling and post-filing debtor-education course. The U.S. Trustee Program maintains the approved provider lists and requirements here: credit counseling & debtor education.

What you keep hinges on exemptions. Michigan’s exemption law, MCL 600.5451, protects core assets and is adjusted every three years. The current Michigan posted amounts (effective for cases filed on or after April 1, 2023) include a homestead cap of $46,125—$69,200 for certain seniors/disabled—and a vehicle cap of $4,250, and remain in effect until the next update. By contrast, the federal exemption set under 11 U.S.C. § 522(d)was last updated for cases filed on or after April 1, 2025. See Michigan’s notice: 2023 CPI adjustment.

Eligibility is means-test driven. Your household income is compared to Michigan medians published by the U.S. Trustee Program and refreshed periodically (latest update posted October 16, 2025, for cases filed on or after November 1, 2025). You can always check the current data here: means-testing page.

From there, the roadmap is straightforward: gather records, complete counseling, file the petition, get a trustee assignment, attend the short “341 meeting,” finish debtor education, and—if all goes smoothly—receive a discharge in roughly four to six months. For Michigan-specific strategy (e.g., choosing between state and federal exemptions and navigating district quirks), review your plan with a local attorney and your district’s site (Eastern / Western).

Want the big-picture overview? Review our national chapter 7 guide. Also check out our national guide on chapter 7 vs chapter 13 bankruptcy key differences, steps and discharge info.

What Is Chapter 7 Bankruptcy?

Chapter 7 is a federal process that wipes out most unsecured debts (like credit cards and medical bills) after a short, structured case—typically about four to six months for straightforward filings, assuming all requirements are met (U.S. Courts).

From day one, filing triggers the automatic stay, which pauses most collections, lawsuits, and garnishments while your case is pending (11 U.S.C. § 362).

In Michigan, what you keep turns on exemptions. The state exemption law—MCL 600.5451—protects core assets (home equity, a vehicle, household goods), and the State Treasurer adjusts those dollar caps every three years (Michigan Treasury CPI notice). Many Michigan filers also compare federal exemptions to choose the better fit for their situation (discuss this choice with counsel).

Eligibility is means-test driven: your household income is compared to Michigan medians published by the U.S. Trustee Program; those figures update periodically, with the most recent notice effective for cases filed on or after November 1, 2025 (UST means-testing).

Some debts generally survive chapter 7 (for example, most student loans, recent certain taxes, and support obligations) under the nondischargeability rules (11 U.S.C. § 523).

Key points to understand about Chapter 7 bankruptcy include:

- Most unsecured debts can be discharged if you complete all steps (U.S. Courts).

- The automatic stay stops most collections after filing (11 U.S.C. § 362).

- Michigan exemptions under MCL 600.5451 protect core assets; dollar limits are CPI-adjusted every 3 years (Treasury notice).

- Typical timeline is ~4–6 months for straightforward cases (U.S. Courts).

- Some debts are not discharged (e.g., support, most student loans, certain taxes) (11 U.S.C. § 523).

Who Qualifies for Chapter 7 Bankruptcy in Michigan?

Eligibility for chapter 7 is set by federal law but applied using your real household income and allowable expenses. Most filers qualify by passing the means test (11 U.S.C. § 707(b)). If your six-month average income—adjusted for household size—is at or below the applicable state median, you typically pass Part 1. If you’re over median, you may still qualify after Part 2 deductions (IRS standards plus actual secured/priority payments) show little to no disposable income.

In practical terms, the chapter 7 means test in Michigan is a screening tool. It takes your “current monthly income” (the average of the last six months of gross income), annualizes it, and then measures that number against the Michigan median for a household of your size.

Think of it as a two-step filter. First, you compare your annualized income to the Michigan medians listed below. Second, if you're over those figures, the means test lets you subtract a mix of standardized and actual expenses (housing, food, transportation, taxes, insurance, secured and priority debt payments, and more) to see what, if anything, is truly left over for unsecured creditors.

How the Michigan means test calculation usually works:

- • Add up all gross income received in the six full calendar months before filing.

- • Divide by six to get your “current monthly income,” then multiply by 12 to annualize it.

