Will Bankruptcy Stop Garnishment?

Learn How Filing for Bankruptcy Can Stop Garnishment and Get You Back on Track

Understanding Bankruptcy and Wage Garnishment Effects

If your wages are being garnished, or if you are worried that they might get garnished, you might be wondering if bankruptcy stops garnishments. Fear not because bankruptcy will stop a wage garnishment, unless the underlying debt falls under a special non-dischargeable category. Read on to see if your garnishment can be stopped.The automatic stay is a powerful tool in this process. It stops most collection activities immediately upon filing.

Understanding how bankruptcy affects garnishment is crucial. It helps individuals make informed decisions about their financial future. This guide will explore the relationship between bankruptcy and wage garnishment. It will provide insights into the automatic stay and its effects.

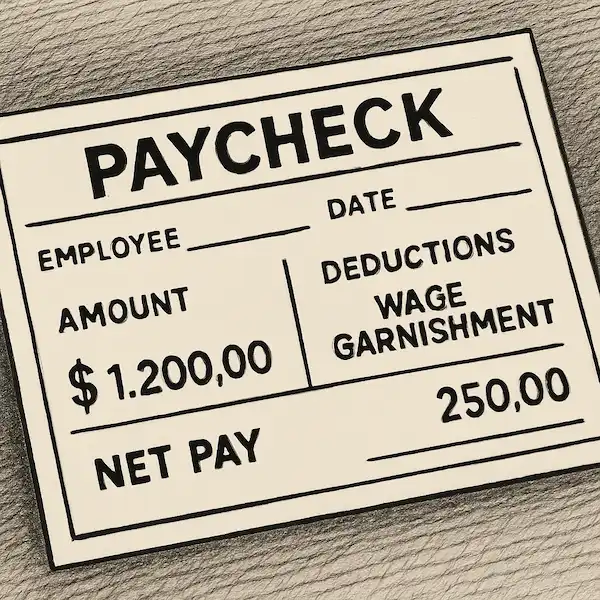

What Is Wage Garnishment?

By definition, wage garnishment is a legal process of taking your wages directly from your paycheck. It usually requires a court order for a creditor to garnish your wages. And don't worry it is more common than you might think. So don't feel alone.

What Causes Garnishments?

Garnishments can be ordered for several reasons, and receiving a garnishment can be alarming. Common types include unpaid taxes, credit card debts, and student loans. These cannot happen without your notification and due process. The court usually authorizes these deductions, and you often get served when you least expect it.

Here's a quick overview of garnishment types:

- Unpaid taxes: Federal or state taxes overdue.

- Credit card debt: Defaulted payments lead to legal actions.

- Child support: Mandated deductions by the court.

- Student loans: Government can garnish for unpaid loans.

- Evictions

- Other debts: Various other court-ordered garnishments.

How Does Bankruptcy Stops Wage Garnishment? The Automatic Stay

Automatic Stay - "An automatic stay is a court order that immediately halts most collection actions by creditors against a debtor the moment a bankruptcy petition is filed. As defined in legal dictionaries, this statutory injunction serves to prevent lawsuits, foreclosure, wage garnishments, and other debt-collection attempts against the debtor or their property. The purpose of the automatic stay is to give the debtor time to reorganize or liquidate assets under the court's supervision. " - Blacks Law Dictionary

As seen in the definition above,automatic stay is the powerful legal mechanism that orders creditors to immediately stand down. It is very strict, it is serious, and failing to recognize it is a violation of a court order that has serious repercussions. Therefore, when you file a bankruptcy case, your garnishment will cease (unless it is the kind that is exempt from the automatic stay). This court ordered protection usually lasts until your case is over, or until a creditor successfully moves the court for relief from the stay.

Examples of What Garnishments Bankruptcy Can Stop:

- Wage garnishments from credit card debt

- Medical bill collections

- Personal loan garnishments

What Types of Garnishments Can't Bankruptcy Stop?

- Domestic support obligations

- Certain tax debts

- Student Loans

- Restitution

- Some court ordered fines

- Debts resulting from bad Conduct

- Debts arising from an even in connection with a DUI

- Debt as a result of fraud

- Debts that are not scheduled or properly noticed

The automatic Stay and the Different Types of Bankruptcy

Quick Overview of the Main types of Consumer Bankruptcy

Each type of bankruptcy has unique features:

- Chapter 7: Discharges most unsecured debts quickly.

- Chapter 13: Allows retaining of assets by creating a repayment plan. You can pay secured debt, pay arrears, pay back taxes in chapter 13.

Both: Trigger the automatic stay to halt garnishments.

The automatic stay acts a little bit differently in each chapter of bankruptcy, in regards to the length that it stays in effect.

The Automatic Stay in Chapter 7

Length of Time Effective

In chapter 7 Bankruptcy, the automatic stay is usually in effect until a case is discharged. The discharge comes before the case is closed. The discharge is the actual order from the court telling creditors that they can no longer collect on a debt. The case is closed after the bankruptcy estate has been administered.