- • Compare that annual figure to the Michigan median for your household size in the table below.

For cases filed on or after November 1, 2025, the median income figures the Michigan chapter 7 means test uses are:

| Household Size | Annual Median Income (USD) |

|---|---|

| 1 | $65,625 |

| 2 | $81,293 |

| 3 | $100,797 |

| 4 | $119,856 |

| Add $11,100 for each person over 4. | |

Figures for cases filed on or after November 1, 2025, based on the U.S. Trustee Program's Census Bureau median family income table. Always double-check the latest numbers at: U.S. Trustee Program Means Testing Data.

If your annualized income falls below the median for your household size, you usually clear the income screen of the means test. If you're above it, you don't automatically lose the ability to file chapter 7—you simply move into Part 2, where allowed expenses and secured and priority payments are applied to see whether there's enough disposable income to support a repayment plan.

New to the means test? Start with our national explainer: What Is the Bankruptcy Means Test? It walks through how the calculation works, what counts as income, and which deductions are allowed.

Other qualification pathways: Some filers don’t apply the consumer means test at all—for example, where most debts are business debts, or for certain disabled-veteran cases arising from a service-connected disability (11 U.S.C. § 707(b)(7), (b)(2)(D)).

Key eligibility rules (beyond income):

- Prior bankruptcies: 8 years since a prior chapter 7 discharge; 6 years since a chapter 13 discharge unless a high payout was made to unsecured creditors (11 U.S.C. § 727(a)(8)–(9)).

- Recent dismissals: A 180-day waiting period can apply after certain dismissals (11 U.S.C. § 109(g)).

- Credit counseling: Complete an approved course within 180 days before filing (11 U.S.C. § 109(h)).

- Good-faith filing: Courts can dismiss cases for abuse even when income is under median.

Practical examples:

- Under median: A single filer’s six-month average is below the applicable state median for a household of one—Part 1 passes; chapter 7 is typically available.

- Over median, still eligible: A family of three exceeds median but Part 2 deductions (taxes, healthcare, childcare, car and mortgage payments, priority arrears) reduce disposable income to ≈$0—chapter 7 can still be an option.

- Business-debt rule: A contractor with primarily business obligations (trade credit, equipment loans) files chapter 7 without applying the consumer means test.

- Not yet eligible: A filer received a chapter 7 discharge five years ago—must wait until the 8-year mark for another chapter 7 discharge.

Pro tips for close cases:

- Run the six-month average carefully—bonuses, overtime, or gaps in work can swing the result.

- Document deductions (healthcare, childcare, secured and priority payments) with receipts and statements.

- Timing matters: shifting the filing month by even one pay period can change eligibility; consult an experienced Michigan bankruptcy lawyer.

The Chapter 7 Bankruptcy Process in Michigan

General Stages: Not a DIY Checklist

Important: The outline below describes the general chapter 7 flow most Michigan cases follow. It is not a complete list of requirements, timelines, or local rules, and it is not legal advice. Because rights and exemptions are on the line, consult an experienced Michigan bankruptcy attorney before filing. For district-specific info, see the Eastern District or Western District courts.

Understanding the Chapter 7 bankruptcy process in Michigan can demystify an otherwise complex procedure. It's a step-by-step process that offers a structured path to debt relief. These are high-level stages; individual cases can differ based on facts and local practice.

The process generally begins with gathering your financial records. This includes income statements, debts, and a complete list of assets. Proper preparation ensures a smoother filing process.

Next, you'll complete a mandatory credit counseling session with an approved provider (UST counseling/debtor education). This session is essential and must happen before filing. It aims to explore whether bankruptcy is the right choice for you.

Once you file your bankruptcy petition, an automatic stay comes into effect, which typically halts most collection actions while your case proceeds (11 U.S.C. § 362). During this time, a trustee is appointed to manage your case.

Afterward, you'll attend a 341 meeting, also known as the meeting of creditors. This meeting allows creditors to ask questions about your finances. Your presence is mandatory at this meeting (U.S. Courts overview).

Finally, you'll complete a financial management (debtor-education) course. After that, you may receive a discharge, wiping away most unsecured debts. Each of these steps is crucial for successfully navigating Chapter 7 bankruptcy in Michigan. An attorney will tailor these steps to your facts and ensure compliance with local rules and deadlines.

Step 1: Credit Counseling and Preparing to File

Before you file for Chapter 7 bankruptcy in Michigan, credit counseling is required. You need to complete this session with a government-approved provider (approved provider lists). This step is mandatory.

The counseling session helps evaluate your financial situation. It offers insights and alternatives to bankruptcy. Preparation for filing includes gathering all necessary financial documents.

Here are key points to prepare for:

- Schedule a credit counseling session early

- Gather all income, expense, and debt documentation

- Research the list of approved credit counseling agencies

Step 2: Filing the Bankruptcy Petition

Filing the bankruptcy petition is the next critical step in this process. This involves submitting required forms to the bankruptcy court. These forms detail your financial status.

You'll need to fill out a statement of financial affairs. It provides a full picture of your economic situation. This includes both your debts and assets.

It's important to ensure that everything is accurate and complete. Errors can delay your case or lead to dismissal. Given the stakes, work with a qualified Michigan bankruptcy attorney rather than filing pro se.

- Complete all bankruptcy forms accurately

- Submit forms to the Michigan bankruptcy court

- Consider legal assistance for the filing

Step 3: The Automatic Stay and Trustee Appointment

After filing, the automatic stay is a relief that comes into play. This legal order stops most collection efforts immediately (11 U.S.C. § 362). Creditors must pause all lawsuits and garnishments.

Following the stay, a trustee is appointed to your case. The trustee's role is to oversee the bankruptcy process. They ensure everything is conducted according to legal standards.

Key aspects of this step include:

- Receiving legal relief via automatic stay

- Understanding the trustee's duties in your case

- Ensuring compliance with all trustee requests

Step 4: The Meeting of Creditors (341 Meeting)

Attending the 341 meeting is another pivotal step. Known as the meeting of creditors, it's a vital part of the process. Your creditors can ask questions under oath.

Your attendance at the meeting is mandatory. It's your opportunity to clarify financial details. The trustee conducts the meeting and verifies the information (U.S. Courts explainer).

Remember to:

- Be punctual and prepared for the meeting

- Answer all questions truthfully under oath

- Bring any necessary documents as requested

Step 5: Financial Management Course and Discharge

To conclude the bankruptcy process, you'll complete a financial management course. This course is essential for learning financial strategies post-bankruptcy (debtor-education providers). It offers guidance for a fresh financial start.

Successfully finishing this course is necessary for discharge. The discharge releases you from most unsecured debts. It provides the financial reset often sought through bankruptcy.

Steps to finalize your process include:

- Enroll and complete the financial management course

- Submit course completion certificates to the court

- Await receipt of the official discharge documentation

Bottom line: treat these as general stages, not a do-it-yourself checklist. A Michigan bankruptcy attorney can apply local rules, optimize exemptions, and safeguard your case timeline.

How Exemptions Work in Michigan Chapter 7 Cases

This section is only a quick overview of how exemptions fit into a Michigan chapter 7 case. For a detailed, always up-to-date breakdown of Michigan bankruptcy exemptions — including current dollar amounts and statute citations — please see our dedicated guide: Michigan Bankruptcy Exemptions.

In chapter 7, “exemptions” are simply the asset protections you choose so you can keep essentials while getting a fresh start. Michigan lets filers elect either the federal system or the Michigan system, and the best choice depends on your facts (11 U.S.C. § 522(b); MCL 600.5451).

Quick note: Michigan adjusts certain state exemption amounts periodically for inflation; always confirm current figures before filing (Michigan Treasury).

At a high level, these protections are designed to cover necessities so you can maintain stability during and after your case. Typical categories include:

- Homestead (primary residence equity)

- Vehicle (a reasonable amount of equity)

- Personal property (household goods, clothing, tools of the trade)

Because the election between state and federal systems can materially change what you keep, it’s smart to compare both options and, if possible, talk with an experienced Michigan bankruptcy attorney.