This is an important distinction because while the automatic stay is over in regard to the debtor (the person(s) who filed), it usually isn't necessary for them to have the benefit of the automatic stay anymore because the creditor has been ordered to never try to collect the debt ever again. The creditor can however collect any funds the chapter 7 trustee may have collected in the case. You can learn more about the differences between chapter 7 and chapter 13 bankruptcy here.

The Automatic Stay in Chapter 13

In chapter 13 Bankruptcy, the automatic stay is usually in effect until the case is closed or dismissed. The discharge in chapter 13 comes after the case is closed. The case is closed after the debtor has completed all payments under their plan.

Chapter 13 can last for 3 to 5 years. The debtor needs the stay to last that long so they can properly restructure. For example if the debtor needs to pay back mortgage arrears or back taxes, the stay will remain in place for the duration of the chapter 13 case so that the debtor may pay those items back without the creditors trying to foreclose or levy.

Post-Filing Steps: Notify Employer and Creditors

After you file a bankruptcy case, the court mails (via good old US snail mail) notice of your case to all of your creditors. If you are being garnished, your attorney should directly contact your employer's payroll department and properly notify them of your bankruptcy case filing. At the same time, your attorney should also directly give notice to the creditor that is garnishing you. This could be the creditor (like the credit card company themselves) or the attorney who represents the creditor, or both. So there is no confusion give notice to both.

Tips to Expedite Ending Your Garnishment

- Get your payroll department's contact information ASAP - Get their phone number, email, fax number, address

- Find out who the manager of your payroll department is and get their contact information - Get their phone number, email, fax number, address

- Get the contact information for the creditor or their attorney - Get their phone number, email, fax number, address

- Give all of this info to your attorney ASAP

Remember, while your attorney can find a lot of information, you probably know the ins and outs of where you work, so do this little bit of leg work to make sure this process goes smoothly and you don't get garnished again.

When to Consult a Bankruptcy Attorney

Determining the right time to consult a bankruptcy attorney is vital. If wage garnishment significantly affects your finances, seeking legal advice promptly is wise. An attorney can provide essential guidance tailored to your situation.

Consulting with a bankruptcy attorney helps clarify whether filing suits your needs. They offer insights on stopping garnishment and navigating the legal process effectively. Their expertise is invaluable in making informed financial decisions.

Regaining Financial Control

Bankruptcy can be a powerful tool to stop wage garnishment. It helps individuals overwhelmed by debt regain control over their finances. The automatic stay offers immediate relief, making it a viable option for many. However, it's essential to weigh the pros and cons. Every financial situation is unique, and careful planning is crucial. With the right guidance, bankruptcy can lead to financial recovery and a fresh start.

Key Considerations and Next Steps

Wage garnishment can be a stressful and financially draining experience, but filing for bankruptcy can provide relief for many individuals. By understanding how bankruptcy impacts wage garnishment and exploring alternative solutions, you can make informed decisions to protect your finances and regain control over your financial future. Remember, consulting with a knowledgeable bankruptcy attorney can help you navigate the complexities of the process and determine the best course of action for your unique situation.

Taking proactive steps to address wage garnishment can help you regain financial stability and achieve long-term success. Whether through bankruptcy or alternative strategies, it's important to explore all available options and choose the path that aligns with your goals and circumstances. By seeking professional guidance and staying informed, you can overcome the challenges of garnishment and build a brighter financial future.

Bankruptcy Stopping Garnishment FAQs

Will Bankruptcy Stop My Wage Garnishment Immediately?

In most cases, yes—the automatic stay begins the moment you file and typically requires creditors and your employer to stop withholding. Certain obligations, such as child support, are not paused. Prompt notice to your payroll department helps ensure the stop is processed quickly.

Do Any Garnishments Continue After Filing Bankruptcy?

Some do. Child support and alimony generally continue despite the automatic stay. Certain tax-related garnishments may pause only temporarily, and student loan collections can require additional steps or a chapter 13 plan to address the debt long-term.

Can I Get Back Wages That Were Garnished Before I Filed?

Sometimes. If wages were taken shortly before your case was filed, your attorney may be able to recover a portion depending on timing, amount, and local rules. The process is technical, so case-specific advice is important.

Should I File chapter 7 Or chapter 13 To Stop a Garnishment?

Both generally stop most garnishments through the automatic stay. chapter 7 aims to wipe out qualifying unsecured debts, while chapter 13 sets a 3–5 year repayment plan that can help catch up on obligations that are not dischargeable.

How Long Does Garnishment Relief Last After I File?

Relief lasts while the automatic stay is in effect. In chapter 7, it can become permanent if the underlying debt is discharged. In chapter 13, relief typically continues as long as you remain in good standing with your plan.

What Should I Do Right After Filing To Ensure Payroll Stops Withholding?

Provide your employer’s payroll department with your case number and filing date, have your attorney notify the creditor and any collection firm, and review your next paystubs to confirm the garnishment has ended.