Homestead (Overview)

Michigan’s homestead protection is meant to preserve equity in your primary residence under the state system (MCL 600.5451). Federal law offers an alternative set of protections. Which route yields more protection depends on equity, household status, and other assets. For specific dollar limits, see the Michigan Bankruptcy Exemptions page.

- Primary residence only

- State amounts are periodically CPI-adjusted

- Compare state vs. federal before you file

Vehicle & Personal Property (Overview)

Both systems protect everyday items needed to live and work — like a car, furniture, clothing, and tools of the trade. Categories and caps differ between the state and federal options, so a side-by-side review is key (§ 522; MCL 600.5451). For a full list of categories and limits, refer to the Michigan Bankruptcy Exemptions guide.

- Protects reasonable vehicle equity

- Covers household essentials and work tools

- Choose the system that best fits your asset mix

Wildcard & Retirement (Overview)

A “wildcard” can shield a limited amount of value in items that don’t fit neatly into other categories, giving strategic flexibility. Retirement accounts are typically protected by statute, but it’s important to confirm the type and any contribution timing rules (§ 522). The Michigan Bankruptcy Exemptions page walks through which accounts are typically protected and where limits apply.

- Wildcard = flexible buffer for priority items

- Most tax-qualified retirement accounts are protected

- Verify current limits and plan type before filing

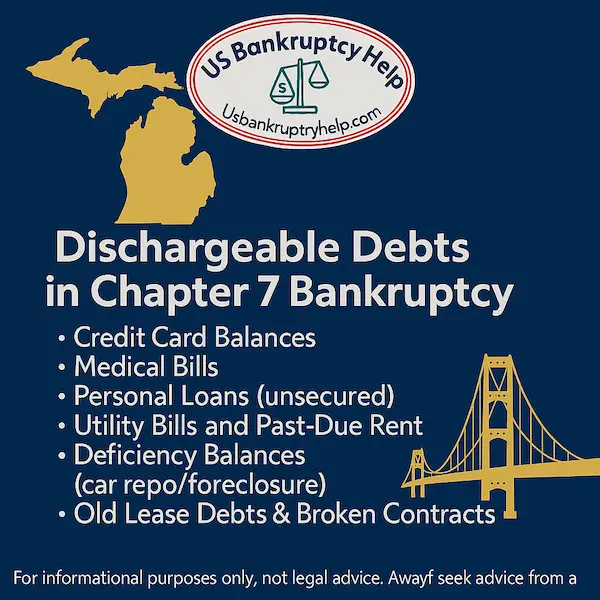

What Debts Can and Cannot Be Discharged?

In a Michigan chapter 7, most unsecured debts can be wiped out at discharge—think credit cards and medical bills—once you complete all requirements. The discharge happens at the end of the case; the automatic stay that starts at filing only pauses collection in the meantime (U.S. Courts).

Some debts generally survive chapter 7 or require extra steps to discharge. Federal law lists common exceptions—like recent certain taxes, domestic support, most student loans absent an undue-hardship ruling, and debts from fraud or willful injury (11 U.S.C. § 523).

For informational purposes only, not legal advice. Always seek advice from a qualified bankruptcy attorney.

Common Debts That Are Usually Dischargeable

- Credit cards, personal loans, and payday loans (U.S. Courts)

- Medical bills and old utility balances

- Most civil judgments on unsecured claims (unless tied to fraud/willful injury)

- Lease rejection damages and certain deficiency balances after surrender

Debts That Often Survive or Need Extra Action

- Domestic support obligations (alimony/child support) (§ 523(a)(5))

- Most student loans absent an undue-hardship ruling in an adversary proceeding (§ 523(a)(8))

- Recent certain taxes and some tax penalties (§ 523(a)(1))

- Debts from fraud, willful/malicious injury, or DUI-related injury (§ 523(a)(2), (6), (9))

- Fines and criminal restitution (§ 523(a)(7))

For informational purposes only, not legal advice. Always seek advice from a qualified bankruptcy attorney.

Important nuances: Liens generally survive on collateral even if the personal debt is discharged; you may see reaffirmation/redemption options in some cases. Some creditors can object to dischargeability within strict deadlines. Because results turn on facts and timing (especially with taxes and student loans), review strategy with a Michigan bankruptcy attorney before filing.

Pros and Cons of Filing Chapter 7 Bankruptcy in Michigan

Top Pros (What Chapter 7 Can Do For You)

- Stops Collections Immediately: The federal automatic stay pauses most lawsuits, garnishments, and calls as soon as you file.

- Discharges Most Unsecured Debt: Credit cards, medical bills, and personal loans are typically wiped out at discharge, usually within about 4–6 months for straightforward cases (U.S. Courts).

- Fresh-Start Focused: Michigan filers can choose between federal and state protections to keep essentials (home equity, a vehicle, household goods) (11 U.S.C. § 522; MCL 600.5451).

- Ends Most Wage Garnishments: Filing generally stops garnishments governed by federal limits (15 U.S.C. § 1673) while the case proceeds.

- Clear Path & Timeline: One court appearance (the 341 meeting) and a defined checklist (counseling, petition, trustee review, debtor education) keep the process predictable (U.S. Courts).

Potential Tradeoffs (What To Weigh Carefully)

- Risk to Non-Exempt Assets: Property above exemption limits can be sold for creditors—strategy matters when choosing state vs. federal systems (MCL 600.5451; § 522).

- Credit Report Impact: A chapter 7 can appear on your credit report for up to 10 years from filing (15 U.S.C. § 1681c).

- Some Debts Survive: Domestic support, many recent taxes, most student loans absent an undue-hardship ruling, and debts from fraud or willful injury often remain (11 U.S.C. § 523).

- Liens Can Survive: Even if the personal obligation is discharged, valid liens may remain on collateral unless addressed (e.g., redemption/reaffirmation) (11 U.S.C. § 524).

- Tax Refund & Timing Issues: Portions of an expected tax refund can be property of the estate; filing timing and exemptions matter (see U.S. Courts basics for scope; discuss specifics with counsel).

How Michigan Strategy Influences the Outcome

- Exemption Election: Choosing Michigan vs. federal protections can change what you keep—compare homestead, vehicle, wildcard, and tools-of-trade categories (MCL 600.5451 / § 522).

- District Details: Local practices differ between the Eastern and Western Districts (filing location, calendars, and trustee procedures). Check district resources: E.D. Mich. / W.D. Mich.

- Means-Test Timing: Pay cycles, bonuses, and household changes can affect eligibility and outcomes—plan filing month carefully (UST means testing).

Bottom line: Chapter 7 can deliver fast, meaningful relief in Michigan, but results hinge on exemptions, timing, and local procedure. Review your options with an experienced Michigan bankruptcy attorney before filing to protect assets and optimize the outcome.

Life After Chapter 7 Bankruptcy: Rebuilding and Moving Forward

What Changes Right After Discharge

Your discharge wipes out most unsecured debts and stops collection on those discharged accounts (U.S. Courts). The bankruptcy can remain on your credit report for up to 10 years from filing, but you can still rebuild meaningful credit well before then (15 U.S.C. § 1681c).

First 60 Days: Clean Up The Report

- Pull free reports and verify each discharged account is marked “included in bankruptcy/$0 balance.” Use AnnualCreditReport.com.

- Dispute any errors with the bureaus; you have rights under the Fair Credit Reporting Act (CFPB dispute guide).

- Set up fraud alerts/credit monitoring if you had prior identity issues (FTC).

Months 2–6: Add Positive Data

- Open one secured credit card or a small credit-builder loan; pay on time and keep balances low (CFPB on building credit).

- Aim for overall utilization under ~30% (lower is better over time) and always pay statement balances by or before the due date (CFPB best practices).

- Consider on-time rent/utility reporting via reputable services, if compatible with your situation (CFPB guidance).

Months 6–12: Broaden Responsibly

- Add a second tradeline only after six months of perfect payments on the first (stagger to show sustained history).

- Set automated payments and calendar reminders to avoid late marks—payment history is the biggest score factor (CFPB).

- Keep old positive accounts open to lengthen average age of credit.

12–24 Months: Major Purchases & Rates

- Auto: Shop multiple lenders; down payments lower rates. Avoid “yo-yo” financing (CFPB auto-loan tips).

- Mortgage: FHA typically requires a two-year wait after chapter 7 discharge, with re-established credit and documented stability (HUD Handbook 4000.1—lender overlays may vary).

- Reserve cash for emergencies (even $1k–$2k) to prevent new high-interest debt.

Michigan-Specific Practicalities

- Confirm any reaffirmation you signed (car/home) and stay current to protect the asset.

- If you moved districts (Eastern ↔ Western), update addresses with creditors/insurers so on-time payments post correctly (E.D. Mich. / W.D. Mich.).

Habits That Move Scores Up

- Never miss due dates; one 30-day late can stall progress for months (CFPB).

- Keep utilization low and avoid opening several accounts at once.

- Review reports every few months and dispute any post-discharge collection attempts on discharged debts (CFPB dispute process).

Bottom line: A chapter 7 on your report doesn’t block recovery. With clean reporting, on-time payments, and disciplined utilization, many Michiganders see measurable score gains within 6–12 months—and are mortgage-eligible on common programs after the standard waiting periods. For individualized strategy (reaffirmations, timing, and underwriting expectations), consult a Michigan bankruptcy attorney and, for mortgages, a licensed loan officer.

Frequently Asked Questions About Chapter 7 Bankruptcy in Michigan

Here are practical answers to the questions Michigan filers ask most, with quick links to official sources.

How Fast Does the Automatic Stay Stop Collections and Garnishments?

In most cases, the stay takes effect the moment you file and pauses most lawsuits, calls, and wage garnishments while your case proceeds (11 U.S.C. § 362).

Where Do I File in Michigan?

Michigan has two bankruptcy districts—Eastern (Detroit/Flint/Bay City) and Western (Grand Rapids/Marquette/Kalamazoo/Lansing/Traverse City). Your residence controls where you file: Eastern District or Western District.

Will I Lose My Car or Home?

It depends on equity, loan status, and which exemption system you elect. Michigan law and the federal system both protect core assets within limits; valid liens can survive unless addressed (e.g., reaffirmation or redemption). See MCL 600.5451 and 11 U.S.C. § 522.

How Long Will Chapter 7 Stay On My Credit Report?

Up to 10 years from the filing date under the Fair Credit Reporting Act (15 U.S.C. § 1681c). You can rebuild sooner with on-time payments and low balances (see the CFPB’s guidance on credit building).

Do I Have To Go To Court?

Most cases require one brief meeting—the “341 meeting” with the trustee. Format and logistics vary by district; check your court’s site: U.S. Courts overview, E.D. Mich., W.D. Mich..

Are All Debts Dischargeable?

No. Domestic support, many recent taxes, most student loans absent an undue-hardship ruling, and debts tied to fraud or willful injury often survive (11 U.S.C. § 523).

What About Recent Credit Card Use Or Cash Advances?

Recent “luxury” charges or cash advances can be challenged as nondischargeable under presumption rules (§ 523(a)(2)(C)); timing and amounts matter—discuss specifics with counsel.

Do Both Spouses Need To File In Michigan?

Not necessarily. Michigan isn’t a community-property state. Whether to file jointly depends on debt ownership, assets, and the means test’s household income analysis (UST means testing).

Will My Bank Account Or Tax Refund Be Affected?

Parts of a pre-petition tax refund and funds on deposit at filing can be property of the estate; exemptions and timing strategy are key. Coordinate with your attorney before filing (U.S. Courts basics).

Do I Need A Lawyer, Or Can I File On My Own?

You’re allowed to file pro se, but rights and exemptions are at stake and local practice varies. We strongly recommend working with an experienced Michigan bankruptcy attorney (U.S. Courts).

Should You File Chapter 7 Bankruptcy? Key Considerations

Use this quick checklist to gauge fit—then confirm strategy with a Michigan bankruptcy lawyer.

- Debt Mix: Are debts mostly unsecured (cards/medical) versus nondischargeable items (§ 523)?

- Eligibility: Do you pass the means test or qualify via business-debt/other exceptions (UST means test)?

- Asset Protection: Which exemption system (Michigan vs. federal) better protects your home, vehicle, and tools (MCL 600.5451 / § 522)?

- Timing: Would shifting the filing month (pay cycles, bonuses, refunds) change the means test or asset picture?

- Alternatives: Would chapter 13, workout, or settlement better fit your goals?

Bottom line: chapter 7 can deliver fast relief in Michigan, but outcomes hinge on exemptions, eligibility, and timing. Review your options with an experienced Michigan bankruptcy attorney before filing.

Working With a Michigan Bankruptcy Attorney

Your chapter 7 outcome in Michigan often turns on strategy, timing, and local practice. A seasoned Michigan bankruptcy lawyer doesn’t just “file forms”—they choose the right exemption system, time the means test, prepare you for the trustee, and protect at-risk assets. Local experience also matters because procedures differ between the Eastern District and the Western District.

What A Good Michigan Lawyer Actually Does

- Compares Michigan vs. federal exemptions to maximize what you keep (MCL 600.5451 / 11 U.S.C. § 522).

- Runs a precise means test and advises on filing month, pay cycles, bonuses, and refunds (UST means testing).

- Preps you for the 341 meeting and addresses trustee requests (U.S. Courts overview).

- Advises on reaffirmation/redemption when liens survive discharge.

How To Vet A Michigan Bankruptcy Lawyer

- Focus: Substantial chapter 7/13 volume in E.D. Mich. or W.D. Mich.; ask which trustees they regularly appear before.

- Clear fees: Flat-fee scope in writing (what’s included: petition, means test, 341 prep, reaffirmation advice).

- Communication: Who answers day-to-day questions and how fast (attorney vs. staff)?

- Reviews & discipline: Check the State Bar of Michigan resources and client feedback.

What To Bring To Your Consultation

- Last 6 months of pay stubs (or profit-and-loss if self-employed) + most recent tax return.

- Creditor list, statements, and any lawsuits, garnishments, or collection letters.

- Vehicle titles/loan statements; mortgage statements; recent bank statements.

- Any expected tax refund info and recent large transactions or transfers.

- Completed or planned counseling course details (approved providers).

Fee & Timeline Expectations

- Timeline: Most straightforward cases run ~4–6 months from filing to discharge (U.S. Courts).

- Flat fee: Many firms use a predictable flat fee for chapter 7; ask about payment arrangements and what’s included.

- Court courses: You’ll complete pre-filing counseling and a post-filing debtor-education course (UST-approved).

Bottom line: Don’t file pro se. A Michigan bankruptcy attorney aligns exemptions, timing, and local practice to protect assets and speed your fresh start—especially if you’re facing garnishments, a repo, or a foreclosure sale date.

A Fresh Start With Chapter 7 Bankruptcy in Michigan

Chapter 7 in Michigan is ultimately about relief and reset: stopping most collections, resolving qualifying unsecured debt, and protecting essentials through the right exemption strategy. With the process mapped out and the right guidance, many filers move from crisis to clarity in a matter of months.

Your situation is unique. The best results come from careful timing, accurate paperwork, and local know-how—especially when comparing Michigan versus federal protections, preparing for the 341 meeting, and addressing any liens or reaffirmations.

Next Steps for Michigan Filers

- Confirm eligibility and timing (pay cycles, bonuses, tax refunds) with a Michigan bankruptcy attorney.

- Choose the exemption system (state vs. federal) that best protects your specific assets.

- Complete approved credit counseling and organize income, debts, and recent transactions.

- Prepare for the trustee’s 341 meeting and post-filing debtor-education course.

In summary: Chapter 7 can be the clean break you need—fast, structured, and focused on a sustainable restart. Partner with an experienced Michigan bankruptcy lawyer to protect what matters and move forward with confidence.

Explore Our Michigan Bankruptcy Guides

Explore Bankruptcy Help by State

Browse our state guides to learn exemptions, means test rules, costs, and local procedures. Use these links to jump between states and compare your options.

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- New York

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Texas

- Virginia

- Wisconsin